Tag: alternative data

Fintechs have been an enormously disruptive force of change in financial services over the past 10 years. From digital payments, lending, insurance, digital banks, to personal finance and many other subsectors in between, fintechs have rapidly transformed everything from business and operating models to customer expectations. It’s this innovative drive that is celebrated and fostered each year at LendIt Fintech - a conference that brings together the fintech and financial services community to connect and reimagine the future of finance. And there may not be another year on record that called for the reimagining of finance more than 2020. Last year, the financial services industry – from consumers, fintechs and other subdivisions across the globe – endured many changes and challenges due to the COVID-19 pandemic. But it also brought accelerated innovations; and with them, increased customer expectations and a focus on financial equity and inclusion. As consumer credit scores and demand for credit continue to rise, fintechs have an opportunity to re-examine what credit looks like in a post-COVID lending environment, and explore opportunities for growth in 2021. Experian’s Chief Product Officer Greg Wright tackled this topic at the recent Lendit Fintech conference, alongside Ibo Dusi of Happy Money, Myles Reaz of Upgrade and the Garry Reeder with the American Fintech Council. Watch the full panel discussion in the video below and hear more about: How panelists define data, alternative data and how it factors in their lending How alternative data can help drive financial inclusion and get to a ‘yes’ more often with consumers Using data to make the consumer experience more frictionless and seamless For more information about how Experian can help fintech organizations of all sizes reach their business and lending goals, visit our fintech solutions page. Explore Experian's Fintech Solutions

Financial services companies have long struggled to make inclusive decisions for small businesses and for low- and moderate-income consumers. One key reason: to make accurate predictions of the financial risks associated with those customers’ accounts requires lenders to rely on a wider variety of data than a credit score alone. To accurately assess risk, expanded Fair Credit Reporting Act regulated data is helpful – including rental data, trended data, enhanced public records, alternative financial services data and more. This expanded FCRA data is one key to financial inclusion. Without that data, lenders risk rejecting potentially profitable customers, including so-called credit invisibles and thin file consumers. In fact, The Federal Reserve, along with four important financial services regulators, highlighted the consumer benefits of alternative data in their December 2019 interagency statement. That statement also highlighted the increased importance of managing compliance when firms use alternative data in credit underwriting. With hundreds of data sources available to help with important tasks such as verifying identity, checking credit, and assessing the value of automotive and real-estate collateral, why have some lenders been slow to use the most appropriate data attributes when making credit decisions? One reason is a matter of IT Architecture; another is priorities. Changing a business process to take advantage of new data requirements can be prohibitively lengthy and costly – in terms of both analytical and IT resources. This is especially true for older systems—which were seldom adapted to use Application Programming Interfaces (APIs) supporting modern data structures such as JSON. Furthermore, data access to older systems can require specific types of system connectivity such as VPNs or leased lines. Latency is important in this type of application: some of these tasks have to be done instantly in a digital-first or digital-only lending environment. So is time to market: lenders deploying analytics processes cannot wait for overtaxed IT teams to complete lengthy projects. Lenders’ analytics and IT teams have long known they need to be more agile and efficient, faster to market, and increasingly secure. Their answer, largely, has been a slow but steady migration of their systems to the cloud. A 2019 McKinsey survey revealed that CIOs were modernizing their infrastructures primarily to achieve four goals: agility and time to market, quality and reliability, cost, and security. There are other benefits as well. But if the business case for a cloud strategy was somewhat clear to IT and analytics leaders, it became crystal clear to the rest of the business in 2020. As companies shifted to at-home work using cloud-based collaboration tools, especially videoconferencing services, most companies conquered what was perhaps the final barrier to entry—the fear that the issues of data privacy and security were somehow more insurmountable with virtual machines, containers, and microservices than with on-premise infrastructure. Last quarter, the leading cloud providers Amazon Web Services, Google Cloud Platform, and Microsoft Azure reported incredible annual revenue growth: 29%, 45%, and 48% respectively. COVID-19 has proven to be the catalyst that greatly sped up the transition to cloud technologies. The jump to the cloud means that lenders are suddenly more capable than ever at making analytically sound – and therefore more financially inclusive decisions. The key to analytical decision-making is to use the right data and to make the most appropriate calculations (called attributes) as part of a business strategy or a mathematical model. With Experian programs such as Attribute Toolbox now available in the cloud, calculating those all-important attributes is as simple for the IT department as coding an API call. Lenders will soon be able just as easily to retrieve and process raw data from over 100 data sources, to recognize their native formats and to extract the desired information quickly enough for real-time and batch decisioning. The pandemic has brought economic distress to millions of Americans—it is unlike anything in our lifetimes. The growth of cloud computing promises to enable these consumers to obtain additional products as well as more favorable pricing and terms. It’s ironic that COVID has accelerated the adoption of the very technologies that will expand access to credit for many people who cannot currently access it from mainstream financial firms. To learn more about our Attribute Toolbox, click here. Learn More

Big data is bringing changes to the way credit scores are reported and making it easier for lenders to find creditworthy consumers, and for consumers to qualify for the financing they need. Since last year’s annual report, alternative credit data1 has continued to gain in popularity. In Experian’s latest 2020 State of Alternative Credit Data report, we take a closer look at why alternative credit data is supplemental and essential to consumer lending and how it’s being adopted by both consumers and financial institutions. While the topic of alternative credit data has become more well known, its capabilities and benefits are still not widely discussed. For instance, did you know that … 89% of lenders agree that alternative credit data allows them to extend credit to more consumers. 96% of lenders agree that in times of economic stress, alternative credit data allows them to more closely evaluate consumer’s creditworthiness and reduce their credit risk exposure. 3 out of 4 consumers believe they are a better borrower than their credit score represents. Not only do consumers believe they’re more financially astute than their credit score depicts – but they’re happy to prove it, with 80% saying they would share various types of financial information with lenders if it meant increased chances for approval or improved interest rates. This year’s report provides a deeper look into lenders’ and consumers’ perceptions of alternative credit data, as well as an overview of the regulatory landscape and how alternative credit data is being used across the lending marketplace. Lenders who incorporate alternative credit data and machine learning techniques into their current processes can harness the data to unlock their portfolio’s growth potential, make smarter lending decisions and mitigate risk. Learn more in the 2020 State of Alternative Credit Data white paper. Download now

In today’s uncertain economic environment, the question of how to reduce portfolio volatility while still meeting consumers’ needs is on every lender’s mind. With more than 100 million consumers already restricted by traditional scoring methods used today, lenders need to look beyond traditional credit information to make more informed decisions. By leveraging alternative credit data, you can continue to support your borrowers and expand your lending universe. In our most recent podcast, Experian’s Shawn Rife, Director of Risk Scoring and Alpa Lally, Vice President of Data Business, discuss how to enhance your portfolio analysis after an economic downturn, respond to the changing lending marketplace and drive greater access to credit for financially distressed consumers. Topics discussed, include: Making strategic, data-driven decisions across the credit lifecycle Better managing and responding to portfolio risk Predicting consumer behavior in times of extreme uncertainty Listen in on the discussion to learn more. Experian · Effective Lending in the Age of COVID-19

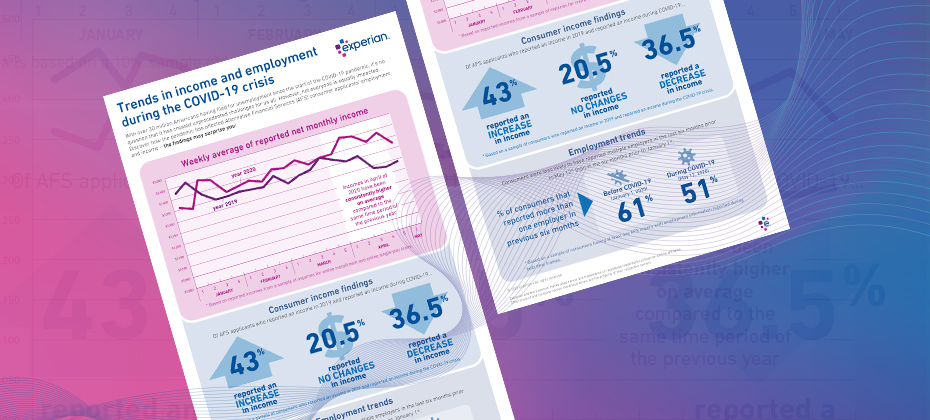

With many individuals finding themselves in increasingly vulnerable positions due to COVID-19, lenders must refine their policies based on their consumers’ current financial situations. Alternative Financial Services (AFS) data helps you gain a more comprehensive view of today's consumer. The COVID-19 pandemic has had far-reaching economic consequences, leading to drastic changes in consumers’ financial habits and behavior. When it comes to your consumers, are you seeing the full picture? See if you qualify for a complimentary hit rate analysis Download AFS Trends Report

The current pandemic will affect the way financial institutions lend and provide credit. Shawn Rife, Experian’s Director of Product Scoring, discusses the ways that financial institutions can navigate the COVID-19 crisis. Check out what he had to say: What implications does the global pandemic have on financial institutions’ analytical needs? SR: In the customer lifecycle, there are 4 different stages: prospecting, acquisitions, portfolio management, and collections. During times of economic uncertainty, lenders typically take additional actions to ensure that there’s a first line of defense against delinquencies and payment stress. Expanding their focus to incorporate account review/portfolio management becomes particularly important. During this time, clients will be looking for leadership, early warning signs, and ways to recession-proof their portfolios (account management), while growing and maintaining their approvals in a healthy way (originations). Lenders may be well advised to delay any focus on collections, since many consumers may be facing major payment stress through no mismanagement of their own doing. Another critical component is with the rollout of government stimulus packages, which lenders can use to identify people in stress who could benefit for second chance opportunities they may not have otherwise been able to receive. As more consumers seek credit, from an analytics perspective, what considerations should financial institutions be making during this time? SR: Financial institutions should be assessing and pre-identifying situations that might place consumers in positions of elevated financial stress. That way, organizations can implement solutions to identify and help at-risk consumers before they fall delinquent. The recent Coronavirus Aid, Relief, and Economic Security Act (CARES Act) – coupled with Experian’s score treatment, are designed to protect consumers against score declines during times of crisis. Furthermore, lenders can provide forbearance and loan deferment programs to help consumers. For lenders, credit risk scores, models, and attributes are the best ways to identify – and even predict - delinquency risk. The FICO® Resilience Index can also identify consumers who are particularly susceptible to delinquency risk directly due to macroeconomic uncertainty. This gives lenders the opportunity to evaluate their portfolios for loss and connect with consumers who may be in need of further support. What is the smartest next play for financial institutions? SR: For financial institutions, the smart play is to add alternative data into their data-driven decisioning strategies as much as possible. Alternative data works to enhance your ability to see a consumer’s entire credit portfolio, which gives lenders the confidence to continue to lend – as well as the ability to track and monitor a consumer’s historical performance (which is a good indicator of whether or not a consumer has both the intention and ability to repay a loan). How will the new attribute subset list benefit financial institutions during this time? SR: Experian’s series of crisis attributes is an example of attributes that can be predictive in times of a crisis. These lists were designed to follow the 3 E’s – Expand, Enhance, and provide Ease of use. Enhance – With these attributes, lenders aren’t limited to traditional data. These attributes allow lenders to look at the entirety of a consumer’s credit or repayment behavior and use more data to make better lending decisions. This becomes crucial in a challenging environment. Expand – This data can also help lenders identify consumers who are in the market for products and services, even if there the lending criteria becomes more stringent. This can open doors and new opportunities for 40-50 million new customers, particularly ones that may not fit initial lending criteria. Ease of Use – Experian has put together the most predictive elements that can identify consumer resilience and potential financial stress in this challenging economy. Experian is committed to helping your organization during times of uncertainty. For more resources, visit our Look Ahead 2020 Hub. Learn more Shawn M. Rife, Director of Risk Scoring, Experian Consumer Information Services, North America Shawn Rife manages Experian’s credit risk scoring models, focused on empowering clients to maximize the scope and influence of their lending universe - while minimizing risk - and complying with ever-changing regulatory standards. Shawn also leads the implementation of Alternative Data within the lending environment, as well as key product implementation initiatives. Prior to Experian, Shawn held key consumer insights and predictive analytics roles for Consumer Packaged Goods and internet companies. Over his career, Shawn has focused on market segmentation, competitive research, new product development and consumer advocacy. He also holds a Master’s degree from Harvard University and a Bachelor’s degree in Political Science and Economics.

In today’s rapidly changing economic environment, the looming question of how to reduce portfolio volatility while still meeting consumers' needs is on every lender’s mind. So, how can you better asses risk for unbanked consumers and prime borrowers? Look no further than alternative credit data. In the face of severe financial stress, when borrowers are increasingly being shut out of traditional credit offerings, the adoption of alternative credit data allows lenders to more closely evaluate consumer’s creditworthiness and reduce their credit risk exposure without unnecessarily impacting insensitive or more “resilient” consumers. What is alternative credit data? Millions of consumers lack credit history or have difficulty obtaining credit from mainstream financial institutions. To ease access to credit for “invisible” and subprime consumers, financial institutions have sought ways to both extend and improve the methods by which they evaluate borrowers’ risk. This initiative to effectively score more consumers has involved the use of alternative credit data.1 Alternative credit data is FCRA-regulated data that is typically not included in a traditional credit report and helps lenders paint a fuller picture of a consumer, so borrowers can get better access to the financial services they need and deserve. How can it help during a downturn? The economic environment impacts consumers’ financial behavior. And with more than 100 million consumers already restricted by the traditional scoring methods used today, lenders need to look beyond traditional credit information to make more informed decisions. By pulling in alternative credit data, such as consumer-permissioned data, rental payments and full-file public records, lenders can gain a holistic view of current and future customers. These insights help them expand their credit universe, identify potential fraud and determine an applicant’s ability to pay all while mitigating risk. Plus, many consumers are happy to share additional financial information. According to Experian research, 58% say that having the ability to contribute positive payment history to their credit files makes them feel more empowered. Likewise, many lenders are already expanding their sources for insights, with 65% using information beyond traditional credit report data in their current lending processes to make better decisions. By better assessing risk at the onset of the loan decisioning process, lenders can minimize credit losses while driving greater access to credit for consumers. Learn more 1When we refer to “Alternative Credit Data,” this refers to the use of alternative data and its appropriate use in consumer credit lending decisions, as regulated by the Fair Credit Reporting Act. Hence, the term “Expanded FCRA Data” may also apply in this instance and both can be used interchangeably.

Article written by Melanie Smith, Senior Copywriter, Experian Clarity Services, Inc. It’s been almost a decade since the Great Recession in the United States ended, but consumers continue to feel its effects. During the recession, millions of Americans lost their jobs, retirement savings decreased, real estate reduced in value and credit scores plummeted. Consumers that found themselves impacted by the financial crisis often turned to alternative financial services (AFS). Since the end of the recession, customer loyalty and retention has been a focus for lenders, given that there are more options than ever before for AFS borrowers. To determine what this looks like in the current climate, we examined today’s non-prime consumers, what their traditional scores look like and if they are migrating to traditional lending. What are alternative financial services (AFS)? Alternative financial services (AFS) is a term often used to describe the array of financial services offered by providers that operate outside of traditional financial institutions. In contrast to traditional banks and credit unions, alternative service providers often make it easier for consumers to apply and qualify for lines of credit but may charge higher interest rates and fees. More than 50% of new online AFS borrowers were first seen in 2018 To determine customer loyalty and fluidity, we looked extensively at the borrowing behavior of AFS consumers in the online marketplace. We found half of all online borrowers were new to the space as of 2018, which could be happening for a few different reasons. Over the last five years, there has been a growing preference to the online space over storefront. For example, in our trends report from 2018, we found that 17% of new online customers migrated from the storefront single pay channel in 2017, with more than one-third of these borrowers from 2013 and 2014 moving to online overall. There was also an increase in AFS utilization by all generations in 2018. Additionally, customers who used AFS in previous years are now moving towards traditional credit sources. 2017 AFS borrowers are migrating to traditional credit As we examined the borrowing behavior of AFS consumers in relation to customer loyalty, we found less than half of consumers who used AFS in 2017 borrowed from an AFS lender again in 2018. Looking into this further, about 35% applied for a loan but did not move forward with securing the loan and nearly 24% had no AFS activity in 2018. We furthered our research to determine why these consumers dropped off. After analyzing the national credit database to see if any of these consumers were borrowing in the traditional credit space, we found that 34% of 2017 borrowers who had no AFS activity in 2018 used traditional credit services, meaning 7% of 2017 borrowers migrated to traditional lending in 2018. Traditional credit scores of non-prime borrowers are growing After discovering that 7% of 2017 online borrowers used traditional credit services in 2018 instead of AFS, we wanted to find out if there had also been an improvement in their credit scores. Historically, if someone is considered non-prime, they don’t have the same access to traditional credit services as their prime counterparts. A traditional credit score for non-prime consumers is less than 600. Using the VantageScore® credit score, we examined the credit scores of consumers who used and did not use AFS in 2018. We found about 23% of consumers who switched to traditional lending had a near-prime credit score, while only 8% of those who continued in the AFS space were classified as near-prime. Close to 10% of consumers who switched to traditional lending in 2018 were classified in the prime category. Considering it takes much longer to improve a traditional credit rating, it’s likely that some of these borrowers may have been directly impacted by the recession and improved their scores enough to utilize traditional credit sources again. Key takeaways AFS remains a viable option for consumers who do not use traditional credit or have a credit score that doesn’t allow them to utilize traditional credit services. New AFS borrowers continue to appear even though some borrowers from previous years have improved their credit scores enough to migrate to traditional credit services. Customers who are considered non-prime still use AFS, as well as some near-prime and prime customers, which indicates customer loyalty and retention in this space. For more information about customer loyalty and other recently identified trends, download our recent reports. State of Alternative Data 2019 Lending Report

Retailers are already starting to display their Christmas decorations in stores and it’s only early November. Some might think they are putting the cart ahead of the horse, but as I see this happening, I’m reminded of the quote by the New York Yankee’s Yogi Berra who famously said, “It gets late early out there.” It may never be too early to get ready for the next big thing, especially when what’s coming might set the course for years to come. As 2019 comes to an end and we prepare for the excitement and challenges of a new decade, the same can be true for all of us working in the lending and credit space, especially when it comes to how we will approach the use of alternative data in the next decade. Over the last year, alternative data has been a hot topic of discussion. If you typed “alternative data and credit” into a Google search today, you would get more than 200 million results. That’s a lot of conversations, but while nearly everyone seems to be talking about alternative data, we may not have a clear view of how alternative data will be used in the credit economy. How we approach the use of alternative data in the coming decade is going to be one of the most important decisions the lending industry makes. Inaction is not an option, and the time for testing new approaches is starting to run out – as Yogi said, it’s getting late early. And here’s why: millennials. We already know that millennials tend to make up a significant percentage of consumers with so-called “thin-file” credit reports. They “grew up” during the Great Recession and that has had a profound impact on their financial behavior. Unlike their parents, they tend to have only one or two credit cards, they keep a majority of their savings in cash and, in general, they distrust financial institutions. However, they currently account for more than 21 percent of discretionary spend in the U.S. economy, and that percentage is going to expand exponentially in the coming decade. The recession fundamentally changed how lending happens, resulting in more regulation and a snowball effect of other economic challenges. As a result, millennials must work harder to catch up financially and are putting off major life milestones that past generations have historically done earlier in life, such as homeownership. They more often choose to rent and, while they pay their bills, rent and other factors such as utility and phone bill payments are traditionally not calculated in credit scores, ultimately leaving this generation thin-filed or worse, credit invisible. This is not a sustainable scenario as we enter the next decade. One of the biggest market dynamics we can expect to see over the next decade is consumer control. Consumers, especially millennials, want to be in the driver’s seat of their “credit journey” and play an active role in improving their financial situations. We are seeing a greater openness to providing data, which in turn enables lenders to make more informed decisions. This change is disrupting the status quo and bringing new, innovative solutions to the table. At Experian, we have been testing how advanced analytics and machine learning can help accelerate the use of alternative data in credit and lending decisions. And we continue to work to make the process of analyzing this data as simple as possible, making it available to all lenders in all verticals. To help credit invisible and thin-file consumers gain access to fair and affordable credit, we’ve recently announced Experian Lift, a new suite of credit score products that combines exclusive traditional credit, alternative credit and trended data assets to create a more holistic picture of consumer creditworthiness that will be available to lenders in early 2020. This new Experian credit score may improve access to credit for more than 40 million credit invisibles. There are more than 100 million consumers who are restricted by the traditional scoring methods used today. Experian Lift is another step in our commitment to helping improve financial health of consumers everywhere and empowers lenders to identify consumers who may otherwise be excluded from the traditional credit ecosystem. This isn’t just a trend in the United States. Brazil is using positive data to help drive financial inclusion, as are others around the world. As I said, it’s getting late early. Things are moving fast. Already we are seeing technology companies playing a bigger role in the push for alternative data – often powered by fintech startups. At the same time, there also has been a strong uptick in tech companies entering the banking space. Have you signed up for your Apple credit card yet? It will take all of 15 seconds to apply, and that’s expected to continue over the next decade. All of this is changing how the lending and credit industry must approach decision making, while also creating real-time frictionless experiences that empower the consumer. We saw this with the launch of Experian Boost earlier this year. The results speak for themselves: hundreds of thousands of previously thin-file consumers have seen their credit scores instantly increase. We have also empowered millions of consumers to get more control of their credit by using Experian Boost to contribute new, positive phone, cable and utility payment histories. Through Experian Boost, we’re empowering consumers to play an active role in building their credit histories. And, with Experian Lift, we’re empowering lenders to identify consumers who may otherwise be excluded from the traditional credit ecosystem. That’s game-changing. Disruptions like Experian Boost and newly announced Experian Lift are going to define the coming decade in credit and lending. Our industry needs to be ready because while it may seem early, it’s getting late.

A few months ago, I got a letter from the DMV reminding me that it was finally time to replace my driver’s license. I’ve had it since I was 21 and I’ve been dreading having to get a new one. I was especially apprehensive because this time around I’m not just getting a regular old driver’s license, I’m getting a REAL ID. For those of you who haven’t had this wonderful experience yet, a REAL ID is the new form of driver’s license (or state ID) that you’ll need to board a domestic flight starting October 1, 2020. Some states already offered compliant IDs, but others—like California, where I’m from—didn’t. This means that if I want to fly within the U.S. using my driver’s license next year, I can’t renew by mail. It’s Easier Than It Looks Imagine my surprise when I started the process to schedule my appointment, and the California DMV website made things really easy! There’s an online application you can fill out before you get to the DMV and they walk you through the documents to bring to the appointment (which I was able to schedule online). Despite common thought that the DMV and agencies like it are slow to adopt technology, the ease of this process may indicate a shift toward a digital-first mindset. As financial institutions embrace a similar shift, they’ll be better positioned to meet the needs of customers. Case in point, the electronic checklist the DMV provided to prepare me for my appointment. I sailed through the first two parts of the checklist, confirming that I’ll bring my proof of identity and social security number, but I paused when I got to the “Two Proofs of Residency” screen. Like many people my age—read: 85% of the millennial population, according to a recent Experian study—I don’t have a mortgage or any other documents relating to property ownership. I also don’t have my name on my utilities (thanks, roomie) or my cell phone bill (thanks Mom). I do however have a signed lease with my name on it, plus my renter’s insurance, both of which are acceptable as proof of residency. And just like that, I’m all set to get my REAL ID, even though I don’t have some of the basic adulting documents you might expect, because the DMV took into account the fact that not all REAL ID applicants are alike. Imagine if lenders could adopt that same flexibility and create opportunities for the more than 45 million U.S. consumers1 who lack a credit report or have too little information to generate a credit score. The Bigger Picture By removing some of the usual barriers to entry, the DMV made the process of getting my REAL ID much easier than it might have been and corrected my assumptions about how difficult the process would be. Experian has the same line of thought when it comes to helping you determine whether a borrower is credit-worthy. Just because someone doesn’t have a credit card, auto loan or other traditional credit score contributor doesn’t mean they should be written off. That’s why we created Experian BoostTM, a product that lets consumers give read-only access to their bank accounts and add in positive utility and telecommunications bill payments to their credit file to change their scores in real time and demonstrate their stability, ability and willingness to repay. It’s a win-win for lenders and consumers. 2 out of 3 users of Experian Boost see an increase in their FICO Score and of those who saw an increase, 13% moved up a credit tier. This gives lenders a wider pool to market to, and thanks to their improved credit scores, those borrowers are eligible for more attractive rates. Increasing your flexibility and removing barriers to entry can greatly expand your potential pool of borrowers without increasing your exposure to risk. Learn more about how Experian can help you leverage alternative credit data and expand your customer base in our 2019 State of Alternative Data Whitepaper. Read Full Report 1Kenneth P. Brevoort, Philipp Grimm, Michelle Kambara. “Data Point: Credit Invisibles.” The Consumer Financial Protection Bureau Office of Research. May 2015.

Would you hire a new employee strictly by their resume? Surely not – there’s so much more to a candidate than what’s written on paper. With that being said, why would you determine your consumers’ creditworthiness based only on their traditional credit score? Resumes don’t always give you the full picture behind an applicant and can only tell a part of someone’s story, just as a traditional credit score can also be a limited view of your consumers. And lenders agree – findings from Experian’s 2019 State of Alternative Credit Data revealed that 65% of lenders are already leveraging information beyond the traditional credit report to make lending decisions. So in addition to the resume, hiring managers should look into a candidate’s references, which are typically used to confirm a candidate’s positive attributes and qualities. For lenders, this is alternative credit data. References are supplemental but essential to the resume, and allow you to gain new information to expand your view into a candidate – synonymous to alternative credit data’s role when it comes to lending. Lenders are tasked with evaluating their consumers to determine their stability and creditworthiness in an effort to prevent and reduce risk. While traditional credit data contains core information about a consumer’s credit data, it may not be enough for a lender to formulate a full and complete evaluation of the consumer. And for over 45 million Americans, the issue of having no credit history or a “thin” credit history is the equivalent of having a resume with little to no listed work experience. Alternative credit data helps to fill in the gaps, which has benefits for both lenders and consumers. In fact, 61% of consumers believe adding payment history would have a positive impact on their credit score, and therefore are willing to share their data with lenders. Alternative credit data is FCRA-compliant and includes information like alternative finance data, rental payments, utility payments, bank account information, consumer-permissioned data and full-file public records. Because this data shows a holistic view of the customer, it helps to determine their ability to repay debts and reveals any delinquent behaviors. These insights help lenders to expand their consumer lending universe– all while mitigating and preventing risk. The benefits can also be seen for home-based and small businesses. Fifty percent of all US small businesses are home-based, but many small business owners lack visibility due to their thin-file nature – making it extremely difficult to secure bank loans and capital to fund their businesses. And, younger generations and small business owners account for 58% of business owners who rely on short term lending. By leveraging alternative credit data, lenders can get greater insights into a small business owner’s credit profile and gauge risk. Entrepreneurs can also benefit from this information being used to build their credit profiles – making it easier for them to gain access to investment capital to fund their new ventures. Like a hiring manager, it’s important for lenders to get a comprehensive view to find the most qualified candidates. Using alternative credit data can expand your choices – read our 2019 State of Alternative Credit Data Whitepaper to learn more and register for our upcoming webinar. Register Now

Alex Lintner, Group President at Experian, recently had the chance to sit down with Peter Renton, creator of the Lend Academy Podcast, to discuss alternative credit data,1 UltraFICO, Experian Boost and expanding the credit universe. Lintner spoke about why Experian is determined to be the leader in bringing alternative credit data to the forefront of the lending marketplace to drive greater access to credit for consumers. “To move the tens of millions of “invisible” or “thin file” consumers into the financial mainstream will take innovation, and alternative data is one of the ways which we can do that,” said Lintner. Many U.S. consumers do not have a credit history or enough record of borrowing to establish a credit score, making it difficult for them to obtain credit from mainstream financial institutions. To ease access to credit for these consumers, financial institutions have sought ways to both extend and improve the methods by which they evaluate borrowers’ risk. By leveraging machine learning and alternative data products, like Experian BoostTM, lenders can get a more complete view into a consumer’s creditworthiness, allowing them to make better decisions and consumers to more easily access financial opportunities. Highlights include: The impact of Experian Boost on consumers’ credit scores Experian’s take on the state of the American consumer today Leveraging machine learning in the development of credit scores Expanding the marketable universe Listen now Learn more about alternative credit data 1When we refer to "Alternative Credit Data," this refers to the use of alternative data and its appropriate use in consumer credit lending decisions, as regulated by the Fair Credit Reporting Act. Hence, the term "Expanded FCRA Data" may also apply in this instance and both can be used interchangeably.

The universe has been used as a metaphor for many things – vast, wide, intangible – much like the credit universe. However, while the man on the moon, a trip outside the ozone layer, and all things space from that perspective may seem out of touch, there is a new line of access to consumers. In Experian's latest 2019 State of Alternative Credit Data report, consumers and lenders alike weigh in on the growing data set and how they are leveraging the data in use cases across the lending lifecycle. While the topic of alternative credit data is no longer as unfamiliar as it may have been a year or two ago, the capabilities and benefits that can be experienced by financial institutions, small businesses and consumers are still not widely known. Did you know?: - 65% of lenders say they are using information beyond the traditional credit report to make a lending decision. - 58% of consumers agree that having the ability to contribute payment history to their credit file make them feel empowered. - 83% of lenders agree that digitally connecting financial account data will create efficiencies in the lending process. These and other consumer and lender perceptions of alternative credit data are now launched with the latest edition of the State of Alternative Credit Data whitepaper. This year’s report rounds up the different types of alternative credit data (from alternative financial services data to consumer-permissioned account data, think Experian BoostTM), as well as an overview of the regulatory landscape, and a number of use cases across consumer and small business lending. In addition, consumers also have a lot to say about alternative credit data: With the rise of machine learning and big data, lenders can collect more data than ever, facilitating smarter and more precise decisions. Unlock your portfolio’s growth potential by tapping into alternative credit data to expand your consumer universe. Learn more in the 2019 State of Alternative Credit Data Whitepaper. Read Full Report View our 2020 State of Alternative Credit Data Report for an updated look at how consumers and lenders are leveraging alternative credit data.

Earlier this month, Experian joined FinovateSpring in San Francisco, CA to demonstrate innovations impacting financial health to over 1,000 attendees. The Finovate conference promotes real-world solutions while highlighting short-form demos and key insights from thought-leaders on digital lending, banking, payments, artificial intelligence and the customer experience. With more than 100 million Americans lacking fair access to credit, it's more important than ever for companies to work to improve the financial health of consumers. In addition to the show's abundance of fintech-centered content, Experian hosted an exclusive, cutting-edge breakout series demonstrating innovations that are positively impacting the financial health of consumers across the nation. Finovate Day One Overview While fintechs, banks, venture capitalist, entrepreneurs and industry analysts ascended on the general conference floor for a fast-paced day of demos, a select subset gathered for a luncheon presented by Experian North America CEO, Craig Boundy, and Group President, Alex Lintner. Attendees were given an in-depth look at new, alternative credit data streams and tools that are helping to increase financial access. Demos included: Experian Boost™: a free, groundbreaking online platform that allows consumers to instantly boost their credit scores by adding telecommunications and utility bill payments to their credit file. More than half a million consumers have leveraged Experian Boost, increasing their score by an average of 13 points. Cumulatively, Experian Boost has helped add more than 2.8 million points to consumers’ credit scores. Ascend Analytical Sandbox™: A first-of-its-kind data and analytics platform that gives companies instant access to more than 17 years of depersonalized credit data on more than 220 million U.S. consumers. It has been the most successful product launch in Experian’s history and recently earned the title of “Best Overall Analytics Platform” at this year’s Fintech Breakthrough Awards. Alternative Credit Data: Comprised of data from alternative credit sources, this data helps lenders make smarter and more informed lending decisions. Additionally, Experian’s Clear Data Platform is next-level credit data that adds supplemental FCRA-compliant credit data to enrich decisions across the entire credit spectrum. This new platform features alternative credit data, rental data, public records, consumer-permissioned data and more Upon conclusion of the luncheon, Alpa Lally, Experian’s Vice President of Data Business at Consumer Information Services, was interviewed for the HousingWire Podcast with Jacob Gaffney, HousingWire Editor in Chief, to discuss how new forms of data streams are helping improve consumers’ access to credit by giving lenders a clearer picture of their creditworthiness and risk. “Alternative credit data is different than traditional credit data and helps us paint a fuller picture of the consumer in terms of their ability to pay, willingness to pay and stability. It helps consumers get better access overall to the credit they deserve so that they can actively participate in the economy,” said Lally. Finovate Day Two Overview On the last day of the conference, expert speakers took to the main stage to analyze the latest fintech trends, opportunities and challenges. Alex Lintner and Sandeep Bhandari, Chief Strategy Officer and Chief Risk Officer at Affirm, participated in a fireside chat titled “Improving the Financial Health of America’s 100 Million Credit Underserved Consumers.” Moderated by David Penn, Finovate Analyst, the session explored the latest innovations, trends and technologies – from machine learning to alternative data – that are making a difference in positively impacting the financial health of Americans and expanding financial opportunities for underserved consumers. The panel discussed the efforts made to put financial health at the center of their business and the impact it’s had on their organizations. Following the fireside chat, Experian hosted a second lunch briefing, presented by Vijay Mehta, Chief Innovation Officer, and Greg Wright, EVP Chief Product Officer. The lunch included exclusive table discussions and open conversations to help attendees leave with a better understanding of the importance of prioritizing financial health to build trust, reach new customers and ultimately grow their business. "We are actively seeking out unresolved problems and creating products and technologies that will help transform the way businesses operate and consumers thrive in our society. But we know we can't do it alone," Experian North American CEO, Craig Boundy said in a recent blog post on Experian's fintech partnerships and Finovate participation. "That's why over the last year, we have built out an entire time of account executives and other support staff that are fully dedicated to developing and supporting partnerships with leading fintech companies. We've made significant strides that will help us pave the way for the next generation of lending while improving the financial health of more people around the world." For more information on how Experian is partnering with fintechs, visit experian.com/fintech or read our recent blog article on consumer-permissioned data for an in-depth discussion on Experian BoostTM.

The lending market has seen a significant shift from traditional financial institutions to fintech companies providing alternative business lending. Fintech companies are changing the brick-and-mortar landscape of lending by utilizing data and technology. Here are four ways fintech has changed the lending process and how traditional financial institutions and lenders can keep up: 1. They introduced alternative lending models In a traditional lending model, lenders accept deposits from customers to extend loan offers to other customers. One way that fintech companies disrupted the lending process is by introducing peer-to-peer lending. With peer-to-peer lending, there is no need to take a deposit at all. Instead, individuals can earn interest by lending to others. Banks who collaborate with peer-to-peer lenders can improve their credit appraisal models, enhance their online lending strategy, and offer new products at a lower cost to their customers. 2. They offer fast approvals and funding In certain situations, it can take banks and credit card providers weeks to months to process and approve a loan. Conversely, fintech lenders typically approve and fund loans in less than 24 hours. According to Mintel, only 30% of consumers find various banking features easy-to-use. Financial experts at Toptal suggest that banks consider speeding up the loan application and funding process within their online lending platforms to keep up with high-tech companies, such as Amazon, that offer customers an overall faster lending process from applications to approval, to payments. 3. They're making use of data Typically, fintech lenders pull data from several different alternative sources to quickly determine how likely a borrow is to pay back the loan. The data is collected and analyzed within seconds to create a snapshot of the consumer's creditworthiness and risk. The information can include utility, rent. auto payments, among other sources. To keep up, financial institutions have begun to implement alternative credit data to get a more comprehensive picture of a consumer, instead of relying solely upon the traditional credit score. 4. They offer perks and savings By enacting smoother automated processes, fintech lenders can save money on overhead costs, such as personnel, rent, and administrative expenses. These savings can then be passed onto the customer in the form of competitive interest rates. While traditional financial institutions generally have low overall interest rates, the current high demand for loans could help push their rates even lower. Additionally, financial institutions have started to offer more customer perks. For example, Goldman Sachs recently created an online lending platform, called Marcus, that offers unsecured consumer loans with no fees. Financial institutions may feel stuck in legacy systems and unable to accomplish the agile environments and instant-gratification that today's consumers expect. However, by leveraging new data sets and innovation, financial institutions may be able to improve their product offerings and service more customers. Looking to take the next step? We can help. Learn More About Banks Learn More About Fintechs