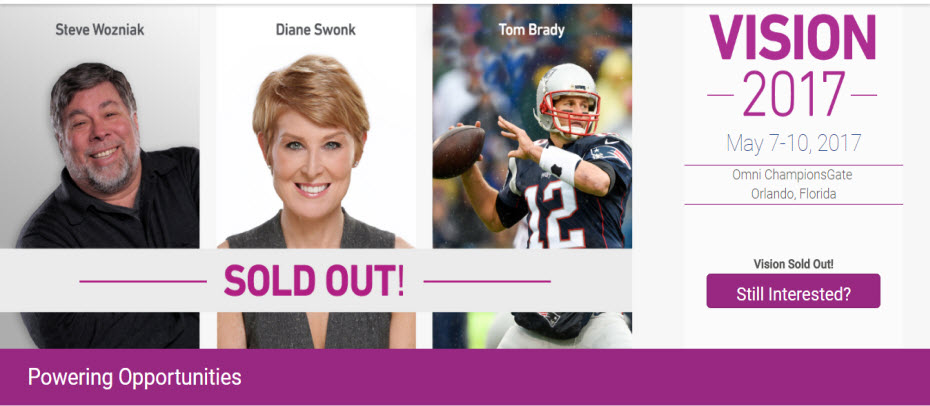

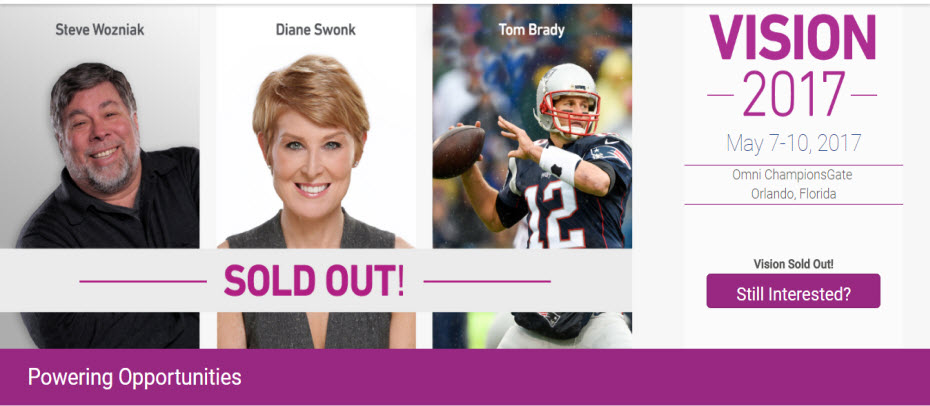

Experian’s annual Vision Conference, a four-day event designed to bring business leaders together to discuss the latest ideas and solutions surrounding targeting new markets, growing customer bases and profitability, reducing fraud and more, begins Sunday evening in Orlando, Florida. Over the course of the week, a total of 65 sessions will touch on newsworthy and breaking trends. Attendees will discover: The latest generational insights – including a first look at the coming-of-age Gen Z crowd – regarding credit scores, spend patterns and digital behaviors Multiple presentations on the economy, the mortgage market, student lending, small business forecasts and new developments in online marketplace lending Deep dives on fraud in relation to the epidemic of synthetic IDs, Know Your Customer (KYC) compliance strategies, maturing your organization to defeat fraud, and the dark web Regulatory round-ups touching on everything from the Military Lending Act (MLA), the Telephone Consumer Protection Act (TCPA), Current Expected Credit Loss (CECL) and what is emerging from the new administration Best-in-class sessions on data and analytics, modeling, virtual collections, trended data and credit marketing Intel on the state of commercial lending, the rise of the mircopreneur and the business credit profile across various life stages. Beyond a jam-packed schedule of breakout sessions, the conference will additionally host a series of general session speakers sure to educate and entertain. On Monday, Steve Wozniak, also known as “The Woz” takes the stage to talk about his experiences as co-founder of Apple Computer Inc. and his years in the emerging technology space. Diane Swonk, CEO of DS Economics, will address the crowd on Tuesday to provide details and analysis on the state of the global and U.S. economies. Finally, legendary quarterback and recent Super Bowl MVP and winner Tom Brady will speak on Wednesday to close out the event. Conference attendees can follow everything utilizing their Experian Vision app. Hot stats, pictures and event news will also be shared on multiple social handles using #ExperianVision.

In a May 4 speech before the ACA International Conference in Washington, FCC Commissioner Michael O’Rielly criticized the FCC’s past decisions on Telephone Consumer Protection Act (TCPA) and outlined his vision on the direction that the new Commission should head to provide more certainty to businesses. Commissioner O’Rielly noted that prior decisions by the FCC and courts have “expanded the boundaries of TCPA far beyond what I believe Congress intended.” He said that the new leadership at the Commission and a new Bureau head overseeing TCPA, provides the FCC with the opportunity to “undo the misguided and harmful TCPA decisions of the past that exposed legitimate companies to massive legal liability without actually protecting consumers.” O’Rielly laid out three principles that he thought would help to frame discussions and guide the development of replacement rules. First, he said that legitimate businesses need to be able to contact consumers to communicate information that they want, need or expect to receive. This includes relief for informational calls, as well as valid telemarketing calls or texts. Second, Commissioner O’Rielly said that FCC should change the definition of an autodialer so that valid callers can operate in an efficient manner. He went on to say that if FCC develops new rules to clarify revocation of consent, it should do so in a clear and convenient way for consumers, but also does not upend standard best practices of legitimate companies. Third, O’Rielly said that the FCC should focus on actual harms and bad actors, not legitimate companies. While Commissioner O’Rielly’ s comments signal his approach to TCPA reform, it is important to note that FCC action on the issue us unlikely to happen overnight. A rule must be considered by the Commission, which will have to allow for public notice and comment. Experian will continue to monitor regulatory and legislative developments on TCPA.

May is Military Appreciation Month, and also a fitting time to check in on the latest news attached to the Military Lending Act, with card compliance coming in October 2017.

- List 1

- List 2

- List 3

<iframe width=”560″ height=”315″ src=”https://www.youtube.com/embed/35exOG0jSJ0?si=amHCm-pJmzhZc9TT” title=”YouTube video player” frameborder=”0″ allow=”accelerometer; autoplay; clipboard-write; encrypted-media; gyroscope; picture-in-picture; web-share” referrerpolicy=”strict-origin-when-cross-origin” allowfullscreen></iframe>

Testing the Border Radius

Changing the heading Page

Experian’s annual Vision Conference, a four-day event designed to bring business leaders together to discuss the latest ideas and solutions surrounding targeting new markets, growing customer bases and profitability, reducing fraud and more, begins Sunday evening in Orlando, Florida. Over the course of the week, a total of 65 sessions will touch on newsworthy and breaking trends. Attendees will discover: The latest generational insights – including a first look at the coming-of-age Gen Z crowd – regarding credit scores, spend patterns and digital behaviors Multiple presentations on the economy, the mortgage market, student lending, small business forecasts and new developments in online marketplace lending Deep dives on fraud in relation to the epidemic of synthetic IDs, Know Your Customer (KYC) compliance strategies, maturing your organization to defeat fraud, and the dark web Regulatory round-ups touching on everything from the Military Lending Act (MLA), the Telephone Consumer Protection Act (TCPA), Current Expected Credit Loss (CECL) and what is emerging from the new administration Best-in-class sessions on data and analytics, modeling, virtual collections, trended data and credit marketing Intel on the state of commercial lending, the rise of the mircopreneur and the business credit profile across various life stages. Beyond a jam-packed schedule of breakout sessions, the conference will additionally host a series of general session speakers sure to educate and entertain. On Monday, Steve Wozniak, also known as “The Woz” takes the stage to talk about his experiences as co-founder of Apple Computer Inc. and his years in the emerging technology space. Diane Swonk, CEO of DS Economics, will address the crowd on Tuesday to provide details and analysis on the state of the global and U.S. economies. Finally, legendary quarterback and recent Super Bowl MVP and winner Tom Brady will speak on Wednesday to close out the event. Conference attendees can follow everything utilizing their Experian Vision app. Hot stats, pictures and event news will also be shared on multiple social handles using #ExperianVision.

In a May 4 speech before the ACA International Conference in Washington, FCC Commissioner Michael O’Rielly criticized the FCC’s past decisions on Telephone Consumer Protection Act (TCPA) and outlined his vision on the direction that the new Commission should head to provide more certainty to businesses. Commissioner O’Rielly noted that prior decisions by the FCC and courts have “expanded the boundaries of TCPA far beyond what I believe Congress intended.” He said that the new leadership at the Commission and a new Bureau head overseeing TCPA, provides the FCC with the opportunity to “undo the misguided and harmful TCPA decisions of the past that exposed legitimate companies to massive legal liability without actually protecting consumers.” O’Rielly laid out three principles that he thought would help to frame discussions and guide the development of replacement rules. First, he said that legitimate businesses need to be able to contact consumers to communicate information that they want, need or expect to receive. This includes relief for informational calls, as well as valid telemarketing calls or texts. Second, Commissioner O’Rielly said that FCC should change the definition of an autodialer so that valid callers can operate in an efficient manner. He went on to say that if FCC develops new rules to clarify revocation of consent, it should do so in a clear and convenient way for consumers, but also does not upend standard best practices of legitimate companies. Third, O’Rielly said that the FCC should focus on actual harms and bad actors, not legitimate companies. While Commissioner O’Rielly’ s comments signal his approach to TCPA reform, it is important to note that FCC action on the issue us unlikely to happen overnight. A rule must be considered by the Commission, which will have to allow for public notice and comment. Experian will continue to monitor regulatory and legislative developments on TCPA.

May is Military Appreciation Month, and also a fitting time to check in on the latest news attached to the Military Lending Act, with card compliance coming in October 2017.