As regulators continue to warn financial institutions of the looming risk posed by HELOCs reaching end of draw, many bankers are asking: Why should I be concerned? What are some proactive steps I can take now to reduce my risk?

This blog addresses these questions and provides clear strategies that will keep your bank on track.

Why should I be concerned?

Just a quick refresher: HELOCs provide borrowers with access to untapped equity in their residences. The home is taken as collateral and these loans typically have a draw period from five to 10 years. At the end of the draw period, the loan becomes amortized and monthly payments could increase by hundreds of dollars. This payment increase could be debilitating for borrowers already facing financial hardships. The cascading affect on consumer liquidity could also impact both credit card and car loan portfolios as borrowers begin choosing what debt they will pay first.

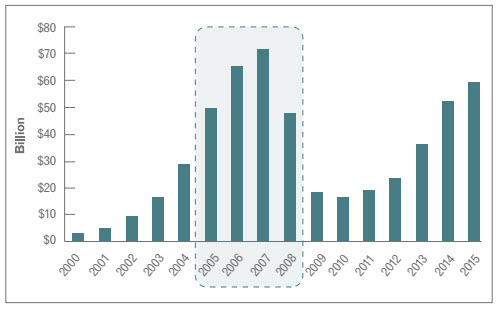

The breadth of the HELOC risk is outlined in an excerpt from a recent Experian white paper. The chart below illustrates the large volume of outstanding loans that were originated from 2005 to 2008. The majority of the loans that originated prior to 2005 are in the repayment phase (as can be seen with the lower amount of dollars outstanding). HELOCs that originated from 2005 to 2008 constitute $236 billion outstanding. This group of loans is nearing the repayment phase, and this analysis examines what will happen to these loans as they enter repayment, and what will happen to consumers’ other loans.

What can you do now?

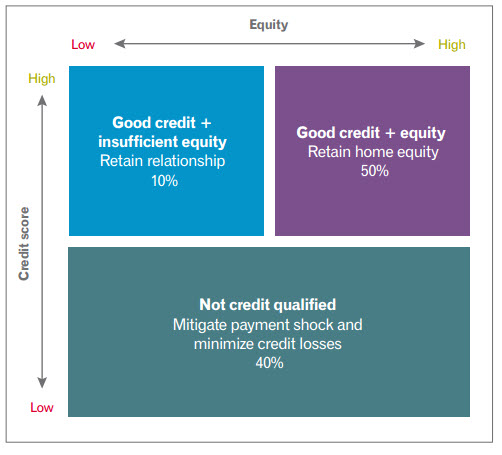

The first step is to perform a portfolio review to assess the extent of your exposure. This process is a triage of sorts that will allow you to first address borrowers with higher risk profiles. This process is outlined below in this excerpt from Experian’s HELOC white paper.

By segmenting the population, lenders can also identify consumers who may no longer be credit qualified. In turn, they can work to mitigate payment shock and identify opportunities to retain those with the best credit quality.

For consumers with good credit but insufficient equity (blue box), lenders can work with the borrowers to extend the terms or provide payment flexibility.

For consumers with good credit but sufficient equity (purple box), lenders can work with the borrowers to refinance into a new loan, providing more competitive pricing and a higher level of customer service.

For consumers with good credit but insufficient equity (teal box), a loan modification and credit education program might help these borrowers realize any upcoming payment shock while minimizing credit losses.

The next step is to determine how you move forward with different customers segments. Here are a couple of options:

Loan Modification: This can help borrowers potentially reduce their monthly payments. Workouts and modification arrangements should be consistent with the nature of the borrower’s specific hardship and have sustainable payment requirements.

Credit Education: Consumers who can improve their credit profiles have more options for refinancing and general loan approval. This equates to a win-win for both the borrower and lender.

HELOCs do not have to pose a significant risk to financial institutions. By being proactive, understanding your portfolio exposure and helping borrowers adjust to payment changes, banks can continue to improve the health of their loan portfolios.

Ancin Cooley is principal with Synergy Bank Consulting, a national credit risk management and strategic planning firm. Synergy provides a rangeof risk management services to financial institutions, which include loan reviews, IT audits, internal audits, and regulatory compliance reviews. As principal, Ancin manages a growing portfolio of clients throughout the United States.

Ancin Cooley is principal with Synergy Bank Consulting, a national credit risk management and strategic planning firm. Synergy provides a rangeof risk management services to financial institutions, which include loan reviews, IT audits, internal audits, and regulatory compliance reviews. As principal, Ancin manages a growing portfolio of clients throughout the United States.