Tag: Commercial Pulse Report

New business formation strong, making accurate credit risk assessment crucial I’m excited to share the current Experian Commercial Pulse Report with you. I have the opportunity each week to analyze data on the millions of U.S. small businesses in Experian’s database and discover actionable insights that benefit our clients. Making these discoveries is rewarding work, and we utilize these insights to guide our recommendations. I thought I would share what I am watching through Experian’s bi-weekly Commercial Pulse Report (just bookmark the link; we will update it on a bi-weekly basis). This week’s report includes a study about the predictive nature of different credit scores, and how well a consumer risk score versus a commercial risk score or a blended risk score works to predict the future risk of a small business. What I am watching: Unemployment increased to 4.1% in June, the first time over 4% since November 2021. The U.S. economy added 206K new jobs in June while job-openings and job-quits continue to trend downward. 424K new businesses opened in May. The high level of new businesses opening makes it critical for lenders to accurately assess credit risk. That’s a quick take – Download the latest report. Download Commercial Pulse Report Commercial Insights Hub

Unemployment inches up as job growth slows I’m excited to share the current Experian Commercial Pulse Report with you. I have the opportunity each week to analyze data on the millions of U.S. small businesses in Experian’s database and discover actionable insights that benefit our clients. Making these discoveries is rewarding work, and we utilize these insights to guide our recommendations. I thought I would share what I am watching through Experian’s bi-weekly Commercial Pulse Report (just bookmark the link; we will update it on a bi-weekly basis). What I am watching: The U.S. population and labor force are experiencing a major transformation Aging Baby Boomers are changing the U.S. labor market. The only age group whose labor force participation rate is projected to rise are people 75 and older. Birth rates declined 50% since 1950. The median employment age is expected to grow from 39.9 in 2002 to 42.8 years old in 2032. That’s a quick take – Download the latest report. Download Commercial Pulse Report

Here are a few quick small business insights from our latest Commercial Pulse Report.

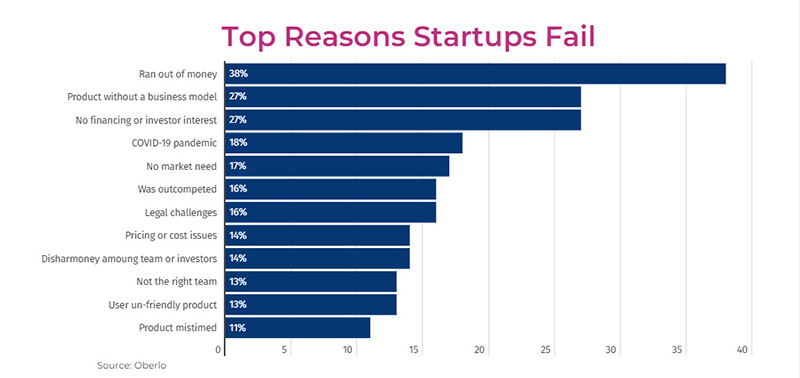

Download our latest Commercial Pulse Report for economic insights and a deep dive on reasons why so many startups fail in first 5 years.

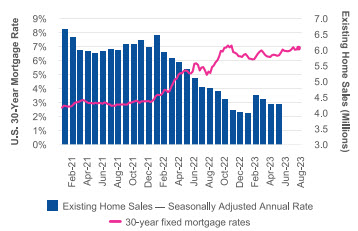

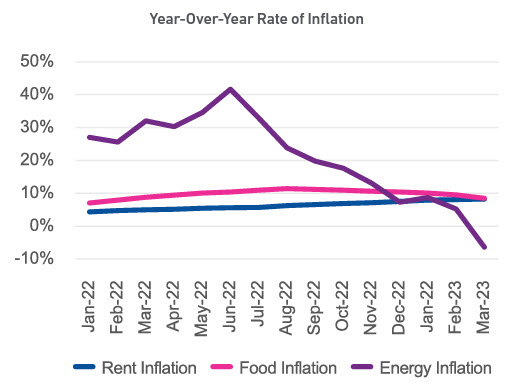

The Federal Reserve’s efforts to tame inflation with aggressive interest rate hikes over the past 15 months appear to be working with July’s core inflation rate reaching the lowest level since October 2021. The U.S. labor market remains strong with low unemployment and 187K knew jobs created in July. As inflation eases and the economy continues to be strong, it is becoming more likely that we could experience a soft landing.

Women led businesses lag behind on venture capital funding, and are turning to commercial loans and lines to bridge the gap Start-ups founded or cofounded by women receive only 44% of financial backing, but generate more revenue. While it is very encouraging to see the progress of women in business advancing, the pace of progress is slow and more could be done to achieve parity. Women’s salaries are slowly catching up, but they are still only about 80% of men’s wages. There are continued barriers to mothers participating in the labor force due to the limited capacity of childcare facilities, the high costs to families for childcare, and the low wages for childcare workers making lower skilled work sometimes more attractive in a tight labor market. These forces disproportionately affect women whether they work for wages or work for themselves as a small business owner. In addition to the issues facing women as workers, there are unique challenges they face as start-up founders as well. There is a known disparity in the funding provided to start-up businesses pitched by a woman versus a man and that is leaving women without the full funding they need to launch new businesses successfully. Added diversity within venture capital and angel investor groups could help change this dynamic so women can access that capital and expertise when launching their businesses at the same rate as their male counterparts. Without this, they are left to rely on self-funding and loans from banks — if they can get approved. The good news is that many women are making it work and the number of successful women-owned businesses continues to climb. What I am watching: The debt-ceiling standoff continues to cause uncertainty in the financial system with no compromise in place and a looming June 1 deadline, according to Secretary Janet Yellen. This situation is going to dwarf all others until there is a resolution, so all eyes are going to be on Congress and the President. Other signs in the economy suggest that inflation may finally be responding to the aggressive interest rate hikes enacted by the Fed. The Fed will have a more difficult decision on whether to raise interest rates one more time in June or hold them steady and wait to see if inflation continues to improve. Subscribe Today Download your copy of Experian's Commercial Pulse Report today. Better yet, subscribe so you'll always know when the latest Pulse Report comes out.

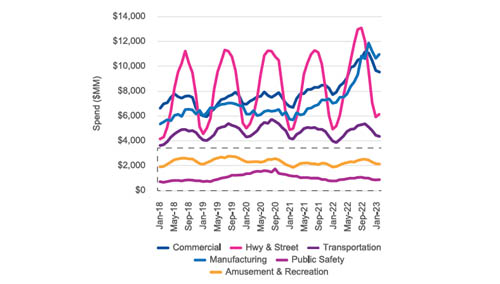

In its continued efforts to tame inflation, the Federal Reserve increased interest rates ¼ point last week, the tenth consecutive increase in just over a year. The cumulative increase is 500bps since March 2022, bringing the Fed Funds rate to 5.00%-5.25%, which is the highest since 2007. While inflation is still above the Fed’s target rate of 2%, they indicated a pause in rate increases. The labor market continues to be strong with April unemployment down to 3.4%, matching the low of January which is the lowest unemployment since 1969. Despite all the efforts by the Fed to have a soft landing, the economy could be upended if Congress does not increase the debt ceiling soon. With inflation slowing, and the labor market strong, a soft landing is possible. Treasury Secretary Yellen said the U.S. could default on debt as early as June 1st. If the U.S. defaults on outstanding debt, many forecast disastrous impacts to the world economy. Despite the recent decline in residential construction spending, construction spend remains strong in both residential and non-residential sectors. The construction industry is one of the few industries that saw a boom throughout the pandemic. Even though over the past few months both residential and non-residential experienced a decline in construction starts and construction spend, the volumes remain above pre-pandemic levels. High construction demand is being met with the formation of many new construction companies. New construction companies are seeking credit at a higher rate, but delinquencies in the construction industry are increasing. Higher risk and higher interest rates are causing commercial lending to tighten, and construction companies are seeing fewer loan originations and smaller loans/lines of credit. What I am watching: The non-residential construction industry is expected to see steady growth in 2023 due to project backlogs but could slow in 2024. Due to higher mortgage rates, the residential construction industry is expected to see a significant decline in housing starts through 2023 with the sector stabilizing in 2024. Aside from the immediate key drivers of interest rates and cost of capital, other areas of focus will be on the labor force and the demand for skilled vs. non-skilled labor. The number of skilled workers is decreasing yet the demand for skilled labor is increasing. The construction industry will have to attract the necessary talent to support the growth. Operational changes in the construction industry will be a driving factor. The construction industry is seeing a shift toward technology in all aspects of construction. Utilization of robotics is increasing which could replace portions of the workforce. Smart Cities, Smart Homes, Green Building are all trending which will materially change construction projects. The Construction Industry is experiencing a noticeable shift and companies will continue to adapt to keep up with demand.

The Commercial Pulse report provides a bi-weekly directional update on small business credit. It delivers a quick read on macroeconomic conditions, high-level credit trends, score and attribute impacts, and other market-related activities.

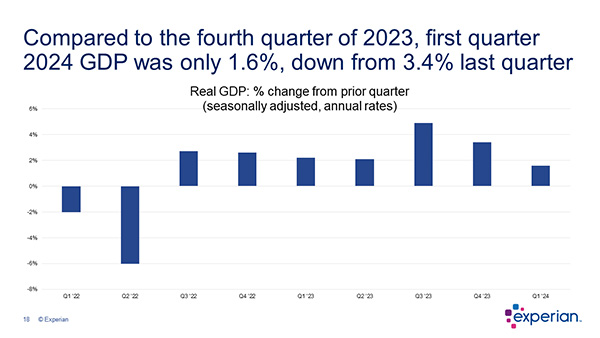

The advanced Q1 2023 GDP numbers show that the U.S. economy grew an annualized 1.1%, down from 2.6% in Q4 2022.