Alternative fuel vehicles aren’t a new concept, but they have certainly been gaining momentum in recent years, as manufacturers introduce new models and costs decrease.

What are the finance implications of the shifting marketplace for alternative fuels? In the Q4 2020 State of the Automotive Finance Market report, we zoomed in on the alternative fuel financing to get a better picture. Here are some of the trends we found.

Electric and hybrid vehicle financing is growing

Both electric and hybrid vehicles are growing their share of the finance market. In Q4 2016, electric and hybrid vehicles made up 2.99% of vehicle financing. It has more than doubled since then, making up 6.72% in Q4 2020.

Average monthly payments run higher for alternative fuel

For consumers looking for a new electric vehicle, they’ll likely be looking at a larger average monthly payment. In Q4 2020, the average monthly payment for an electric vehicle was $689.

Hybrid vehicles saw average monthly payments that aligned closer to those of gasoline vehicles. The average monthly payment for a gasoline vehicle in Q4 2020 was $524, and the average monthly payment for a hybrid vehicle was just $5 more, at $529.

Electric vehicles have the highest average credit scores for financing

Similar to what we’ve seen with average credit scores for new car loans, the average scores for new alternative fuel vehicles have mostly seen steady increases in the last few years. As of Q4 2020, the highest is for electric vehicles, at 763, followed by hybrid (756), and gasoline/flex (731).

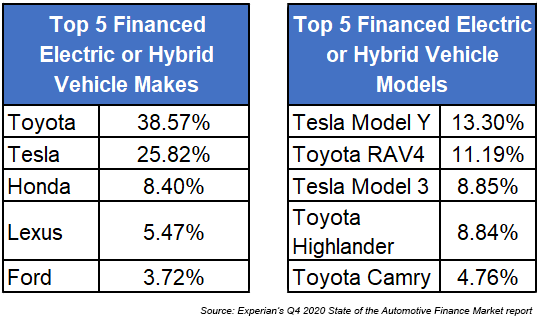

Toyota and Tesla are the most popular make and model

When looking at electric and hybrids, Toyota has the greatest market share at 38.5%, followed by Tesla at 25.82%. The most popular makes also go to these two brands: The Tesla Model Y was the most popular in Q4 2020 at 13.3%, followed by the Toyota RAV4 at 11.19%. Here’s how the top 5 round out for each category:

As manufacturers continue to introduce new electric and hybrid models, it is likely that the alternative fuel market will continue to grow in finance market share. By staying close to the data, lenders and dealers can make the most strategic decisions to navigate the ever-changing market in the years to come.

Learn more by watching Experian’s full Q4 2020 State of the Automotive Finance Market report