Latest Posts

Using data from IntelliViewSM, Credit.com recently compiled a list of states with the highest average bankcard utilization rates. Alaska took first place, with an average utilization ratio of 27.73 percent. This should come as no surprise since Alaska has recently topped lists for highest credit card balances and highest revolving debt.

By: Maria Moynihan Government organizations that handle debt collection have similar business challenges regardless of agency focus and mission. Let’s face it, debtors can be elusive. They are often hard to find and even more difficult to collect from when information and processes are lacking. To accelerate debt recovery, governments must focus on optimization--particularly, streamlining how resources get used in the debt collection process. While the perception may be that it’s difficult to implement change given limited budgets, staffing constraints or archaic systems, minimal investment in improved data, tools and technology can make a big difference. Governments most often express the below as their top concerns in debt collection: Difficulty in finding debtors to collect on late tax submissions, fines or fees. Prioritizing collection activities--outbound letters, phone calls, and added steps in decisioning. Difficulty in incorporating new tools or technology to reduce backlogs or accelerate current processes. By simply utilizing right party contact data and tools for improved decisioning, agencies can immediately expose areas of greater possible ROI over others. Credit and demographic data elements like address, income models, assets, and past payment behavior can all be brought together to create a holistic view of an individual or business at a point in time or over time. Collections tools for improved monitoring, segmentation and scoring could be incorporated into current systems to improve resource allotment. Staffing can then be better allocated to not only focus on which accounts to pursue by size, but by likelihood to make contact and payment. Find additional best practices to optimize debt recovery in this guide to Maximizing Revenue Potential in the Public Sector. Be sure to check out our other blog posts on debt collection.

I don’t know about your neighborhood this past Fourth of July, but mine contained an interesting mix of different types of fireworks. From our front porch, we watched a variety of displays simultaneously: an organized professional fireworks show several miles away, our next-door neighbor setting off the “Safe and Sane” variety and the guy at the end of the street with clearly illegal ones. This made me think about how our local police approach this night. There’s no way they can investigate every report or observance of illegal fireworks as well as all of the other increased activity that occurs on a holiday. So it must come down to prioritization, resources and risk assessment. When it comes to fraud prevention, compliance and risk, businesses — much the same as the police — have a lot of ground to cover and limited resources. Consider the bureau alerts (aka high-risk conditions) on a credit report. They’re an easy, quick tool that can help mitigate risk and save money cost-effectively. When considering bureau alerts, clients commonly ask the following questions: How do I investigate all of the alerts with the limited resources I have? How should I prioritize the ones I am able to review? I usually recommend that, if possible, they incorporate a fraud risk score into their evaluation process. The job of the fraud risk score is to take a very large amount of data and put it into an easy-to-understand and actionable form. It is built to evaluate negative or risky information (at Experian, this includes bureau alerts and many other items) as well as positive or low-risk information (analysis of address, Social Security number, date of birth, and other current and historical personal information). The result is a holistic assessment rather than a binary flag, which can be tuned to resource levels, risk tolerance or other drivers. That’s always where I start. If a fraud score is not an option, then I suggest prioritizing the alerts by the most risk and the frequency of occurrence. With some light analysis, you’ll typically see that the frequency of the most risky alerts is often low, so you can be sure to review each one — or as many as possible. As the frequency of occurrence increases, you then can make decisions about which ones to review or how many of them you can handle. For example, I worked with a client recently to prioritize high-risk but low-frequency alerts. Almost all involved the Social Security number (SSN): The inquiry SSN was recorded as deceased The report contained a security statement There was a high probability that the SSN belongs to another person The best on-file SSN was recorded as deceased I would expect other organizations to have a similar prioritized risk-to-frequency ratio. However, it’s always good (and pretty easy) to make sure your data backs this up. That way, you’re making the most of your limited resources and your tools.

A recent survey of government benefit agencies shows an increased need for fraud detection technology to prevent eligibility fraud. Only 26 percent of respondents currently use fraud detection technology, and 57 percent cite false income reporting as the leading cause of fraud. Insufficient resources and difficulty integrating multiple data sources were the greatest challenges in preventing eligibility fraud.

The desire to return to portfolio growth is a clear trend in mature credit markets, such as the US and Canada. Historically, credit unions and banks have driven portfolio growth with aggressive out-bound marketing offers designed to attract new customers and members through loan acquisitions. These offers were typically aligned to a particular product with no strategy alignment between multiple divisions within the organization. Further, when existing customers submitted a new request for credit, they were treated the same as incoming new customers with no reference to the overall value of the existing relationship. Today, however, financial institutions are looking to create more value from existing customer relationships to drive sustained portfolio growth by increasing customer retention, loyalty and wallet share. Let’s consider this idea further. By identifying the needs of existing customers and matching them to individual credit risk and affordability, effective cross-sell strategies that link the needs of the individual to risk and affordability can ensure that portfolio growth can be achieved while simultaneously increasing customer satisfaction and promoting loyalty. The need to optimize customer touch-points and provide the best possible customer experience is paramount to future performance, as measured by market share and long-term customer profitability. By also responding rapidly to changing customer credit needs, you can further build trust, increase wallet share and profitably grow your loan portfolios. In the simplest sense, the more of your products a customer uses, the less likely the customer is to leave you for the competition. With these objectives in mind, financial organizations are turning towards the practice of setting holistic, customer-level credit lending parameters. These parameters often referred to as umbrella, or customer lending, limits. The challenges Although the benefits for enhancing existing relationships are clear, there are a number of challenges that bear to mind some important questions to consider: · How do you balance the competing objectives of portfolio loan growth while managing future losses? · How do you know how much your customer can afford? · How do you ensure that customers have access to the products they need when they need them · What is the appropriate communication method to position the offer? Few credit unions or banks have lending strategies that differentiate between new and existing customers. In the most cases, new credit requests are processed identically for both customer groups. The problem with this approach is that it fails to capture and use the power of existing customer data, which will inevitably lead to suboptimal decisions. Similarly, financial institutions frequently provide inconsistent lending messages to their clients. The following scenarios can potentially arise when institutions fail to look across all relationships to support their core lending and collections processes: 1. Customer is refused for additional credit on the facility of their choice, whilst simultaneously offered an increase in their credit line on another. 2. Customer is extended credit on a new facility whilst being seriously delinquent on another. 3. Customer receives marketing solicitation for three different products from the same institution, in the same week, through three different channels. Essentials for customer lending limits and successful cross-selling By evaluating existing customers on a periodic (monthly) basis, financial institutions can assess holistically the customer’s existing exposure, risk and affordability. By setting customer level lending limits in accordance with these parameters, core lending processes can be rendered more efficient, with superior results and enhanced customer satisfaction. This approach can be extended to consider a fast-track application process for existing relationships with high value, low risk customers. Traditionally, business processes have not identified loan applications from such individuals to provide preferential treatment. The core fundamentals of the approach necessary for the setting of holistic customer lending (umbrella) limits include: · The accurate evaluation of credit and default risk · The calculation of additional lending capacity and affordability · Appropriate product offerings for cross-sell · Operational deployment Follow my blog series over the next few months as we explore the essentials for customer lending limits and successful cross-selling.

There are two core fundamentals of evaluating loan loss performance to consider when generating organic portfolio growth through the setting of customer lending limits. Neither of which can be discussed without first considering what defines a “customer.” Definition of a customer The approach used to define a customer is critical for successful customer management and is directly correlated to how joint accounts are managed. Definitions may vary by how joint accounts are allocated and used in risk evaluation. It is important to acknowledge: Legal restrictions for data usage related to joint account holders throughout the relationship Impact on predictive model performance and reporting where there are two financially linked individuals with differently assigned exposures Complexities of multiple relationships with customers within the same household – consumer and small business Typical customer definitions used by financial services organizations: Checking account holders: This definition groups together accounts that are “fed” by the same checking account. If an individual holds two checking accounts, then she will be treated as two different and unique customers. Physical persons: Joint accounts allocated to each individual. If Mr. Jones has sole accounts and holds joint accounts with Ms. Smith who also has sole accounts, the joint accounts would be allocated to both Mr. Jones and Ms. Smith. Consistent entities: If Mr Jones has sole accounts and holds joint accounts with Ms. Smith who also has sole accounts, then 3 “customers” are defined: Jones, Jones & Smith, Smith. Financially-linked individuals: Whereas consistent entities are considered three separate customers, financially-linked individuals would be considered one customer: “Mr. Jones & Ms. Smith”. When multiple and complex relationships exist, taking a pragmatic approach to define your customers as financially-linked will lead to a better evaluation of predicted loan performance. Evaluation of credit and default risk Most financial institutions calculate a loan default probability on a periodic basis (monthly) for existing loans, in the format of either a custom behavior score or a generic risk score, supplied by a credit bureau. For new loan requests, financial institutions often calculate an application risk score, sometimes used in conjunction with a credit bureau score, often in a matrix-based decision. This approach is challenging for new credit requests where the presence and nature of the existing relationship is not factored into the decision. In most cases, customers with existing relationships are treated in an identical manner to those new applicants with no relationship – the power and value of the organization’s internal data goes overlooked whereby customer satisfaction and profits suffer as a result. One way to overcome this challenge is to use a Strength of Relationship (SOR) indicator. Strength of Relationship (SOR) indicator The Strength of Relationship (SOR) indicator is a single-digit value used to define the nature of the relationship of the customer with financial institution. Traditional approaches for the assignment of a SOR are based upon the following factors Existence of a primary banking relationship (salary deposits) Number of transactional products held (DDA, credit cards) Volume of transactions Number of loan products held Length of time with bank The SOR has a critical role in the calculation of customer level risk grades and strategies and is used to point us to the data that will be the most predictive for each customer. Typically the stronger the relationship, the more we know about our customer, and the more robust will be predictive models of consumer behavior. The more information we have on our customer, the more our models will lean towards internal data as the primary source. For weaker relationships, internal data may not be robust enough alone to be used to calculate customer level limits and there will be a greater dependency to augment internal data with external third party data (credit bureau attributes.) As such, the SOR can be used as a tool to select the type and frequency of external data purchase. Customer Risk Grade (CRG) A customer-level risk grade or behavior score is a periodic (monthly) statistical assessment of the default risk of an existing customer. This probability uses the assumption that past performance is the best possible indicator of future performance. The predictive model is calibrated to provide the probability (or odds) that an individual will incur a “default” on one or more of their accounts. The customer risk grade requires a common definition of a customer across the enterprise. This is required to establish a methodology for treating joint accounts. A unique customer reference number is assigned to those customers defined as “financially-linked individuals”. Account behavior is aggregated on a monthly basis and this information is subsequently combined with information from savings accounts and third party sources to formulate our customer view. Using historical customer information, the behavior score can accurately differentiate between good and bad credit risk individuals. The behavior score is often translated into a Customer Risk Grade (CRG). The purpose of the CRG is to simplify the behavior score for operational purposes making it easier for noncredit/ risk individuals to interpret a grade more easily than a mathematical probability. Different methods for evaluating credit risk will yield different results and an important aspect in the setting of customer exposure thresholds is the ability to perform analytical tests of different strategies in a controlled environment. In my next post, I’ll dive deeper into adaptive control, champion challenger techniques and strategy design fundamentals. Related content: White paper: Improving decisions across the Customer Life Cycle

Small-business credit conditions improved in Q1 2013, reversing much of the deterioration seen during Q4 2012. The Q1 rise was fueled primarily by falling delinquency rates in every segment compared with a year earlier. The total share of delinquent dollars was 11.2 percent for Q1 2013 - 1.4 percentage points lower than a year ago.

A recent Experian credit trends analysis of new mortgages and bankcards from Q1 2013 shows a 16 percent year-over-year increase in mortgage origination volume and a 20 percent increase in bankcard limits. Providing further evidence of continued economic recovery throughout the nation, mortgage delinquency rates reached multi-year lows and bankcard delinquency rates reached near-record lows.

Despite the improving real-estate market, financial institutions are concerned about lending to consumers who have pursued strategic defaults. In a recent VantageScore Solutions survey, 85 percent of respondents believe that consumers who have pursued strategic defaults pose increased risk, even if they meet the institution’s other lending criteria. More than half of those surveyed said they are not likely to approve strategic defaulters for a mortgage loan in the next 12 months. Source: The Score: Short sales and foreclosures make lenders wary VantageScore® is a registered trademark of VantageScore Solutions, LLC.

By: Joel Pruis So we know we need to determine the overall net yield on assets required to cover the cost of funds and the operating expenses but how? In the movie Moneyball, the Oakland A’s develop a strategy to win 99 games by scoring 814 runs and only allowing 645 runs by the opposition. In order to generate the necessary runs, Peter Brand boils down all the stats into one number, on base percentage. By looking at the on-base percentage of all the players in the league, Brand is able to determine the likelihood of generating runs. There are a few key phrases/quotes from this scene that need to be highlighted: “it’s about getting things down to one number” “People are overlooked for a variety of biased reasons and ‘perceived’ flaws.” “Bill James and mathematics cut straight through that [biased reasons and perceived flaws].” Getting things down to one number is the liberating element for the Oakland A’s and for banking. We have already identified the one number for banking – Net Yield on Assets. Let’s define this a bit further though. For this exercise, net yield means the gross yield (interest income plus fee income) on assets less charge offs. We are looking to see what is going to be the consistent return on the assets less what can be expected net charge off related to the assets. When Billy Beane and Peter Brand got it down to the one number “On Base Percentage” it altered the player selection process and highlighted the biases of the scouts such as: Giambi’s brother was “getting a little thick around the waist” “Old Man” Justice Justice will be “lucky if he hits his weight” in July and August Justice’s “legs are gone Hatteberg “can’t throw” Hatteberg’s “best part of his career is over” Hatteberg “walks a lot” None of the above comments used any facts or data to disprove each player’s on base percentage. Can you imagine if they were underwriters or lenders? What type of compliance issues would we have on our hands with the above comments? Biased against disabilities (Hatteberg with nerve damage); Age Discrimination (“Old Man” Justice), Physical Appearance (Giambi’s brother “getting a little thick around the waist”), these scouts would be a compliance liability let alone obstacles in any type of organizational change. But one can readily see how focusing on one number liberates the thinking and removes the old constraints or ways of thinking. One of the scouts commented that Hatteberg had a high on base percentage because he walks a lot, considering a walk as a negative while a hit is a positive but why? Why is getting on base by being walked a negative but getting on base with a hit is positive? The result is the same as the movie points out. How about in commercial lending? If we focus on net yield on the portfolio as the one number, does that do anything to remove biases? I believe that it does. One example is the perception of charge offs in a portfolio. To this day the notion of a charge off in a commercial portfolio, even in the small business portfolio, is frowned upon and can jeopardize one’s career. Similar to the walk, the charge off is not desired but if we focus on the one number, net yield, it actually removes the stigma of the charge off! If we need at minimum a 6% net asset yield and we are able to generate a gross yield of 9% with an expected loss rate of 2%, we actually exceed our “one number” of a targeted net yield of 6% with an expected net yield of 7%. With that change that removes the biases and flawed perception, can we now start to find opportunities that provide us with the ability to step away from the norm; stop competing with the rest; and generate that higher return that is required? What are the potential biases and flawed perceptions that will need to be addressed? “High Risk” Industries? “Undesired” Loan types? Consumer vs. Commercial? Real Estate Secured vs. Unsecured? Loans vs. Treasuries or other earning asset types? But just as in the movie, you need to be prepared for the response you may get from the traditional ‘seasoned’ lenders in your organization. When Billy Beane puts the new strategy into place at the Oakland A’s, the lead scout responds with: “You don’t put a team together with a computer” “Baseball isn’t just numbers, it isn’t science. If it was anybody could do what we do but they can’t.” “They don’t know what we know. They don’t have our experience and they don’t have our intuition.” Ah, just like the traditional baseball scout is the traditional commercial lender with the years of experience, judgment and intuition. I used to be one and used almost word for word the same argument against credit scoring and small business before I truly understood what it was all about. Don’t get me wrong. Experience, judgment and intuition is valuable and necessary. But that type of judgment tends to get into trouble when it stops looking outside for data and only relies on past personal experience to assess the next moves. Experience is always important but it has to continually review, assess and interpret the data. So let’s start looking at the different types of data. On deck – How do we know how many runs the opposition is going to score? The use of external data.

By: Joel Pruis I am going to take some liberties here. Nowhere in the movie Moneyball does Peter Brand tell us how he got to the magic number of winning 99 games to get to the playoffs. My assumption is that given the way that he evaluates the Oakland A’s, he also evaluations the other teams in their conference. Assessing the competitive landscape provides Brand with the estimated runs their opponents will generate. Now we could take the approach that such analysis would correlate to assessing how your competition is going to perform but I am going to take a different approach. I would compare the conference assessment in Moneyball to be similar to an economic forecast/assessment. We need to assess what are the overall conditions in which we must operate that will allow us to generate the net yield on the assets of our financial institution. Some of the things we need to assess to determine what we will be able to generate related to the net yield on assets would be: Gross yield on assets Current interest rate environment (yield on treasuries, federal home loan bank, etc. Interest rate trends (increasing, declining, trends toward fixed rates, variable rates) Industry information General trend of businesses across the nation How are businesses faring? How well are they paying their creditors? Are they relying more or less on credit? Are new businesses being started? Are they succeeding? Are they failing? General trends (same as above) within your financial institution’s market footprint One such source of the industry information is the Small Business Credit Index generated by Experian & Moody’s Analytics. In the recent release of the Small Business Credit Index, small business is indicating stronger from the prior quarter moving from 104.3 to 109. But this is from a national perspective. Depending on your financial institution, it is important to always get an overall view of the economy but more importantly, what is happening in your particular market footprint. Just as the Oakland A’s in Moneyball maintained an overall perspective of Major League Baseball, their focus for success was targeting their specific conference to reach the playoffs. So as we look at information such as the Small Business Credit Index, we are able to see highlights of regional trends (certain states west of the Mississippi are doing better while certain states along the east coast are not) and specific industry trends. From such data we need to drill down into our specific footprint and current portfolio. We need to review such items as: What industry concentrations do we have that are doing well in the economy and how is our portfolio doing compared to the external data? What industries are we not engaging that may provide a good opportunity for our financial institution? What changes are taking place in the general economy that may impact our ability to achieve our expected results? What external factors must we be monitoring that may impact our strategy (such as the impact of Obamacare and how it will impact the hiring for businesses with more than 50 employees?) Just as in Moneyball, Brand continues to monitor the performance of the overall league (and the individual players for future trades), we need to continually monitor the national, state and local economies to determine what adjustments we will need to make to achieve our strategies. So we have assessed the general environment, on to strategies or “How do we win 99 games with a total payroll of $38 million?”

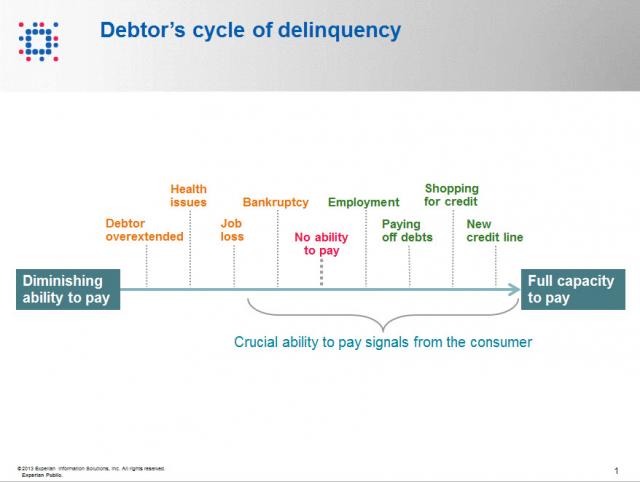

Contact information such as phone numbers and addresses are fundamental to being able to reach a debtor, but knowing when to reach out to the debtor is also a crucial factor impacting success or failure in getting payment. As referenced in the chart below, when a consumer enters the debtor life cycle, they often avoid talking with you about the debt because they do not have the ability to pay. When the debtor begins to recover financially, you want to be sure you are among the first to reach out to them so you can be the first to be paid. According to Don Taylor, President of Automated Collection Services, they have seen a lift of more than 12% of consumers with trigger hits entering repayment, and this on an aged portfolio that has already been actively worked by debt collection staff. Monitoring for a few key changes on the credit profiles of debtors provides the passive monitoring that is needed to tell you the optimal time to reach back to the consumer for payment. Experian compiled several recent collection studies and found that a debtor paying off an account that was previously past due provided a 710% increase in the average payment. Positive improvement on a consumers’ credit profile is one of those vital indicators that the consumer is beginning to recover financially and could have the will—and ability—to pay bad debts. The collection industry is not like the big warehouse stores—quantity and value do not always work hand in hand for the debt collection industry. Targeting the high value credit events that are proven to increase collection amounts is the key to value, and Experian has the expertise, analytics and data to help you collect in the most effective manner. Be sure to check out our other debt collection blog posts to learn how to recover debt more quickly and efficiently.

By: Joel Pruis What is it we as bankers are trying to accomplish? If you have been in the industry for 20+ years, this question may sound ridiculous! We do what we do! We are bankers! What do you mean define what are we trying to do? But that is the question, what is it we are trying to do? I am going to propose we boil it down to the basic/fundamental element – Banks aggregate money from various sources and redeploy these funds to earn a return for the shareholders. Ultimately, our objective is to generate an appropriate return for the shareholders Getting back to the movie Moneyball, Billy Beane and Peter Brand define the objective of the Oakland A’s for the season in terms of projecting the number of wins that are needed to assure, with all probability, that the team makes the playoffs (this would be similar to the objective of banking to generate an appropriate return for the shareholders). But Peter Brand quickly moves into very specific targets that are required for the A’s to make it to the playoffs, namely win 99 regular season games. In order to win 99 regular season games, the A’s offense will need to score 814 runs in the season and defensively only allow 645 runs. Plain and simple. Very objective, very measurable and it is all based upon data, data, data. Let’s break this down. Based upon their conference, the teams in their conference along with the overall schedule, Peter Brand projects that 99 wins are necessary to land a spot in the playoffs. No gut check, no darts or crystal ball but rather historical data that when analyzed provides the benchmark of 99 wins to statistically assure the Oakland A’s that they will make the playoffs. So let’s apply this to banking. Our objective is to generate the appropriate return for our shareholders or the old Return on Equity. So, for example, if our targeted return on equity is 20% (making the playoffs) we need to make sure we generate enough net income (99 wins) through producing the necessary gross yield on assets (814 runs generated by the Oakland A’s offense) less the expected charge offs (645 runs allowed by the Oakland A’s defense). For a quick dive into details, our data would provide for a margin of error on the variable to provide for statistical assurance of achieving the objective (Return on Equity). In the movie there is no guaranty that the 814 runs will win the conference but at the same time there is no guaranty that the Oakland A’s opponents will score 645 runs. Never in the movie does the coach, Billy Beane or Peter Brand tell the team, “You only have to score X number of runs this game, don’t score anymore.” Or even crazier, “You are not letting the other team score enough runs, they need to score 645!” No, the strategy is still to generate as many runs as possible while minimizing the number of runs scored by the opposition. Rather it is the review of the total amount of earning assets of the financial institution and the overall credit quality that we must understand and control to determine our ability to generate the net yield on assets required to generate the return on equity that is required. If we assume too much risk in the portfolio in order to generate the required yield it would be similar to having a poor pitching staff projected to allow 10 runs a game requiring the team to produce 11 runs a game in order to win. It just is not realistic. So basically we need to assess at the high level, are we appropriately structured to allow for the generation of enough profit to provide the appropriate return on equity. At this point, we do not need to complicate it any further than that. Now let’s take a look at the constraints. We know we have them in banking, let’s take a look at probably the single biggest constraint imposed on Billy Beane and the Oakland A’s. In the movie, before Billy Beane is even aware of the Moneyball concept, his is given his constraint by the owner. Beane asks for more money to ‘buy players’ and is flat out rejected by the owner. The owner, in fact, cuts Beane off by asking, “is there anything else I can do for you?”. Net result is that the Oakland A’s have $38 million dollars for payroll vs. the New York Yankees at $120 million. Seriously it does not seem fair. How can you attract the needed talent when you cannot pay the type of salary needed to get the necessary players to win a championship? Let’s rephrases this for banking… How can a bank be expected to deploy its assets when such a high rate of return is required? Boiling it down to a specific example, “How can I originate a commercial loan at this rate of interest when the competition is ½ to 1% lower than our rates?” Up next – Why will 99 games get us to the playoffs? How do we assess the environment?

A recent study comparing financial differences between men and women found that, overall, women are better at managing money and debt. Differences between the two populations include:

By: Joel Pruis Times are definitely different in the banking world today. Regulations, competition from other areas, specialized lenders, different lending methods resulting in the competitive landscape we have today. One area that is significantly different today, and for the better, is the availability of data. Data from our core accounting systems, data from our loan origination systems, data from the credit bureaus for consumer and for business. You name it, there is likely a data source that at least touches on the area if not provides full coverage. But what are we doing with all this data? How are we using it to improve our business model in the banking environment? Does it even factor into the equation when we are making tactical or strategic decisions affecting our business? Unfortunately, I see too often where business decisions are being made based upon anecdotal evidence and not considering the actual data. Let’s take, for example, Major League Baseball. How much statistics have been gathered on baseball? I remember as a boy keeping the stats while attending a Detroit Tigers game, writing down the line up, what happened when each player was up to bat, strikes, balls, hits, outs, etc. A lot of stats but were they the right stats? How did these stats correlate to whether the team won or lost, does the performance in one game translate into predictable performance of an entire season for a player or a team? Obviously one game does not determine an entire season but how often do we reference a single event as the basis for a strategic decision? How often do we make decisions based upon traditional methods without questioning why? Do we even reference traditional stats when making strategic decisions? Or do we make decisions based upon other factors as the scouts of the Oakland A’s were doing in the movie Moneyball? In one scene of the Movie, Billy Beane, general manager of the A’s, is asking his team of scouts to define the problem they are trying to solve. The responses are all very subjective in nature and only correlate to how to replace “talented” players that were lost due to contract negotiations, etc. Nowhere in this scene do any of the scouts provide any true stats for who they want to pursue to replace the players they just lost. Everything that the scouts are talking about relates to singular assessments of traits that have not been demonstrated to correlate to a team making the playoffs let alone win a single game. The scouts with all of their experience focus on the player’s swing, ability to throw, running speed, etc. At one point the scouts even talk about the appearance of the player’s girlfriends! But what if we changed how we looked at the sport of baseball? What if we modified the stats used to compile a team; determine how much to pay for an individual player? The movie Moneyball highlights this assessment of the conventional stats and their impact or correlation to a team actually winning games and more importantly the overall regular season. Bill James is given the credit in the movie for developing the methodology ultimately used by the Oakland A’s in the movie. This methodology is also referred to as Sabermetrics. In another scene, Peter Brand, explains how baseball is stuck in the old style of thinking. The traditional perspective is to buy ‘players’. In viewing baseball as buying players, the traditional baseball industry has created a model/profile of what is a successful or valuable player. Buy the right talent and then hopefully the team will win. Instead, Brand changes the buy from players to buying wins. Buying wins which require buying runs, in other words, buy enough average runs per game and you should outscore your opponent and win enough games to win your conference. But why does that mean we would have to change the way that we look at the individual players? Doesn’t a high batting average have some correlation to the number of runs scored? Don’t RBI’s (runs batted in) have some level of correlation to runs? I’m sure there is some correlation but as you start to look at the entire team or development of the line up for any give game, do these stats/metrics have the best correlation to lead to greater predictability of a win or more specifically the predictability of a winning season? Similarly, regardless of how we as bankers have made strategic decisions in the past, it is clear that we have to first figure out what it is exactly we are trying to solve, what we are trying to accomplish. We have the buzz words, the traditional responses, the non-specific high level descriptions that ultimately leave us with no specific direction. Ultimately it allows us to just continue the business as usual approach and hope for the best. In the next few upcoming blogs, we will continue to use the movie Moneyball as the back drop for how we need to stir things up, identify exactly what it is we are trying to solve and figure out how to best approach the solution.