Consumers are paying bills on time as steady growth in subprime credit card limits continue

Consumers are paying bills on time as steady growth in subprime credit card limits continue

The first six months of 2016 has shown that the total credit card limits among the subprime and deep subprime credit range totaled $6.4 billion, the highest amount reported for those groups in the last five years. Our Q2 2016 Experian-Oliver Wyman Market Intelligence Report webinar will analyze the trends impacting consumer credit decisions in the current economy. The Q2 2016 data is from the latest Experian Market Intelligence Brief report available for download.

At the same time limits increased, delinquency rates, for consumers who were 60 days or more late, among subprime and deep subprime consumers have decreased by 6% over the same span. Overall, all consumers have shown an ability to meet their payment obligations as delinquency rates have decreased by 43% comparing Q2 2016 versus Q2 2011. However, when looking at year-over-year comparisons the overall consumer delinquency rates have increased 7% but still remain relatively flat among subprime and deep subprime consumers.

“Consumers credit card behavior improved since exiting the recession as evidenced by the growth of credit card limits in particular among the subprime credit card market,” said Kelly Kent, vice president of Experian Decision Analytics. “Yet, even with the solid improvements, the year-over-year figures indicate a slight increase in delinquency rates.”

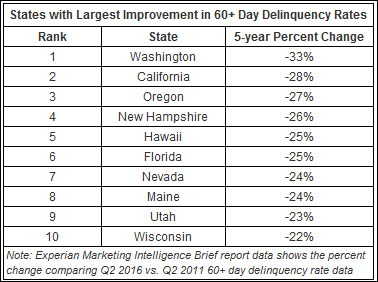

Across the country, 32 states saw their credit card delinquency rates improve by double-digits during those 5 years. Washington, California, and Oregon led the way, followed by New Hampshire and Hawaii. Only seven states saw an improvement in 60+ data delinquency rates comparing the data from 2016 Q2 versus 2015 Q2, but 49 states saw an improvement comparing Q2 2016 versus Q1 2016.

Attend our Q2 2016 Experian-Oliver Wyman Market Intelligence Report webinar to hear more details on recent credit trends.