When checking access accounts were first introduced, it wasn’t uncommon for banks to provide new customers “basic” transaction services in starter checking accounts. These services typically included an automatic teller machine (ATM) access card and the ability to withdraw cash at their local branch. As consumers developed a relationship and established financial trust with their bank, they eventually would get a checkbook, which allowed check-writing access. This took time and a consumer demonstrating both the willingness and ability to manage finances to the bank’s expectations. Establishing the financial relationship was a trust-building process.

With the onset of general-purpose debit cards and a host of other digital money-movement capabilities, such as online banking, the majority of banks now offer just basic and preferred checking. A minimum acceptance standard leaves many consumers out of the financial transaction system, which is something that concerns regulatory bodies such as the Consumer Financial Protection Bureau (CFPB). Approval criteria vary across financial institutions, but a typical basic checking account has some form of overdraft feature enabled, and some consumers may not be able to afford these fees even if they elect to opt in for overdraft functionality. Nonetheless, banks still screen applicants to ensure prior accounts at other institutions were managed with no losses incurred by other banks. In today’s modern world, it is difficult to participate fully in our credit-driven society without a checking account at a recognized bank or credit union. The answer in many cases would be checking accounts for consumers that have either overdraft functionality assigned based on the consumer’s wish to opt in or overdraft access that matches that same consumer’s ability to pay.

In early February, the CFPB passed new guidelines to increase access to basic check products. While a step towards making checking accounts available to all, the most recent actions still leave unresolved regulatory actions regarding what the CFPB refers to as “affordable” checking access. For instance, for those consumers without disposable income, the issue of fees for overdraft and nonsufficient funds is still an unresolved regulatory matter.

In the most recent announcement, the CFPB took several actions related to its focus on increasing consumer access to checking transaction accounts with banks:

- Sending a letter to CEOs of the top 25 banks encouraging them to take steps to help consumers with affordable checking account access such as “no fee” and/or “no overdraft” checking accounts

- Providing several new resources to consumers such as a guide to “Low Risk Checking, Managing Checking and Consumer Guide to Checking Account Denial”

- Introducing the Consumer Protection Principles, which include a drive toward:

- Faster funds availability

- Improved consumer transparency into checking account fee structure, funds availability and security

- Tailoring products to reach a larger percentage of consumers

- Developing no-overdraft type checking products, which only a handful of large banking institutions had

What lurks ahead for banks is the need to develop products that are designed to reach a larger population that includes under banked and unbanked consumers with troubled financial repayment history. Coupling this product development effort with the CFPB desire for no-overdraft-fee type products makes me wonder if we should look to account features from several decades ago, such as creating a 21st century version of the checking account with digital money-movement features that protects consumers’ privacy, but doesn’t put them in a position to rack up large amounts of overdraft fees they can’t afford to pay in the event they overdraw the checking account.

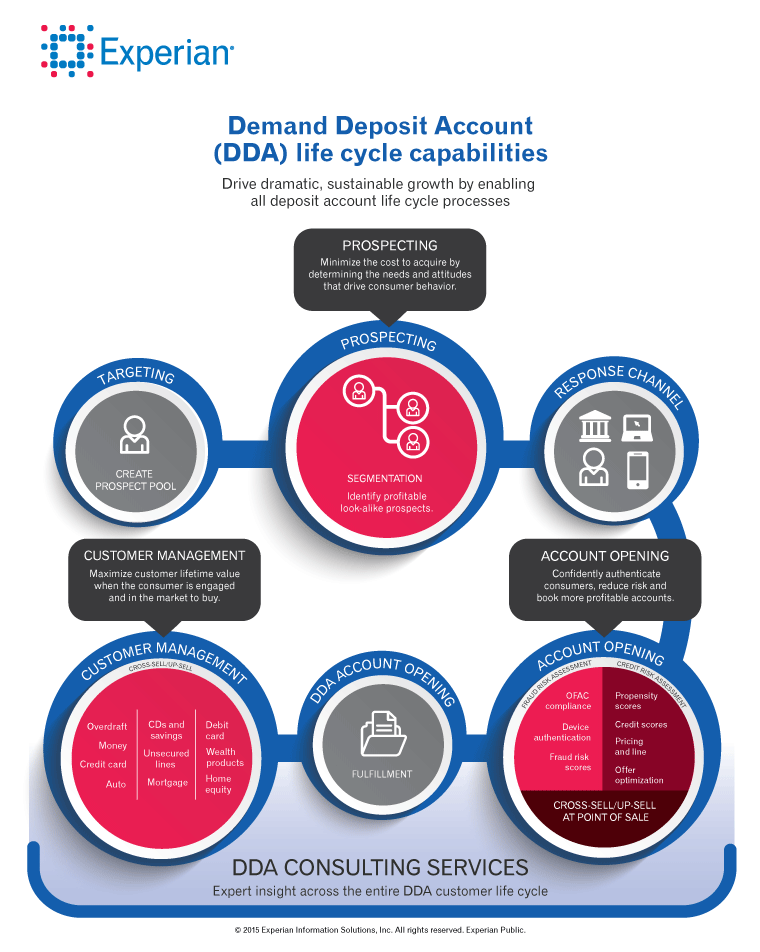

Experian® suggests taking the following steps:

- Conduct a Business Review to ensure that your product offering includes the type of account the CFPB is advocating and your existing core banking platform can operationalize this account

- Align your checking account prospect and opening procedures to key segments to ensure more consumers are approved and right-sized to the appropriate checking product

- Enhance your business profitability by cross-selling credit products that fit the affordability and disposable income of various consumer segments you originate

These steps will make your journey “back to the future” much less turbulent and ensure you don’t break the bank in your efforts to address CFPB’s well-intentioned focus on check access for consumers.