Gift cards are the most requested gift item and have been for the last eight years. Merchants love gift cards because they take up very little space and the recipient often ends up spending more than the value of the gift card.

Tax return fraud: Using 3rd party data and analytics to stay one step ahead of fraudsters By Neli Coleman According to a May 2014 Governing Institute research study of 129 state and local government officials, 43 percent of respondents cited identity theft as the biggest challenge their agency is facing regarding tax return fraud. Nationwide, stealing identities and filing for tax refunds has become one of the fastest-growing nonviolent criminal activities in the country. These activities are not only burdening government agencies, but also robbing taxpayers by preventing returns from reaching the right people. Anyone who has access to a computer can fill out an income-tax form online and hit submit. Most tax returns are processed and refunds released within a few days or weeks. This quick turnaround doesn’t allow the government time to fully authenticate all the elements submitted on returns, and fraudsters know how to exploit this vulnerability. Once released, these monies are virtually untraceable. Unfortunately, simply relying on business rules based on past behaviors and conducting internal database checks is no longer sufficient to stem the tide of increasing tax fraud. The use of a risk-based identity-authentication process coupled with business-rules-based analysis and knowledge-based authentication tools is critical to identifying fraudulent tax returns. The ability to perform non-traditional checks that go beyond the authentication of the individual to consider the methods and devices used to perpetrate the tax-refund fraud further strengthens the tax-refund fraud-detection process. The inclusion of multiple non-traditional checks within a risk-based authentication process closes additional loopholes exploited by the tax fraudster, while simultaneously decreasing the number of false positives. Experian’s Tax Return Analysis PlatformSM provides both the verification of identity and the risk-based authentication analytics that score the potential fraud risk of a tax return along with providing specific flags that identify the return as fraudulent. Our data and analytics are a product of years of expertise in consumer behavior and fraud detection along with unique services that detect fraud in the devices being used to submit the returns and identity credentials that have been used to perpetrate fraud in financial transactions outside of tax. Together, the combination of rules-based and risk-based income-tax-refund fraud-detection protocols can curb one of the fastest-growing nonviolent criminal activities in the country. With identity theft reaching unprecedented levels, government agencies need new technologies and processes in place to stay one step ahead of fraudsters. In a world where most transactions are conducted in virtual anonymity, it is difficult, but not impossible, to keep pace with technological advances and the accompanying pitfalls. A combination of existing business rules based on authentication processes and risk-based authentication techniques provided through third-party data and analytics services create a multifaceted approach to income-tax-refund fraud detection, which enables revenue agencies to further increase the number of fraudulent returns detected. Every fraudulent return that is identified and unpaid, improves the government’s ability to continue to meet the demand for services by its constituents while at the same time strengthening the public’s trust in the tax system.

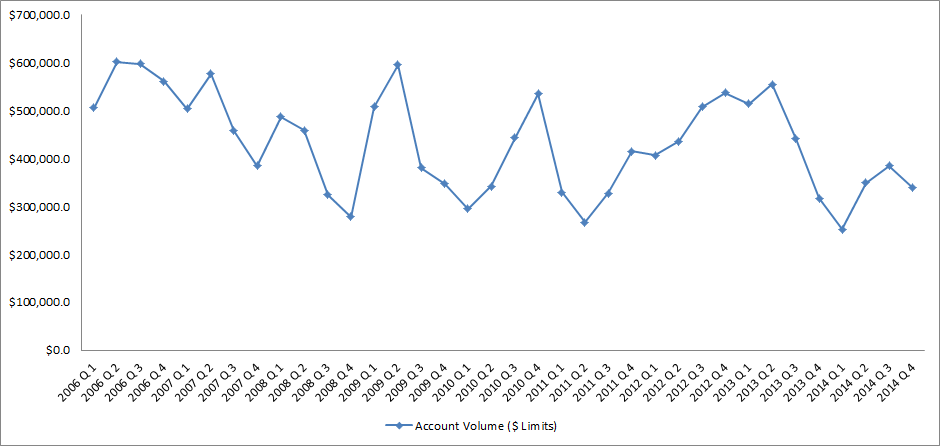

Source: IntelliViewsm powered by Experian Sales of existing homes dropped 50% from the peak in August 2005 to the low point in July 2010. The spike in home sales in late 2009 and early 2010 was due to the large number of foreclosure sales as well as very low prices. Since 2010, sales have increased to almost to the level they were in 2000, before the financial crisis. However, the homeownership rate has steadily gone down. How could sales have picked up while the homeownership rate declined? Investors have entered the market snapping up single family homes and renting them. Therefore, the recent good news in the existing home market has been driven by investors, not homeowners. But as I point out below, this is changing. Looking at the homeownership rate by age, shown in the table below, it is clear that since the crisis the rate has declined most for people under 45. The potential for marketing is greatest in this cohort as the numbers indicate a likely demand for housing. Homeownership Rate by Age Source: U.S. Census Bureau and Haver Analytics as reported on the Federal Reserve Bank of St. Louis Fred database The factors that have impeded growth, described above, are beginning to reverse which, along with pent-up demand, will present an opportunity for mortgage originators in 2015. Home prices have risen in 246 of the 277 cities tracked by Clear Capital.With prices going up, investors have begun to back away from the market, resulting in prices increasing at a slower rate in some cities but they are still increasing.Therefore the perception that homeownership is risky will likely change.In fact, in some areas, such as California’s coastal cities, sales are strong and prices are going up rapidly. Lenders and regulators are recognizing that the stringent guidelines put in place in reaction to the crisis have overly constrained the market.Fannie Mae and Freddie Mac are reducing down payment requirements to as low as 3%.FHA is lowering their guarantee fee, reducing the amount of cash buyers need to close transactions.Private securitizations, which dried up completely, are beginning to reappear, especially in the jumbo market. As unemployment continues to go down, consumer confidence will rise and household formation will return to more normal levels which result in more sales to first time homebuyers, who drive the market.According to Lawrence Yun, chief economist for the National Association of Realtors, “…it’s all about consistent job growth for a prolonged period, and we’re entering that stage.” The number of houses in foreclosure, according to RealtyTrac, has fallen to pre-crisis levels.This drag on the market has, for the most part, cleared and as prices continue to inflate, potential buyers will be motivated to buy before homes become unaffordable.Despite the recent increases, home prices are still, on average, 23% lower than they were at the peak. Focusing marketing dollars on those people with the highest propensity to buy has always been a challenge but in this market there are identifiable targets. “Boomerangs” are people who owned real estate in the past but are currently renting and likely to come back into the market.Marketing to qualified former homeowners would provide a solid return on investment. People renting single family houses are indicating a lifestyle preference that can be marketed to. Newly-formed households are also profitable targets. The housing market, at long last, appears to be finally turning the corner and normalizing. Experian’s expertise in identifying the right consumers can help lenders to pinpoint the right people on whom marketing dollars should be invested to realize the highest level of return. Click here to learn more.