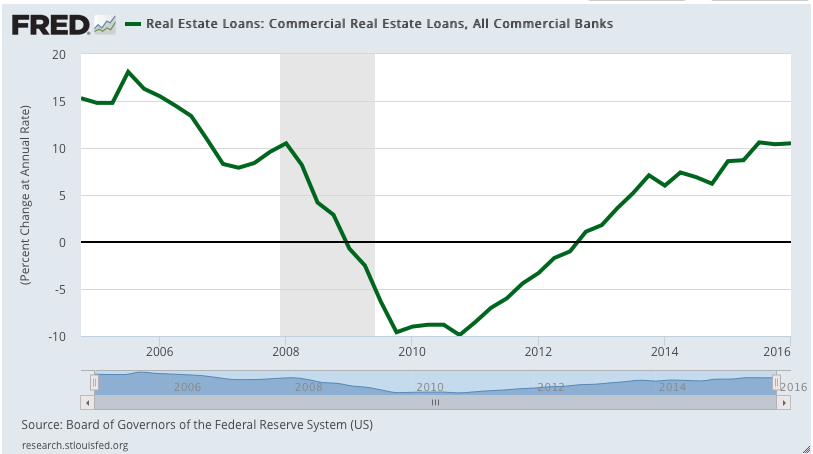

As net interest margins tighten and commercial real estate concentrations begin to slowly creep back to 2008 levels, financial institutions should consider looking to their branch networks to drive earnings. Why wouldn’t you, right?

As net interest margins tighten and commercial real estate concentrations begin to slowly creep back to 2008 levels, financial institutions should consider looking to their branch networks to drive earnings. Why wouldn’t you, right?

The good news is branch networks can embrace that challenge by simply using some of the tools they already have access to – most notably the credit report.

Credit reports are generally seen as a tool to assist financial institutions in assessing credit risk. However, if used properly, credit reports can provide a wealth of insight on selling opportunities as well.

Typically when a customer’s credit report is pulled, the personal banker or customer service representative is primarily focused on whether or not a loan application is approved based on the institution’s approval parameters. Instead, what if a lender elected to view this customer interaction as an opportunity to deepen the relationship?

So, here are three ways to utilize credit reports to generate earnings through retail loan growth:

1. Opportunities to Consolidate Debt

Looking for debt consolidation opportunities is probably the simplest way to mine for opportunities.

For example:

Personal Banker: “It looks like you also have a card credit with XYZ and ABC Bank. Based on your application, we can consolidate both of those balances into one and give you a lower interest rate.”

Be specific. Tell the customer exactly how much money per month they would be able to save and the benefits of consolidation.

Not to mention, debt consolidation often reduces a lender’s credit risk and enhances customer loyalty, so this is a win for the institution as well.

2. Opportunities to Provide Additional Credit

Another method would be to “soft pull” a segment of your portfolio to identify customers who qualify for larger credit card balances or refinance opportunities. This strategy is best executed at the portfolio management level, as insight is needed on the bank risk appetite and concentration levels. Layering on a basic prescreen helps qualify and segment your prospect list according to your unique credit criteria. You can also expand the universe with an Experian extract list, identifying new consumers who might be open to new offers.

3. Find Hidden Opportunities

Credit scoring models are not perfect. There are times when a person’s credit score does not reflect an applicant’s true risk profile. For example, a person who was temporarily out of work may have missed two to three payments during that period. A deeper scan of the credit report during underwriting may reveal an opportunity to lend to a person rebounding from financial difficulties not yet reflected by their credit score. For example, this individual may have missed two credit card payments but hasn’t missed a mortgage or car payment in 20 years. A score is just one dimension to the story, but trended insights can shine a light on who best to lend to in the future.

Conclusion: With the proper tools and training, your retail team can get more out of the basic credit report and find additional opportunities to deepen customer relationships while maintaining your desired risk profile. The credit report can be a workhorse for your team, so why not leverage it for more business.

Note: The information above outlines several uses for a credit report. Separate credit reports are required for each use with the intended permissible purpose.

Ancin Cooley is principal with Synergy Bank Consulting, a national credit risk management and strategic planning firm. Synergy provides a rangeof risk management services to financial institutions, which include loan reviews, IT audits, internal audits, and regulatory compliance reviews. As principal, Ancin manages a growing portfolio of clients throughout the United States.

Ancin Cooley is principal with Synergy Bank Consulting, a national credit risk management and strategic planning firm. Synergy provides a rangeof risk management services to financial institutions, which include loan reviews, IT audits, internal audits, and regulatory compliance reviews. As principal, Ancin manages a growing portfolio of clients throughout the United States.