Our identity solutions leverage data and machine learning to help organizations enhance relationships and experiences

Making identities personal

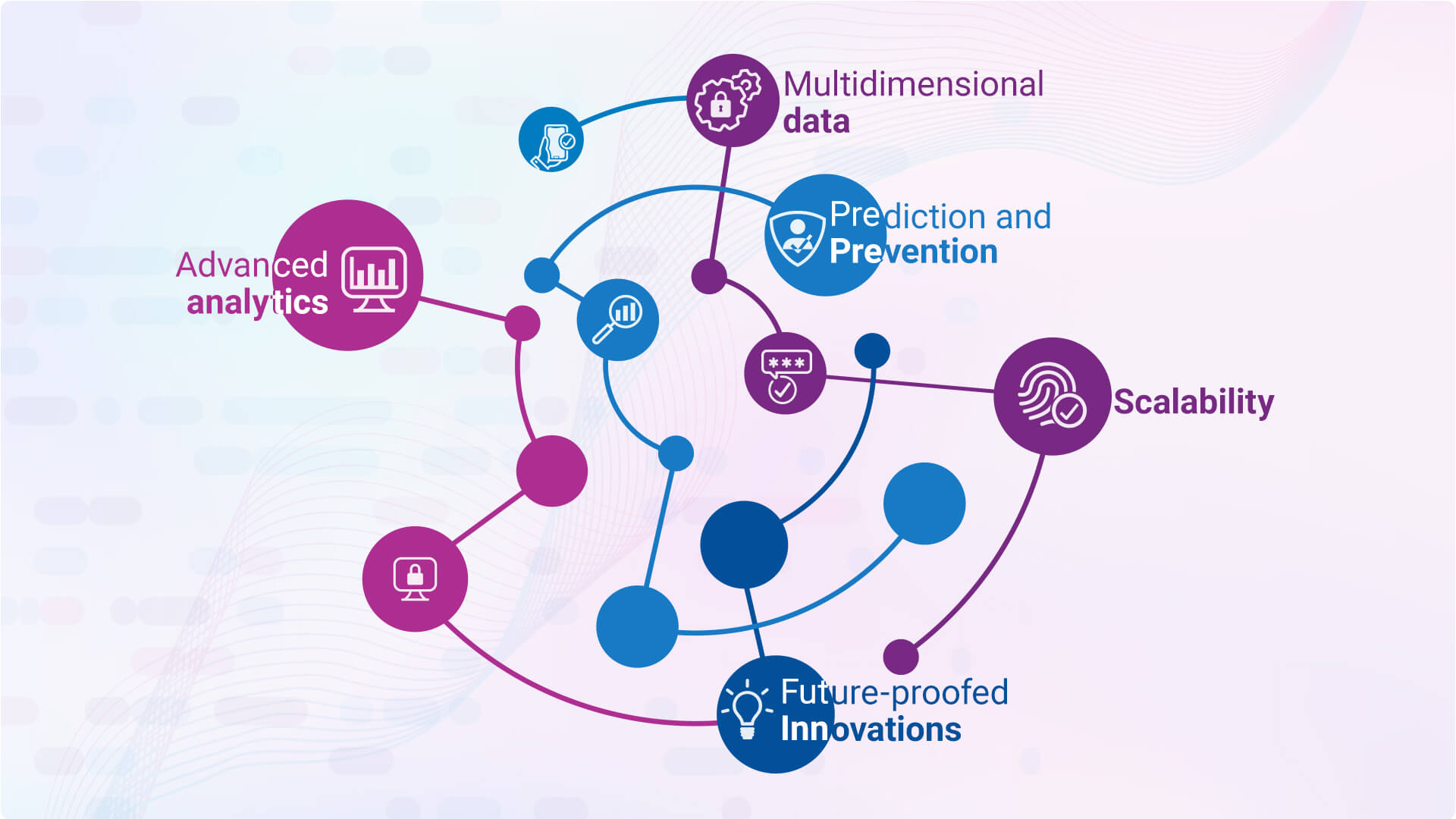

A holistic identity strategy requires a multi-faceted approach. We leverage multidimensional data, advanced analytics, scalable technology, and fraud prediction and prevention capabilities to create seamless, secure experiences.

Consumer identity protection

Help consumers prevent identity theft to keep them and your organization safe

Multidimensional data

Leverage Experian’s comprehensive and diverse digital and offline data sources to resolve, verify and authenticate identities.

Pinpoint and accelerate engagement

Model and use accurate, reliable digital and offline data to make confident decisions and safely fast-track consumer and business engagement.

Flexible, scalable solutions

Interconnected data and systems that create attribute-rich and unique consumer profiles for improved identity proofing, insights, targeting and efficiency.

Future-proofed innovations

Implement new technologies and make smart, long-term technology investments to stay ahead of the fast-moving market landscape.

Predict and prevent threats

Data science and transformative technology partner with advanced deterministic and probabilistic capabilities to mitigate risk and protect data privacy.

Provide peace of mind

Offer consumers comprehensive identity protection solutions that can drive engagement and help prevent and detect potential fraud.

Powering identity for tomorrow and today

We leverage our breadth of expertise to provide a holistic identity solution to the market. Hear what some of our experts have to say.

of consumers say it's important for business to be able to accurately identify them online

of consumers have a high degree of trust toward organizations who recognize them on a repeated basis

of consumers moved their new account opening process to another organization because of a poor experience

Frequently asked questions

Digital identities are a digital representation of an entity such as a consumer or a business. They’re made up of a combination of online and offline data attributes that include:

Something a user knows, like a username, password or PIN.

Something a user has, like a mobile phone or security token.

Something that’s part of a user, like a fingerprint, iris, voice pattern, behavior or preferences.

Digital identity solutions are a combination of processes that coordinate to confirm consumer and business identities during onboarding and return logins. Digital identity solutions generally include identity verification, know your customer and customer identification programs, document proofing, fraud prevention and more.

Personal credit report assistance is not available here.

If you have questions or issues related to your personal credit report, disputes, identity theft or fraud alerts, visit Experian.com/help.

We are unable to address personal credit report and/or membership inquiries via this business form. Visit Experian.com/help or call 888-397-3742 for consumer assistance.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

- Solutions

- Advanced Analytics & Modeling

- Collections & Debt Recovery

- Customer Management

- Credit Decisioning

- Credit Profile Reports

- Data Reporting & Furnishing

- Data Sources

- Data Quality & Management

- Fraud Management

- Identity Solutions

- Marketing Solutions

- Regulatory Compliance

- Risk Management

- Workforce Management