Give your customers the frictionless experience they expect, while spotting risky behavior and suspicious device usage before bad transactions occur

Identity linkage

Predictive scoring

Transaction monitoring

What is account takeover fraud (ATO)?

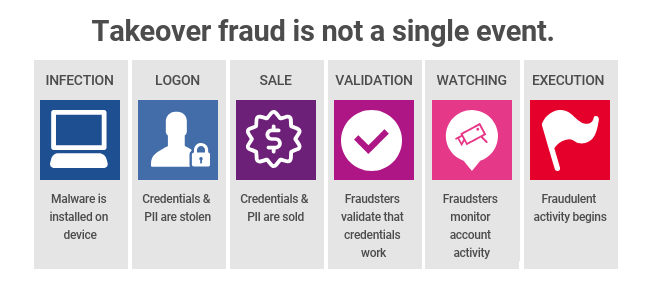

Account takeover fraud is when a fraudster gains access to an account that does not belong to them, changes information such as log in credentials or personal information, and then makes unauthorized transactions in that account. This has gone a step further in recent years, where the fraudster also gains control of separate accounts, such as mobile or email accounts, where one-time passwords or password change instructions can be sent. According to Javelin research, there was a 72% increase in year-over-year ATO fraud in 2019.*

In the future, we predict that hackers will increasingly turn to automated methods, including script creation and credential stuffing to make cyberattacks and account takeovers easier and more scalable than ever before.

*Source: 2020 Identity Fraud Study: Genesis of the Identity Fraud Crisis, Javelin Research, April 2020

How can your business prevent account takeover fraud?

Customer experience considerations are always top-of-mind when speaking about portfolio or account management. When it comes to detecting fraud in your customer accounts, it’s important to minimize outreach and false positives and instead present the opportunity for your customers to self-cure before disabling an account, which causes customer friction and frustration. Aite research shows that 64% of financial institutions are seeing higher rates of ATO fraud attacks now than prior to the pandemic.* Is your business ready to prevent automated attacks, including credential stuffing?

Alleviate the risk of account takeover fraud and confidently engage customers using holistic, risk-based identity and device authentication, as well as targeted, knowledge-based authentication that allows good customers to move throughout the process and frustrate fraudsters. Reduce manual processes for your staff through an end-to-end fraud management solution that removes the risk of information silos and enables seamless processes. When investigation is necessary, help your staff make decisions quickly and accurately with the best data possible.

*Source: Key Trends Driving Fraud Transformation in 2021 and Beyond, Aite Group, December 2020

Credential stuffing

Monitor and identify credential stuffing attacks fast before account compromise.

Email account takeover

Recognize email account takeover before escalation to cross account takeover.

Call center fraud

Enable your call center staff to proactively detect account takeover risk.

The best way to manage fraud is to stop it before it happens.

Learn about the five top strategies for managing your existing customer interactions and account portfolios in this tip sheet.

- Quickly identify if an account has been compromised and take decisive action.

- Drive successful transactions with identity monitoring and flagging unusual activities.

- Stop fraudulent account access and reduce your fraud losses.

- Confidently detect fraud rings, staging and compromised devices.

- Optimize your resources by focusing on high-risk accounts that need closer monitoring.

- Improve your customer relationships by performing fewer intrusive security checks without sacrificing protection.

CrossCore

Flexible fraud prevention platform to help you recognize account takeover risks and act quickly to minimize fraud losses and protect your customers.

FraudNet

Digital device intelligence to help identify illegitimate customers across channels, frustrate fraudsters, and optimize your customer experience.

Knowledge IQ

Knowledge-based authentication questions to frustrate fraudsters and provide customers with a fast, easy experience.

Resources

Infographic

Account takeover fraud trends

Prevent ATO by first understanding it and the financial risks it represents in this infographic.

Blog post

Account takeover: The defense in depth strategy

Explore the considerations of a Defense in Depth strategy for stopping ATO.

- Solutions

- Advanced Analytics & Modeling

- Cloud Applications & Services

- Collections & Debt Recovery

- Customer Management

- Credit Decisioning

- Credit Profile Reports

- Data Reporting & Furnishing

- Data Sources

- Data Quality & Management

- Employer Services

- Fraud Management

- Identity Solutions

- Marketing Solutions

- Regulatory Compliance

- Risk Management