All posts by Stefani Wendel

“Disruption has caused enormous amounts of innovation,” said Jennifer Schulz, CEO of Experian, North America. “We must continue to be the disruptors in our industry which takes effort, data, technology, bright minds and vision for what the future will be.” Schulz kicked off the 39th Vision conference with a future-focused keynote delivered to a crowd of more than 400 attendees. Alex Lintner, Group President, Experian Consumer Information Services, talked about the next phase of great, highlighting the digital transformation that has taken place in the generations of the past and the disruption and innovation happening today and in the future. Keynote speaker: Dr. Mohamed A. El-Erian Dr. Mohamed A. El-Erian, renowned economist and author, President of Queens’ College, Cambridge, Chief Economic Advisor at Allianz, Chair of President Obama’s Global Development Council and Former CEO and Co-Chief Investment Officer of PIMCO, spoke about the Fed, inflation, negative interest rates and the labor market, as well as the importance of inclusion. El-Erian, who said he reads the Financial Times religiously, acknowledged that we will make mistakes on the journey as we work to be even more inclusive. To navigate what’s ahead, he said we will need resilience, optionality and agility. “It’s important to connect with information, acknowledge the insecurity, in a language people understand, in order to connect,” he said. Session highlights – day 1 The conference hall was buzzing with conversations, discussions and thought leadership. Buy Now Pay Later A large audience was in attendance for a session that introduced Experian’s Buy Now Pay Later Bureau™ and explored how it’s the first and only solution of its kind — serving consumers, BNPL providers, financial institutions and regulators. Identity Identity is constantly evolving, and while biometrics and authentication may have become ubiquitous, there is much activity around the concepts of eIDs, identity wallets and identity networks. Experian is making identities personal and helping businesses to recognize, manage and connect customer identities in new ways using data, analytics and technology. Marketing In today’s hypercompetitive world, businesses need to engage the freshest data and increase velocity when it comes to time to market. An average of 120 days won’t cut it. Ascend Marketing speeds time to market and helps achieve higher ROI. Regulatory Landscape With so much happening at Capitol Hill, a panel of experts from DC discussed a number of topics and proposals (and their impacts), including the defense for risk-based pricing, the impact of suppressing negative data, and trending topics like Buy Now Pay Later and data portability. All the while, the tech showcase had a constant flow of attendees with demos ranging from data and decisioning to financial inclusion and technology. This is just the beginning. And as Schulz said, “There’s more to do.” More insights from Vision to come. Follow @ExperianVision to see more of the action.

Experian’s in-person Vision conference returns next Monday, April 11 in Los Angeles, Calif. The event is known for premier thought leadership, net-new insights and the latest and greatest in technology, innovation and data science. This year’s agenda promises to have intentional discussions around tomorrow’s trending topics including financial inclusion, buy now pay later, open banking, the future of fraud, alternative data strategies, and much more. A few spotlight sessions include: Top trends including the future application of the cloud and emerging technologies, emerging regulatory legislation and the broader implications and opportunities of DeFi. A deep dive into strategies around the targeting/marketing revolution and how to deliver in the post-COVID-19 market environments and bolster financial inclusion decisions. An introduction to Experian’s Buy Now Pay Later BureauTM, the industry’s first and only solution designed to address the needs of consumers, BNPL providers, financial institutions and regulators alike. A roundup of sessions addressing innovation in action spanning from real-time verifications, to data-driven automation, and unified platforms from data to deployment to decisioning. Several sessions highlighting future-looking strategies and solutions that leverage alternative data that can increase conversion rates while concurrently reducing risk. Multiple sessions centered on the rapidly changing identity environment and combatting emerging fraud threats. The event will also include a Tech Showcase, where attendees can get a taste of tomorrow today with more than 20 demos and the latest innovations at their fingertips. And, as always, the event features marquee keynote speakers sure to inspire. This year’s featured speakers are Dr. Mohamed A. El-Erian, President of Queens’ College, Cambridge, Chief Economic Advisor at Allianz, and Former CEO and Co-Chief Investment Officer of PIMCO; Allyson Felix, Olympic Gold Medalist, co-founder of Saysh, a footwear and lifestyle brand for women, and Right to Play and Play Works ambassador; and the closing keynote will feature actor, investor, entrepreneur and philanthropist, Ashton Kutcher. Stay tuned for additional highlights and insights on our social media platforms throughout the course of the conference. Follow Experian Insights on Twitter and LinkedIn.

In today’s evolving and competitive market, the stakes are high to deliver both quantity and quality. That is, to deliver growth goals while increasing customer satisfaction. OneAZ Credit Union is the second largest credit union in Arizona, serving over 157,000 members across 21 branches. Wanting to fund more loans faster and offer a better member experience through their existing loan origination system (LOS), OneAZ looked to improve their decisioning system and long-standing underwriting criteria. They partnered with Experian to create an automated underwriting strategy to meet their aggressive approval rate and loss rate goals. By implementing an integrated decisioning system, OneAZ had flexible access to data credit attributes and scores, resulting in increased automation through their existing LOS – meaning they didn’t have to completely overhaul their decisioning systems. Additionally, they leveraged software that enabled champion/challenger strategies and the flexibility to manage their decision criteria. Within one month of implementation, OneAZ saw a 26% increase in loan funding rates and a 25% decrease in manual reviews. They can now pivot quickly to respond to continuously evolving conditions. “The speed at which we can return a decision and our better understanding of future performance has really propelled us in being able to better serve our members,” said John Schooner, VP Credit Risk Management at OneAZ. Read our case study for more insight on how automation and PowerCurve Originations Essentials can move the needle for your organization, including: Streamlined strategy development and execution to minimize costly customizations and coding Comprehensive data assets across multiple sources to ensure ID verification and a holistic view of your prospect Proactive monitoring and real-time visibility to challenge and rapidly adjust strategies as needed Download the full case study

It is no news that businesses are increasing their focus on advanced analytics and models. Whether looking to increase resources or focus on artificial intelligence (AI) and machine learning (ML), growth is the name of the game. But how do you maximize impact while minimizing risk? And how can you secure expertise and ROI when budgets are strapped? Does your organization have the knowledge and talent in-house to remain competitive? No matter where you are on the analytics maturity curve, (outlined in detail below), your organization can benefit from making sure your machine learning models solution consists of: Regulatory documentation: Documentation for model and strategy governance is critical, especially as there is more conversation surrounding fair lending and how it relates to machine learning models. How does your organization ensure your models are explainable, well documented and making fair decisions? These are all questions you must be asking of your partners and solutions. Integrated services: For some service providers, “integrated,” is merely a marketing ploy, but it is essential that your solution truly integrates attributes, scores, models and decisions into one another. Not only does this serve as a “checks and balances” system of sorts, but it also is a primary driver for the speed of decisioning, which is crucial in today’s digital-first world. Deep expertise: Models are a major component for your decisioning, but ensuring those models are built and backed by experts is the one-two punch your strategies depend on. Make sure your services are managed by data scientists with extensive experience to take the best approach to solving your business problems. Usability: Does your solution close the loop? To future proof your processes, your solution must analyze the performance of attributes, scores and strategies. On top of that, your solution should make sure the items being built are useable and can be modified when needed. A one-and-done model does not suit the unique needs of your organization, so ensure your solution provides actionable analysis for continual refinement. Does your machine learning model solution check these boxes? Do you want to transform your existing system into a state-of-the-art AI platform? Learn more about how you can take your business challenges head-on by rapidly developing, deploying and monitoring sophisticated models and strategies to more accurately predict risk and achieve better outcomes. Learn more Access infographic More information: What’s the analytics maturity curve? “Analytics” is the discovery, interpretation and communication of meaningful patterns in data; the connective tissue between data and effective decision-making within an organization. You can be along this journey for different decision points you’re making or product types, said Mark Soffietti, Director of Analytics Consulting at Experian, at our recent AI-driven analytics and strategy optimization webinar. Where you are on this curve often depends on your organization’s use of generic versus custom scores, the systems currently engaged to make those decisions and the sophistication of an organization’s models and/or strategies. Here’s a breakdown of each of the four stages: Descriptive Analytics – Descriptive analytics is the first step of the analytics maturity curve. These analytics answer the question “What is happening?” and typically revolve around some form of reporting. An example would be the information that your organization received 100 applications. Diagnostic Analytics – These analytics move from what happened to, “Why did it happen?” By digging into the 100 applications received, diagnostic analytics answer questions like “Who were we targeting?” and “How did those people come into our online portal/branch?” This information helps organizations be more strategic in their practices. Predictive Analytics – Models come into play at this stage as organizations try to predict what will happen. Based on the data set and an understanding of what the organization is doing, effort is put towards automating information to better solve business problems. Prescriptive Analytics – Optimization is key for prescriptive analytics. At this point in the maturity curve, there are multiple models and/or information that may be competing against one another. Prescriptive analytics will attempt to prescribe what an organization is doing and how it can drive more desired behaviors. For more information and to get personalized recommendations throughout your analytics journey, visit our website.

Despite an unprecedented 18 months since the pandemic was in full force and many Americans were sent home, financial wellness continues to be on the up and up. Consumers continue to manage credit well and the average credit score climbed seven points since 2020 to 695, the highest point in more than 13 years. In Experian’s 12th annual State of Credit report, the headlines are hopeful regarding how Americans are managing personal finances in the face of the pandemic. The report provides a comprehensive look at the credit performance of consumers across America by highlighting consumer credit scores and borrowing behaviors. This year’s report features data from 2019 pre-pandemic, the 2020 pandemic year, and the start of 2021. “The findings from this year’s report show something I’ve always believed: Americans are resilient, for the most part they make smart decisions in the face of adversity and they are agile in adjusting their financial habits when the environment or circumstances change,” said Alex Lintner, President, Experian Consumer Information Services. Highlights of Experian’s State of Credit report: 2021 State of Credit Report 2019 2020 2021 Average VantageScore® credit score [1] 682 688 695 Median VantageScore® credit score 687 697 707 Average number of credit cards 3.0 3.0 3.0 Average credit card balance $6,494 $5,897 $5,525 Average revolving utilization rate 30% 26% 25% Average number of retail credit cards 2.50 2.42 2.33 Average retail credit card balance $1,930 $2,044 $1,887 Average nonmortgage debt $25,057 $25,483 $25,112 Average mortgage debt $210,263 $215,655 $229,242 Average auto loan or lease $19,034 $19,462 $20,505 Average 30–59 days past due delinquency rates 3.8% 2.4% 2.3% Average 60–89 days past due delinquency rates 1.9% 1.3% 1.0% Average 90–180 days past due delinquency rates 6.6% 3.8% 2.5% We asked Joseph Mayans, Principal Economist at Advantage Economics, LLC, for his reactions to the findings: “The State of Credit Report captures the three central themes of the pandemic. First, it shows the overwhelming success of the fiscal support packages. By far, the most striking example of this is the broad based and significant decline in delinquencies during a time when millions of people were out of work. Second, the report showcases the resiliency of American households. People used their stimulus dollars to stay on top of their bills and pay down debt, which boosted average credit scores across all generations. And third, it highlights the unique behavioral shifts brought on by the pandemic. We can see these changes in the rise of housing and auto debt as people bought larger homes and sought to drive rather than ride public transportation.” Generational Trends As indicated in the findings, consumers across all generations except Gen Z saw decreased utilization rates and decreased credit card balances year over year. Consumers are also missing fewer payments with notable improvements seen among the youngest consumers. Mortgage debt was up across every generation, which may correlate with the record low interest rates on mortgages, refinances and moves. According to the CBRE, “the pandemic accelerated several long-standing American migration patterns” as evidenced by more than 15.9 million people filing change-of-address requests with the United States Postal Service. Compared with 2019, 2020 change-of-address requests show a 4% increase in total movers, 2% increase in permanent movers and 27% increase in temporary movers, according to a study by MyMove. Mayans also made note of the mortgage trends. “It’s becoming clearer that millennials are stepping into the homebuying phase in a big way. Once thought to be the generation of apartments and urban revival, many older millennials are now buying homes and moving to the suburbs much like their parents before them,” Mayans said. “This will have significant implications for the post-pandemic world, especially as work from home becomes more prevalent.” State Trends The states with the highest and lowest average credit score remained unchanged from last year with the highest average score of 726 held by Minnesota and an average score of 666 held by Mississippi. New Jersey had the highest number of credit cards and retail cards at 3.37 and 2.54 respectively, and Alaska had the highest credit card debt at $7,089 (U.S. average is $5,525) and Texas had the highest retail debt at $2,248 (U.S. average is $1,888). What Lies Ahead Some have argued that the past year of the pandemic and quarantine forced a lot of time for reflection. The continued positive trends of consumer behavior seem to indicate some of that effort was put toward better financial health practices. That said, like any sourdough bread recipe or DIY home glow-up, there’s always more to learn and opportunities to seize when it comes to financial health. “We are committed to working with lenders and the industry to help consumers gain access to credit, driving broader financial inclusion, while also teaching consumers how to responsibly build and use credit responsibly,” Lintner said. In addition to the free weekly credit report at AnnualCreditReport.com, Experian also offers consumers free access to their credit report and ongoing credit monitoring at Experian.com. Additional credit education resources and tools Join Experian’s #creditchat hosted by @Experian on Twitter with financial experts every Wednesday at 3 p.m. Eastern time. Bilingual and Spanish speakers are also invited to join Experian’s monthly #ChatdeCredito hosted on Twitter at 3 p.m. Eastern time beginning September 16. Visit the Ask Experian blog for answers to common questions, advice and education about credit. Add positive telecom, utility and streaming service payments to your Experian credit report for an opportunity to improve your credit scores by visiting experian.com/boost[2] For additional resources, visit https://www.experian.com/consumereducation To see all the findings, download the 2021 State of Credit Report. Download the full report [1] VantageScore® is a registered trademark of VantageScore Solutions, LLC. VantageScore® credit score range is 300 to 850. [2] Results may vary. See Experian.com for details

Despite the constant narrative around “unprecedented times” and the “new normal,” if the current market volatility tells us anything, it’s to go back to basics. As financial institutions navigate COVID-19’s economic impact, and challenges that are likely to be different or more extreme than in the past, the best credit portfolio management practices are fundamental. The global pandemic impacts today’s data as existing data and analytics may not accurately reflect what is happening now, resulting in inaccurate portfolio assessment. In order to successfully navigate loss forecasting, predicting borrower behavior and controlling loss ratios, lenders must engage new data, analytics and economic scenarios suited for today’s changing times. In Experian’s latest white paper, “Credit Portfolio Management After the COVID-19 Recession,” we’ll explore best practices to combat the following challenges: Forecasting credit losses despite increased economic volatility Businesses have long used a variety of data, analytics and models to anticipate and project the future direction of their organization based on a number of data points; however, with the onset of the global pandemic, long-standing scenarios became suddenly irrelevant. Predicting borrower behavior given increased financial disparities The post-pandemic and pre-pandemic worlds are very different places for some borrowers. Pandemic-related job losses and other economic effects will not be spread evenly and this variability may be reflected in lenders’ portfolios. Controlling loss ratios In the post-COVID world, it will be mission critical for lenders to use high-quality and up-to-date data to balance priorities and identify which areas of their portfolio need attention now. Whether your portfolio is doing better than expected, as expected, or worse than expected, now is the time to refresh portfolio management strategy. Lenders should be watching for early indicators in loan portfolios to better navigate a fluctuating economy and that requires new resources and better tools. Take control of your business’ trajectory. Download now

2020 is finally over – been there, done that. And while it seems safe to say most everyone is all too eager to kick off a new calendar year, the reality is we’re still reeling – and will continue to reel – through the economic impacts of the COVID-19 global pandemic. As we inch closer to the one year marker of when many businesses were sent home – across all industries, including those tech-inclined and those less so – the understatement of the year is that the world has since changed as have consumer communication preferences, how businesses and customers interact, tweaked definitions of privacy, and new (heightened) expectations of evolving a positive customer experience with minimal friction and maximum security. While last year’s predictions of entering a new set of Roaring 20’s may not have panned out the way we had initially imagined, many of the trends thought to evolve over the last 365 days did. As we all look toward a post-pandemic world, here are six top trends to keep tabs on throughout 2021. 1. Data Data as a commodity and as a business differentiating factor has reached an all-time high. It’s doing more across the entire customer lifecycle and can elevate businesses to best prep for growth, especially as consumers begin to look for more financial products (whether looking for financial assistance as the CARES Act accommodation period ends, or to take advantage of the booming mortgage industry, etc.). Data can also give more insights into consumers than ever before. Far beyond just credit scores and financial data, today’s data sets can reveal consumers’ lifestyle preferences, their preferred communication channels, their rental histories, and so much more. With alternative credit data and non-traditional data (including consumer-permissioned data), businesses can get a holistic picture of their customers’ payment behaviors. That streaming media service monthly payment may seem minimal, but now could increase your credit score through Experian Boost. Experian is still making big strides in all efforts to use data for good. As of December 31, 2020, Experian Boost has “boosted” Americans’ credit scores nearly 47 million points. Additionally, throughout 2020, Experian worked with financial institutions and credit furnishers to continue to put consumers first and serve as the consumer’s bureau. Coming up in 2021? Using data for differentiation, which can ultimately drive business growth. From instant prescreens to identifying your best customers (and offering them cross-sell and upsell opportunities to increase retention and customer loyalty) to helping customers that may be on the brink of financial distress and connecting them with management solutions to help them get back on their feet, data can help businesses – and their customers – get there. 2. Fraud and Friction (And the Reduction of Both) With the pandemic, fraud saw increases across the board. Here are just some quick stats: 200% increase in first-time online banking usage immediately following shelter-in-place orders (Aite Group, “Workplace Distancing: Adapting Fraud and AML Operations to COVID-19,” April 2020) 652% year-over-year increase in records found on the dark web (Experian CyberAgent technology) 50% increase in human farming – real people being hired for purposes of fraud – month-over-month in March 2020 (Arkose Labs) And, unsurprisingly, consumer and business sentiments toward fraud are also evolving with these increasing trends. For example, according to Experian’s North America Trends Report, half of consumers continue to site security as the most important factor of their online experience. Additionally, there’s been an increase in the percentage of businesses who have recently increased or are planning to increase fraud budget from 76% in 2019 to 89% as of Sept. 2020. More complex phishing schemes and increased fraudster activity is due in part to numerous industries having to shift to online processes and business transactions overnight. Adoption for mobile wallets has jumped 11% since July 2020, according to the 2020 Global Insights Report. Systems and technology that were not ready or not armed with the necessary infrastructure left critical access points open that could be exploited by fraudsters. Fraud exists across the customer lifecycle, at every access point. And while fraud is complex, with Experian as your partner, solving it isn’t. Innovative technology enables businesses to prevent fraud by identifying credible customers and applying the correct treatment to the riskiest consumer and business accounts. We can help you develop a layered risk management strategy so you can focus resources on growing and protecting your customer relationships. 3. A New Administration – Changing of the Guards on the Regulatory Front With the new year enters the inauguration of a new president and administration. Though there is still much to be determined, certain areas are drawing a lot of attention with this changing of the guards. The highlights? The CFPB. Priorities and leadership could change. With COVID-19 top of mind, it is likely there will be aggressive agendas put forth to help protect the millions of consumers who have suffered economic distress and harm as a result of the pandemic. Data Portability. With an increased consumer appetite to port their data, questions and concerns around data security – and how to verify for a third party asking for the data – are also on the rise. There are a number of issues facing financial institutions around data portability, one of the largest being defining the line between consumer account information and proprietary data. All things privacy – state vs. national bills. The debate continues on how to move forward (whether privacy legislation will be handled by the states or at the national level), but for now it seems there is more progress at the state level. California was the first state to push through state-level privacy legislation in the form of the California Consumer Privacy Act of 2018. Twenty-four states are considering legislation that would require consent before collecting or disclosing personal information with third parties. 4. Analytics + Digitalization – Smarter, Better, Faster COVID-19 accelerated digital transformation for many. Some companies were ready, having already started making the headway in years prior, while others struggled – and some continue to struggle. The pandemic – and its corresponding recovery – is reason now, more than ever, to get some of your digital transformation priorities checked off of your list. Your customers demand it and your business needs it. Tackling analytics and digitalization not only brings your business up to speed, but improves your decisioning, enhances your offerings, and enables better platforms and data usage. In addition to digitalization, artificial intelligence for credit decisioning and personalized banking can also be expected to be a top trend, especially AI that is ethical and explainable, as will the increasing adoption and implementation of cloud computing. As consumer experience continues to reign supreme, any and all technology to enhance and improve that experience – think chatbots and virtual assistants – will also likely increase in presence. 5. Verification & Identity Identity has been a trending topic over the last few years, brought on by increasingly digital lifestyles and the intersection of personalization, frictionless transactions and adequate security. Identity verification and verification of other information such as income, employment and the like are increasingly needed in a today’s pandemic and tomorrow’s post-pandemic world. Leveraged across the lifecycle and during critical customer interactions, the need is especially heightened for insights, data accuracy, and diversification of data sets – to name a few. And while it was already established that identity verification is not just for marketing services, there are now even greater needs for financial institutions to be able to confidently know that their customers are who they say they are. Some areas to keep your eye on in 2021? Identity, income, assets and employment. 6. Redefining the Modern Mortgage As has been a common trend, spurred by the disruption caused by COVID-19, the mortgage industry is one of the many to have a magnifying glass brought to its areas for improvement. Some of those areas include operational efficiency, digital adoption and transparency. In line with the better and faster needs that lenders are continually trying to pace with, the need for speed is hitting mortgage originations, with an ideal situation outlined as closing in 30 days or less. Creating operational efficiencies through faster, fresher data can be the key for lenders to more accurately assess a borrower’s ability to pay upfront. Additionally, now, as most mortgage lenders are breaking previous origination records by a landslide (thanks pandemic), there’s new focus on other performance indicators. With such impetus, the modern mortgage is constantly evolving, incorporating customer-centric facets including a seamless digital process, providing meaningful customer experiences and leveraging the latest and greatest technology to better future-proof the industry through scalable technology, while aiming to reduce costs. For all your needs in 2021 and beyond, Experian has you covered. Learn More

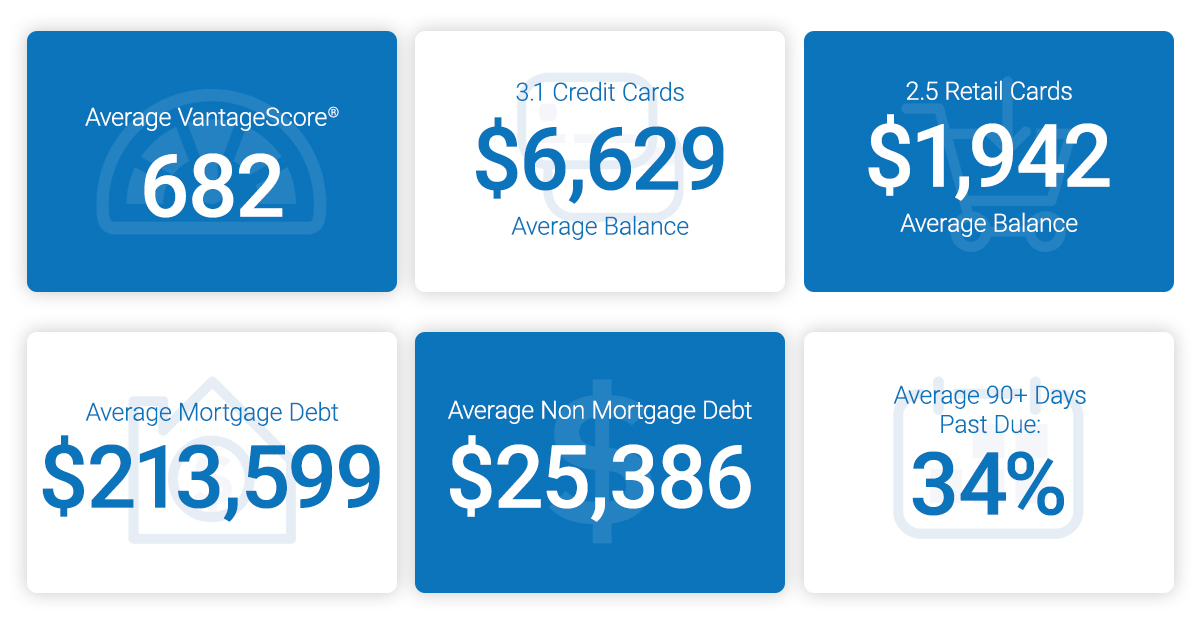

In what has been an unprecedented year, marked by a global pandemic and a number of economic and personal challenges for both businesses and consumers, Americans are maintaining healthy credit profiles during the COVID-19 pandemic. Experian released the 11th annual State of Credit report, which provides a comprehensive look at the credit performance of consumers across America by highlighting consumer credit scores and borrowing behaviors. This year’s report provided an extended view into how consumers are managing and repaying their debts; showing most Americans are practicing responsible credit management by reducing utilization rates, credit card balances and late payments. Even in light of the pandemic, data on American consumers across all generations shows responsible credit management including reduced utilization rates, credit card balances and late payments. “While it’s difficult to predict when the economy will return to pre-pandemic levels, we are seeing promising signs of responsible credit management, especially among younger consumers,” said Alex Lintner, group president Experian Consumer Information Services. Highlights of Experian’s State of Credit report: 2020 State of Credit Report 2019 2020 Average VantageScore® credit score [1,2] 682 688 Average number of credit cards 3.07 3.0 Average credit card balance $6,629 $5,897 Average revolving utilization rate 30% 26% Average number of retail credit cards 2.51 2.42 Average retail credit card balance $1,942 $2,044 Average nonmortgage debt [3] $25,386 $25,483 Average mortgage debt $213,599 $215,655 Average 30 - 59 days past due delinquency rates 3.9% 2.4% Average 60 - 89 days past due delinquency rates 1.9% 1.3% Average 90 - 180 days past due delinquency rates 6.8% 3.8% Though not the same, some consumers are experiencing a second economic downturn. The economic fallout stemming from COVID-19 coming after the Great Recession of 2009, which took place in the not too distant past. Silent, Boomer, Gen X and Gen Z Americans are managing responsible credit utilization rates and holding credit cards below the recommended maximum. Are the older generations more credit responsible? Average VantageScore® credit score follows rank order from oldest to youngest – though contributed to by length of time possessing credit, number of lines of credit, and other factors that drive credit score – with the Silent Generation having the highest score (729), then Boomers (716), followed by Gen X (676), Gen Y (658) and Gen Z (654). Gen X consumers have the highest average credit card balance at $7,718 and utilization at 32%, while Gen Z has the lowest average credit card balance at $2,197 and the Silent Generation has the lowest utilization at 13%. Year over year data shows positive results driven by younger borrowers. While average utilization rates dropped for every generation, the most significant decreases were seen in Gen Z borrowers who saw a 6 percent reduction in their use of available credit, followed by Millennials who saw a 5% decrease year-over-year. While Gen Z and Gen Y are carrying more credit cards than they were in 2020, their credit card balances decreased year-over-year. These factors fueled a 13-point increase in average credit scores for Gen Z and an 11-point increase for Millennials. When spliced by state, the data Minnesota had the highest credit score, while Mississippi had the lowest credit score. While the future is still uncertain, perhaps consumers can find comfort in knowing there is much they can do to improve their financial health – including their credit scores – and that there are numerous resources for them to access during these unprecedented times. “As the consumer’s bureau, we are committed to informing, guiding, and protecting consumers. Educating Americans about the factors included in their credit profile and how to manage these responsibly is of critical importance, especially on the road to economic recovery from the COVID-19 pandemic,” said Lintner. In an effort to encourage consumers to regularly monitor and understand the information in their credit reports, Experian joined forces with the other U.S. credit reporting agencies, to offer free weekly credit reports to all Americans through April 2021 via AnnualCreditReport.com. In addition to the free weekly credit report at AnnualCreditReport.com, Experian also offers consumers free access to their credit report and ongoing credit monitoring at Experian.com. Additional credit education resources and tools Experian’s #CreditChat: Hosted by @Experian on Twitter with financial experts every Wednesday at 3 p.m. Eastern time The Ask Experian blog: Find answers to common questions, advice and education about credit Experian Boost: Add positive telecom and utility payments to your Experian credit report for an opportunity to improve your credit scores experian.com/consumer-education-content/ experian.com/coronavirus 1VantageScore® is a registered trademark of VantageScore Solutions, LLC. 2VantageScore® credit score range is 300 to 850.

Account management is a critical strategy during any type of economy (pro-cycle, counter-cycle, cycle neutral). In times like these, marked by economic volatility, it is an effective way to identify which parts of your portfolio and which of your consumers need the most attention. Check out this podcast where Cyndy Chang, Senior Director of Product Management, and Craig Wilson, Senior Director of Consulting, discuss the foundational elements of account management, best practices and use cases. Account management today looks very different than what it has been during over a decade of growth proactive; account review is a critical part of navigating the path forward. Questions that need to be addressed include: Do you have the right data? Are you monitoring between data loads? Are you reviewing accounts at the frequency that today’s changing demands require? Listen in on the discussion to learn more. Experian · Look Ahead Podcast

Today, Experian and Oliver Wyman launched the Ascend Portfolio Loss ForecasterTM, a solution built to help lenders make better decisions – during COVID-19 and beyond – with customized forecasts and macroeconomic data. Phrases like “the new normal,” “unprecedented times,” and “extreme economic volatility” have flooded not only media for the last few months, but also financial institutions’ strategic discussions regarding plans to move forward. What has largely been crisis response is quickly shifting to an urgent need to answer the many questions around “Will we survive this crisis?,” let alone “What’s next?” And arguably, we’ve entered a new era of loss forecasting. After the longest period of economic growth in post-war U.S. history, previously built models are not sufficient for the unprecedented and sudden changes in economic conditions due to COVID-19. Lenders need instant insights to assess impact and losses to their portfolios. The Ascend Portfolio Loss Forecaster combines advanced modeling from Oliver Wyman, pandemic-specific insights and macroeconomic scenarios from Oxford Economics, and Experian’s quality data to analyze and produce accurate loan loss forecasts. Additionally, all of the data, including the forecasts and models, are regularly updated as macroeconomic conditions change. “Experian’s agility and innovative technologies allow us to help lenders make informed decisions in real time to mitigate future risk,” said Greg Wright, chief product officer of Experian’s Consumer Information Services, in a recent press release. “We’re proud to work with our partners, Oxford Economics and Oliver Wyman, to bring lenders a product powered by machine learning, comprehensive data and macroeconomic forecast scenarios.” Built using advanced modeling and expert scenarios, the web-based application maximizes the more than 15 years of Experian’s loan-level data, including VantageScore® credit score, bankruptcy scores and customer-level attributes. Financial institutions can gauge loan portfolio performance under various scenarios. “It is important that the banks take into account the evolving credit behaviors due to the COVID-19 pandemic, in addition to the robust modeling technique for their loss forecasting and strategic decisioning,” said Anshul Verma, senior director of products at Oliver Wyman, also in the release. “With the Ascend Portfolio Loss Forecaster, lenders get robust models that work in the current conditions and take into account evolving consumer behaviors,” Verma said. To watch Experian’s webinar on portfolio loss forecasting, please click here and to learn more about the Ascend Portfolio Loss Forecaster, click the button below. Learn More

The largest industry disruptor was a surprise to everyone. Where bets may have been placed on digital transformation, automated decisioning, or better omnichannel programs, no one foresaw the global pandemic of COVID-19 and the corresponding economic fall out that ensued. As financial institutions have spent the past two months scattered and then regrouping, whether with pivoted downturn contingency strategies or with a business-focused Hail Mary, some might argue that the dust is beginning to settle. While the world and the majority of businesses are working to manage and stabilize a new normal against a background of some form of chaos, once federal and state regulations are loosened, the world – and financial institutions in particular – will need a plan forward. So, what comes after COVID-19? With stimulus checks and what everyone hopes will soon be a re-stimulating of the economy, consumers will seek credit. And when that influx comes, there will be a need to strategize what is the right offer for the right consumer. How do you take on more customers while minimizing risk? Non-existent and/or shrinking budgets Many marketing budgets were already small prior to the global pandemic, so coming out of it, to say every marketing dollar counts is an understatement. Traditional prescreen, while a pillar in acquisition operations, is an antiquated strategy. Using hyper-segmentation via a true end-to-end marketing service, pumped up by the right data for decision making, enables financial institutions to not only build the right audience but tailor quality experiences that increase engagement and loyalty. That means ultimately reducing operating costs while improving experiences and take rates. Work from home turned life from home Going virtual has gone viral. Seemingly overnight, most brick and mortar operations went online. Some versions of digital transformation became a need to have, versus a nice to have, and the gap between the financial institutions who were equipped to pivot online, versus those who were not, spread further. As the vast majority of consumers are at home – whether by way of work from home or furlough – our society has quickly embraced everything being online. Reach your consumers where they are, in the digital-first channels to which they have become familiar with and accustomed. As consumers are at the center of every marketing strategy, engaging omnichannel delivery enhances reach across critical touchpoints. Inclusive of social media, email, direct mail, TV, and more, the campaign should provide a seamless experience, all working together in a synchronized fashion. Consistency has always been key, but especially during these volatile times, to reflect stability, empathy and constant messaging is an undertone that can only help strengthen consumers’ view of your organization. Learn fast, grow faster For marketing financial products, it’s a matter of connecting the dots between consumer touchpoints and results data. By making these critical connections, financial institutions will be better positioned to identify the most effective elements in the campaign. By gleaning more insights from campaign performance, organizations can optimize future campaigns and minimize wasted ad spend. These key learnings, delivered at the end of every campaign cycle, help your organization to remain nimble, pivot quickly and execute campaigns that get increasingly better ROI as you hone in on the nuances revealed by data on consumer behavior, preferences, motivations and more. Changing times and even faster-changing needs There’s always been a need for faster decisioning and more results with increasingly fewer resources. The need for speed has been put on hyperdrive as the economy has entered the current environment. How do you keep up with the changing needs of your consumers? Get your marketing right from the start and see results through to the end. Incorporating the right data, advanced analytics and constant access ultimately enable more strategic focus and shorter campaign cycles. As we all navigate the ever-changing “normal,” offering the right support to your consumers is the right thing to do for them and for you. Managing rising consumer needs, while also minimizing risk to your bottom line, is also the right thing to do for your business. Once plans move from managing business operations through the crisis to moving forward, make sure your marketing – how you are reaching out to existing customers and prospective customers for the next steps in their financial journey – is data-driven. To learn more about how Experian can help you execute data-driven marketing that fuels customer acquisition, visit our website. Learn More

While an overdue economic downturn has been long discussed, arguably no one could have foreseen the economic disruption from COVID-19 to the extent that’s been witnessed thus far. But now that we’re here, is there a line of sight to financial institutions’ next move? With the current situation marked by a history-making rise in unemployment, massive amounts of uncertainty within the market as well as for consumers and small businesses and consumer spending changes, loss forecasting is more important now than ever before. After the longest period of economic growth in history, financial institutions are caught off guard. While large banks are more prepared as they have stress testing capabilities in place and are estimating the potential large impact on their loss allowances, the since-delayed CECL requirements emphasized forecasting for the masses, and yet many are still under-equipped. Loss forecasting has evolved from a need for a small few to now a necessary strategy for all. While some financial institutions will look to loss forecasting to potentially reduce the severity of impact for the path ahead during these times (or even how they might come out stronger than their competition), for many, loss forecasting is the key to survival. Bare necessities. Understanding the possible outcomes of the pandemic’s impact is necessary to make critical business decisions. Lenders are likely receiving numerous questions about their portfolios and possible outcomes. These questions include, but are not limited to: What could the range of outcomes to my portfolio based on expert forecasts of macroeconomic conditions? How will I make lending decisions in the short term? Do my models need to change? How bad could charge offs be for my portfolio? If I have reduced marketing and application flows, at what point do I need to begin opening new accounts or consider portfolio acquisitions? How can lenders get answers? Loss forecasting. As Mohammed Chaudhri, Experian Chief Economist, said, “Loss forecasting is more pivotal than ever…existing models are not going to be up to the task of accurately predicting losses.” Whatever questions you’re receiving, you need certain necessary pieces of information to navigate this new era of loss forecasting. Those pieces are frequently updated client and industry data; ongoing access to expert macroeconomic forecasts; and sophisticated and evolved forecasting models. Client and Industry Data Loan-level data, bankruptcy scores and customer-level attributes are key insights to fueling loss forecasting models. By combining several data sets and scores (and a comprehensive history of both) your organization can see greater benefits. Macroeconomic Forecasts As has been mentioned numerous times, the economic impact resulting from COVID-19 is not at all like the Great Recession. As such, leveraging macroeconomic forecasts, and specifically COVID-19 forecasts, is critical to analyzing the potential impacts to your organization. Sophisticated Models Whether building models on your own or leveraging an expert, the key ingredients include the innerworkings of the model, leveraging historical data and making sure that both the models and the data are updated regularly to ensure you have the most accurate, thorough forecasts available. Also, leveraging machine learning tools is imperative for model specification and evaluation. Fortunately, while model building and loss forecasting used to be synonymous with countless resources and dollar signs, innovation and digital transformation have made these strategies within reach for financial institutions of all sizes. Incorporating the right data (and ensuring that data is regularly updated), with the right tools and macroeconomic scenarios (including COVID-19, upside, baseline, adverse and severely adverse scenarios) enables you to get a line of sight into the actions you need to take now. Empowered with insights to compare and benchmark results, discover the cause of changes in results, explore result scenarios in advance, and access recommended optimizations, loss forecasting enables you to focus on the critical decisions your business depends on. Experian helps you with loss forecasting for now and the future. For more information, including an on-demand webinar Experian presented with Oliver Wyman as well as the opportunity to engage Experian experts into your loss forecasting strategy, please click the button below. Learn More

Update: After closely monitoring updates from the WHO, CDC, and other relevant sources related to COVID-19, we have decided to cancel our 2020 Vision Conference. If you had the chance to experience tomorrow, today, would you take it? What if it meant you could get a glimpse into the future technology and trends that would take your organization to the next level? If you’re looking for a competitive edge – this is it. For more than 38 years, Experian’s premier conference has connected business leaders to data-driven ideas and solutions, fueling them to target new markets, grow existing customer bases, improve response rates, reduce fraud and increase profits. What’s in it for you? Everything to gain and nothing to lose. Are you a marketer? These sessions were made to drive your conversion rates to new heights: Know your customers via omnichannel marketing: Your customers are everywhere, but can you reach them? Learn how to drive business-expansion strategy, brand affinity and customer engagement across multiple channels. Plus, gain insight into connecting with customers via one-to-one messaging. By invitation only, the future of ITA marketing: An evolving landscape means marketers face new challenges in effectively targeting consumers while staying compliant. In this session, we’ll explore how you can leverage fair lending-friendly marketing data for targeting, analysis and measurement. Want the latest in technology trends? Dive into discussions to transform your customer experience: Credit in the age of technology transformation: Machine learning and artificial intelligence are the current darlings of big data, but the platform that drives the success of any big data endeavor is crucial. This session will dive into what happens behind the curtain. Put away your plastic – next-generation identity: An industry panel of experts discusses the newest digital identity and authentication capabilities – those in use today and also exciting solutions on the horizon. How about for the self-proclaimed data geeks? Analyze these: Alternative data: Listen in on an in-depth conversation about creative and impactful examples of using emerging data assets, such as alternative and consumer-permissioned data, for improved consumer inclusion, risk assessment and verification services. The next wave in open data: Experian will share their views on the potential of advanced data and models and how they benefit the global value chain – from consumer scores to business opportunities – regardless of local regulations. And the risk masters? Join us as we kick fraud to the curb: Understanding and tackling synthetic ID fraud: Synthetic IDs present a serious challenge for our entire industry. This expert panel will explore the current landscape – what’s working and what’s not, the expected impact of the next generation SSA eCBSV service, and best practice prevention methods. You are your ID – the new reality of biometrics: Consumers are becoming increasingly comfortable with biometrics. Just as CLEAR has transformed how we use our biometric identity to move through airports, sports venues and more, financial transactions can also be made friction-free. The point is, there’s something for everyone at Vision 2020. It’s not just another conference. Trade in stuffy tradeshow halls and another tri-fold brochure for the insights and connections you need to take your career and organization to the next level. Like technology itself, Vision 2020 promises to connect us, unify us and enable us all to create a better tomorrow. Join us for unique networking opportunities, one-on-one conversations with subject-matter experts and more than 50 breakout sessions with the industry’s most sought-after thought leaders.

It may be a new decade of disruption, but one thing remains constant – the consumer is king. As such, customer experience (and continually evolving digital transformations necessary to keep up), digital expansion and all things identity will also reign supreme as we enter this new set of Roaring 20s. Here are seven of the top trends to keep tabs of through 2020 and beyond. 1. Data that does more – 100 million borrowers and counting Traditional, alternative, public record, consumer-permissioned, small business, big business, big, bigger, best – data has a lot of adjectives preceding it. But no matter how we define, categorize and collate data, the truth is there’s a lot of it that’s untapped, which is keeping financial institutions from operating at their max efficiency levels. Looking for ways to be bigger and bolder? Start with data to engage your credit-worthy consumer universe and beyond. Across the entire lending lifecycle, data offers endless opportunities – from prospecting and acquisitions to fraud and risk management. It fuels any technology solution you have or may want to implement over the coming year. Additionally, Experian is doing their part to create a more holistic picture of consumer creditworthiness with the launch of Experian LiftTM in November. The new suite of credit score products combines exclusive traditional credit, alternative credit and trended data assets, intended to help credit invisible and thin-file consumers gain access to fair and affordable credit. "We're committed to improving financial access while helping lenders make more informed decisions. Experian Lift is our latest example of this commitment brought to life,” said Greg Wright, Executive Vice President and Chief Product Officer for Experian Consumer Information Services. “Through Experian Boost, we're empowering consumers to play an active role in building their credit histories. And, with Experian Lift, we're empowering lenders to identify consumers who may otherwise be excluded from the traditional credit ecosystem,” he said. 2. Identity boom for the next generation Increasingly digital lifestyles have put personalization and frictionless transactions on hyperdrive. They are the expectation, not a nice-to-have. Having customer intelligence will become a necessary survival strategy for those in the market wanting to compete. Identity is not just for marketing purposes; it must be leveraged across the lending lifecycle and every customer interaction. Fragmented customer identities are more than flawed for decisioning purposes, which could potentially lead to losses. And, of course, the conversation around identity would be incomplete without a nod to privacy and security considerations. With the roll-out of the California Consumer Privacy Act (CCPA) earlier this month, we will wait to see if the other states follow suit. Regardless, consumers will continue to demand security and trust. 3. All about artificial intelligence and machine learning We get it – we all want the fastest, smartest, most efficient processes on limited – and/or shrinking – budgets. But implementing advanced analytics for your financial institution doesn’t have to break the bank. And, when it comes to delivering services and messaging to customers the way they want it, how to do that means digital transformation – specifically, leveraging big data and actionable analytics to evaluate risk, uncover industry intel and improve decisioning. One thing’s for certain, financial institutions looking to compete, gain traction and pull away from the competition in this next decade will need to do so by leveraging a future-facing partner’s expertise, platforms and data. AI and machine learning model development will go into hyperdrive to add accuracy, efficiency, and all-out speed. Real-time transactional processing is where it’s at. 4. Customer experience drives decisioning and everything Faster, better, more frictionless. 2020 and the decade will be all about making better decisions faster, catering to the continually quickening pace of consumer attention and need. Platforms and computing language aside, how do you increase processing speed at the same time as increasing risk mitigation? Implementing decisioning environments that cater to consumer preferences, coupled with best-in-class data are the first two steps to making this happen. This can facilitate instant decisioning within financial institutions. Looking beyond digital transformation, the next frontier is digital expansion. Open platforms enable financial institutions to readily add solutions from numerous providers so that they can connect, access and orchestrate decisions across multiple systems. Flexible APIs, single integrations and better strategy and design build the foundation of the framework to be implemented to enhance and elevate customer experience as it’s known today. 5. Credit marketing that keeps up with the digital, instant-gratification age Know your customer may be a common acronym for the financial services industry, but it should also be a baseline for determining whether to send a specific message to clients and prospects. From the basics, like prescreen, to omni-channel marketing campaigns, financial institutions need to leverage the communication channels that consumers prefer. From point of sale to mobile – there are endless possibilities to fit into your consumers’ credit journey. Marketing is clearly not a one-and-done tactic, and therefore multi-channel prequalification offers and other strategies will light the path for acquisitions and cross-sell/up-sell opportunities to come. By developing insights from customer data, financial institutions have a clear line of sight into determining optimal strategies for customer acquisition and increasing customer lifetime value. And, at the pinnacle, the modern customer acquisition engine will continue to help financial institutions best build, test and optimize their customer channel targeting strategies faster than ever before. From segmentation to deployment, and the right data across it all, today and tomorrow’s technology can solve many of financial organizations’ age-old customer acquisition challenges. 6. Three Rs: Recession, regulatory and residents of the White House Last March, the yield curve inverted for the first time since 2007. Though the timing of the next economic correction is debated, messaging is consistent around making a plan of action now. Whether it’s arming your collections department, building new systems, updating existing systems, or adjusting rules and strategy, there are gaps every organization needs to fill. By leveraging the stability of the economy now, financial institutions can put strategies in place to maximize profitability, manage risk, reduce bad debt/charge-offs, and ensure regulatory compliance among their list of to-do’s, ultimately resulting in a more efficient, better-performing program. Also, as we near the election later this year, the regulatory landscape will likely change more than the usual amount. Additionally, we will witness the first accounts of what CECL looks like for SEC-filing financial institutions (and if that will suggest anything for how non-SEC-filing institutions may fare as their deadline inches closer), as well as see the initial implications of the CCPA roll out and whether it will pave a path for other states to follow. As system sophistication continues to evolve, so do the risks (like security breaches) and new regulatory standards (like GDPR and CCPA) which provide reasons for organizations to transform. 7. Focus on fraud (in all forms) With evolving technology, comes evolved fraudsters. Whether it’s loyalty and rewards programs, account openings, breaches, there are so many angles and entry points. Synthetic identity fraud is the fastest-growing type of financial crime in the United States. The cost to businesses is estimated to grow to $1.2 billion by 2020, according to the Aite Group. To ensure the best protection for your business and your customers, a layered, risk-based approach to fraud management provides the highest levels of confidence in the industry. Balance is key – while being compliant with regulatory requirements and conscious of user experience, ensuring consumers’ peace of mind is priority one. Not a new trend, but recognizing fraud and recognizing good consumers will save continue to save financial institutions money and reputational harm, driving significant improvement in key performance indicators. Using the right data (and aggregating multiple data sets) and digital device intelligence tools is the one-two punch to protect your bottom line. For all your needs in 2020 and throughout the next decade, Experian has you covered. Learn more

As consumers prepare for the next decade, we look at how we’re rounding out this year. The results? The average American credit score is 682, an eight-year high. Experian released the 10th annual state of credit report, which provides a comprehensive look at the credit performance of consumers across America by highlighting consumer credit scores and borrowing behaviors. And while the data is spliced to show men vs. women, as well as provides commentary at the state and generational level, the overarching trend is up. Even with the next anticipated economic correction often top of mind for financial institutions, businesses and consumers alike, 2019 was a year marked by more access, more spending and decreasing delinquencies. Things are looking up. “We are seeing a promising trend in terms of how Americans are managing their credit as we head into a new decade with average credit scores increasing two points since 2018 to 682 – the highest we’ve seen since 2011,” said Shannon Lois, Senior Vice President and Head of EAS, Analytics, Consulting & Operations for Experian Decision Analytics. “Average credit card balances and debt are up year over year, yet utilization rates remain consistent at 30 percent, indicating consumers are using credit as a financial tool and managing their debts responsibly.” Highlights of Experian’s State of Credit report: 3-year comparison 2017 2018 2019 Average number of credit cards 3.06 3.04 3.07 Average credit card balances $6,354 $6,506 $6,629 Average number of retail credit cards 2.48 2.59 2.51 Average retail credit card balances $1,841 $1,901 $1,942 Average VantageScore® credit score[1, 2] 675 680 682 Average revolving utilization 30% 30% 30% Average nonmortgage debt[3] $24,706 $25,104 $25,386 Average mortgage debt $201,811 $208,180 $231,599 Average 30 days past due delinquency rates 4.0% 3.9% 3.9% Average 60 days past due delinquency rates 1.9% 1.9% 1.9% Average 90+ days past due delinquency rates 7.3% 6.7% 6.8% In the scope of the credit score battle of the sexes, women have a four-point lead over men with an average credit score of 686 compared to 682. Their lead is a continued trend since 2017 where they’ve bested their male counterparts. According to the report, while men carry more non-mortgage and mortgage debt than women, women have more credit cards and retail cards (albeit they carry lower balances). Generationally, Generations X, Y and Z tend to carry more debt, including mortgage, non-mortgage, credit card and retail card, than older generations with higher delinquency and utilization rates. Segmented by state and gender, Minnesota had the highest credit scores for both men and women, while Mississippi was the state with the lowest average credit score for females and Louisiana was the lowest average credit score state for males. As we round out the decade and head full-force into 2020, we can reflect on the changes in the past year alone that are helping consumers improve their financial health. Just to name a few: Experian launched Experian BoostTM in March, allowing millions of consumers to add positive payment history directly to their credit file for an opportunity to instantly increase their credit score. Since then, there has been over 13 million points boosted across America. Experian LiftTM was launched in November, designed to help credit invisible and thin-file consumers gain access to fair and affordable credit. Long-standing commitments to consumer education, including the Ask Experian Blog and volunteer work by Experian’s Education Ambassadors, continue to offer assistance to the community and help consumers better understand their financial actions. From what we can tell, this is just the beginning. “Understanding the factors that influence their overall credit profile can help consumers improve and maintain their financial health,” said Rod Griffin, Experian’s director of consumer education and awareness. “Credit can be used as a financial tool. Through this report, we hope to provide insights that will help consumers make more informed decisions about credit use as we prepare to head into a new decade.” Learn more 1 VantageScore® is a registered trademark of VantageScore Solutions, LLC. 2 VantageScore® credit score range is 300 to 850. 3 Average debt for this study includes all credit cards, auto loans and personal loans/student loans.