Ecommerce / Retail

Everyone loves a story. Correction, everyone loves a GOOD story. A customer journey map is a fantastic tool to help you understand your customer’s story from their perspective. Perspective being the operative word. This is not your perspective on what YOU think your customer wants. This is your CUSTOMER’S perspective based on actual customer feedback – and you need to understand where they are from those initial prospecting and acquisition phases all the way through collections (if needed). Communication channels have expanded from letters and phone calls to landlines, SMS, chat, chat bots, voicemail drops, email, social media and virtual negotiation. When you create a customer journey map, you will understand what channel makes sense for your customer, what messages will resonate, and when your customer expects to hear from you. While it may sound daunting, journey mapping is not a complicated process. The first step is to simply look at each opportunity where the customer interacts with your organization. A best practice is to include every department that interacts with the customer in some way, shape or form. When looking at those touchpoints, it is important to drill down into behavior history (why is the customer interacting), sociodemographic data (what do you know about this customer), and customer contact patterns (Is the customer calling in? Emailing? Tweeting?). Then, look at your customer’s experience with each interaction. Again, from the customer’s viewpoint: Was it easy to get in touch with you? Was the issue resolved or must the customer call back? Was the customer able to direct the communication channel or did you impose the method? Did you offer self-serve options to the right population? Did you deliver an email to someone who wanted an email? Do you know who prefers to self-serve and who prefers conversation with an agent, not an IVR? Once these two points are defined: when the customer interacts and the customer experience with each interaction, the next step is simply refining your process. Once you have established your baseline (right channel, right message, right time for each customer), you need to continually reassess your decisions. Having a system in place that allows you to track and measure the success of your communication campaigns and refine the method based on real-time feedback is essential. A system that imports attribute – both risk and demographic – and tracks communication preferences and campaign success will make for a seamless deployment of an omnichannel strategy. Once deployed, your customer’s experience with your company will be transformed and they will move from a satisfied customer to one that is a fan and an advocate of your brand.

Direct mail is dead. It’s so 90s. Digital is the way to reach consumers. Marketers have heard this time and again, and many have shifted their campaign focus to the digital space. But as our lives become more and more consumed by digital media, consumers are giving less time and attention to the digital messages they receive. The average lifespan of an email is now just two seconds and brand recall directly after seeing a digital ad is just 44%, compared to direct mail which has a brand recall of 75%. Further research shows direct mail marketing is one of the most effective tools for customer acquisition and loan growth. The current Data & Marketing Association (DMA) response rate report reveals the direct mail response rates for 2016 were at the highest levels since 2003. Additionally, while mailing volume has trended down since October 2016, response rates have trended up, and reached 0.68% in March 2017, up from 0.56% in October 2016. Using data and insights to tailor a direct mail campaign can yield big results. Here are some attention-grabbing tips: Identify Your Target Market: Before developing your offer and messaging strategy, begin with the customer profile you are trying to attract. Propensity models and estimated interest rates are great tools for identifying consumers who are more likely to respond to an offer. Adding them as an additional filter to a credit-qualified population can help increase response rates. Verify your Mailing List: Experian’s address verification software validates the accuracy and completeness of a physical address, flags inaccuracies, and corrects errors before they can negatively impact your campaign. Personalize the Offer: Consumers are more likely to open offers that are personalized, and appeal to their life stage, organizational affiliations or interests. Experian’s Mosiac profile report is a simple, inexpensive way to gather data-based insight into the lifestyle and demographics of your audience. Time the Offer: Timing your campaign with peak market demand is key. For example, personal loan demand is highest in the first quarter after the holidays, while student loans demand peaks in the Spring. Direct mail can help overcome digital fatigue that many consumers are experiencing, and when done right, it’s the printed piece that helps marketers boost response rates.

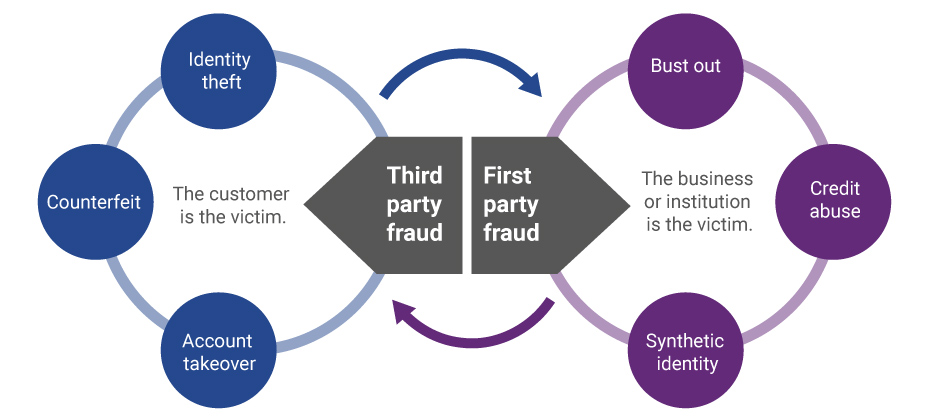

Evolution of first-party fraud to third Third-party and first-party schemes are now interchangeable, and traditional fraud detection practices are less effective in fighting these evolving fraud types. Fighting this shifting problem is a challenge, but it isn’t impossible. To start, incorporate new and more robust data into your identity verification program and provide consistent fraud classification and tagging. Learn more>

It should come as no surprise that the process of trying to collect on past-due accounts has been evolving. We’ve seen the migration from traditional mail and outbound calls, to offering an electronic payment portal, to digital collections and virtual negotiators. Being able to get consumers who have past-due debt on the phone to discuss payments is almost impossible. In fact, a recent informal survey divulged a success rate of a 15% contact rate to be considered the best by several first-party collectors; most reported contact rates in the 8%-range. One can only imagine what it must be like for collection agencies and debt buyers. Perhaps, inviting the consumer to establish a non-threatening dialog with an online system can be a better approach? Now that collectors have had time to test virtual collections, we’ve collected some data points. Conversion rates, revisits, and time of day An analysis of several clients found that on average 52% of consumers that visit a digital site will proceed to a payment schedule if the right offer is made. 21% of the visits were outside the core hours of 8 a.m. to 8 p.m., an indication that consumers were taking advantage of the flexibility of reaching out at any time of the day or night to explore their payment and settlement options. The traditional business hours don’t always work. Here is where it really gets interesting, and invites a clear comparison to the traditional phone calls that collectors make trying to get the consumer to commit to a payment plan on the line. Of the consumers that committed to a payment plan, only 56% did it in a single visit. The remaining 44% that committed to payments did so mostly later that day, or on a subsequent day. This strongly suggests they either took time to check their financial status, or perhaps asked a friend or family to help with the payment. In other words, rather than refusing to agree to an instantaneous agreement pressured by a collector, the consumer took time to reflect and decide what was the best course of action to settle the amount due. On a similar note, the attrition rate of “Promises to Pay” were 24% lower using online digital solutions versus the traditional collector phone call. This would be consistent with more time to agree to a payment plan that could be met, rather than weakly agreeing to a collector phone call just to get the collector off the phone. Another possible reason for a lower attrition rate may be that a well-defined digital collection solution can send out reminders to consumers via email or text in advance of the next scheduled payment, so that the consumer can be reminded to have the funds available when the next payment hits their account. For accounts where settlement offers are part of the mix, a higher percentage of balances is being resolved versus the collection floor. In fact, the average payment improvement is 12% over what collectors tend to get on the collections floor. The reason for this significant change is unclear, but the suspicion is that a digital collection solution will negotiate stronger than a collector, who is often moving to the bottom of an acceptable range too soon. What's next? Further assessing the consumer’s needs and capabilities during the negotiation session will undoubtedly be a theme going forward. Logical next steps will include a “behind-the-scenes” look at the consumer’s entire credit picture to help the creditor craft an optimal settlement amount that both the consumer can meet, and at the same time optimizes recovery. Potential impact to credit scores will also come into the picture. Depending on where the consumer and his past-due debt is in the credit lifecycle, being able to reasonably forecast the negative impact of a missed payment can act as an additional argument for making a past-due or delinquent payment now. As more financial institutions test this new virtual approach, we anticipate customer satisfaction and resolutions will continue to climb.

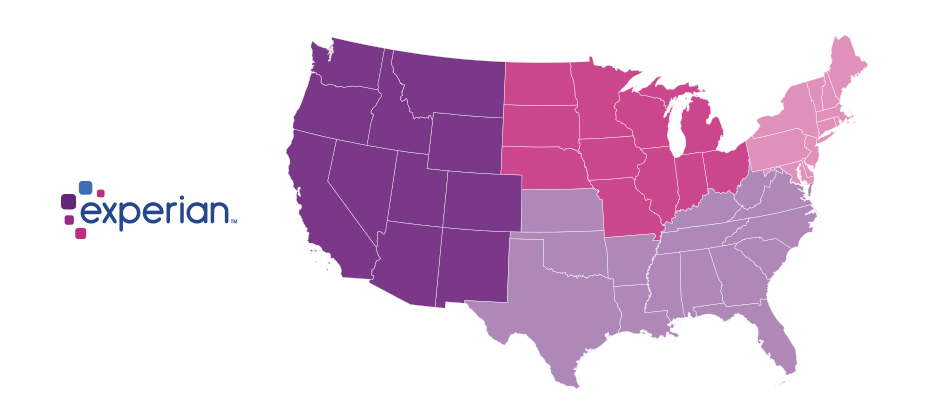

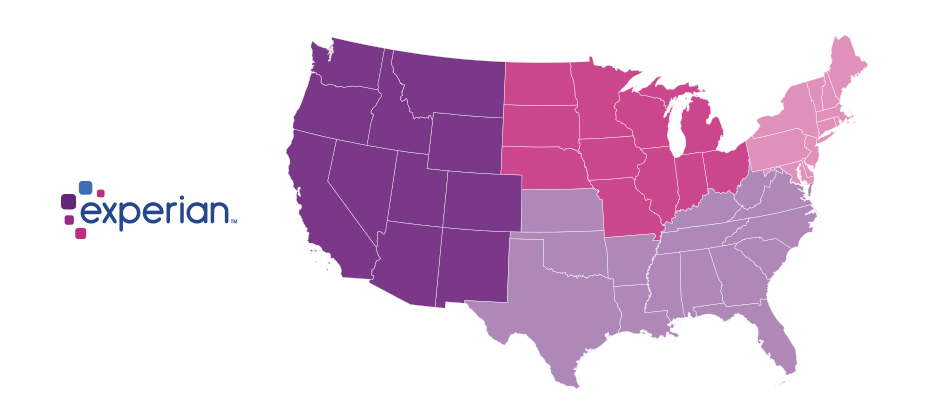

We recently analyzed millions of online transactions from the first half of 2017 to identify fraud attack rates. Here are the top 3 riskiest states for e-commerce billing and shipping fraud for H1 2017: Riskiest states for billing fraud Oregon Delaware Washington, D.C. Riskiest states for shipping fraud Oregon Delaware Florida Fraudsters are extremely creative, motivated and often connected. Protect all points of contact with your customers to prevent this growing type of fraud. Is your state in the top 10?

Since the advent of the internet, our lives have changed drastically for the better. We can perform many of life’s daily activities from the comfort of our own home. According to Aite, in 2016 alone 36 million Americans made some form of mobile payment — paying a bill, purchasing something online, paying for fast food or making a mobile wallet purchase at a retailer. Simply put, the internet has made our lives easier. But with the good also comes the bad. While most consumers have moved to the digital world, so have fraudsters. With minimal risk and high reward at stake, e-commerce fraud attacks have increased dramatically over the last few years, with no signs of slowing down. We recently analyzed millions of transactions from the first half of 2017 to identify fraud attack rates based on billing and shipping addresses and broke down the findings into various geographic trends. Fraud attack rates represent the attempted fraudulent e-commerce transactions against the population of overall e-commerce orders. Consumers living out West and in the South have experienced more than their fair share of fraud. During the first half of 2017, the West and the South were the top two regions for both billing and shipping attacks. While both regions were at the top during the same time last year, the attacks themselves have increased substantially. Given the proximity to seaports and major international airports, this is somewhat unsurprising — particularly for shipping fraud — as many fraudsters will leverage reshippers to transport goods soon after delivery. .dataTb{margin:20px auto;width:100%}.dataTb:after{clear:both}.dataTb table{}.dataTb td,.dataTb th{border:1px solid #ddd;padding:.8em}.dataTb th{background:#F4F4F4}.tbL{float:left;width:49%}.tbR{float:right;width:49%;margin:0 0 0 2%} Shipping: Riskiest Regions Region Attack rate West 38.1 South 32.1 Northeast 27.0 North Central 20.7 Billing: Riskiest Regions Region Attack rate West 37.2 South 32.9 Northeast 27.3 North Central 24.0 At the state level, the top three shipping fraud states remained the same as 2016 — Delaware, Oregon and Florida — but the order changed. Oregon was the most targeted, with a fraud rate of 135.2 basis points, more than triple its rate at in the end of 2016. Though no longer in the top spot, Delaware saw alarming spikes as well, with shipping attack rates nearly triple last year’s rate at 128.6 basis points and billing attacks at 79.6 basis points. .dataTb{margin:20px auto;width:100%}.dataTb:after{clear:both}.dataTb table{}.dataTb td,.dataTb th{border:1px solid #ddd;padding:.8em}.dataTb th{background:#F4F4F4}.tbL{float:left;width:49%}.tbR{float:right;width:49%;margin:0 0 0 2%} Shipping: Riskiest States State Attack rate Oregon 135.2 Delaware 128.2 Florida 57.4 New York 45.0 Nevada 36.9 California 36.9 Georgia 33.5 Washington, D.C 30.8 Texas 29.6 Illinois 29.4 Billing: Riskiest States Region Attack rate Oregon 87.5 Delaware 79.6 Washington, D.C. 63.0 Florida 47.4 Nevada 38.8 California 36.9 Arkansas 36.6 New York 35.5 Vermont 34.2 Georgia 33.4 Diving a bit deeper, ZIPTM codes in Miami, Fla., make up a significant portion of the top 10 ZIP CodeTM lists for shipping and billing attacks — in fact, many of the same ZIP codes appear on both lists. The other ZIP Code that appears on both lists is South El Monte, Calif., which has a high percentage of industrial properties — common targets for fraudsters to ship packages, then reship overseas. You can download the top 100 riskiest Zip Codes in the U.S. for H1 2017. .dataTb{margin:20px auto;width:100%}.dataTb:after{clear:both}.dataTb table{}.dataTb td,.dataTb th{border:1px solid #ddd;padding:.8em}.dataTb th{background:#F4F4F4}.tbL{float:left;width:49%}.tbR{float:right;width:49%;margin:0 0 0 2%} Shipping: Top 10 riskiest ZIP™ Codes ZIP Code Attack rate 33122 [Miami, Fla.] 2409.4 91733 [South El Monte, Calif.] 1655.5 33198 [Miami, Fla.] 1295.2 33166 [Miami, Fla.] 1266.0 33195 [Miami, Fla.] 1037.3 33192 [Miami, Fla.] 893.9 97251 [Portland, Ore.] 890.6 07064 [Port Reading, NJ] 808.9 89423 [Minden, Nev.] 685.5 77072 [Houston, Tex.] 629.3 Billing: Top 10 riskiest ZIP™ Codes ZIP Code Attack rate 77060 [Houston, Tex.] 1337.6 33198 [Miami, Fla.] 1215.6 33122 [Miami, Fla.] 1106.2 33166 [Miami, Fla.] 1037.4 91733 [South El Monte, Calif.] 780.1 33195 [Miami, Fla.] 713.7 97252 [Portland, Ore.] 670.8 33191 [Miami, Fla.] 598.8 33708 [St. Petersburg, Fla.] 563.6 33792 [Miami, Fla.] 493.0 As e-commerce fraud continues to grow, businesses need to be proactive to keep themselves and their customers safe. That means incorporating multiple, layered fraud prevention strategies that work together seamlessly — for example, understanding details about users and their devices, knowing how users interact with the business and evaluating previous transaction history. This level of insight can help businesses distinguish real customers from nefarious ones without impacting the customer experience. While businesses are ultimately responsible for the safety of customers and their data, the onus doesn’t rest solely with them. Consumers should also be vigilant when it comes to protecting their digital identities and payment information. That means creating strong, unique passwords; actively monitoring online accounts; and using two-factor authentication to secure account access. At the end of the day, e-commerce fraud is a challenge that businesses and consumers will experience for the foreseeable future. But rising attack rates don’t have to spell doom and gloom for the industry. E-commerce growth is still extremely strong, as consumers interact through multiple channels (in-store, mobile and web) and expect a personalized experience. Establishing trust and verifying digital identities are key to meeting these latest expectations, which provide new opportunities for businesses and consumers to interact seamlessly and transact securely. With multiple safeguards in place, businesses have a variety of options to protect their customers and their brand reputation. Experian is a nonexclusive full-service provider licensee of the United States Postal Service®. The following trademarks are owned by the United States Postal Service®: ZIP and ZIP Code. The price for Experian’s services is not established, controlled or approved by the United States Postal Service.

School is nearly back in session. You know what that means? The next wave of college students is taking out their first student loans. It’s a milestone moment – and likely the first trade on the credit file for many of these individuals. According to the College Board, the average cost of tuition and fees for the 2016–2017 school year was $33,480 at private colleges, $9,650 for state residents at public colleges, and $24,930 for out-of-state residents attending public universities. So really, regardless of where students go, the cost of a college education is big. In fact, from January 2006 to July 2016, the Consumer Price Index for college tuition and fees increased 63 percent. So, unless mom and dad did a brilliant job saving, chances are many of today’s students will take on at least some debt to foot the college bill. But it’s not just the young who are consumed by student loan debt. In Experian’s latest State of Student Lending report, we dive into how the $1.4 trillion in student loan debt for Americans is impacting all generations in regards to credit scores, debt load and delinquencies. The document additionally looks at geographical trends, noting which states have the most consumers with student loan debt and which ones have the least. Overall, we discovered 13.4% of U.S. consumers have one or more student loan balances on their credit file with an average total balance of $34k. Additionally, these consumers have an average of 3.7 student loans with 1.2 student loans in deferment. The average VantageScore® credit score for student loan carriers is 650. As we looked across the generations, every group – from the Silents (age 70+) to Gen Z (oldest are between 18 to 20) had some student loan debt. While we can make assumptions that the Silents and Boomers are likely taking out these loans to support the educational pursuits of their children and grandchildren, it can be mixed for Gen X, who might still be paying off their own loans and/or supporting their own kids. Gen X members also reported the largest average student loan total balance at $39,802. Gen Z, the newest members to the credit file, have just started to attend college, thus their generation has the largest percent of student loan balances in deferment at 77%. Their average student loan total balance is also the lowest of all generations at $11,830, but that is to be expected given their young ages. In regards to geographical trends, the Northern states tended to sport the highest average student loan total balances, with consumers in Washington D.C. winning that race with $52.5k. Southern states, on the other hand, reported higher percentages of consumers with student loan balances 90+ days past due. South Carolina, Louisiana, Mississippi, Arkansas and Texas held the top spots in the delinquency category. Access the complete State of Student Lending report. Data from this report is representative of student loan data on file as of June 2017.

We live in a digital world where online identities are ubiquitous. But with the internet’s inherent anonymity, how do you know you’re interacting with a legitimate individual rather than an imposter? Too often we hear stories about consumers who see unauthorized purchases on their credit cards, enable access to their devices based on an imposter claiming to be a security vendor or send money to someone they met online only to learn they’ve been “catfished” by a fraudster. These are growing problems, as more consumers transition to digital services and look to businesses to protect them, enable seamless trusted interactions and maintain their privacy. I recently chatted with MarketWatch about how consumers can protect themselves and their privacy when using online dating apps, as well as what businesses are doing to safeguard digital data. As part of the discussion, I mentioned that a simple, standard verification process companies of all sizes can leverage is vital to our rapidly evolving digital economy. Today, companies have their own policies, processes and definitions of identity verification, depending on the services they offer. This ranges from secure access requiring strong identity proofing, document verification, multifactor authentication and biometric enrollment to new social profiles that do little more than validate receipt of an email to establish an online account. To satisfy those diverse risk-based needs, more organizations are turning to federated identity verification options. A federated system allows businesses to leverage trusted, reputable, third-party sources to validate identity by cross-referencing the information they’ve received from a consumer against these sources to determine whether to establish an account or allow a transaction. While some organizations have attempted to develop similar identity verification capabilities, many lack a trusted identity source. For example, there are solutions that leverage data from social media accounts or provide multifactor fraud and authentication options, but they often become easily compromised because of the absence of verifiable data. A trusted solution aggregates data across multiple providers that have undergone thorough security and data quality vetting to ensure the identity data is accurately submitted in accordance with business and compliance requirements. In fact, there are only a handful of trusted identity sources with this level of due diligence and oversight. At Experian, we assess verification requests against an aggregate of hundreds of millions of records that include identity relationships, profile risk attributes, historical usage records and demographic data assets. With decades of knowledge about identity management and fraud prevention, we help companies of all sizes balance risk mitigation and maintain compliance requirements — all while ensuring consumer data privacy. Trust takes years to build and mere seconds to lose, and the industry has made undeniable progress in security. But there is much left to do. Consumers are increasingly involved in the protection and use of their data. However, they often don’t realize downloading a hot new app and entering personal details or linking to their friends exposes them to unnecessary risk. It’s important for businesses to be clear about their identity verification processes so consumers can make educated decisions before electing to provide invaluable identity data. The most effective fraud prevention and identity strategy is one that quickly establishes trust without inconveniencing the consumer. By staying up to date on verification methods, businesses can ensure customers have a smooth, personalized and engaging online experience.

Many institutions take a “leap of faith” when it comes to developing prospecting strategies as it pertains to credit marketing. But effective strategies are developed from deep, analytical analysis with clearly identified objectives. They are constantly evolving – no setting and forgetting. So what are the basics to optimizing your prospecting efforts? Establish goals Unfortunately, far too many discussions begin with establishing targeting criteria before program goals are set. But this leads to confusion. Developing targeting criteria is kind of like squeezing a balloon; when you restrict one end, the other tends to expand. Imagine the effect of maximizing response rates when soliciting new loans. If no other criteria are considered, you could end up targeting high-risk individuals who cannot get approved elsewhere. Obviously, we’re not interested in increasing originations at all cost; risk must be understood as well. But this is where things get complicated. Lower-risk consumers tend to be the most coveted, get the best offers, and therefore have lower response rates and margins. Simplicity is best The US Navy developed the KISS acronym (keep it simple, stupid) in the 1960s on the philosophy that complexity increases the probability of error. This is largely true in targeting methodologies, but don’t mistake limiting complexity for simplicity. Perhaps the most simplistic approach to prescreen credit marketing is using only risk criteria to set an eligible population. Breaking a problem down to this single dimension generally results in low response rates and wasted budget. Propensity models and estimated interest rates are great tools for identifying consumers that are more likely to respond. Adding them as an additional filter to a credit-qualified population can help increase response rates. But what about ability to pay? So far we’ve considered propensity to open and risk (the latter being based on current financial obligations). Imagine a consumer with on-time payment behavior and a solid credit score who takes a loan only to be unable to meet their obligations. You certainly don’t want to extend debt that will cause a consumer to be overextended. Instead of going through costly income verification, income estimation models can assist with identifying the ability to repay the loan you are marketing. Simplicity is great, but not to the point of being one-dimensional. Take off the blindfold Even in the days of smartphones and GPS navigation, most people develop a plan before setting off on a road trip. In the case of credit marketing, this means running an account review or archive analysis. Remember that last prescreen campaign you ran? What could have happened with a more sophisticated targeting strategy? Having archive data appended to a past marketing campaign allows for “what if” retrospective analysis. What could response rates have been with a propensity tool? Could declines due to insufficient income have been reduced with estimated income? Archive data gives 20/20 hindsight to what could have been. Just like consulting a map to determine the shortest distance to a destination or the most scenic route, retrospective analysis on past campaigns allows for proactive planning for future efforts. Practice makes perfect Even with a plan, you probably still want to have the GPS running. Traffic could block your planned route or an unforeseen detour could divert you to a new path. Targeting strategies must continually be refined and monitored for changes in customer behavior. Test and control groups are essential to continued improvement of your targeting strategies. Every campaign should be analyzed against the goals and KPIs established at the start of the process. New hypotheses can be evaluated through test populations or small groups designed to identify new opportunities. Let’s say you typically target consumers in a risk range of 650-720, but an analyst spots an opportunity where consumers with a range of 625-649 with no delinquencies in the past 12 months performs nearly at the rate of the current population. A small test group could be included in the next campaign and studied to see if it should be expanded in future campaigns. Never “place bets” Assumptions are only valid when they are put to the test. Never dive into a strategy without testing your hypothesis. The final step in implementing a targeting strategy should be the easiest. If goals are clearly understood and prioritized, past campaigns are analyzed, and hypotheses are laid out with test and control groups, the targeting criteria should be obvious to everyone. Unfortunately, the conversation usually starts at this phase, which is akin to placing bets at the track. Ever notice that score breaks are discussed in round numbers? Consider the example of the 650-720 range. Why 650 and not 649 or 651? Without a test and learn methodology, targeting criteria ends up based on conventional wisdom – or worse, a guess. As you approach strategic planning season, make sure you run down these steps (in this order) to ensure success next year. Establish program goals and KPIs Balance simplicity with effectiveness Have a plan before you start Begin with an archive Learn and optimize In God we trust, all others bring data

Millennials have long been the hot topic over the course of the past few years with researchers, brands and businesses all seeking to understand this large group of people. As they buy homes, start families and try to conquest their hefty student loan burdens, all will be watching. Still, there is a new crew coming of age. Enter Gen Z. It is estimated that they make up ¼ of the U.S. population, and by 2020 they will account for 40% of all consumers. Understanding them will be critical to companies wanting to succeed in the next decade and beyond. The oldest members of this next cohort are between the ages of 18 and 20, and the youngest are still in elementary school. But ultimately, they will be larger than the mystical Millennials, and that means more bodies, more buying power, more to learn. Experian recently took a first look at the oldest members of this generation, seeking to gain insights into how they are beginning to use credit. In regards to credit scores, the eldest Gen Z members sported a VantageScore® credit score of 631 in 2016. By comparison, younger Millennials were at 626 and older Millennials were at 638. Given their young age, Gen Z debt levels are low with an average debt-to-income at just 5.7%. Their tradelines largely consist of bankcards, auto and student loans. Their average income is at $33.8k. Surprisingly, there was a very small group of Gen Z already on file with a mortgage, but this figure was less than .5%. Auto loans were also small, but likely to grow. Of those Gen Z members who have a credit file, an estimated 12% have an auto trade. This is just the beginning, and as they age, their credit files will thicken, and more insights will be gained around how they are managing credit, debt and savings. While they are young today, some studies say they already receive about $17 a week in allowance, equating to about $44 billion annually in purchase power in the U.S. Factor in their influence on parental or household purchases and the number could be closer to $200 billion! For all brands, financial services companies included, it is obvious they will need to engage with this generation in not just a digital manner, but a mobile manner. They are being raised in an era of instant, always-on access. They expect a quick, seamless and customized mobile experience. Retailers have 8 seconds or less — err on the side of less — to capture their attention. In general, marketers and lenders should consider the following suggestions: Message with authenticity Maintain a long-term vision Connect them with something bigger Provide education for financial literacy and of course Keep up with technological advances. Learn more by accessing our recorded webinar, A First Look at Gen Z and Credit.

Mitigating synthetic identities Synthetic identity fraud is an epidemic that does more than negatively affect portfolio performance. It can hurt your reputation as a trusted organization. Here is our suggested 4-pronged approach that will help you mitigate this type of fraud: Identify how much you could lose or are losing today to synthetic fraud. Review and analyze your identity screening operational processes and procedures. Incorporate data, analytics and cutting-edge tools to enable fraud detection through consumer authentication. Analyze your portfolio data quality as reported to credit reporting agencies. Reduce synthetic identity fraud losses through a multi-layer methodology design that combats both the rise in synthetic identity creation and use in fraud schemes. Mitigating synthetic identity fraud>

The creation of synthetic identities (synthetic id) relies upon an ecosystem of institutions, data aggregators, credit reporting agencies and consumers. All of which are exploited by an online and mobile-driven market, along with an increase in data breaches and dark web sharing. It’s a real and growing problem that’s impacting all markets. With significant focus on new customer acquisition and particular attention being paid to underbanked, emerging, and new-to-country consumers, this poses a large threat to your onboarding and customer management policies, in addition to overall profitability. Synthetic identity fraud is an epidemic that does more than negatively affect portfolio performance. It can hurt your reputation as a trusted organization and expose institutions, like yours, as paths of lesser resistance for fraudsters to use in the creation and farming of synthetic identities. Here is a suggested four-pronged approach to mitigate this type of fraud: The first step is knowing your risk exposure to synthetic identity fraud. Identify how much you could lose or are losing today using a targeted segmentation analysis to examine portfolios or customer populations. Next, review your front- and back-end identity screening operational processes and procedures and analyze that information to ensure you have industry best practices, procedures and verification tools deployed. Then incorporate data, analytics and some of the industry’s cutting edge tools. This enables you to perform targeted consumer authentication and identify opportunities to better capture the majority of fraud and operational waste. Lastly, ensure your organization is part of the solution – not the problem. Analyze your portfolio data quality as reported to credit reporting agencies and then minimize your exposure to negative compliance audit results and reputational risk. Our fraud and identity management consultants can help you reduce synthetic identity fraud losses through a multilayer methodology design that combats the rise in synthetic identity creation and use in fraud schemes.

On June 7, the Consumer Financial Protection Bureau (CFPB) released a new study that found that the ways “credit invisible” consumers establish credit history can differ greatly based on their economic background. The CFPB estimated in its May 2015 study "Data Point: Credit Invisibles" that more than 45 million American consumers are credit invisible, meaning they either have a thin credit file that cannot be scored or no credit history at all. The new study reviewed de-identified credit records on more than one million consumers who became credit visible. It found that consumers in lower-income areas are 240 percent more likely to become credit visible due to negative information, such as a debt in collection. The CFPB noted consumers in higher-income areas become credit visible in a more positive way, with 30 percent more likely to become credit visible by using a credit card and 100 percent more likely to become credit visible by being added as a co-borrower or authorized user on someone else’s account. The study also found that the percentage of consumers transitioning to credit visibility due to student loans more than doubled in the last 10 years. CFPB’s research highlights the need for alternative credit data The new study demonstrates the importance of moving forward with inclusion of new sources of high-quality financial data — like on-time payment data from rent, utility and telecommunications providers — into a consumer’s credit file. Experian recently outlined our beliefs on the issue in comments responding to the CFPB’s Request for Information on Alternative Data. As a brand, we have a long history of using alternative credit data to help lenders make better lending decisions. Extensive research has shown that there is an immense opportunity to facilitate greater access to fair and affordable credit for underserved consumers through the inclusion of on-time telecommunications, utility and rental data in credit files. While these consumers may not have a traditional credit history, many make on-time payments for telephone, rent, cable, power or mobile services. However, this data is not typically being used to enhance traditional credit files held by the nationwide consumer reporting agencies, nor is it being used in most third-party or custom credit scoring models. Further, new advances in financial technology and data analytics through account aggregation platforms are also integral to the credit granting process and can be applied in a manner to broaden access to credit. Experian is currently using account aggregation software to obtain consumer financial account information for authentication and income verification to speed credit decisions, but we are looking to expand this technology to increase the collection and utilization of alternative data for improving credit decisions by lenders. Policymakers should act to help credit invisible consumers While Experian continues to work with telecommunications and utility companies to facilitate the furnishing of on-time credit data to the nationwide consumer reporting agencies, regulatory barriers continue to exist that deter utility and telecommunications companies from furnishing on-time payment data to credit bureaus. To help address this issue, Congress is currently considering bipartisan legislation (H.R. 435, The Credit Access and Inclusion Act of 2017) that would amend the FCRA to clarify that utility and telecommunication companies can report positive credit data, such as on-time payments, to the nation' s credit reporting bureaus. The legislation has bipartisan support in Congress and Experian encourages lawmakers to move forward with this important initiative that could benefit tens of millions of American consumers. In addition, Experian believes policymakers should more clearly define the term alternative data. In public policy debates, the term "alternative data" is a broad term, often lumping data sources that can or have been proven to meet regulatory standards for accuracy and fairness required by both the Fair Credit Reporting Act and the Equal Credit Opportunity Act with data sources that cannot or have not been proven to meet these standards. In our comment letter, Experian encourages policymakers to clearly differentiate between different types of alternative data and focus the consumer and commercial credit industry on public policy recommendations that will increase the use of those sources of data that have or can be shown to meet legal and societal standards for accuracy, validity, predictability and fairness. More info on Alternative Credit Data More Info on Alternative Financial Services

There are about as many definitions for people-based marketing as there are companies using the term. Each company seems to skew the definition to fit their particular service offering. The distinctions are vast, and especially for financial services companies running regulated campaigns, they can be incredibly important. At Experian, we define people-based marketing in its purest form: targeting at the individual level across channels. This is a practice we’re very familiar with in offline marketing, having honed arguably one of the most accurate views of U.S. consumers over the past three decades. And now we’re taking those tried and true principals and applying them to digital channels. It’s not as easy as it sounds. The challenge with people-based marketing With direct mail, people-based marketing was easy. Jane Doe lives at 123 Main St. If I want to reach her, I can simply send her a direct mail piece at that address. To help, I can utilize any number of services, including the National Change of Address database, to know where to reach her if she ever moves. People-based marketing through digital channels is exponentially more difficult. While direct mail has one signal with which you use to identify a consumer (the address), digital channels offer countless signals. And not all of those signals can be used, either individually or in conjunction with other signals, to reliably tie a consumer to a persistent offline ID. A prime example of this is cookies. The problem with cookies A cookie, in and of itself, isn’t the problem. The problem is the linkage. How was a cookie associated with the person to whom the ad is being served? As marketers, we need to make sure that we are reaching the right people with the right ad … and more importantly not reaching those people who have opted out. This is especially true in the world of regulated data, where you need to know who you are targeting. And cookie-based linkage is controlled by a handful of companies, many of which are walled gardens who don’t share how they link offline people to online cookies and don’t collect this information directly. They rely on other third-party websites to gather PII, and connect it to their cookies. In some cases, the data is very accurate (especially with transaction data). In some cases, it is not (think websites that collect PII when giving surveys, offering coupons, etc.). In short, in order for you to use cookie-based targeting accurately, you need to have insight into the source of the base linkage data that was used to connect the offline consumer record to the online cookie. This same concept applies to all forms of digital linkage that drive people-based marketing. Why does people-based marketing matter in digital credit marketing? With campaigns that utilize non-regulated data, such as “Invitation to Apply” campaigns that are driven from demographic and psychographic data, the consequences of not reaching the consumer you meant to target are negligible. But with campaigns that utilize regulated data, you must ensure you’re targeting the exact consumer you meant to reach. More importantly, you must make sure you’re not targeting an ad to a consumer who had previously opted out of receiving offers driven with regulated data (prescreen offers, for example). Even if you’ve already delivered a direct mail piece with the same offer, this doesn’t negate your responsibility to reach only approved consumers who have not opted out. --- Bottom line, the world of 1:1 marketing is growing more sophisticated, and that’s a good thing. Marketers just need to understand that while regulated data can be powerful, they must also take great responsibility when handling it. The data exists to deliver firm offers of credit to your very specific target in all-new mediums. People-based marketing has its place, and it can now be done in a compliant, digitally-savvy way – in the financial services space, nonetheless. Register for our webinar on Credit Marketing Strategies to Drive Today's Digital Consumer.

The final day of Vision 2017 brought a seasoned group of speakers to discuss a wide range of topics. In just a few short hours, attendees dove into a first look at Gen Z and their use of credit, ecommerce fraud, the latest in retail, the state of small business and leadership. Move over Millennials – Gen Z is coming of credit age Experian Analytics leaders Kelley Motley and Natasha Madan gave audience members an exclusive look at how the first wave of Gen Z is handling and managing credit. Granted most of this generation is still under the age of 18, so the analysis focused on those between the ages of 18 to 20. Yes, Millennials are still the dominant generation in the credit world today, standing strong at 61 million individuals. But it’s important to note Gen Z is sized at 86 million, so as they age, they’ll be the largest generation yet. A few stats to note about those Gen Z individuals managing credit today: Their average debt is $12,679, compared to younger Millennials (21 to 27) who have $65,473 in debt and older Millennials (28 to 34) who sport $121,460. Given their young age, most of Gen Z is considered thin-file (less than 5 tradelines) Average Gen Z income is $33,000, and average debt-to-income is low at 5.7%. New bankcard balances are averaging around $1,574. As they age, acquire mortgages and vehicles, their debt and tradelines will grow. In the meantime, the speakers provided audience members a few tips. Message with authenticity. Think long-term with this group. Maintain their technological expectations. Build trust and provide financial education. State of business credit and more on the economy Moody’s Cris deRitis reiterated the U.S. economy is looking good. He quoted unemployment at 4.5%, stating “full employment is here.” Since the recession, he said we’ve added 15 million jobs, noting we lost 8 million during the recession. The great news is that the U.S. continues to add about 200,000 jobs a month, and that job growth is broad-based. Small business loans are up 10% year-to-date vs. last year. While there has been a tremendous amount of buzz around small business, he adds that most job creation has come from mid0size business (50 to 499 employees). The case for layered fraud systems Experian speaker John Sarreal shared a case study that revealed by layering on fraud products and orchestrating collaboration, a business can go from a string 75% fraud detection rate to almost 90%. Additionally, he commented that Experian is working to leverage dark web data to mine for breached identity data. More connections for financial services companies to make with mobile and social Facebook speaker Olivia Basu reinforced the need for all companies to be thinking about mobile. “Mobile is not about to happen,” she said. “Mobile is now. Mobile is everything. You look at the first half of 2017 and we’re seeing 40% of all purchases are happening on mobile devices.” Her challenge to financial services companies is to make marketing personal again, and of course leverage the right channels. Experian Sr. Director of Credit Marketing Scott Gordon commented on Experian’s ability to reach consumers accurately – whether that be through direct or digital delivery channels. A great deal of focus has been around person-based marketing vs. leveraging the cookie. -- The Vision conference was capped off with a keynote speech from legendary quarterback and Super Bowl MVP Tom Brady. He chatted about the details of this past season, and specifically the comeback Super Bowl win in February 2017. He additionally talked about leadership and what that means to creating a winning team and organization. -- Multiple keynote speeches, 65 breakout sessions, and hours of networking designed to help all attendees ready themselves for growing profits and customers, step up to digital, regulatory and fraud challenges, and capture the latest data insights. Learn more about Experian’s annual Vision conference.