Models & Scores

In today’s rapidly changing economic environment, the looming question of how to reduce portfolio volatility while still meeting consumers' needs is on every lender’s mind. So, how can you better asses risk for unbanked consumers and prime borrowers? Look no further than alternative credit data. In the face of severe financial stress, when borrowers are increasingly being shut out of traditional credit offerings, the adoption of alternative credit data allows lenders to more closely evaluate consumer’s creditworthiness and reduce their credit risk exposure without unnecessarily impacting insensitive or more “resilient” consumers. What is alternative credit data? Millions of consumers lack credit history or have difficulty obtaining credit from mainstream financial institutions. To ease access to credit for “invisible” and subprime consumers, financial institutions have sought ways to both extend and improve the methods by which they evaluate borrowers’ risk. This initiative to effectively score more consumers has involved the use of alternative credit data.1 Alternative credit data is FCRA-regulated data that is typically not included in a traditional credit report and helps lenders paint a fuller picture of a consumer, so borrowers can get better access to the financial services they need and deserve. How can it help during a downturn? The economic environment impacts consumers’ financial behavior. And with more than 100 million consumers already restricted by the traditional scoring methods used today, lenders need to look beyond traditional credit information to make more informed decisions. By pulling in alternative credit data, such as consumer-permissioned data, rental payments and full-file public records, lenders can gain a holistic view of current and future customers. These insights help them expand their credit universe, identify potential fraud and determine an applicant’s ability to pay all while mitigating risk. Plus, many consumers are happy to share additional financial information. According to Experian research, 58% say that having the ability to contribute positive payment history to their credit files makes them feel more empowered. Likewise, many lenders are already expanding their sources for insights, with 65% using information beyond traditional credit report data in their current lending processes to make better decisions. By better assessing risk at the onset of the loan decisioning process, lenders can minimize credit losses while driving greater access to credit for consumers. Learn more 1When we refer to “Alternative Credit Data,” this refers to the use of alternative data and its appropriate use in consumer credit lending decisions, as regulated by the Fair Credit Reporting Act. Hence, the term “Expanded FCRA Data” may also apply in this instance and both can be used interchangeably.

Originally posted by Experian Global News blog At Experian, we have an unwavering commitment to helping consumers and clients manage through this unprecedented period. We are actively working with consumers, lenders, lawmakers and regulators to help mitigate the potential impact on credit scores during times of financial hardship. In response to the urgent and rapid changes associated with COVID-19, we are accelerating and enhancing our financial education programming to help consumers maintain good credit and gain access to the financial services they need. This is in addition to processes and tools the industry has in place to help lenders accommodate situations where consumers are affected by circumstances beyond their control. These processes will be extended to those experiencing financial hardship as a result of COVID-19. As the Consumer’s Credit Bureau, our commitment at Experian is to inform, guide and protect our consumers and customers during uncertain times. With expected delays in bill payments, unprecedented layoffs, hiring freezes and related hardships, we are here to help consumers in understanding how the credit reporting system and personal finance overall will move forward in this landscape. One way we’re doing this is inviting everyone to join our special eight-week series of #CreditChat conversations surrounding COVID-19 on Wednesdays at 3 p.m. ET on Twitter. Our weekly #CreditChat program started in 2012 to help the community learn about credit and important personal finance topics (e.g. saving money, paying down debt, improving credit scores). The next several #CreditChats will be dedicated to discussing ways to manage finances and credit during the pandemic. Topics of these #CreditChats will include methods and strategies for bill repayment, paying down debt, emergency financial assistance and preparing for retirement during COVID-19. “As the consumer’s credit bureau, we are committed to working with consumers, lenders and the financial community during and following the impacts of COVID-19,” says Craig Boundy, Chief Executive Officer of Experian North America. “As part of our nation’s new reality, we are planning for options to help mitigate the potential impact on credit scores due to financial hardships seen nationwide. Our #CreditChat series and supporting resources serve as one of several informational touchpoints with consumers moving forward.” Being fully committed to helping consumers and lenders during this unprecedented period, we’ve created a dedicated blog page, “COVID-19 and Your Credit Report,” with ongoing and updated information on how COVID-19 may impact consumers’ creditworthiness and – ultimately – what people should do to preserve it. The blog will be updated with relevant news as we announce new solutions and tactics. Additionally, our “Ask Experian” blog invites consumers to explore immediate and evolving resources on our COVID-19 Updates page. In addition to this guidance, and with consumer confidence in the economy expected to decline, we will be listening closely to the expert voices in our Consumer Council, a group of leaders from organizations committed to helping consumers on their financial journey. We established a Consumer Council in 2009 to strengthen our relationships and to initiate a dialogue among Experian and consumer advocacy groups, industry experts, academics and other key stakeholders. This is in addition to ongoing collaboration with our regulators. Additionally, our Experian Education Ambassador program enables hundreds of employee volunteers to serve as ambassadors sharing helpful information with consumers, community groups and others. The goal is to help the communities we serve across North America, providing the knowledge consumers need to better manage their credit, protect themselves from fraud and identity theft and lead more successful, financially healthy lives. COVID-19 has impacted all industries and individuals from all walks of life. We want our community to know we are right there with you. Learn more about our weekly #CreditChat and upcoming schedule here. Learn more

There are more than 100 million people in the United States who don’t have a fair chance at access to credit. These people are forced to rely on high-interest credit cards and loans for things most of us take for granted, like financing a family car or getting an apartment. At Experian, we have a fundamental mission to be a champion for the consumer. Our commitment to increasing financial inclusion and helping consumers gain access to the financial services they need is one of the reasons we have been selected as a Fintech Breakthrough Award winner for the third consecutive year. The Fintech Breakthrough Awards is the premier awards program founded to recognize the fintech innovators, leaders and visionaries from around the world. The 2020 Fintech Breakthrough Award program attracted more than 3,750 nominations from across the globe. Last year, Experian took home the award for Best Overall Analytics Platform for our Ascend Analytical Sandbox™, a first-to-market analytics environment that promised to move companies beyond just business intelligence and data visualization to data insights and answers they could use. The year prior, Experian won the Consumer Lending Innovation Award for our Text for Credit™ solution, a powerful tool for providing consumers the convenience to securely bypass the standard-length ‘pen & paper’ or keystroke intensive credit application process while helping lenders make smart, fraud protected lending decisions. This year, we are excited to announce that Experian has been selected once again as a winner in the Consumer Lending Innovation category for Experian Boost™. Experian Boost – with direct, active consumer consent – scans eligible accounts for ‘boostable’ positive payment data (e.g., utility and telecom payments) and provides the means for consumers to add that data to their Experian credit reports. Now, for the very first time, millions of consumers benefit from payments they’ve been making for years but were never reflected on their credit reports. Since launching in March 2019, cumulatively, more than 18 million points have been added to FICO® Scores via Experian Boost. Two-thirds of consumers who completed the Experian Boost process increased their FICO Score and among these, the average score increase has been more than 13 points, and 12% have moved up in credit score category. “Like many fintechs, our goal is to help more consumers gain access to the financial services they need,” said Alex Lintner, Group President of Experian Consumer Information Services. “Experian Boost is an example of our mission brought to life. It is the first and only service to truly put consumers in control of their credit. We’re proud of this recognition from Fintech Breakthrough and the momentum we’ve seen with Experian Boost to date.” Contributing consumer payment history to an Experian credit file allows fintech lenders to make more informed decisions when examining prospective borrowers. Only positive payment histories are aggregated through the platform and consumers can remove the new data at any time. There is no limit to how many times one can use Experian Boost to contribute new data. For more information, visit Experian.com/Boost.

Update: After closely monitoring updates from the WHO, CDC, and other relevant sources related to COVID-19, we have decided to cancel our 2020 Vision Conference. If you had the chance to experience tomorrow, today, would you take it? What if it meant you could get a glimpse into the future technology and trends that would take your organization to the next level? If you’re looking for a competitive edge – this is it. For more than 38 years, Experian’s premier conference has connected business leaders to data-driven ideas and solutions, fueling them to target new markets, grow existing customer bases, improve response rates, reduce fraud and increase profits. What’s in it for you? Everything to gain and nothing to lose. Are you a marketer? These sessions were made to drive your conversion rates to new heights: Know your customers via omnichannel marketing: Your customers are everywhere, but can you reach them? Learn how to drive business-expansion strategy, brand affinity and customer engagement across multiple channels. Plus, gain insight into connecting with customers via one-to-one messaging. By invitation only, the future of ITA marketing: An evolving landscape means marketers face new challenges in effectively targeting consumers while staying compliant. In this session, we’ll explore how you can leverage fair lending-friendly marketing data for targeting, analysis and measurement. Want the latest in technology trends? Dive into discussions to transform your customer experience: Credit in the age of technology transformation: Machine learning and artificial intelligence are the current darlings of big data, but the platform that drives the success of any big data endeavor is crucial. This session will dive into what happens behind the curtain. Put away your plastic – next-generation identity: An industry panel of experts discusses the newest digital identity and authentication capabilities – those in use today and also exciting solutions on the horizon. How about for the self-proclaimed data geeks? Analyze these: Alternative data: Listen in on an in-depth conversation about creative and impactful examples of using emerging data assets, such as alternative and consumer-permissioned data, for improved consumer inclusion, risk assessment and verification services. The next wave in open data: Experian will share their views on the potential of advanced data and models and how they benefit the global value chain – from consumer scores to business opportunities – regardless of local regulations. And the risk masters? Join us as we kick fraud to the curb: Understanding and tackling synthetic ID fraud: Synthetic IDs present a serious challenge for our entire industry. This expert panel will explore the current landscape – what’s working and what’s not, the expected impact of the next generation SSA eCBSV service, and best practice prevention methods. You are your ID – the new reality of biometrics: Consumers are becoming increasingly comfortable with biometrics. Just as CLEAR has transformed how we use our biometric identity to move through airports, sports venues and more, financial transactions can also be made friction-free. The point is, there’s something for everyone at Vision 2020. It’s not just another conference. Trade in stuffy tradeshow halls and another tri-fold brochure for the insights and connections you need to take your career and organization to the next level. Like technology itself, Vision 2020 promises to connect us, unify us and enable us all to create a better tomorrow. Join us for unique networking opportunities, one-on-one conversations with subject-matter experts and more than 50 breakout sessions with the industry’s most sought-after thought leaders.

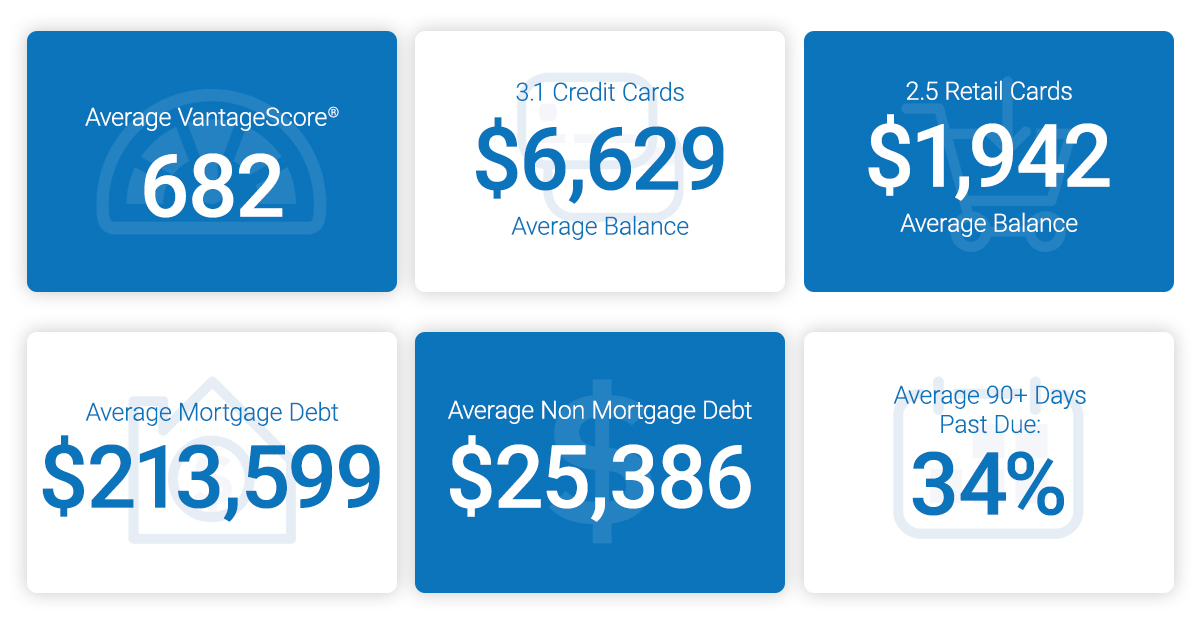

As consumers prepare for the next decade, we look at how we’re rounding out this year. The results? The average American credit score is 682, an eight-year high. Experian released the 10th annual state of credit report, which provides a comprehensive look at the credit performance of consumers across America by highlighting consumer credit scores and borrowing behaviors. And while the data is spliced to show men vs. women, as well as provides commentary at the state and generational level, the overarching trend is up. Even with the next anticipated economic correction often top of mind for financial institutions, businesses and consumers alike, 2019 was a year marked by more access, more spending and decreasing delinquencies. Things are looking up. “We are seeing a promising trend in terms of how Americans are managing their credit as we head into a new decade with average credit scores increasing two points since 2018 to 682 – the highest we’ve seen since 2011,” said Shannon Lois, Senior Vice President and Head of EAS, Analytics, Consulting & Operations for Experian Decision Analytics. “Average credit card balances and debt are up year over year, yet utilization rates remain consistent at 30 percent, indicating consumers are using credit as a financial tool and managing their debts responsibly.” Highlights of Experian’s State of Credit report: 3-year comparison 2017 2018 2019 Average number of credit cards 3.06 3.04 3.07 Average credit card balances $6,354 $6,506 $6,629 Average number of retail credit cards 2.48 2.59 2.51 Average retail credit card balances $1,841 $1,901 $1,942 Average VantageScore® credit score[1, 2] 675 680 682 Average revolving utilization 30% 30% 30% Average nonmortgage debt[3] $24,706 $25,104 $25,386 Average mortgage debt $201,811 $208,180 $231,599 Average 30 days past due delinquency rates 4.0% 3.9% 3.9% Average 60 days past due delinquency rates 1.9% 1.9% 1.9% Average 90+ days past due delinquency rates 7.3% 6.7% 6.8% In the scope of the credit score battle of the sexes, women have a four-point lead over men with an average credit score of 686 compared to 682. Their lead is a continued trend since 2017 where they’ve bested their male counterparts. According to the report, while men carry more non-mortgage and mortgage debt than women, women have more credit cards and retail cards (albeit they carry lower balances). Generationally, Generations X, Y and Z tend to carry more debt, including mortgage, non-mortgage, credit card and retail card, than older generations with higher delinquency and utilization rates. Segmented by state and gender, Minnesota had the highest credit scores for both men and women, while Mississippi was the state with the lowest average credit score for females and Louisiana was the lowest average credit score state for males. As we round out the decade and head full-force into 2020, we can reflect on the changes in the past year alone that are helping consumers improve their financial health. Just to name a few: Experian launched Experian BoostTM in March, allowing millions of consumers to add positive payment history directly to their credit file for an opportunity to instantly increase their credit score. Since then, there has been over 13 million points boosted across America. Experian LiftTM was launched in November, designed to help credit invisible and thin-file consumers gain access to fair and affordable credit. Long-standing commitments to consumer education, including the Ask Experian Blog and volunteer work by Experian’s Education Ambassadors, continue to offer assistance to the community and help consumers better understand their financial actions. From what we can tell, this is just the beginning. “Understanding the factors that influence their overall credit profile can help consumers improve and maintain their financial health,” said Rod Griffin, Experian’s director of consumer education and awareness. “Credit can be used as a financial tool. Through this report, we hope to provide insights that will help consumers make more informed decisions about credit use as we prepare to head into a new decade.” Learn more 1 VantageScore® is a registered trademark of VantageScore Solutions, LLC. 2 VantageScore® credit score range is 300 to 850. 3 Average debt for this study includes all credit cards, auto loans and personal loans/student loans.

It’s December, and if you’re like most credit union leaders, your strategic plan is distributed, and the 2020 budget is approved. Before you know it, you and your team will be off and running to pursue the New Year’s goals. Another thing most of us have in common is a strategic membership growth priority. New members are needed to help us take loan and deposit growth to the next level. Specifically, who are you looking for? It’s surprising how many credit union leaders have a difficult time clarifying their ideal member(s). They usually come up short after they have called out younger borrowers, active checking account users, prime credit, middle income, homeowners, etc. The reality is in today’s competitive market, these general audiences are not definitive enough. Many then go to market with a limited universe that is too generic to be highly effective. Savvy marketers have a much deeper understanding of who they are reaching and why. First, they have clearly defined the ideal member i.e. product profitability, relationship profitability, referrals, how they access the credit union, etc. Second, they use data, analytics and demographic segmenting to refine their search further to reveal the ideal member. They leverage information to understand what drives the potential members decision making. They understand that every potential member does not live the same type of life. They segment markets into groups to understand their shared values and life experiences. These segments include geographic, demographic, financial behavior, and motivation that includes psychographics and social values. Thus, armed with this information, they align the consumer’s needs with the credit union’s products, purpose and strategic goals. This clarity allows them to invest their marketing dollars for the best possible result. Most credit unions would identify “younger borrowers” as a desired member, so we’ve laid out two examples of just how different this member can look. Ambitious Singles – is a demographic segment comprised of younger cutting-edge singles living in mid-scale, metro areas that balance work and leisure lifestyles. Annual Median income $75k - $100K Highly educated First time home buyers Professionals, upwardly mobile Channel preferences for engaging with brands (and their offers) is while watching or streaming TV, listening to their favorite radio apps or while browsing the web on their phones. They are also quite email receptive (but subject lines must be compelling) Families Matter Most – This segment is comprised of young middle-class families in scenic suburbs, leading family focused lives. Annual Median income $75K - $99K Have children 4-6 yrs. old Educated Homeowners Child-related purchases Credit revolver and auto borrowers (larger vehicles) Go online for banking, telecommuting and shopping Both segments represent younger borrowers with similar incomes, but they have different loan needs, lifestyle priorities and preferences for engaging with a marketing offer. These are just two examples of the segmentation data that is available from Experian. The segmentation solution provides a framework to help credit unions identify the optimal customer investment strategy for each member segment. This framework helps the credit union optimize their marketing between differentiating segments. For some segments the investment may be directed toward finding the ideal member. Others may be made to find depositors. While many credit unions don’t have infinite marketing budgets or analytical resources, segmentation help marketers more efficiently and effectively pursue the best member or develop member personas to better resonate with existing members. The feedback we have heard from credit union leaders is that the solution is the best segmentation tool they have seen. Learn more about it here. What your team is up against Today, credit unions face national competitors that are using state-of-the-art data analytics, first-rate technology and in-depth market segmentation to promote very attractive offers to win new members, deposits, checking accounts and loans. Their offers have a look, feel, message and offer that are relevant to the person receiving the offer. Here are a few recent “offer” examples that we have heard of that should give you pause: Fintech companies, like the Lending Club offering auto loan refinances (the offer provides an estimate of refinance interest savings). The ad we saw had an estimated monthly payment of $80. PayPal Cashback Mastercard® – with a $300 early use cash bonus and 3% cash back on purchases. High limit personal loans that take minutes to apply and to be funded. Banks acting alone or in partnership with a fintech to offer online checking accounts with new account opening bonuses ranging from $300-$600. and of course, Quicken® Mortgage promoting low rates and fast and seamless origination. These are just a few recent examples from thousands of offers that are reaching your ideal member. Besides offering great rates, cash back, low fees and seamless service – these offers are guided by robust data analytics and consumer segmentation to reach and engage a well-defined, ideal consumer. Why it matters The 2020 race is on. Hopefully your team has clarity of the member(s) they want to reach, access to robust data analytics, in depth consumer insights, reliable credit resources and marketing tools they will need to compete in the toughest financial market any of us have likely ever seen. If you’re afraid that you can’t afford the right tools when it comes to marketing, consider what the dealer fee is for purchasing an indirect auto loan. What if the 2% or more fee was reallocated to finding organic loan growth with consumers you’re more likely to build a relationship with? Or consider the cost of consistently marketing to the wrong consumer segments with the wrong message, at the wrong time and in the wrong channels. What if you could increase your market engagement rate from 5% to 10%? Perhaps the best strategic question is can you afford NOT to have the best tools that support future membership growth? If you don’t win your ideal member, somebody else will. Learn More About Scott Butterfield, CUDE, CCUE Principal, Your Credit Union Partner Scott Butterfield is a trusted advisor to the leaders of more than 170 credit unions located throughout the United States. A respected veteran of the CU Movement, he understands the challenges and opportunities facing credit unions today. Scott believes that credit unions matter, and that consumers and small businesses need credit unions to now more than ever.

Article written by Melanie Smith, Senior Copywriter, Experian Clarity Services, Inc. It’s been almost a decade since the Great Recession in the United States ended, but consumers continue to feel its effects. During the recession, millions of Americans lost their jobs, retirement savings decreased, real estate reduced in value and credit scores plummeted. Consumers that found themselves impacted by the financial crisis often turned to alternative financial services (AFS). Since the end of the recession, customer loyalty and retention has been a focus for lenders, given that there are more options than ever before for AFS borrowers. To determine what this looks like in the current climate, we examined today’s non-prime consumers, what their traditional scores look like and if they are migrating to traditional lending. What are alternative financial services (AFS)? Alternative financial services (AFS) is a term often used to describe the array of financial services offered by providers that operate outside of traditional financial institutions. In contrast to traditional banks and credit unions, alternative service providers often make it easier for consumers to apply and qualify for lines of credit but may charge higher interest rates and fees. More than 50% of new online AFS borrowers were first seen in 2018 To determine customer loyalty and fluidity, we looked extensively at the borrowing behavior of AFS consumers in the online marketplace. We found half of all online borrowers were new to the space as of 2018, which could be happening for a few different reasons. Over the last five years, there has been a growing preference to the online space over storefront. For example, in our trends report from 2018, we found that 17% of new online customers migrated from the storefront single pay channel in 2017, with more than one-third of these borrowers from 2013 and 2014 moving to online overall. There was also an increase in AFS utilization by all generations in 2018. Additionally, customers who used AFS in previous years are now moving towards traditional credit sources. 2017 AFS borrowers are migrating to traditional credit As we examined the borrowing behavior of AFS consumers in relation to customer loyalty, we found less than half of consumers who used AFS in 2017 borrowed from an AFS lender again in 2018. Looking into this further, about 35% applied for a loan but did not move forward with securing the loan and nearly 24% had no AFS activity in 2018. We furthered our research to determine why these consumers dropped off. After analyzing the national credit database to see if any of these consumers were borrowing in the traditional credit space, we found that 34% of 2017 borrowers who had no AFS activity in 2018 used traditional credit services, meaning 7% of 2017 borrowers migrated to traditional lending in 2018. Traditional credit scores of non-prime borrowers are growing After discovering that 7% of 2017 online borrowers used traditional credit services in 2018 instead of AFS, we wanted to find out if there had also been an improvement in their credit scores. Historically, if someone is considered non-prime, they don’t have the same access to traditional credit services as their prime counterparts. A traditional credit score for non-prime consumers is less than 600. Using the VantageScore® credit score, we examined the credit scores of consumers who used and did not use AFS in 2018. We found about 23% of consumers who switched to traditional lending had a near-prime credit score, while only 8% of those who continued in the AFS space were classified as near-prime. Close to 10% of consumers who switched to traditional lending in 2018 were classified in the prime category. Considering it takes much longer to improve a traditional credit rating, it’s likely that some of these borrowers may have been directly impacted by the recession and improved their scores enough to utilize traditional credit sources again. Key takeaways AFS remains a viable option for consumers who do not use traditional credit or have a credit score that doesn’t allow them to utilize traditional credit services. New AFS borrowers continue to appear even though some borrowers from previous years have improved their credit scores enough to migrate to traditional credit services. Customers who are considered non-prime still use AFS, as well as some near-prime and prime customers, which indicates customer loyalty and retention in this space. For more information about customer loyalty and other recently identified trends, download our recent reports. State of Alternative Data 2019 Lending Report

Retailers are already starting to display their Christmas decorations in stores and it’s only early November. Some might think they are putting the cart ahead of the horse, but as I see this happening, I’m reminded of the quote by the New York Yankee’s Yogi Berra who famously said, “It gets late early out there.” It may never be too early to get ready for the next big thing, especially when what’s coming might set the course for years to come. As 2019 comes to an end and we prepare for the excitement and challenges of a new decade, the same can be true for all of us working in the lending and credit space, especially when it comes to how we will approach the use of alternative data in the next decade. Over the last year, alternative data has been a hot topic of discussion. If you typed “alternative data and credit” into a Google search today, you would get more than 200 million results. That’s a lot of conversations, but while nearly everyone seems to be talking about alternative data, we may not have a clear view of how alternative data will be used in the credit economy. How we approach the use of alternative data in the coming decade is going to be one of the most important decisions the lending industry makes. Inaction is not an option, and the time for testing new approaches is starting to run out – as Yogi said, it’s getting late early. And here’s why: millennials. We already know that millennials tend to make up a significant percentage of consumers with so-called “thin-file” credit reports. They “grew up” during the Great Recession and that has had a profound impact on their financial behavior. Unlike their parents, they tend to have only one or two credit cards, they keep a majority of their savings in cash and, in general, they distrust financial institutions. However, they currently account for more than 21 percent of discretionary spend in the U.S. economy, and that percentage is going to expand exponentially in the coming decade. The recession fundamentally changed how lending happens, resulting in more regulation and a snowball effect of other economic challenges. As a result, millennials must work harder to catch up financially and are putting off major life milestones that past generations have historically done earlier in life, such as homeownership. They more often choose to rent and, while they pay their bills, rent and other factors such as utility and phone bill payments are traditionally not calculated in credit scores, ultimately leaving this generation thin-filed or worse, credit invisible. This is not a sustainable scenario as we enter the next decade. One of the biggest market dynamics we can expect to see over the next decade is consumer control. Consumers, especially millennials, want to be in the driver’s seat of their “credit journey” and play an active role in improving their financial situations. We are seeing a greater openness to providing data, which in turn enables lenders to make more informed decisions. This change is disrupting the status quo and bringing new, innovative solutions to the table. At Experian, we have been testing how advanced analytics and machine learning can help accelerate the use of alternative data in credit and lending decisions. And we continue to work to make the process of analyzing this data as simple as possible, making it available to all lenders in all verticals. To help credit invisible and thin-file consumers gain access to fair and affordable credit, we’ve recently announced Experian Lift, a new suite of credit score products that combines exclusive traditional credit, alternative credit and trended data assets to create a more holistic picture of consumer creditworthiness that will be available to lenders in early 2020. This new Experian credit score may improve access to credit for more than 40 million credit invisibles. There are more than 100 million consumers who are restricted by the traditional scoring methods used today. Experian Lift is another step in our commitment to helping improve financial health of consumers everywhere and empowers lenders to identify consumers who may otherwise be excluded from the traditional credit ecosystem. This isn’t just a trend in the United States. Brazil is using positive data to help drive financial inclusion, as are others around the world. As I said, it’s getting late early. Things are moving fast. Already we are seeing technology companies playing a bigger role in the push for alternative data – often powered by fintech startups. At the same time, there also has been a strong uptick in tech companies entering the banking space. Have you signed up for your Apple credit card yet? It will take all of 15 seconds to apply, and that’s expected to continue over the next decade. All of this is changing how the lending and credit industry must approach decision making, while also creating real-time frictionless experiences that empower the consumer. We saw this with the launch of Experian Boost earlier this year. The results speak for themselves: hundreds of thousands of previously thin-file consumers have seen their credit scores instantly increase. We have also empowered millions of consumers to get more control of their credit by using Experian Boost to contribute new, positive phone, cable and utility payment histories. Through Experian Boost, we’re empowering consumers to play an active role in building their credit histories. And, with Experian Lift, we’re empowering lenders to identify consumers who may otherwise be excluded from the traditional credit ecosystem. That’s game-changing. Disruptions like Experian Boost and newly announced Experian Lift are going to define the coming decade in credit and lending. Our industry needs to be ready because while it may seem early, it’s getting late.

Retail banking leaders in a variety of industries (including risk management, credit, information technology and other departments) want to incorporate more data into their business strategies. By doing so, consumer banks and other financial companies benefit by expanding their markets, controlling risk, improving compliance and the customer experience. However, many companies don’t know how or where to start. The challenges? There’s just too much data – and it’s overwhelming. Technical integration issues Maintaining regulatory data and attribute governance and compliance The slow speed of adoption Join Jim Bander, PhD, analytics and optimization leader at Experian, in an upcoming webinar with the Consumer Bankers Association on Tuesday, Oct. 1, 2019 at 9:00-10:00 a.m. PT. The webinar will discuss how some of the country’s best banks – big and small – are making better, faster and more profitable decisions by using the right set of data sources, while avoiding data overload. Key topics will include: Technology Trends: Discover how the latest technology, including the cloud and machine learning, makes it easier than ever to access data, define and manage attributes throughout the enterprise and perform complex calculations in real time. Time to Market: Discover how consumer banks and other financial companies that have mastered data and attribute management are able to integrate data and attributes quickly and seamlessly. Business Benefits: Understand how advanced analytics helps financial institutions of all sizes make better business decisions. This includes growing their portfolios, mitigating fraud and credit risk, controlling operating expenses, improving compliance and enhancing the customer experience. Critical Success Factors: Learn how to stay ahead of ever-evolving business and data requirements and continuously improve your lending operations. Join us as we unveil the secrets to avoiding data overload in consumer banking. Special Offer For non-current CBA members, this webinar costs $95 to attend. However, with special discount code: EX1001, non-CBA members can attend for FREE. Register Now

The future is, factually speaking, uncertain. We don't know if we'll find a cure for cancer, the economic outlook, if we'll be living in an algorithmic world or if our work cubical mate will soon be replaced by a robot. While futurists can dish out some exciting and downright scary visions for the future of technology and science, there are no future facts. However, the uncertainty presents opportunity. Technology in today's world From the moment you wake up, to the moment you go back to sleep, technology is everywhere. The highly digital life we live and the development of our technological world have become the new normal. According to The International Telecommunication Union (ITU), almost 50% of the world's population uses the internet, leading to over 3.5 billion daily searches on Google and more than 570 new websites being launched each minute. And even more mind-boggling? Over 90% of the world's data has been created in just the last couple of years. With data growing faster than ever before, the future of technology is even more interesting than what is happening now. We're just at the beginning of a revolution that will touch every business and every life on this planet. By 2020, at least a third of all data will pass through the cloud, and within five years, there will be over 50 billion smart connected devices in the world. Keeping pace with digital transformation At the rate at which data and our ability to analyze it are growing, businesses of all sizes will be forced to modify how they operate. Businesses that digitally transform, will be able to offer customers a seamless and frictionless experience, and as a result, claim a greater share of profit in their sectors. Take, for example, the financial services industry - specifically banking. Whereas most banking used to be done at a local branch, recent reports show that 40% of Americans have not stepped through the door of a bank or credit union within the last six months, largely due to the rise of online and mobile banking. According to Citi's 2018 Mobile Banking Study, mobile banking is one of the top three most-used apps by Americans. Similarly, the Federal Reserve reported that more than half of U.S. adults with bank accounts have used a mobile app to access their accounts in the last year, presenting forward-looking banks with an incredible opportunity to increase the number of relationship touchpoints they have with their customers by introducing a wider array of banking products via mobile. Be part of the movement Rather than viewing digital disruption as worrisome and challenging, embrace the uncertainty and potential that advances in new technologies, data analytics and artificial intelligence will bring. The pressure to innovate amid technological progress poses an opportunity for us all to rethink the work we do and the way we do it. Are you ready? Learn more about powering your digital transformation in our latest eBook. Download eBook Are you an innovation junkie? Join us at Vision 2020 for future-facing sessions like: - Cloud and beyond - transforming technologies - ML and AI - real-world expandability and compliance

In today’s age of digital transformation, consumers have easy access to a variety of innovative financial products and services. From lending to payments to wealth management and more, there is no shortage in the breadth of financial products gaining popularity with consumers. But one market segment in particular – unsecured personal loans – has grown exceptionally fast. According to a recent Experian study, personal loan originations have increased 97% over the past four years, with fintech share rapidly increasing from 22.4% of total loans originated to 49.4%. Arguably, the rapid acceleration in personal loans is heavily driven by the rise in digital-first lending options, which have grown in popularity due to fintech challengers. Fintechs have earned their position in the market by leveraging data, advanced analytics and technology to disrupt existing financial models. Meanwhile, traditional financial institutions (FIs) have taken notice and are beginning to adopt some of the same methods and alternative credit approaches. With this evolution of technology fused with financial services, how are fintechs faring against traditional FIs? The below infographic uncovers industry trends and key metrics in unsecured personal installment loans: Still curious? Click here to download our latest eBook, which further uncovers emerging trends in personal loans through side-by-side comparisons of fintech and traditional FI market share, portfolio composition, customer profiles and more. Download now

Experian Boost provides a unique opportunity to help dealers build loyalty while helping consumers.

Many companies rely on attributes for decisioning but lack the resources needed to invest in developing, managing, and updating the attributes themselves. Experian is there to guide you every step of the way with our Attribute Toolbox – our source independent solution that provides maximum flexibility and multiple data sources you can use in the calculation and management of attributes. To create and manage our attributes, Experian has established development principles and created a set methodology to ensure that our attribute management system works across the attribute life cycle. Here’s how it works: Develop Attributes The attribute development process includes: discovery, exploratory data analysis, filter leveling, and the development of attributes. When we create attributes, Experian takes great care to ensure that we: Analyze the available data elements and how they are populated (the frequencies of fields). Determine a “sensible” definition of the attribute. Evaluate attribute frequencies. Review consumer credit reports, where possible. Refine the definition and assess more frequencies and examples. Test Attributes Before implementing, Experian performs an internal audit of filters and attributes. Defining, coding and auditing filters is 80% of the attribute development process. The main objective of the auditing process is to ensure both programming and logical accuracy. This involves electronic and manual auditing and requires a thorough review of all data elements used in development. Deploy Attributes Deployment is very similar to attribute testing. However, in this case, the primary objective of the deployment audit is to ensure both the programming and logical accuracy of the output is executing correctly on various platforms. We aim to maintain consistency among various business lines and products, between batch and online environments across the life cycle, and wherever your models are deployed: on premises, in the cloud, and off-site in your partners’ systems. Govern Attributes Experian places a robust attribute governance process in place to ensure that our attributes remains up-to-date and on track with internal and external compliance regulations and audits. New learnings, industry and regulatory changes can lead to updated attributes or new attributes over time. Because attributes are ever-changing, we take great care to expand, update and add new attributes over time based on three types of external changes: economic, bureau, and reporting changes. Fetch Data While we gather the data, we ensure that you can integrate a variety of external data sources, including: consumer bureau, business, fraud, and other data sources. Attributes need to be: Highly accurate. Suitable for use across the Customer Life Cycle. Suitable for use in credit decisioning and model development. Available and consistent across multiple platforms. Supportive and adaptable to ever-evolving regulatory considerations. Thoroughly documented and monitored. Monitor Performance We generate attribute distribution reports and can perform custom validations using data from credit reporting agencies (CRAs) and other data providers. This is based on monthly monitoring to ensure continued integrity and stability to stand up to regulatory scrutiny and compliance regulations. Variations that exceed predetermined thresholds are identified, quantified, and explained. If new fields or data values within existing fields are announced, we assess the impact and important of these values on attributes – to determine if revisions are needed. Maintain Attributes Credit bureau data updates, new attributes in response to market needs, compliance requirements, corrections in logic where errors are identified or improvements to logic often lead to new version releases of attributes. With each new version release, Experian takes care to conduct thorough analyses comparing the previous and current set of attributes. We also make sure to create detailed documentation on what’s changed between versions, the rationale for changes and the impact on existing attributes. Experian Attributes are the key to unlocking consistent, enhanced and more profitable decisions. Our data analysts and statisticians have helped hundreds of clients build custom attributes and custom models to solve their business problems. Our Attribute Toolbox makes it easier to deploy and manage attributes across the customer lifecycle. We give companies the power to code, manage, test, and deploy all types of attributes, including: Premier AttributesSM, Trended 3DTM, and custom attributes – without relying on a third-party. We do the heavy lifting so that you don’t have to. Learn More

Today is National Fintech Day – a day that recognizes the ever-important role that fintech companies play in revolutionizing the customer experience and altering the financial services landscape. Fintech. The word itself has become synonymous with constant innovation, agile technology structures and being on the cusp of the future of finance. Fintech challengers are disrupting existing financial models by leveraging data, advanced analytics and technology – both inspiring traditional financial institutions in their digital transformation strategies and giving consumers access to a variety of innovative financial products and services. But to us at Experian, National Fintech Day means more than just financial disruption. National Fintech Day represents the partnerships we have carefully fostered with our fintech clients to drive financial inclusion for millions of people around the globe and provide consumers with greater control and more opportunities to access the quality credit they deserve. “We are actively seeking out unresolved problems and creating products and technologies that will help transform the way businesses operate and consumers thrive in our society. But we know we can’t do it alone,” said Experian North American CEO, Craig Boundy in a recent blog article on Experian’s fintech partnerships. “That’s why over the last year, we have built out an entire team of account executives and other support staff that are fully dedicated to developing and supporting partnerships with leading fintech companies. We’ve made significant strides that will help us pave the way for the next generation of lending while improving the financial health of people around the world.” At Experian, we understand the challenges fintechs face – and our real-world solutions help fintech clients stay ahead of constantly changing market conditions and demands. “Experian’s pace of innovation is very impressive – we are helping both lenders and consumers by delivering technological solutions that make the lending ecosystem more efficient,” said Experian Senior Account Executive Warren Linde. “Financial technology is arguably the most important type of tech out there, it is an honor to be a part of Experian’s fintech team and help to create a better tomorrow.” If you’d like to learn more about Experian’s fintech solutions, visit us at Experian.com/Fintech.

The fact that the last recession started right as smartphones were introduced to the world gives some perspective into how technology has changed over the past decade. Organizations need to leverage the same technological advancements, such as artificial intelligence and machine learning, to improve their collections strategies. These advanced analytics platforms and technologies can be used to gauge customer preferences, as well as automate the collections process. When faced with higher volumes of delinquent loans, some organizations rapidly hire inexperienced staff. With new analytical advancements, organizations can reduce overhead and maintain compliance through the collections process. Additionally, advanced analytics and technology can help manage customers throughout the customer life cycle. Let’s explore further: Why use advanced analytics in collections? Collections strategies demand diverse approaches, which is where analytics-based strategies and collections models come into play. As each customer and situation differs, machine learning techniques and constraint-based optimization can open doors for your organization. By rethinking collections outreach beyond static classifications (such as the stage of account delinquency) and instead prioritizing accounts most likely to respond to each collections treatment, you can create an improved collections experience. How does collections analytics empower your customers? Customer engagement, carefully considered, perhaps comprises the most critical aspect of a collections program—especially given historical perceptions of the collections process. Experian recently analyzed the impact of traditional collections methods and found that three percent of card portfolios closed their accounts after paying their balances in full. And 75 percent of those closures occurred shortly after the account became current. Under traditional methods, a bank may collect outstanding debt but will probably miss out on long-term customer loyalty and future revenue opportunities. Only effective technology, modeling and analytics can move us from a linear collections approach towards a more customer-focused treatment while controlling costs and meeting other business objectives. Advanced analytics and machine learning represent the most important advances in collections. Furthermore, powerful digital innovations such as better criteria for customer segmentation and more effective contact strategies can transform collections operations, while improving performance and raising customer service standards at a lower cost. Empowering consumers in a digital, safe and consumer-centric environment affects the complete collections agenda—beginning with prevention and management of bad debt and extending through internal and external account resolution. When should I get started? It’s never too early to assess and modernize technology within collections—as well as customer engagement strategies—to produce an efficient, innovative game plan. Smarter decisions lead to higher recovery rates, automation and self-service tools reduce costs and a more comprehensive customer view enhances relationships. An investment today can minimize the negative impacts of the delinquency challenges posed by a potential recession. Collections transformation has already begun, with organizations assembling data and developing algorithms to improve their existing collections processes. In advance of the next recession, two options present themselves: to scramble in a reactive manner or approach collections proactively. Which do you choose? Get started