Regulatory Compliance

Deposit accounts for everyone Over the last several years, the Consumer Financial Protection Bureau (CFPB) has, not so quietly, been actively pushing for changes in how banks decision applicants for new checking accounts. Recent activity by the CFPB is accelerating the pace of this change for those managing deposits-gathering activities within regulated financial institutions. It is imperative banks begin adopting modern technology and product strategies that are designed for a digital age instead of an age before the internet even existed. In October 2014, the CFPB hosted the Forum On Access To Checking Accounts to push for more transparent account opening procedures, suggesting that bank’s use of “blacklists” that effectively “exclude” applicants from opening a transaction account are too opaque. Current regulatory trends are increasingly signaling the need for banks to bring checking account originations strategies into the 21st century as I indicated in Banking in the 21st Century. The operations and technology implications for banks must include modernizing the approach to account opening that goes beyond using different decision data to do “the same old thing” that only partially addresses broader concerns from consumers and regulators. Product features attached to check accounts, such as overdraft shadow limits, can be offered to consumers where this liquidity feature matches what the customer can afford. Banking innovation calls for deposit gatherers to find more ways to approve a basic transaction account, such as a checking account, that considers the consumer’s ability to repay and limit approving overdraft features for some checking accounts even if the consumer opts in. This doesn’t mean banks cannot use risk management principles in assessing which customers get that added liquidity management functionality attached to a checking account. It just means that overdraft should be one part of the total customer level exposure the bank considers in the risk assessment process. The looming regulatory impacts to overdraft fees, seemingly predictable, will further reduce bank revenue in an industry that has been hit hard over the last decade. Prudent financial institutions should begin managing the impact of additional lost fee revenue now and do it in a way that customers and regulators will appreciate. The CFPB has been signaling other looming changes for check account regulations, likely to accelerate throughout 2015, and portend further large impacts to bank overdraft revenue. Foreshadowing this change are the 2013 overdraft study by the CFPB and the proposed rules for prepaid cards published for commentary in December 2014 where prepaid account overdraft is “subject to rules governing credit cards under TILA, EFTA, and their implementing regulations”. That’s right, the CFPB has concluded overdraft for prepaid cards are the same as a loan falling under Reg Z. If the interpretation is applied to checking account debit card overdraft rules, it would effectively turn overdraft fees into finance charges and eliminate a huge portion of remaining profitability for banks from those fees. The good news for banks is that the solution for the new deposits paradigm is accomplished by bringing retail banking platforms into the 21st century that leverage the ability to set exposure for customers at the client level and apportioned to products or features such as overdraft. Proactively managing regulatory change, that is predictable and sure to come, includes banks considering the affordability of consumers and offering products that match the consumer’s needs and ability to repay. The risk decision is not different for unsecured lending in credit cards or for overdraft limits attached to a checking account. Banks becoming more innovative by offering checking accounts enabling consumers more flexible and transparent liquidity management functionality at a reasonable price will differentiate themselves in the market place and with regulatory bodies such as the CFPB. Conducting a capabilities assessment, or business review, to assess product innovation options like combining digital lines of credit with check accounts, will inform your business what you should do to maintain customer profitability. I recommend three steps to begin the change process and proactively manage through the deposit industry regulatory changes that lay ahead: First, assess the impacts of potential lost fees if current overdraft fees are further limited or eliminated and quantify what that means to your product profitability. Second, begin designing alternative pricing strategies, product offerings and underwriting strategies that allow you to set total exposure at a client level and apportion this exposure across lending products that includes overdraft lines and is done in a way that it is transparent to your customers and aligns to what they can afford. Third, but can be done in parallel with steps one and two, begin capability assessments of your financial institution’s core bank decision platform that is used to open and manage customer accounts to ensure your technology is prepared to handle future mandatory regulatory requirements without driving all your customers to your competitors. It is a given that change is inevitable. Deposit organizations are well served to manage this current shift in regulatory policy related to checking account acquisitions in a way consistent with guaranteeing your bank’s competitive advantage. Banks can stay out front of competitors by offering transparent and relevant financial products consumers will be drawn to buy and can’t afford to live without! Thank you for following my blog and insights in DDA best practices. Please accept my invitation to participate in a short market study. Click here to participate. Participants in this 5 minute survey will receive a copy of the results as a token of appreciation.

This is the third post in a three-part series. Experian® is not a doctor. We don’t even play one on TV. However, because of our unique business model and experience with a large number of data providers, we do know data governance. It is a part of our corporate DNA. Our experiences across our many client relationships give us unique insight into client needs and appropriate best practices. Note the qualifier — appropriate. Just as every patient is different in his or her genetic predispositions and lifestyle influences, every institution is somewhat unique and does not have a similar business model or history. Nor does every institution have the same issues with data governance. Some institutions have stabile growth in a defined footprint and a history of conservative audit procedures. Others have grown quickly through aggressive acquisition marketing plans and unique channels and via institution acquisition/merger, leading to multiple receivable systems and data acquisition and retention platforms. Experian has provided valuable services to both environments many times throughout the years. As the regulatory landscape has evolved, lenders/service providers demand a higher level of hands-on experience and regulatory-facing credibility. Most recently, lenders have required assistance on the issues driven by mandates coming from the Comprehensive Capital Analysis and Review (CCAR), Office of the Comptroller of the Currency (OCC) and the Consumer Financial Protection Bureau (CFPB) bulletins and guidelines. Lenders are best served to begin their internal review of their data governance controls with a detailed individual attribute audit and documentation of findings. We have seen these reviews covering fewer than 200 attributes to as many as more than 1,000 attributes. Again, the lender/provider size, analytic sophistication and legacy growth and IT issues will influence this scope. The source and definition of the attribute and any calculation routines should be fully documented. The life cycle stage of attribute acquisition and usage also is identified, and the fair lending implication regarding the use of the attribute across the life cycle needs to be considered and documented. As part of this comprehensive documentation, variances in intended definition and subsequent design and deployment are to be identified and corrective action guidance must be considered and documented for follow-up. Simultaneously, an assessment of the current risk governance policies, processes and documentation typically is undertaken. A third party frequently is leveraged in this review to ensure an objective perspective is maintained. This initiative usually is a series of exploratory reviews and a process and procedures assessment with the appropriate management team, risk teams, attribute design and development personnel, and finally business and end-user teams, as necessary. From these interviews and the review of available attribute-level documentation, documents depicting findings and best practices gap analysis are produced to clarify the findings and provide a hierarchy of need to guide the organization’s next steps: A more recent evolution in this data integrity ecosystem is the implication of leveraging a third party to house and manipulate data within client specifications. When data is collected or processed in “the cloud,” consistent data definitions are needed to maintain data integrity and to limit operational costs related to data cleansing and cloud resource consumption. Maintaining the quality of customer personal data is a critical compliance and privacy principle. Another challenge is that of maintaining cloud-stored data in synchronization with on-premises copies of the same data. Delegation to a third party does not discharge the organization from managing risk and compliance or from having to prove compliance to the appropriate authorities. In summary, a lender/service provider must ensure it has developed a rigorous data governance ecosystem for all internal and external processes supporting data acquisition, retention, manipulation and utilization: A secure infrastructure includes both physical and system-level access and control. Systemic audit and reporting are a must for basic compliance standards. If data becomes corrupted, alternative storage, backup or other mechanisms should be available to protect the information. Comprehensive documentation must be developed to reveal the event, the causes and the corrective actions. Data persistence may have multiple meanings. It is imperative that the institution documents the data definition. Changes to the data must be documented and frequently will lead to the creation of a new data attribute meeting the newer definition to ensure that usage in models and analytics is communicated clearly. Issues of data persistence also include making backups and maintaining multiple archive copies. Periodic audits must validate that data and usage conform to relevant laws, regulations, standards and industry best practices. Full audit details, files used and reports generated must be maintained for inspection. Periodic reporting of audit results up to the board level is recommended. Documentation of action plans and follow-up results is necessary to disclose implementation of adequate controls. In the event of lost or stolen data, appropriate response plans and escalation paths should be in place for critical incidents. Throughout this blog series, we have discussed the issues of risk and benefits from an institution’s data governance ecosystem. The external demands show no sign of abating. The regulators are not looking for areas to reduce their oversight. The institutional benefits of an effective data governance program are significant. Discover how a proven partner with rich experience in data governance, such as Experian, can provide the support your company needs to ensure a rigorous data governance ecosystem. Do more than comply. Succeed with an effective data governance program.

There are two sides to every coin and in banking the question is often to you want to chase the depositor of that coin, or lend it out? Well the Federal Reserve’s decision to hold interest rates at record lows since the economic downturn gave the banks’ in the United States loan portfolios a nice boost from 2010-2011, but the subsequent actions and banking environment resulted in deposit growth outpacing loans – leading to a marked reduction in loan-to-deposit ratios across banks since 2011. In fact currently there is almost $1.30 in deposits for every loan out there today. This, in turn, has manifested itself as a reduction in net interest margins for all U.S. banks over the last three years – a situation unlikely to improve until the Fed hikes interest rates. Additionally, the banks’ have found that while they are now holding on to more of these deposits that additional regulations in the form of the CFPB looking to evaluate account origination processes, Basel III Liquidity concerns, CCAR and CIP & KYP have all made the burden of holding these deposits more costly. In fact the CFPB suggests four items they believe will improve financial institution’s checking account screening policies and practices: Increase the accuracy of data used from CRA’s Identify how institutions can incorporate risk screening tools while not excluding potential accountholders unnecessarily Ensure consumers are aware and notified of information used to decision the account opening process Ensure consumers are informed of what account options exist and how they access products that align with their individual needs Lastly, to add to this already challenging environment, technology has switched the channel of choice to your smartphone and has introduced a barrage of risks associated with identity authentication – as well as operational opportunities. As leaders in retail banking and in addressing the needs of your customers, I would like to extend an invitation on behalf of Experian for you to participate in our latest survey on the changing landscape of DDA opportunities. How are regulations changing your product set, what role does mobile play now and in the future, and what are your top priorities for 2015 and beyond? These are just a few of the insights we would like to gain from experts such as you. To access our survey, please click here. Our brief survey should take no more than seven minutes to complete and your insights will be highly valued as we look to better support you and your organization’s demand product needs. Our survey period will close in three weeks, so please respond now. As a sign of our appreciation for your insights, we will send all participants an anonymous aggregation of the responses so that you can see how others view the retail banking marketplace. So take advantage of this chance to learn from your peers and participate in this industry study and don’t leave your strategy to a flip of a coin.

This is the second post in a three-part series. Imagine the circumstances of a traveler coming to a never before visited culture. The opportunity is the new sights, cuisine and cultural experiences. Among the risks is the not before experienced pathogens and the strength of the overall health services infrastructure. In a similar vein, all too frequently we see the following conflict within our client institutions. The internal demands of an ever-increasing competitive landscape drive businesses to seek more data; improved ease of accessibility and manipulation of data; and acceleration in creating new attributes supporting more complex analytic solutions. At the same time, requirements for good governance and heightened regulatory oversight are driving for improved documentation and controlled access, all with improved monitoring and documented and tested controls. As always, the traveler/businessman must respond to the environment, and the best medicine is to be well-informed of both the perils and the opportunities. The good news is that we have seen many institutions invest significantly in their audit and compliance functions over the past several years. This has provided the lender with both better insights into its current risk ecosystem and the improved skill set to continue to refine those insights. The opportunity is for the lender to leverage this new strength. For many lenders, this investment largely has been in response to broadening regulatory oversight to ensure there are proper protocols in place to confirm adherence to relevant rules and regulations and to identify issues of disparate impact. A list of the more high-profile regulations would include: Equal Credit Opportunity Act (ECOA) — to facilitate enforcement of fair lending laws and enable communities, governmental entities and creditors to identify business and community development needs and opportunities of women-owned, minority-owned and small businesses. Home Mortgage Disclosure Act (HMDA) — to require mortgage lenders to collect and report additional data fields. Truth in Lending Act (TLA) — to prohibit abusive or unfair lending practices that promote disparities among consumers of equal creditworthiness but of different race, ethnicity, gender or age. Consumer Financial Protection Bureau (CFPB) — evolving rules and regulations with a focus on perceptions of fairness and value through transparency and consumer education. Gramm-Leach-Bliley Act (GLBA) — requires companies to give consumers privacy notices that explain the institutions’ information-sharing practices. In turn, consumers have the right to limit some, but not all, sharing of their information. Fair Debt Collections Practices Act (FDCPA) — provides guidelines for collection agencies that are seeking to collect legitimate debts while providing protections and remedies for debtors. Recently, most lenders have focused their audit/compliance activities on the analytics, models and policies used to treat consumer/client accounts/relationships. This focus is understandable since it is these analytics and models that are central to the portfolio performance forecasts and Comprehensive Capital Analysis and Review (CCAR)–mandated stress-test exercises that have been of greater emphasis in responding to recent regulatory demands. Thus far at many lenders, this same rigor has not yet been applied to the data itself, which is the core component of these policies and frequently complex analytics. The strength of both the individual consumer–level treatments and the portfolio-level forecasts is negatively impacted if the data underlying these treatments is compromised. This data/attribute usage ecosystem demands clarity and consistency in attribute definition; extraction; and new attribute design, implementation to models and treatments, validation and audit. When a lender determines there is a need to enhance its data governance infrastructure, Experian® is a resource to be considered. Experian has this data governance discipline within our corporate DNA — and for good reason. Experian receives large and small files on a daily basis from tens of thousands of data providers. In order to be sure the data is of high quality so as not to contaminate the legacy data, rigorous audits of each file received are conducted and detailed reports are generated on issues of quality and exceptions. This information is shared with the data provider for a cycle of continuous improvement. To further enhance the predictive insights of the data, Experian then develops new attributes and complex analytics leveraging the base and developed attributes for analytic tools. This data and the analytic tools then are utilized by thousands of authorized users/lenders, who manage broad-ranging relationships with millions of individuals and small businesses. These individuals and businesses then have rights to reproach Experian for error(s) both perceived and actual. This demanding cycle underscores the value of the data and the value of our rigorous data governance infrastructure. This very same process occurs at many lenders sites. Certainly, a similar level of data integrity born from a comprehensive data governance process also is warranted. In the next and final blog in this series, we will explore how a disciplined business review of an institution’s data governance process is conducted. Discover how a proven partner with rich experience in data governance, such as Experian, can provide the support your company needs to ensure a rigorous data governance ecosystem. Do more than comply. Succeed with an effective data governance program.

Opening a new consumer checking account in the 21st century should be simple and easy to understand as a customer right? Unfortunately, not all banks have 21st century systems or processes reflecting the fact that negotiable order of withdrawal (NOW) accounts, or checking accounts, were introduced decades ago within financial institutions and often required the consumer to be in person to open the account. A lot has changed and consumers demand simpler and transparent account opening processes with product choices that match their needs at a price that they’re willing to pay. Financial institutions that leverage modernized technology capabilities and relevant decision information have the best chance to deliver consumer friendly experiences that meet consumer expectations. It is obvious to consumers when we in the financial services industry get it right and when we don’t. The process to open a checking account should be easily understood by consumers and provide them with appropriate product choices that aren’t “one size fits all”. Banks with more advanced core-banking systems incorporating relevant and compliant decision data and transparent consumer friendly approval processes have a huge opportunity to differentiate themselves positively from competitors. The reality is that banking deposit management organizations throughout the United States continue to evolve check screening strategies, technology and processes. This is done in an effort to keep up with evolving regulatory expectations from the consumer advocacy regulatory bodies such as the Consumer Financial Protection Bureau (CFPB) and designed to improve transparency of checking account screening for new accounts for an increased number of consumers. The CFPB advocates that financial institutions adopt new checking account decision processes and procedures that maintain sound management practices related to mitigating fraud and risk expense while improving consumer transparency and increasing access to basic consumer financial instruments. Bank shareholders demand that these accounts be extended to consumers profitably. The CFPB recognizes that checking accounts are a basic financial product used by almost all consumers, but has expressed concerns that the checking account screening processes may prevent access to some consumers and may be too opaque with respect to the reasons why the consumer may be denied an account. The gap between the expectations of the CFPB, shareholders and bank deposit management organization’s current products and procedures are not as wide as they may seem. The solution to closing the gap includes deploying a more holistic approach to checking account screening processes utilizing 21st century technology and decision capabilities. Core banking technology and checking products developed decades ago leave banks struggling to enact much needed improvements for consumers. The CFPB recognizes that many financial institutions rely on reports used for checking account screening that are provided by specialty consumer reporting agencies (CRAs) to decision approval for new customers. CRAs specialize in checking account screening and provide financial institutions with consumer information that is helpful in determining if a consumer should be approved or not. Information such as the consumer’s check writing and account history such as closed accounts or bounced checks are important factors in determining eligibility for the new account. Financial institutions are also allowed to screen consumers to assess if they may be a credit risk when deciding whether to open a consumer checking account because many consumers opt-in for overdraft functionality attached to the checking account. Richard Cordray, the CFPB Director, clarified the regulatory agency’s position as to how consumers are treated in checking account screening processes within his prepared remarks at a forum on this topic in October 2014. “The Consumer Bureau has three areas of concern. First, we are concerned about the information accuracy of these reports. Second, we are concerned about people’s ability to access these reports and dispute any incorrect information they may find. Third, we are concerned about the ways in which these reports are being used.” The CFPB suggests four items they believe will improve financial institution’s checking account screening policies and practices: Increase the accuracy of data used from CRA’s Identify how institutions can incorporate risk screening tools while not excluding potential accountholders unnecessarily Ensure consumers are aware and notified of information used to decision the account opening process Ensure consumers are informed of what account options exist and how they access products that align with their individual needs Implementing these steps shouldn’t be too difficult to accomplish for deposit management organizations as long as they are fully leveraging software such as Experian’s PowerCurve customized for deposit account origination, relevant decision information such as Experian’s Precise ID Platform and Vantage Score® credit score combined with consumer product offerings developed within the bank and offered in an environment that is real-time where possible and considers the consumer’s needs. Enhancing checking account screening procedures by taking into account consumer’s life-stage, affordability considerations, unique risk profile and financial needs will satisfy expectations of the consumers, regulators and the financial institution shareholders. Financial institutions that use technology and data wisely can reduce expenses for their organizations by efficiently managing fraud, risk and operating costs within the checking account screening process while also delighting consumers. Regulatory agencies are often delighted when consumers are happy. Shareholders are delighted when regulators and consumers are happy. Reengineering checking account opening processes for the modern age results in a win-win-win for consumers, regulators and financial institutions. Discover how an Experian Global Consultant can help you with your banking deposit management needs.

This is the first post in a three-part series. You’ve probably heard the adage “There is a little poison in every medication,” which typically is attributed to Paracelsus (1493–1541), the father of toxicology. The trick, of course, is to prescribe the correct balance of agents to improve the patient while doing the least harm. One might think of data governance in a similar manner. A well-disciplined and well-executed data governance regimen provides significant improvements to the organization. So too, an overly restrictive or poorly designed and/or ineffectively monitored data governance ecosystem can result in significant harm; less than optimal models/scorecards, inaccurate reporting, imprecise portfolio outcome forecasts and poor regulatory reports, subsequently resulting in significant investment and loss of reputation. In this blog series, we will address the issues and best practices associated with the broad mandate of data governance. In its simplest definition, data governance is the management of the availability, usability, integrity and security of the data employed in an enterprise. A sound data governance program includes a governing body or council, a defined set of procedures and a plan to execute those procedures. Well, upon quick reflection, effective data governance is not simple at all. After all, data is ubiquitous, is becoming more available, encompasses aspects of our digital lives not envisioned as little as 15 years ago and is constantly changing as people’s behavior changes. To add another level of complexity, regulatory oversight is becoming more pervasive as regulations passed since the Great Recession have become more intrusive, granular and demanding. When addressing issues of data governance lenders, service providers and insurers find themselves trying to incorporate a wide range of issues. Some of these are time-tested best practices, while others previously were never considered. Here is a reasonable checklist of data governance concerns to consider: Who owns the data governance responsibility within the organization? Is the data governance group seen as an impediment to change or is it a ready part of the change management culture? Is the backup and retrieval discipline — redundancy and recovery — well-planned and periodically tested? How agile/flexible is the governance structure to new data sources? How does the governance structure document and reconcile similar data across multiple providers? Are there appropriate and documented approvals and consents from the data provider(s) for all disclosures? Are systemic access and modification controls and reporting fully deployed and monitored for periodic refinement? Does the monitoring of data integrity, persistence and entitled access enable a quick fix culture where issues are identified and resolved at the source of the problem and not settled by downstream processes? Are all data sources, including those that are proprietary, fully documented and subject to systemic accuracy/integrity reporting? Once obtained, how is the data stored and protected in both definition and accessibility? How do we alter data and leverage the modified outcome? Are there reasonable audits and tracking of downstream reporting? In the event of a data breach, does the organization have well-documented protocols and notification thresholds in place? How recently and to what extent have all data retrieval, manipulation, usage and protection policies and processes been audited? Are there scheduled and periodic reports made to the institution board on issues of data governance? Certainly, many institutions have most of these aspects covered. However, “most” is imprecise medicine, and ill effects are certain to follow. As Paracelsus stated, “The doctor can have a stronger impact on the patient than any drug.” As in medical services, for data governance initiatives those impacts can be beneficial or harmful. In our next blog, we’ll discuss observations of client data governance gaps and lessons learned in evaluating the existing data governance ecosystem. Make sure to read Compliance as a Differentiator perspective paper for deeper insight on regulations affecting financial institutions and how you can prepare your business. Discover how a proven partner with rich experience in data governance, such as Experian, can provide the support your company needs to ensure a rigorous data governance ecosystem. Do more than comply. Succeed with an effective data governance program.

By: Mike Horrocks I am at the Risk Management Association’s annual conference in DC and I feel like I am back to where my banking career began. One of the key topics here is how important the Risk Rating Grade is and what impact that right or wrong Risk Rating Grade can have on the bank. It is amazing to me how a risk rating is often a shot in the dark at some institutions or can even vary on the training of one risk manager to another. For example, you could have a commercial credit with fantastic debt service coverage and have it tied to a terrible piece of collateral and that risk rating grade will range anywhere from prime type credit (cash flow is king and the loan will never default – so why concern ourselves with collateral) to low, subprime (do we really want that kind of collateral dragging us down or in our OREO portfolio?), to anywhere in between. Banks need to define the attributes of a risk rating grade and consistently apply that grade. The failure of doing that will lead to having that poor risk rating grade impact ALLL calculations (with either an over allocation or not enough) and then that will roll into the loan pricing (making you more costly or not enough to match for the risk). The other thing I hear consistently is that we don’t have the right solutions or resources to complete a project like this. Fortunately there is help. A bank should never feel like they should try to do this alone. I recall how it was an all hands on deck when I first started out to make sure we were getting the right loan grading and loan pricing in place at the first super-regional bank I worked at – and that was without all the compliance pressure of today. So take a pause and look at your loan grading approach – is it passing or failing your needs? If it is not passing, take some time to read up on the topic, perhaps find a tutor (or business partner you can trust) and form a study group of your best bankers. This is one grade that needs to be at the top of the class. Looking forward to more from RMA 2014!

By: Joel Pruis I have just completed the first of two presentations on Model Risk Governance at the RMA Annual Conference. The focus of the presentation was the compliance with the Model Risk Governance guidance at the smaller asset sized financial institutions. The big theme across all of the attendees at the first session was the need for resources to execute on the Model Risk Governance. Such resources are scarce at the smaller asset sized institutions forcing the need and use for external vendors to assist in the development and ongoing validation of any models in use. With that said, the one area that cannot be outsourced is the model risk governance responsibility of the financial institution. While resources are few, we have to look for existing roles within the organization to support the model risk governance such as: - Internal Audit - reviewing process, inputs, consistency - Loan Review - accuracy, consistency, thresholds, etc. - Compliance - Data usage, pricing consistency, etc. Start gathering your governance team at your organization and begin the effort around model risk governance! Discover how an Experian business consultant can help with your Model Risk Governance strategies and processes. Also, if you are interested in gaining deeper insight on regulations affecting financial institutions and how to prepare your business, download Experian’s Compliance as a Differentiator perspective paper.

By: Joel Pruis When the OCC put forth the supervisory guidance on model risk governance the big focus in the industry was around the larger financial institutions that had created their own risk models. The overall intent to make sure that the larger financial institutions were properly managing the risk they were assuming through the use of the custom risk models they had developed. While we can’t say that this model risk governance was a significant issue, the guidance provided by the OCC is intended to provide financial institutions with the minimum requirements for model risk governance. Now that the OCC and the Federal Reserve have gone through the model risk governance reviews for the largest financial institutions in the US, their attention has turned to the rest of the group. While you may not have developed your own custom scorecard model, you may be using a generic scorecard model to support your credit decisions either for loan origination and/or portfolio management. As a result of the use of even generic scorecards and models, you do have obligations for model risk governance as stated in the guidance. While you may not be basing any decisions strictly on a score alone, the questions you have to asking yourself are: Does my credit policy or underwriting guidelines reference the use of a score in my decision process? While I may not be doing any type of auto-decision, do I restrict any credit authority based upon a score? Do I adjust any thresholds/underwriting guidelines based upon a score that is returned? For example, do I allow a higher debt to income if the score is above a certain level? How long have you been using a score in your decision processes that may have become a significant influence on how you decision credit? As you can see from the questions above, the guidance covers a significant population of the financial institutions in the US. As a result, some of the basic components that your financial institution must demonstrate it has done (or will do) are: Recent validation of the scorecard against your portfolio performance Demonstration of appropriate policy governing the use of credit risk models per the regulation Independence around the authority and review of the model risk governance and validations Proper support and documentation from your generic scorecard provider per the guidance. If you would like to learn more on this topic, please join me at the upcoming RMA Annual Risk Management Conference where I will be speaking on Model Validation for Community Banks on Monday, Oct. 27, 9:30 a.m. – 10:30 a.m. or 11 a.m. – 12 p.m. Also, if you are interested in gaining deeper insight on regulations affecting financial institutions and how to prepare your business, download Experian’s Compliance as a Differentiator perspective paper.

Data quality continues to be a challenge for many organizations as they look to improve efficiency and customer interaction.

By: Mike Horrocks The Wall Street Journal just recently posted an article that mentioned the cost of the financial regulations for some of the largest banks. Within the article it is staggering to see the cost of the financial crisis and also to see how so much of this could have been minimized by sound banking practices, adoption to technology, etc. As a former commercial banker and as I talk with associates in the banking industry, I know that there are more causes to point at for the crisis then there are fingers…but that is not the purpose of my blog today. My point is the same thing I ask my teenage boys when they get in trouble, “Now, what are you going to do to fix it?” Here are a couple of ideas that I want to share with the banking industry. Each bank and market you are going after is a bit unique; however think about these this week and what you could do. It is about the customer – the channel is just how you touch that customer. Every day you hear the branch office is dead and that mobile is the next wave. And yes, if I was a betting man, I would clearly say mobile is the way to go. But if you don’t do it right, you will drive customers away just as fast (check out the stats from a Google mobile banking study). At the end of the day, make sure you are where your customers want to be (and yes for some that could even be a branch). Trust is king. The Beatles may have said that “All You Need Is Love”, but in banking it is all about trust. Will my transaction go thru? Will my account be safe? Will I be able to do all that I need to do on this mobile phone and still be safe since it also has Angry Birds on it? If your customer cannot trust you to do what they feel are simple things, then they will walk. You have to protect your customers, as they try to do business with you and others. Regulations are here to stay. It pains me to say it, but this is going to be a truth for a long while. Banks need to make sure they check the box, stay safe, and then get on to doing what they do best – identify and manage risk. No bank will win the war for shareholder attention because they internally can answer the regulators better than the competition. When you are dealing with complicated issues like CCAR, Basel II or III, or any other item, working with professionals can help you stay on track. This last point represents a huge challenge for banks as the number of regulations imposed on financial institutions has grown significantly over the past five years. On top that the level of complexity behind each regulation is high, requiring in-depth knowledge to implement and comply. Lenders have to understand all the complexity of these regulations so they can find the balance to meet compliance obligations. At the same time they need to identify profitable business opportunities. Make sure to read our Comply whitepaper to gain more insight on regulations affecting financial institutions and how you can prepare your business. A little brainstorming and a single action toward each of these in the next 90 days will make a difference. So now, what are you going to do to fix it?

As part of its guidance, the Office of the Comptroller of the Currency recommends that lenders perform regular validations of their credit score models in order to assess model performance.

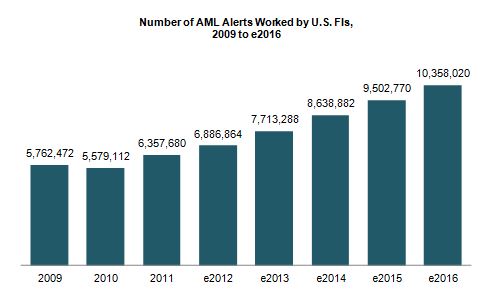

Julie Conroy - Research Director, Aite Group Finding patterns indicative of money laundering and other financial crimes is akin to searching for a needle in a haystack. With the increasing pressure on banks’ anti-money laundering (AML) and fraud teams, many with this responsibility increasingly feel like they’re searching for those needles while a combine is bearing down on them at full speed. These pressures include: Regulatory scrutiny: The high-profile—and expensive—U.S. enforcement actions that took place during the last couple of years underscore the extent to which regulators are scrutinizing FIs and penalizing those who don’t pass muster. Payment volumes and types increasing: As the U.S. economy is gradually easing its way into a recovery, payment volumes are increasing. Not only are volumes rebounding to pre-recession levels, but there have also been a number of new financial products and payment formats introduced over the last few years, which further increases the workload for the teams who have to screen these payments for money-laundering, sanctions, and global anti-corruption-related exceptions. Constrained budgets: All of this is taking place during a time in which top line revenue growth is constrained and financial institutions are under pressure to reduce expenses and optimize efficiency. Illicit activity on the rise: Criminal activity continues to increase at a rapid pace. The array of activity that financial institutions’ AML units are responsible for detecting has also experienced a significant increase in scope over the last decade, when the USA PATRIOT Act expanded the mandate from pure money laundering to also encompass terrorist financing. financial institutions have had to transition from activity primarily focused on account-level monitoring to item-level monitoring, increasing by orders of magnitude the volumes of alerts they must work (Figure 1) Figure 1: U.S. FIs Are Swimming in Alerts Source: Aite Group interviews with eight of the top 30 FIs by asset size, March to April 2013 There are technologies in market that can help. AML vendors continue to refine their analytic and matching capabilities in an effort to help financial insitutions reduce false positives while not adversely affecting detection rates. Hosted solutions are increasingly available, reducing total cost of ownership and making software upgrades easier. And many institutions are working on internal efficiency efforts, reducing vendors, streamlining processes, and eliminating the number of redundant efforts. How are institutions handling the increasing pressure cooker that is AML compliance? Aite Group wants to know your thoughts. We are conducting a survey of financial insitution executives to understand your pain points and proposed solutions. Please take 20 minutes to share your thoughts, and in return, we’ll share a complimentary copy of the resulting report. This data can be used to compare your efforts to those of your peers as well as to glean new ideas and best practices. All responses will be kept confidential and no institutions names will be mentioned anywhere in the report. You can access the survey here: SURVEY

The security world was taken by surprise earlier this month when researchers discovered Heartbleed, a new large-scale threat that exploits a security vulnerability in OpenSSL.

By: Teri Tassara In my blog last month, I covered the importance of using quality credit attributes to gain greater accuracy in risk models. Credit attributes are also powerful in strengthening the decision process by providing granular views on consumers based on unique behavior characteristics. Effective uses include segmentation, overlay to scores and policy definition – across the entire customer lifecycle, from prospecting to collections and recovery. Overlay to scores – Credit attributes can be used to effectively segment generic scores to arrive at refined “Yes” or “No” decisions. In essence, this is customization without the added time and expense of custom model development. By overlaying attributes to scores, you can further segment the scored population to achieve appreciable lift over and above the use of a score alone. Segmentation – Once you made your “Yes” or “No” decision based on a specific score or within a score range, credit attributes can be used to tailor your final decision based on the “who”, “what” and “why”. For instance, you have two consumers with the same score. Credit attributes will tell you that Consumer A has a total credit limit of $25K and a BTL of 8%; Consumer B has a total credit limit of $15K, but a BTL of 25%. This insight will allow you to determine the best offer for each consumer. Policy definition - Policy rules can be applied first to get the desirable universe. For example, an auto lender may have a strict policy against giving credit to anyone with a repossession in the past, regardless of the consumer’s current risk score. High quality attributes can play a significant role in the overall decision making process, and its expansive usage across the customer lifecycle adds greater flexibility which translates to faster speed to market. In today’s dynamic market, credit attributes that are continuously aligned with market trends and purposed across various analytical are essential to delivering better decisions.