When you think of criteria for prescreen credit marketing, what comes to mind?

Most people will immediately discuss the risk criteria used to ensure consumers receiving the mailing will qualify for the product offered. Others mention targeting criteria to increase response rates and ROI. But if this is all you’re looking at, chances are you’re not seeing the whole picture.

When it comes to building campaigns, marketers should consider the entire customer lifecycle, not just response rates. Yes, response rates drive ROI and can usually be measured within a couple months of the campaign drop. But what happens after the accounts get booked?

Traditionally, marketers view what happens after origination as the responsibility of other teams. Managing delinquencies, attrition, and loyalty are fringe issues for the marketing manager, not the main focus. But more and more, marketers must expand their role in the organization by taking a comprehensive approach to credit marketing.

In fact, truly successful campaigns will target consumers that build lasting relationships with the institution by using the three pillars of comprehensive credit marketing.

Pillar #1: Maximize Response Rates

At any point in time, most consumers have no interest in your products. You don’t have to look far to prove this out. Many marketing campaigns are lucky to achieve greater than a 1% response rate. As a result, marketers frequently leverage propensity to open models to improve results. These scores are highly effective at identifying consumers who are most likely to be receptive to your offer, while saving those that are not for future efforts.

However, many stop with this single dimension. The fact is no propensity tool can pick out 100% of responders. Layering just a couple credit attributes to a propensity score allows you to swap in new consumers. Simultaneously, credit attributes can identify consumers with high propensity scores that are actually unlikely to open a new account. The net effect is even higher response rates than can be achieved by using a propensity score alone.

Pillar #2: Risk Expansion

Credit criteria are usually set using a risk score with some additional attributes. For example, a lender may target consumers with a credit score greater than 700 and no derogatory or delinquent accounts reported in the past 12 months. But, most of this data is based on a “snapshot” of the credit profile and ignores trends in the consumer’s use of credit.

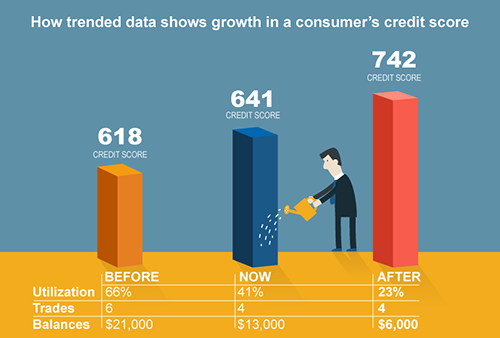

Consider a consumer who currently has a 690 credit score and has spent the past six months paying down debt. During that time, utilization has dropped from 66% to 41%, they’ve paid off and closed two trades, and balances have reduced from $21,000 to $13,000. However, if you only target consumers with a score greater than 700, this consumer would never appear on your prescreen list. Trended data helps spot how consumers use data over time. Using swap set analysis, you can expand your approval criteria without taking on the incremental risk. Being there when a consumer needs you is the first step in building long-term relationships.

Pillar #3: Customer profitability and early attrition

There’s more to profitability than just originating loans. What happens to your profitability assumptions when a consumer opens a loan and closes it within a few months? According to recent research by Experian, as many as 26% of prime and super-prime consumers, and 38% of near-prime consumers had closed a personal loan trade within nine months of opening. Further, nearly 32% of consumers who closed a loan early opened a new personal loan trade within a few months.

Segmentation can help identify consumers who are likely to close a personal loan early, giving account management teams a head start to try and retain them. As it turns out, many consumers use personal loans as a form of revolving debt. These consumers occasionally close existing trades and open new trades to get access to more cash. Anticipating who is likely to close a loan early allows your retention team to focus on understanding their needs. If you don’t, you’re competition will take advantage through their marketing efforts.

Building the strategy

Building a comprehensive strategy is an iterative process. It’s critical for organizations to understand each campaign is an opportunity to learn and refine the methodology. Consistently leveraging control and test groups and new data assets will allow the process to become more efficient over time. Importantly, marketers should work closely across the organization to understand broader objectives and pain points. Credit data can be used to predict a range of future behaviors. As such, marketing managers should play a greater role as the gatekeepers to the organization’s growth.