In what has been an unprecedented year, marked by a global pandemic and a number of economic and personal challenges for both businesses and consumers, Americans are maintaining healthy credit profiles during the COVID-19 pandemic.

In what has been an unprecedented year, marked by a global pandemic and a number of economic and personal challenges for both businesses and consumers, Americans are maintaining healthy credit profiles during the COVID-19 pandemic.

Experian released the 11th annual State of Credit report, which provides a comprehensive look at the credit performance of consumers across America by highlighting consumer credit scores and borrowing behaviors. This year’s report provided an extended view into how consumers are managing and repaying their debts; showing most Americans are practicing responsible credit management by reducing utilization rates, credit card balances and late payments.

Even in light of the pandemic, data on American consumers across all generations shows responsible credit management including reduced utilization rates, credit card balances and late payments.

“While it’s difficult to predict when the economy will return to pre-pandemic levels, we are seeing promising signs of responsible credit management, especially among younger consumers,” said Alex Lintner, group president Experian Consumer Information Services.

Highlights of Experian’s State of Credit report:

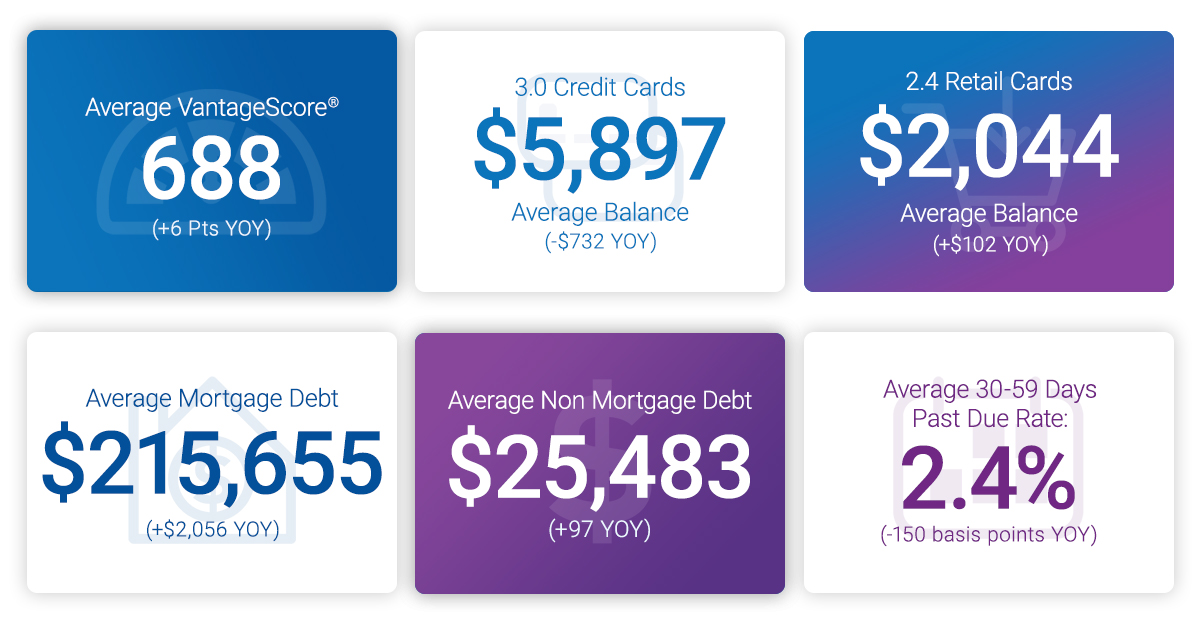

2020 State of Credit Report 2019 2020 Average VantageScore® credit score [1,2] 682 688 Average number of credit cards 3.07 3.0 Average credit card balance $6,629 $5,897 Average revolving utilization rate 30% 26% Average number of retail credit cards 2.51 2.42 Average retail credit card balance $1,942 $2,044 Average nonmortgage debt [3] $25,386 $25,483 Average mortgage debt $213,599 $215,655 Average 30 – 59 days past due delinquency rates 3.9% 2.4% Average 60 – 89 days past due delinquency rates 1.9% 1.3% Average 90 – 180 days past due delinquency rates 6.8% 3.8%

Though not the same, some consumers are experiencing a second economic downturn. The economic fallout stemming from COVID-19 coming after the Great Recession of 2009, which took place in the not too distant past. Silent, Boomer, Gen X and Gen Z Americans are managing responsible credit utilization rates and holding credit cards below the recommended maximum.

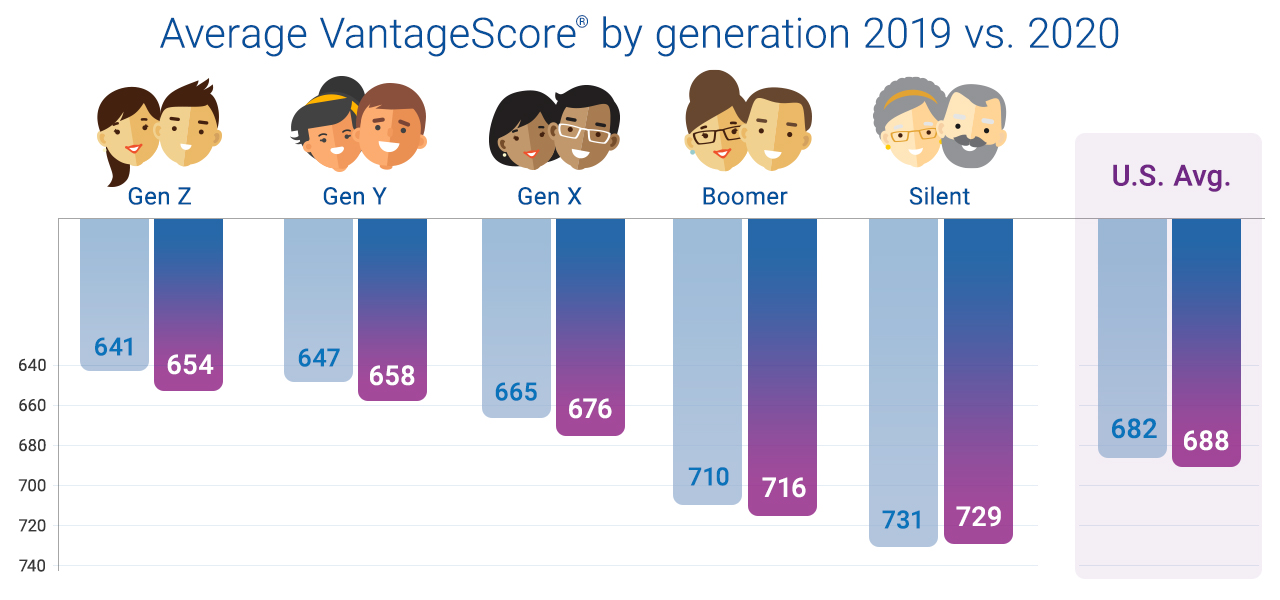

Are the older generations more credit responsible? Average VantageScore® credit score follows rank order from oldest to youngest – though contributed to by length of time possessing credit, number of lines of credit, and other factors that drive credit score – with the Silent Generation having the highest score (729), then Boomers (716), followed by Gen X (676), Gen Y (658) and Gen Z (654).

Gen X consumers have the highest average credit card balance at $7,718 and utilization at 32%, while Gen Z has the lowest average credit card balance at $2,197 and the Silent Generation has the lowest utilization at 13%.

Year over year data shows positive results driven by younger borrowers. While average utilization rates dropped for every generation, the most significant decreases were seen in Gen Z borrowers who saw a 6 percent reduction in their use of available credit, followed by Millennials who saw a 5% decrease year-over-year. While Gen Z and Gen Y are carrying more credit cards than they were in 2020, their credit card balances decreased year-over-year. These factors fueled a 13-point increase in average credit scores for Gen Z and an 11-point increase for Millennials.

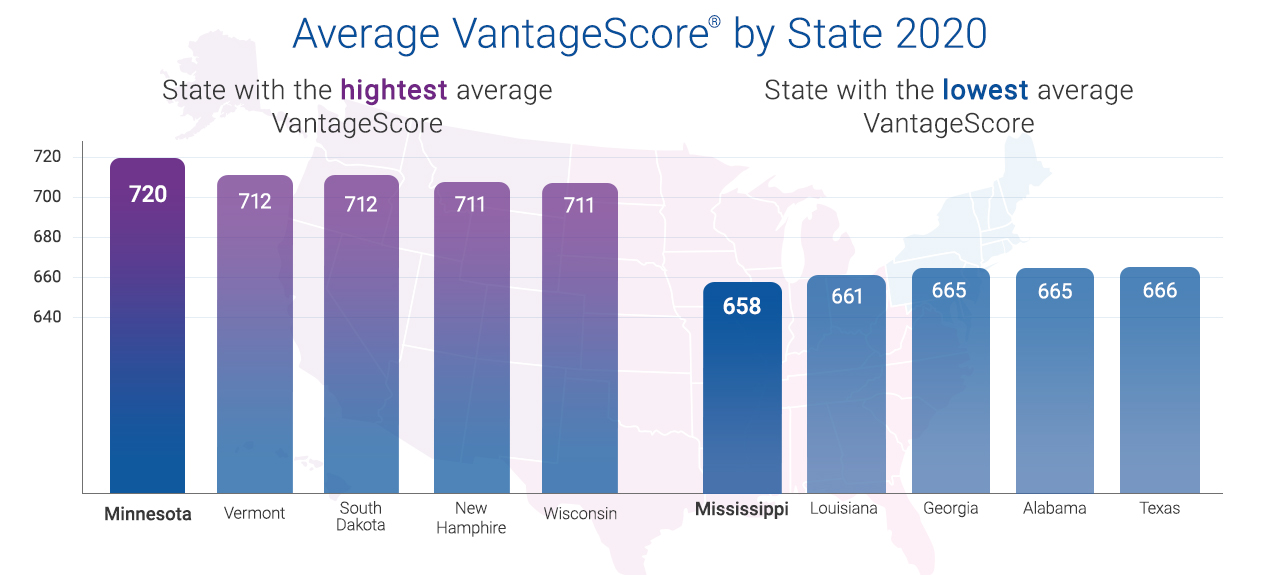

When spliced by state, the data Minnesota had the highest credit score, while Mississippi had the lowest credit score.

While the future is still uncertain, perhaps consumers can find comfort in knowing there is much they can do to improve their financial health – including their credit scores – and that there are numerous resources for them to access during these unprecedented times.

“As the consumer’s bureau, we are committed to informing, guiding, and protecting consumers. Educating Americans about the factors included in their credit profile and how to manage these responsibly is of critical importance, especially on the road to economic recovery from the COVID-19 pandemic,” said Lintner.

In an effort to encourage consumers to regularly monitor and understand the information in their credit reports, Experian joined forces with the other U.S. credit reporting agencies, to offer free weekly credit reports to all Americans through April 2021 via AnnualCreditReport.com.

In addition to the free weekly credit report at AnnualCreditReport.com, Experian also offers consumers free access to their credit report and ongoing credit monitoring at Experian.com.

Additional credit education resources and tools

- Experian’s #CreditChat: Hosted by @Experian on Twitter with financial experts every Wednesday at 3 p.m. Eastern time

- The Ask Experian blog: Find answers to common questions, advice and education about credit

- Experian Boost: Add positive telecom and utility payments to your Experian credit report for an opportunity to improve your credit scores

- experian.com/consumer-education-content/

- experian.com/coronavirus

1VantageScore® is a registered trademark of VantageScore Solutions, LLC.

2VantageScore® credit score range is 300 to 850.