At A Glance

It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.Paragraph Block- is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.

New Text!

Heading 2

Heading 3

Heading 4

Heading 5

- This is a list

- Item 1

- Item 2

- Sub list

- Sub list 2

- Sub list 3

- More list

- More list 2

- More list 3

- More more

- More more

This is the pull quote block Lorem Ipsumis simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s,

ExperianThis is the citation

This is the pull quote block Lorem Ipsumis simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s,

ExperianThis is the citation

| Table element | Table element | Table element |

| my table | my table | my table |

| Table element | Table element | Table element |

Media Text Block

of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum

My Small H5 Title

As part of its guidance, the Office of the Comptroller of the Currency recommends that lenders perform regular validations of their credit score models in order to assess model performance.

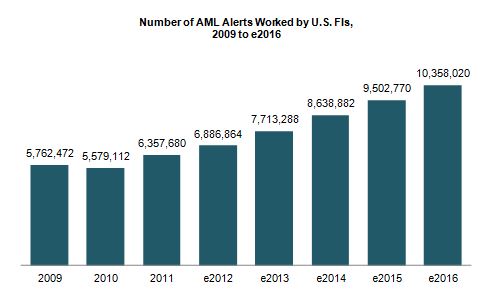

Julie Conroy – Research Director, Aite Group Finding patterns indicative of money laundering and other financial crimes is akin to searching for a needle in a haystack. With the increasing pressure on banks’ anti-money laundering (AML) and fraud teams, many with this responsibility increasingly feel like they’re searching for those needles while a combine is bearing down on them at full speed. These pressures include: Regulatory scrutiny: The high-profile—and expensive—U.S. enforcement actions that took place during the last couple of years underscore the extent to which regulators are scrutinizing FIs and penalizing those who don’t pass muster. Payment volumes and types increasing: As the U.S. economy is gradually easing its way into a recovery, payment volumes are increasing. Not only are volumes rebounding to pre-recession levels, but there have also been a number of new financial products and payment formats introduced over the last few years, which further increases the workload for the teams who have to screen these payments for money-laundering, sanctions, and global anti-corruption-related exceptions. Constrained budgets: All of this is taking place during a time in which top line revenue growth is constrained and financial institutions are under pressure to reduce expenses and optimize efficiency. Illicit activity on the rise: Criminal activity continues to increase at a rapid pace. The array of activity that financial institutions’ AML units are responsible for detecting has also experienced a significant increase in scope over the last decade, when the USA PATRIOT Act expanded the mandate from pure money laundering to also encompass terrorist financing. financial institutions have had to transition from activity primarily focused on account-level monitoring to item-level monitoring, increasing by orders of magnitude the volumes of alerts they must work (Figure 1) Figure 1: U.S. FIs Are Swimming in Alerts Source: Aite Group interviews with eight of the top 30 FIs by asset size, March to April 2013 There are technologies in market that can help. AML vendors continue to refine their analytic and matching capabilities in an effort to help financial insitutions reduce false positives while not adversely affecting detection rates. Hosted solutions are increasingly available, reducing total cost of ownership and making software upgrades easier. And many institutions are working on internal efficiency efforts, reducing vendors, streamlining processes, and eliminating the number of redundant efforts. How are institutions handling the increasing pressure cooker that is AML compliance? Aite Group wants to know your thoughts. We are conducting a survey of financial insitution executives to understand your pain points and proposed solutions. Please take 20 minutes to share your thoughts, and in return, we’ll share a complimentary copy of the resulting report. This data can be used to compare your efforts to those of your peers as well as to glean new ideas and best practices. All responses will be kept confidential and no institutions names will be mentioned anywhere in the report. You can access the survey here: SURVEY

A breach notification letter is important for firms to let consumers know that their information may have been compromised.

In this article…

typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.