Tag: consumer credit trends

The economic expansion just passed the eight-year mark, and consumer credit defaults across mortgages, bankcards and auto loans are at pre–financial crisis levels. More specifically: The first-mortgage default rate dropped 4 basis points from May to 0.60%. The bankcard default rate experienced its first drop in 9 months, with a decrease of 4 basis points bringing it to 3.49%. Auto loan defaults decreased 3 basis points from the previous month to 0.82%. With inflation at 1% to 2%, debt service levels close to record lows, and disposable income increasing and supporting spending growth, consumers are in good financial shape nationally. Lenders should take this opportunity to review and adjust their acquisition strategies accordingly. Can your originations platform capitalize on this?

1 in 10 Americans are living paycheck to paycheck Financial health means more than just having a great credit score or money in a savings account. It includes being able to manage daily finances, save for the future and weather a financial shock. Here are some facts about Americans’ financial health: 46% of Americans are struggling financially. Roughly 31% of nonretired adults have no retirement savings or pension. Approximately 50% are unprepared for a financial emergency, and about 1 in 5 have no savings set aside to cover unexpected emergencies. It’s never too late for people to achieve financial health. By providing education on money management, you can drive new opportunities for increased engagement, loyalty and long-term revenue streams. Why financial health matters >

Summer spending A study by Experian and Edelman Berland noted that travelers relied heavily on credit for vacation purchases last year — with many planning to charge more than half of their vacation expenses this summer. Of those surveyed about their 2015 summer purchases: 86% spent money on a summer vacation in 2015. $2,275 was spent per person, with $1,308 of that being credit card purchases. 35% hadn’t saved in advance. 61% spent more than they planned. Summer brings vacations and credit card use. By identifying consumer credit trends like these, you can target new customers and identify balance transfer opportunities. Learn more>

Analyzing credit scores and card balances According to a study by VantageScore® Solutions LLC, consumers with credit scores between 601 and 650 carry the largest credit card bills, at more than $10,000 — nearly 2x that of the average consumer. Other key findings include: Those with the highest scores have the largest total credit limit ($46,735), compared with just $2,816 for those with the lowest scores. The average credit card holder has $29,197 in credit lines, with an average balance of $5,720. Those with scores between 701 and 750 use an average of 27% of their available credit versus 47% for those with scores between 651 and 700. The study reinforces the importance of staying current on the latest credit trends to best identify areas of opportunity and adjust lending strategies accordingly. Make better decisions >

Although the average mortgage rate was more than 4% at the end of the first quarter*, Q1 mortgage originations were nearly $450 billion — a 5% increase over the $427 billion a year earlier. As prime homebuying season kicks off, lenders can stay ahead of the competition by using advanced analytics to target the right customers and increase profitability. Revamp your mortgage and HELOC acquisitions strategies>

Knowing a consumer’s credit information at a single point in time tells only part of the story. For the whole story, lenders need to assess a consumer’s credit behavior over time. Understanding how a consumer uses credit or pays back debt over several months can better position you to: Offer the right products and terms to increase response rates. Identify profitable customers. Avoid consumers with payment stress. Trended data adds needed color to the consumer’s credit story. And with the right analytics and systems, you can derive valuable insights on consumers. Trended data>

Divorce often affects financial health negatively. It’s expensive – often causing nearly $20,000 in losses. A recent Experian survey found: 34% say their divorce put them in financial ruin. 19% percent say things were so bad they filed for bankruptcy. 39% report they’ll never marry again because of the financial loss of a divorce. Lenders can provide support to loyal customers by providing personalized credit education and create a new revenue stream for your company. Learn more>

A recent Experian study found that the amount of time it’s taking for automotive loans opened in Q4 2015 to become delinquent is actually similar to the pace in 2008. When looking at the 60+ DPD rate across all risk levels, the delinquency rate for accounts opened in Q4 2015 reached 0.50% within 6 months, compared with 0.51% for accounts opened in Q4 2008. Lenders can design more effective strategies by using analytics to gain insight into the latest trends and target the right customers. Video: Auto Acquisition Strategies>

Big changes for the new year 2017 is expected to bring some big changes. But what do those changes mean for the financial services space? Here are 3 trends and twists Experian expects to occur over the next 12 months: Trump and the Republican-controlled Congress will move forward with a deregulatory agenda. Recognizing and scoring more previously invisible consumers through alternative data sources will be emphasized. Personalized credit offers delivered via multiple digital channels in a sequenced, trackable manner. What are your predictions for 2017? Only time will tell, but we’re certain that regulations and advancements in digital will be huuuge. >>More 2017 trends

The holidays can be a stressful time for consumers — and an important time for lenders to anticipate the aftermath of big credit card spending. According to our recent study with Edelman Intelligence: 56% of respondents said holiday shopping puts a strain on their finances. 43% said the stress of holiday shopping makes it difficult to enjoy the season. With the holiday shopping season over, those hefty credit card statements are coming soon. Now is the time for lenders to prepare for the January and February consolidations. Want to know more?

Looking to score more consumers, but worried about increased risk? A recent VantageScore® LLC study found that consumers rendered “unscoreable” by commonly used credit scoring models are nearly identical in their financial and credit behavior to scoreable consumers. To get a more detailed financial portrait of the “expanded” population, credit files were supplemented with demographic and economic data. The study found: Consumers who scored above 620 using the VantageScore® credit score exhibited profiles of sufficient quality to justify mortgage loans on par with those of conventionally scoreable consumers. 3 to 2.5 million – a majority of the 3.4 million consumers categorized as potentially eligible for mortgages – demonstrated sufficient income to support a mortgage in their geographic areas. The findings demonstrate that the VantageScore® credit score is a scalable solution to expanding mortgage credit without relaxing credit standards should the FHFA and GSEs accept VantageScore® credit scores. Want to know more?

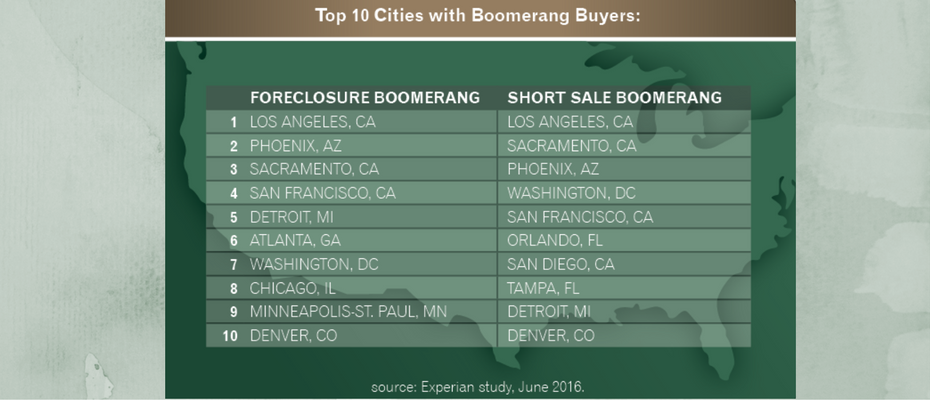

A recent Experian analysis shows that about 2.5 million consumers will have a foreclosure, short sale or bankruptcy fall off their credit report between June 2016 and June 2017 — with 68% of these consumers scoring in the near-prime or high credit segments. Additional highlights include: Nearly 29% of those who short-sold between 2007 and 2010 have opened a new mortgage. Delinquencies for this group are below the national average for bankcard and auto loan payments. More than 12% of those who foreclosed now have boomeranged (opened new mortgages). With millions of borrowers potentially re-entering the housing market, the trends are promising for both the mortgage seeker and the lender. Want to know more?

According to a national survey by Experian, college students may be receiving their degrees, but their financial management knowledge still needs some schooling. The survey reveals some troubling data about recent graduates: Average student loan debt is $22,813 31% have maxed out a credit card 39% have accepted credit card terms and conditions without reading them Learning to manage debt and finances properly is key to young adults’ future financial success. Since students aren’t receiving credit and debt management education in college, they need to educate themselves proactively. Credit education resources are available on Experian's Website. >> Experian College Graduate Survey Report

According to the most recent State of the Automotive Finance Market report, the total balance of open automotive loans increased 11.1% in Q1 2016, reaching $1.005 trillion — up from $905 billion in Q1 2015. This is the first time on record that automotive loans have passed the $1 trillion mark. The report also revealed that subprime loan volumes experienced double-digit growth and overall delinquencies remained low. With more consumers relying on financing, lenders should monitor credit and delinquency trends in order to adjust strategies accordingly. >>Webinar: Hear about the latest consumer credit trends

A recent study shows that small-business credit conditions remained relatively unchanged in Q1 2016, as delinquency and bankruptcy rates held steady at low levels. Much of the slight decrease in delinquencies was driven by fewer small businesses falling within the 61 to 90 and 91+ days past-due categories. Gaining deeper insight into the health of small businesses is important for both lenders and small-business owners. Experian® provides market-leading tools that enable small businesses to find new customers, process new applications, manage customer relationships and collect on delinquent accounts. >> Q1 2016 report