Welcome to the Experian Thought Leadership Hub

Gain insights into the fast-changing world of consumer and business data through our extensive library of resources.

16 resultsPage 1

Case Study

Case Study

It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout. The point of using Lorem Ipsum is that it has a more-or-less normal distribution of letters, as opposed to using 'Content here, content here', making it look like readable English.

Many desktop publishing packages and web page editors now use Lorem Ipsum as their default model text, and a search for 'lorem ipsum' will uncover many web sites still in their infancy. Various versions have evolved over the years, sometimes by accident, sometimes on purpose (injected humour and the like).

Infographic

Infographic

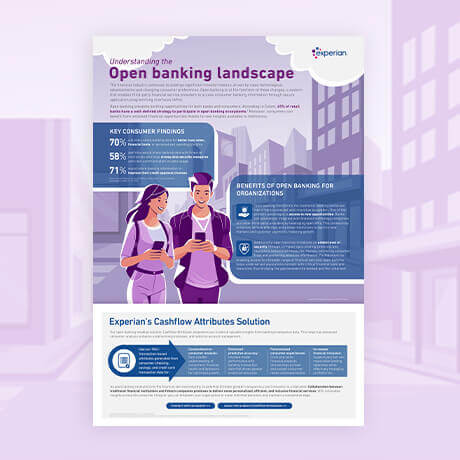

The financial industry continues to undergo significant transformations, driven by rapid technological advancements and changing consumer preferences. Open banking is at the forefront of these changes, a system that enables third-party financial service providers to access consumer banking information through secure application programming interfaces (APIs).

Enhance your strategy and lead the charge in this banking revolution.

Case Study

Case Study

In today's market, consumers are expecting to increase their banking activities online and seek more affordable credit options. View our use case to see how one bank was able to deliver personalized savings options to their customers digitally, allowing them to grow their portfolio and customer relationships.