Latest Posts

The Commercial Pulse report provides a bi-weekly directional update on small business credit. It delivers a quick read on macroeconomic conditions, high-level credit trends, score and attribute impacts, and other market-related activities.

Explore how Experian's Ascend Commercial Suite helps risk managers navigate portfolio risk in an uncertain economy with data insights and strategic tools.

Recent news of the SVB collapse highlights the vulnerability of small banks and their crucial role in serving local communities. Small and medium-sized financial institutions should prepare for additional interest rate hikes.

If you crave economic insight into small business trends, download the Spring Beyond the Trends report from Experian, a unique outlook on the economy.

Account takeover fraud is plaguing commercial lenders, we explain how to takle it in its many forms so you can protect small business clients.

Bankruptcies and collections are on the rise since mid 2022. Pandemic-related relief and forgiveness suppressed collections for most of 2021 and the first half of 2022.

A recent credit study of a regional utility found significant numbers of small businesses with no credit profile despite a history of positive payments.

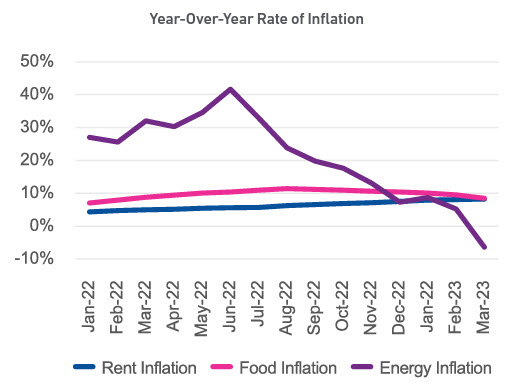

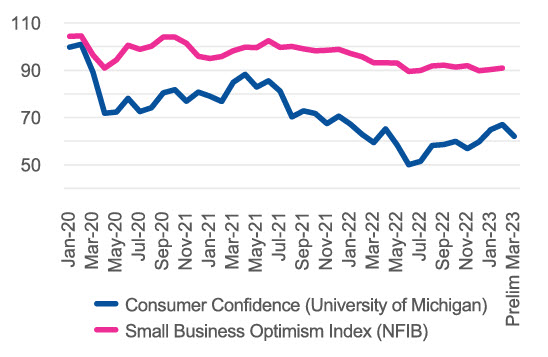

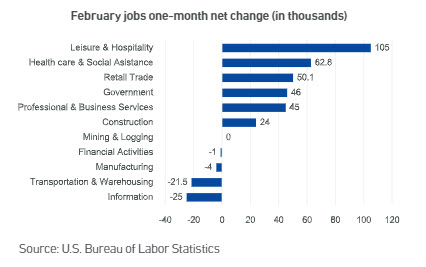

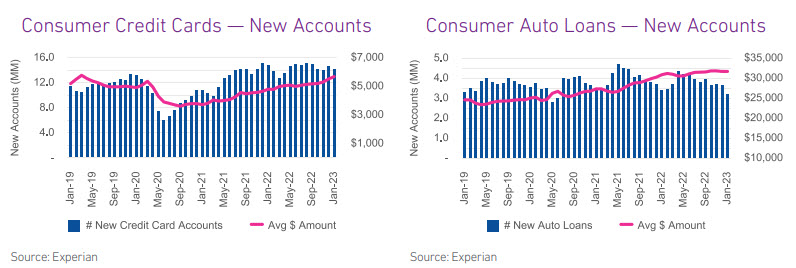

Consumers are borrowing to maintain spending levels even though higher interest rates make borrowing more expensive.

This week Experian and Oxford Economics released the Q4 2022 Main Street Report. The report provides insight into the financial well-being of the small business landscape. Critical factors in the Main Street Report include business credit data (credit balances, delinquency rates, utilization rates, etc.) and macroeconomic information (employment rates, income, retail sales, industrial production, etc.). Report Highlights Consumer sentiment improved in Q4 2022, despite a softening of spending behavior. This positive behavior has contributed to the positive health and growth perspective of small businesses heading into 2023, leading to stable cash flow performance. In addition, commercial lending markets remained open and commercial delinquencies returned to pre-pandemic levels. However, higher goods and services costs may pressure spending as affordability tightens and personal cash flows thin. The US economy grew strongly in Q4 2022, but the core of the economy was soft, indicating that a repeat performance in early 2023 is unlikely. The trend in job growth has decelerated, and the Fed needs to engineer a soft landing. The Fed is pushing back against market expectations of rate cuts and is likely to hike more than expected. Download Q4 2022 Report