Attract and retain high-value demand deposit accounts

The excitement of the new year has ended, and now the big question remains: What will 2016 hold for our market and the economy? So far, we’ve seen this election year bring a volatile financial market:

- The Federal Reserve increased short-term interest rates by 25 basis in December, and there is uncertainty if and when future increases will come

- China’s gross domestic product is forecasted at 6.5 percent, the lowest in a quarter century

- The Dow Jones industrial average is down 10 percent to start the year, signaling a lot of uncertainty for banks and consumers

It’s hard to find answers in a shifting financial landscape with a long list of mixed signals. The average consumer is looking on and wondering if we face another Great Recession or if the current economy is spiking a fever just before it is completely cured.

The reality, for those of us in the banking industry, is that the modest economic recovery is likely to continue as part of a new normal pattern. In 2016, banks that remain competitive in a more digital world will be those that have frictionless products and processes to attract and retain high-value, highly sought-after consumer deposits and loans.

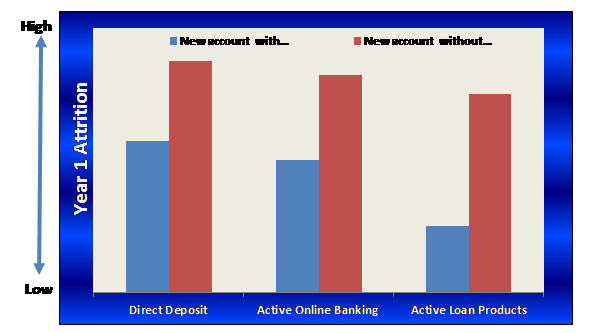

Banks should expect the competition for deposits to intensify, and they will need to ensure that new deposit customers are on boarded effectively and cross-sold loan products quickly to reduce first-year attrition. Cross-selling at the point of origination for the demand deposit account (DDA) customers is the best way to ensure that new customers keep the institution as their primary bank.

Financial institutions can exceed consumer expectations and ensure a competitive business model by leveraging modernized technology capabilities fully in combination with making relevant decisions to deliver consumer-friendly experiences. First-year DDA attrition rates will demonstrate how the consumer’s expectations were met and if the new bank got the account-opening process right or wrong.

Experian® suggests three capabilities clients should consider:

Experian® suggests three capabilities clients should consider:

- A deposits technology platform that offers frictionless change to data, origination strategies and instant cross-sell to loan products that yield sticky customers

- Strategies that comply with current and evolving regulatory demands, such as those being sought by the Consumer Financial Protection Bureau (CFPB)

- Business planning to identify execution gaps and a road map to ensure that gaps are addressed, confirming continued competitive ability to attract high-value deposit and loan customers

DDA-account opening effectiveness can be achieved by using a consumer’s life stage, affordability considerations, unique risk profile and financial needs to on board optimally and grow those high-value consumers effectively and efficiently. Financial institutions that are nimble and fast adopters of these critical capabilities will reduce operating expenses for their organizations, grow sustainable revenue from new prospects and customers, and delight those new customers along the way. This is a win-win for banks and consumers.

Join me next week as we discuss best practices across the entire demand deposit account life cycle.