Tag: consumer credit

Credit card balances grew to $786.6 billion at the end of 2017, a 6.7% increase to the previous year and the largest outstanding balance in over a decade. And while the delinquency rate increased slightly to 2.26%, it is significantly lower than the 4.73% delinquency rate in 2008 when outstanding balances were $737 billion. The increase in credit card balances combined with the slight growth in delinquencies points to a positive credit environment. Stay up to date on the latest credit trends to maximize your lending strategies and capitalize on areas of opportunity. Get more credit trends and insights at our webinar on March 8. Register here

Our 8th annual State of Credit report shows that consumer credit scores and signs of economic recovery continue on an upward trend, coming close to a prerecession environment. The average U.S. credit score is up 2 points to 675 from last year and is just 4 points away from the 2007 average. Originations are increasing across nearly all loan types, with personal loans and automotive loans showing 11% and 6% increases year-over-year, respectively. Consumer confidence is up 25% year-over-year and has increased more than 16% from this period in 2007. With employment and consumer confidence rising, the economy is expected to expand at a healthy pace this year and continue to rebound from the recession. Now is the time to capitalize on this promising credit trend. State of Credit 2017

School is nearly back in session. You know what that means? The next wave of college students is taking out their first student loans. It’s a milestone moment – and likely the first trade on the credit file for many of these individuals. According to the College Board, the average cost of tuition and fees for the 2016–2017 school year was $33,480 at private colleges, $9,650 for state residents at public colleges, and $24,930 for out-of-state residents attending public universities. So really, regardless of where students go, the cost of a college education is big. In fact, from January 2006 to July 2016, the Consumer Price Index for college tuition and fees increased 63 percent. So, unless mom and dad did a brilliant job saving, chances are many of today’s students will take on at least some debt to foot the college bill. But it’s not just the young who are consumed by student loan debt. In Experian’s latest State of Student Lending report, we dive into how the $1.4 trillion in student loan debt for Americans is impacting all generations in regards to credit scores, debt load and delinquencies. The document additionally looks at geographical trends, noting which states have the most consumers with student loan debt and which ones have the least. Overall, we discovered 13.4% of U.S. consumers have one or more student loan balances on their credit file with an average total balance of $34k. Additionally, these consumers have an average of 3.7 student loans with 1.2 student loans in deferment. The average VantageScore® credit score for student loan carriers is 650. As we looked across the generations, every group – from the Silents (age 70+) to Gen Z (oldest are between 18 to 20) had some student loan debt. While we can make assumptions that the Silents and Boomers are likely taking out these loans to support the educational pursuits of their children and grandchildren, it can be mixed for Gen X, who might still be paying off their own loans and/or supporting their own kids. Gen X members also reported the largest average student loan total balance at $39,802. Gen Z, the newest members to the credit file, have just started to attend college, thus their generation has the largest percent of student loan balances in deferment at 77%. Their average student loan total balance is also the lowest of all generations at $11,830, but that is to be expected given their young ages. In regards to geographical trends, the Northern states tended to sport the highest average student loan total balances, with consumers in Washington D.C. winning that race with $52.5k. Southern states, on the other hand, reported higher percentages of consumers with student loan balances 90+ days past due. South Carolina, Louisiana, Mississippi, Arkansas and Texas held the top spots in the delinquency category. Access the complete State of Student Lending report. Data from this report is representative of student loan data on file as of June 2017.

1 in 10 Americans are living paycheck to paycheck Financial health means more than just having a great credit score or money in a savings account. It includes being able to manage daily finances, save for the future and weather a financial shock. Here are some facts about Americans’ financial health: 46% of Americans are struggling financially. Roughly 31% of nonretired adults have no retirement savings or pension. Approximately 50% are unprepared for a financial emergency, and about 1 in 5 have no savings set aside to cover unexpected emergencies. It’s never too late for people to achieve financial health. By providing education on money management, you can drive new opportunities for increased engagement, loyalty and long-term revenue streams. Why financial health matters >

Millennials have long been the hot topic over the course of the past few years with researchers, brands and businesses all seeking to understand this large group of people. As they buy homes, start families and try to conquest their hefty student loan burdens, all will be watching. Still, there is a new crew coming of age. Enter Gen Z. It is estimated that they make up ¼ of the U.S. population, and by 2020 they will account for 40% of all consumers. Understanding them will be critical to companies wanting to succeed in the next decade and beyond. The oldest members of this next cohort are between the ages of 18 and 20, and the youngest are still in elementary school. But ultimately, they will be larger than the mystical Millennials, and that means more bodies, more buying power, more to learn. Experian recently took a first look at the oldest members of this generation, seeking to gain insights into how they are beginning to use credit. In regards to credit scores, the eldest Gen Z members sported a VantageScore® credit score of 631 in 2016. By comparison, younger Millennials were at 626 and older Millennials were at 638. Given their young age, Gen Z debt levels are low with an average debt-to-income at just 5.7%. Their tradelines largely consist of bankcards, auto and student loans. Their average income is at $33.8k. Surprisingly, there was a very small group of Gen Z already on file with a mortgage, but this figure was less than .5%. Auto loans were also small, but likely to grow. Of those Gen Z members who have a credit file, an estimated 12% have an auto trade. This is just the beginning, and as they age, their credit files will thicken, and more insights will be gained around how they are managing credit, debt and savings. While they are young today, some studies say they already receive about $17 a week in allowance, equating to about $44 billion annually in purchase power in the U.S. Factor in their influence on parental or household purchases and the number could be closer to $200 billion! For all brands, financial services companies included, it is obvious they will need to engage with this generation in not just a digital manner, but a mobile manner. They are being raised in an era of instant, always-on access. They expect a quick, seamless and customized mobile experience. Retailers have 8 seconds or less — err on the side of less — to capture their attention. In general, marketers and lenders should consider the following suggestions: Message with authenticity Maintain a long-term vision Connect them with something bigger Provide education for financial literacy and of course Keep up with technological advances. Learn more by accessing our recorded webinar, A First Look at Gen Z and Credit.

Sometimes life throws you a curve ball. The unexpected medical bill. The catastrophic car repair. The busted home appliance. It happens, and the killer is that consumers don’t always have the savings or resources to cover an additional cost. They must make a choice. Which bills do they pay? Which bills go to the pile? Suddenly, a consumer’s steady payment behavior changes, and in some cases they lose control of their ability to fulfill their obligations altogether. These shifts in payment patterns aren’t always reflected in consumer credit scores. At a single point in time, consumers may look identical. However, when analyzing their past payment behaviors, differences emerge. With these insights, lenders can now determine the appropriate risk or marketing decisions. In the example below, we see that based on the trade-level data, Consumer A and Consumer B have the same credit score and balance. But once we see their payment pattern within their trended data, we can clearly see Consumer A is paying well over the minimum payments due and has a demonstrated ability to pay. A closer look at Consumer B, on the other hand, reveals that the payment amount as compared to the minimum payment amount is decreasing over time. In fact, over the last three months only the minimum payment has been made. So while Consumer B may be well within the portfolio risk tolerance, they are trending down. This could indicate payment stress. With this knowledge, the lender could decide to hold off on offering Consumer B any new products until an improvement is seen in their payment pattern. Alternatively, Consumer A may be ripe for a new product offering. In another example, three consumers may appear identical when looking at their credit score and average monthly balance. But when you look at the trend of their historical bankcard balances as compared to their payments, you start to see very different behaviors. Consumer A is carrying their balances and only making the minimum payments. Consumer B is a hybrid of revolving and transacting, and Consumer C is paying off their balances each month. When we look at the total annual payments and their average percent of balance paid, we can see the biggest differences emerge. Having this deeper level of insight can assist lenders with determining which consumer is the best prospect for particular offerings. Consumer A would likely be most interested in a low- interest rate card, whereas Consumer C may be more interested in a rewards card. The combination of the credit score and trended data provides significant insight into predicting consumer credit behavior, ultimately leading to more profitable lending decisions across the customer lifecycle: Response – match the right offer with the right prospect to maximize response rates and improve campaign performance Risk – understand direction and velocity of payment performance to adequately manage risk exposure Retention – anticipate consumer preferences to build long-term loyalty All financial institutions can benefit from the value of trended data, whether you are a financial institution with significant analytical capabilities looking to develop custom models from the trended data or looking for proven pre-built solutions for immediate implementation.

Knowing a consumer’s credit information at a single point in time only tells part of the story. I often hear one of our Experian leaders share the example of two horses, running neck-in-neck, at the races. Who will win? Well, if you had multiple insights into those two horses – and could see the race in segments – you might notice one horse losing steam, and the other making great strides. In the world of credit consumers, the same metaphor can ring true. You might have two consumers with identical credit scores, but Consumer A has been making minimum payments for months and showing some payment stress, while Consumer B has been aggressively making larger pay-offs. Trended data adds that color to the story, and suddenly there is more intel on who to market to for future offers. To understand the whole story, lenders need the ability to assess a consumer’s credit behavior over time. Understanding how a consumer uses credit or pays back debt over time can help lenders: Offer the right products & terms to increase response rates Determine up sell and cross sell opportunities Prevent attrition Identify profitable customers Avoid consumers with payment stress Limit loss exposure The challenge with trended data, however, is finding a way to sort through the payment patterns in the midst of huge datasets. At the singular level, one consumer might have 10 trades. Trended data in turn reveals five historical payment fields and then you multiple all of this by 24 months and you suddenly have 1,200 data points. But let’s be real … a lender is not going to look at just one consumer as they consider their marketing or retention campaigns. They may look at 100,000 consumers. And on that scale you are now looking at sorting through 120M data points. So while a lender may think they need trended data – and there is definitely value in accessing it – they likely also need a solution to help them wade through it all, assessing and decisioning on those 120M data points. Tapping into something like Credit3D, which bundles in propensity scores, profitability models and trended attributes, is the solution that truly unveils the value of trended data insights. By layering in these solutions, lenders can clearly answer questions like: Who is likely to respond to an offer? How does a consumer use credit? How can I identify revolvers, transactors and consolidators? Is there a better way to understand risk or to conduct swap set analysis? How can I acquire profitable consumers? How do I increase wallet share and usage? Trended data sounds like a “no-brainer” and it definitely has the ability to shed light on that consumer credit horse race. Lenders, however, also need to have the appropriate analytics and systems to assess on the huge volume of data points. Need more information on Trended Data and Credit 3D? Contact Us

As lenders seek to enhance their credit marketing strategies this year, they are increasingly questioning how to split their budgets between digital, direct mail and beyond. What is the ideal media mix to reach consumers in 2017? And is the solution different in the financial services space? Scott Gordon, Experian's senior director of digital credit marketing, recently tackled some of the tough questions financial services marketers are posing. Here are his responses: Q: We live in a world where consumers are receiving hundreds of messages and offers on a daily basis. How can financial services companies stand out and capture the attention of the customers they wish to engage with relevant offers? A: When it comes to the optimal marketing media mix, there is no “silver bullet.” It varies from product to product. The current post-campaign analysis is showing us that consumers react positively to coordinated multi-channel messaging. We’ve seen studies showing that marketers can see up to a 30% lift in sales by combining email with social media, for example. This makes sense, when you look at how consumers engage through devices. We are no longer a single channel culture; we check Facebook while watching TV, listen to podcasts while checking our email, etc. Consequently, marketers have had to adapt their campaign strategies accordingly – and this starts with the organizational structure. Far too often we see silo’ed groups responsible for disparate media verticals. For example, a company may have a direct mail group and a digital marketing team, and then (in extreme cases) outsource television to one agency group and social media to another. Aligning these groups and breaking down the barriers between the groups is a critical first step toward building a true multi-channel campaign strategy. This includes addressing budget concerns that are inherent with a culture where the size of a budget is tied to job security and corporate status. Aligning campaigns and finding the perfect cross channel market mix is much easier once you’ve broken down internal barriers and encouraged marketing collaboration. Q: What are some of the new best practices financial companies must embrace in 2017 in order to improve their marketing efforts? A: Thanks to tremendous efforts from industry leaders, we can now utilize regulated data with the same proficiency that they’ve been executing campaigns using non-regulated data. This presents unique challenges, as the industry races to get up-to-speed on new capabilities, take best-in-breed practices and apply them to the world of regulated campaigns. We’re seeing tremendous demand to combine programmatic advertising with people-based advertising, with cross-channel campaigns spanning mobile, video, social, and addressable TV. Measurement and analytics must play a large part in these strategies. While the industry hasn’t achieved true cross-channel measurement to identify a consumer’s path to purchase across multiple devices, it’s getting closer, thanks to technology advances. Q: Is direct mail dead? How should financial marketers be using direct mail in 2017? How can it best be combined with digital? A: Direct mail is certainly not dead. It has its place among a media mix that continues to grow as new advertising technologies come to market and are adopted by consumers. Will direct mail’s influence diminish in the future? Possibly. At Experian, we are focused on making sure that our advertisers can reach consumers where they spend time, when they are most receptive to receiving messages, and most importantly in a cost-effective manner. So no matter where consumers shift their focus in the future, we’ll be able to support comprehensive targeted advertising campaigns. How can digital be best combined with direct mail? We’ve seen encouraging results in retargeting direct mail with digital credit marketing like email and display. With that said, we haven’t seen a silver bullet solution, and we’re still advising our clients to put a heavy focus toward “test and learn” in concert with comprehensive campaign measurement and analytics protocols. Q: What are the advantages to serving up a firm offer of credit to a consumer in a digital format? Are consumers ready to embrace this type of delivery in the financial services space? A: The advantages of serving up a firm offer of credit to a consumer in a digital format are similar to those benefits for “traditional” digital marketing. Lower cost, more measurement capabilities, and greater flexibility to optimize campaigns are just some of the benefits. Early indications show that consumers are very receptive to digital credit marketing offers. It provides them with offers in the channels in which they spend time, in a consumer friendly manner which offers them numerous paths in which they can have a voice in the messages that they receive. Q: Some say digital credit marketing should largely be directed to Millennials? Do you think other generations are ready to embrace this type of digital messaging? A: We don’t view digital credit marketing as an exclusive offering just for Millennials. It is a holistic consumer offering – applicable to all generations as our parents and grandparents make the move to new channels such as addressable TV and social media. Need more info on Digital Credit Marketing? Learn More

Prescreen, prequalification and preapproval. The terms sound similar, but lenders beware. These credit solutions are quite different and regulations vary depending on which product is utilized. Let’s break it down … What’s involved with a prescreen? Prescreen is a behind-the-scenes process that screens consumers for a firm offer of credit without their knowledge. Typically, a Credit Reporting Agency, like Experian, will compile a list of consumers who meet specific credit criteria, and then provide the list to a lending institution. Consumers then see messaging like, “You have been approved for a new credit card.” Sometimes, marketing offers use the phrase “You have been preapproved,” but, by definition, these are prescreened offers and have specific notice and screening requirements. This solution is often used to help credit grantors reduce the overall cost of direct mail solicitations by eliminating unqualified prospects, reducing high-risk accounts and targeting the best prospects more effectively before mailing. A firm offer of credit and inquiry posting is required. And, it’s important to note that prescreened offers are governed by the Fair Credit Reporting Act (FCRA). Specifically, the FCRA requires lenders initiating a prescreen to: Provide special notices to consumers offered credit based on the prescreened list; Extend firm offers of credit to consumers who passed the prescreening, but allows lenders to limit the offers to those who passed the prescreening; Maintain records regarding the prescreened lists; and Allow for consumers to opt-out of prescreened offers. Lenders and the Consumer Reporting Agencies must scrub the list against the opt-outs. Finally, it is important to note that a soft inquiry is always logged to the consumer’s credit file during the prescreen process. What’s involved with a prequalification? Prequalification, on the other hand, is a consumer consent-based credit screening tool where the consumer opts-in to see which credit products they may be qualified for in real time at the point of contact. Unlike a prescreen which is initiated by the lender, the prequalification is initiated by the consumer. In this instance, envision a consumer visiting a bank and inquiring about whether or not they would qualify for a credit card. During a prequalification, the lender can actually explore if the consumer would be eligible for multiple credit products – perhaps a personal loan or HELOC as well. The consumer can then decide if they would like to proceed with the offer(s). A soft inquiry is always logged to the consumer’s credit file, and the consumer can be presented with multiple credit options for qualification. No firm offer of credit is required, but adverse action may be required, and it is up to the client’s legal counsel to determine the manner, content, and timing of adverse action. When the consumer is ready to apply, a hard inquiry must be logged to the consumer’s file for the underwriting process. How will a prequalification or prescreen invitation/offer impact a consumer’s credit report? Inquiries generated by prequalification offers will appear on a consumer’s credit report as a soft inquiry. For “soft” inquiries, in both prescreen and prequalification instances, there is no impact to the consumer’s credit score. However, once the consumer elects to proceed with officially applying for and/or accepting a new line of credit, the hard inquiry will be noted in the consumer’s report, and the credit score may be impacted. Typically, a hard inquiry subtracts a few points from a consumer’s credit score, but only for a year, depending on the scoring model. --- Each of these product solutions have their place among lenders. Just be careful about using the terms interchangeably and ensure you understand the regulatory compliance mandates attached to each. More info on Prequalification More Info on Prescreen

Personal loans have been booming for the past couple of years with double-digit growth year-over-year. But the party can’t last forever, right? In a recent Experian webinar, experts noted they have seen originations leveling off. In fact, numbers indicate it’s gone from leveled off to a slight year-over-year decline. They projected the first quarter of calendar year 2017 may also be down, but then we’ll see a peak again in the second quarter, which is typical with the seasonality often associated with personal loans. The landscape is changing. A recent data pull revealed a 9-point shift in the average VantageScore® credit score for originations from Q3 to Q4 of 2016. Lenders are digging deeper in order to keep their loan volumes up, and it is definitely a more competitive marketplace. The days where lenders were once able to grow their personal loan business with little effort are gone. Kelley Motley, Experian’s director of analytics, noted some of the personal loan origination volume shifts may be due to the rebound in the housing market and increased housing values, enabling super-prime and prime consumers to now also consider home equity loans and lines of credit, in lieu of personal loans. Still, the personal loan market is healthy. Lenders just need to be smart about their marketing efforts and utilize data to improve their response rates, expand their risk criteria to identify consumers trending upward in the credit ranks, and then retain them as their cash-flow and financial situations evolve. In the presentation, experts revealed a few interesting stats: 67% of those that open a personal installment loan had a revolving trade with a balance >$0 5% of consumer that close a personal loan reopen another within a few months of the original loan closure 68% of consumers that re-open a new personal loan within a short timeframe of closing another personal loan do so with the same company Together, these stats illustrate that individuals are largely leveraging personal loans to consolidate debt or perhaps fund an expense like a vacation or an unexpected event. Once the consumer comes into cash, they’ll pay off the loan, but consider revisiting a personal loan again if their financial situation warrants it. The calendar year Q2 peak has been consistent since the Great Recession. For many consumers, after racking up holiday debt and end-of-year expenses, the bills start coming in during the first quarter. With the high APRs often attached to revolving cards, there is a sense of urgency to consolidate and lock in a more reasonable rate. Others utilize the personal loan to fund weddings, vacations and home improvement projects. Kyle Matthies, a senior product manager for Experian, reminded participants that most people don’t need your product, so it’s essential to leverage data find those that do. Utilizing propensity score and attributes, as well as tools to dig into ability-to-pay metrics and offer alignment can really fine-tune both an organization’s marketing and retention strategies. To learn more about the current state of personal loans, access our free webinar How lenders can capitalize on the growth in personal loans.

The market is inevitably changing, and while batch and daily alerts are still effective in tackling client and consumer challenges, you are probably seeing more real-time alerts. Perhaps you were at the auto dealership applying for a car loan and you got an instant alert on your mobile app revealing there was an inquiry pulled on your credit report. Or maybe you applied for a credit card online and instead of waiting for weeks to see if you got approved, you receive notification on the spot. It’s official. We live in a world where we want immediate and instant feedback, communication, and decisions. From a client’s perspective, this means getting a credit-event alert on a customer now vs. 24 hours later. Delays can sometimes mean the difference of losing or retaining a customer. In a recent Experian survey, findings revealed consumers expect to be notified of changes to their credit profile as they occur in real time. In fact, 90 percent of Experian Members said they place a “high value on real-time alerts.” To meet these consumer expectations, clients can consider implementing a trigger solution to offer real-time notifications on inquiries, security alerts and consumer disputes. These triggering events are pushed in real-time as opposed to a 24- to 48-hour turnaround when using standard daily triggers. What are inquiry and security alert triggers? Inquiry triggers cover 13 different industries and also fraud, theft, and active-duty military alerts. They are designed specifically for financial institutions that wish to monitor their existing customer base for account management, and for consumers wanting immediate awareness, education, and protection of their credit. How do real-time triggers work in the consumer dispute process? Dispute updates can be pushed out to the consumer in real-time as opposed to the standard dispute process that takes up to 30 days to receive an update. These triggers also include freeze, thaw and lift alerts pushed in real-time as opposed to the typical 24- to 48-hour turnaround when using standard daily triggers. These alerts are designed specifically for consumers wanting immediate awareness, education, and protection of their credit. Other than the speed of delivery, are there any other differences between daily vs. real-time triggers? Instead of having the files run nightly with the trigger report being sent to the client every morning through a STS delivery method, the real-time events are pushed via Cloud or STS delivery method. Clients can retrieve these events at their own pace. Implementation time takes around two weeks. Are there additional opportunities to utilize real-time triggers? In addition to real-time inquiry alerts designed for companies to monitor their existing customer base for retention purposes, Experian also offers real-time inquiry alerts for prospecting and marketing purposes. This means financial institutions can identify which consumers are shopping for new credit in real-time. As a result, immediate firm offers of credit or cross-sell offers could be sent to consumers before it’s too late.

You know what I love getting in the mail? Holiday cards, magazines, the occasional picturesque catalog. What I don’t open? Credit card offers, invitations to apply for loans and other financial advertisements. Sorry lenders, but these generally go straight into my shredder. Your well-intentioned efforts were a waste in postage, printing and fulfillment costs, and I’m guessing my mail consumption habits are likely shared by millions of other Americans. I’m a cusper, straddling the X and Millennial generations, and it’s no secret people like me have grown accustomed to living on our mobile devices, shopping online and managing our financial lives digitally. While many retailers have wised up to the trends and shifted marketing dollars heavily into the digital space, the financial services industry has been slow to follow. I’m hoping 2017 will be the year they adapt, because solutions are emerging to help lenders deliver firm offers of credit via email, display, retargeting and even social media platforms. There are multiple reasons to make the shift to digital credit marketing. It’s trackable. The beauty of digital marketing is that it can be tracked much more efficiently over direct mail efforts. You can see if offer emails are opened, if banners are clicked, if forms are completed and how quickly all of this takes place. In short, there are more touchpoints to measure and track, and more insights made available to help with marketing and offer optimization. It’s efficient. A solid digital campaign means you now have more flexibility. And once those assets start to deploy and you begin tracking the results, you can additionally optimize on the fly. Subject line not getting the open rate you want? Test a new one. Banners not getting clicked? Change the creative. A portion of your target audience not responding? Capture that feedback sooner rather than later, and strategize again. With direct mail, the lag time is long. With digital, the intelligence gathering begins immediately. It’s what many consumers want. They are spending 25% of their time on mobile devices. Research has found they check their phones and average 46 times per day. They are bouncing from screen to screen, engaging on desktops, tablets, smartphones, wearables and smart TVs. If you want to capture the eyeballs and mindshare of consumers, financial marketers must embrace the delivery of digital offers. Consumer behaviors have evolved, so must lenders. Sure, there is still a place for direct mail efforts, but it would be wasteful to not embrace the world of digital credit marketing and find the right balance between offline and online. It’s a digital world. It’s time financial institutions join the masses and communicate accordingly.

Let’s play word association. When I say holiday season, what’s the first thing that comes to mind? Childhood memories. Connecting with family. A special dish mom used to make. Or perhaps it’s budgeting, debt and credit card spend. The holidays can be a stressful time of year for consumers, and also an important time for lenders to anticipate the aftermath of big credit card spend. According to a recent study by Experian and Edelman Intelligence: 48 percent of respondents felt thoughtful when thinking about the season 30 percent felt stressed 24 percent felt overwhelmed. Positive emotions are up across the board this year, which may be a good sign for retailers and bankcard lenders. And if emotion is an indicator of spending, 2016 is looking good. But while the holly-jolly sentiment is high, 56 percent of consumers say holiday shopping puts a strain on their finances. And, 43 percent of respondents said the stress of holiday shopping makes it difficult to enjoy the season. Regardless of stress, consumers are seeking ways to spend. Nearly half of respondents plan to use a major credit card to finance at least a portion of their holiday spending, second only to cash. With 44 percent of consumers saying they feel obligated to spend more than they can afford, it’s easy to see why credit cards are so important this time of year. Bankcard originations have fully rebounded from the recession, exceeding $104 billion in the third quarter of 2016, the highest level since the fourth quarter of 2007. While originations have rebounded, delinquency rates have remained at historic lows. The availability of credit is giving consumers more purchasing power to fund their holiday spending. But what happens next? As it turns out, many consumers resolve to consolidate all that holiday debt in the new year. Experian research shows that balance transfer activity reaches annual highs during the first quarter as consumers seek to simplify repayment and take advantage of lower interest rates. Proactive lenders can take advantage of this activity by making timely offers to consumers in need. At the same time, reactive lenders may feel the pain as balances transfer out of their portfolio. By identifying consumers who are most likely to engage in a card-to-card balance transfers, lenders can anticipate these consumer bankcard trends. The insights can then be used to acquire new customers and balances through prescreen campaigns, while protecting existing balances before they transfer out of an existing lender portfolio. With Black Friday and Cyber Monday behind us, the card balances are likely already rising. Now is the time for lenders to prepare for the January and February consolidations. Those hefty credit card statements are coming soon.

Consumers want to pay less. This is true in retail and in lending. No big surprise, right? So in order for lenders to capitalize and identify the right consumers for their respective portfolios, they need insights. Lenders want to better understand what rates consumers have. They want to know how much interest their customers pay. They want to know if consumers within their portfolio are at risk of leaving, and they want visibility into new prospects they can market to in an effort to grow. Luckily, lenders can look to trade level fields to be in the know. These inferred data fields, powered by Trended Data, allow lenders to offer products and terms that serve two purposes: First, their use in response models and offer alignment strategies drive better performance, ROI and life-time value. As noted earlier, consumers want to pay less, so if they are offered a better rate or money-saving offer, they’re more likely to respond. Second, they ultimately save consumers money in a way that benefits each consumer’s unique financial situation- overall savings on interest paid over the life of the loan, or consolidation of other debt often combined for a lower monthly payment. These trade level fields allow lenders to dig into various trends and insights surrounding consumers. For example, Experian data can identify big spenders and transactors (those who pay off their purchases every month). Research reveals these individuals love to be rewarded for how they use credit, demanding rewards, airline miles or other goodies for the spending they do. They also really like to be rewarded with higher credit lines, whether they use the increased line or not. Fail to serve these transactors in the right way and lenders could be faced with lackluster performance in the form poor response rates, booking rates, activation rates and early attrition. Thus, a little trade level insight can go a long way in helping lenders personalize products, offers and anticipate future financial needs. Knowing the profitability of a customer across all of their accounts is important, and accessing this intelligence in a seamless way is ideal. The data exists. For lenders, it’s just a matter of unlocking it, making those small, but meaningful changes and keeping a pulse on the portfolio. Together, these strategies can help lenders keep their best customers and acquire new ones that stick around longer.

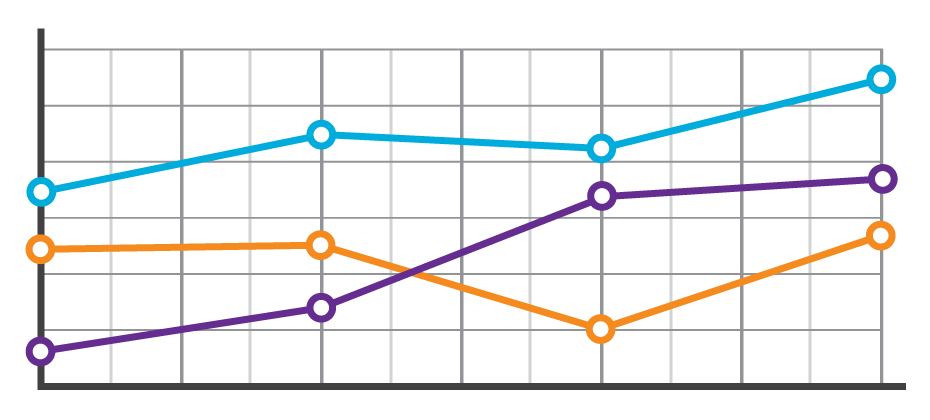

As regulators continue to warn financial institutions of the looming risk posed by HELOCs reaching end of draw, many bankers are asking: Why should I be concerned? What are some proactive steps I can take now to reduce my risk? This blog addresses these questions and provides clear strategies that will keep your bank on track. Why should I be concerned? Just a quick refresher: HELOCs provide borrowers with access to untapped equity in their residences. The home is taken as collateral and these loans typically have a draw period from five to 10 years. At the end of the draw period, the loan becomes amortized and monthly payments could increase by hundreds of dollars. This payment increase could be debilitating for borrowers already facing financial hardships. The cascading affect on consumer liquidity could also impact both credit card and car loan portfolios as borrowers begin choosing what debt they will pay first. The breadth of the HELOC risk is outlined in an excerpt from a recent Experian white paper. The chart below illustrates the large volume of outstanding loans that were originated from 2005 to 2008. The majority of the loans that originated prior to 2005 are in the repayment phase (as can be seen with the lower amount of dollars outstanding). HELOCs that originated from 2005 to 2008 constitute $236 billion outstanding. This group of loans is nearing the repayment phase, and this analysis examines what will happen to these loans as they enter repayment, and what will happen to consumers’ other loans. What can you do now? The first step is to perform a portfolio review to assess the extent of your exposure. This process is a triage of sorts that will allow you to first address borrowers with higher risk profiles. This process is outlined below in this excerpt from Experian’s HELOC white paper. By segmenting the population, lenders can also identify consumers who may no longer be credit qualified. In turn, they can work to mitigate payment shock and identify opportunities to retain those with the best credit quality. For consumers with good credit but insufficient equity (blue box), lenders can work with the borrowers to extend the terms or provide payment flexibility. For consumers with good credit but sufficient equity (purple box), lenders can work with the borrowers to refinance into a new loan, providing more competitive pricing and a higher level of customer service. For consumers with good credit but insufficient equity (teal box), a loan modification and credit education program might help these borrowers realize any upcoming payment shock while minimizing credit losses. The next step is to determine how you move forward with different customers segments. Here are a couple of options: Loan Modification: This can help borrowers potentially reduce their monthly payments. Workouts and modification arrangements should be consistent with the nature of the borrower’s specific hardship and have sustainable payment requirements. Credit Education: Consumers who can improve their credit profiles have more options for refinancing and general loan approval. This equates to a win-win for both the borrower and lender. HELOCs do not have to pose a significant risk to financial institutions. By being proactive, understanding your portfolio exposure and helping borrowers adjust to payment changes, banks can continue to improve the health of their loan portfolios. Ancin Cooley is principal with Synergy Bank Consulting, a national credit risk management and strategic planning firm. Synergy provides a rangeof risk management services to financial institutions, which include loan reviews, IT audits, internal audits, and regulatory compliance reviews. As principal, Ancin manages a growing portfolio of clients throughout the United States.