Tag: covid-19

The COVID-19 pandemic created a global shift in the volume of online activity and experiences over the past several months. Not only are consumers increasing their usage of mobile and digital channels to bank, shop, work and socialize — and anticipating more of the same in the coming months — they’re closely watching how businesses respond to their needs. Between late June and early July of this year, Experian surveyed 3,000 consumers and 900 businesses to explore the shifts in consumer behavior and business strategy pre- and post-COVID-19. More than half of businesses surveyed believe their operational processes have mostly or completely recovered since COVID-19 began. However, many consumers fear that a second wave of COVID-19 will further deplete their already strained finances. They are looking to businesses for reassurance as they shift their behaviors by: Reducing discretionary spending Building up emergency savings Tapping into financial reserves Increasing online spending Moving forward, businesses are focusing on short-term investments in security, managing credit risk with artificial intelligence, and increasing online customer engagement. Download the full report to get all of the insights into global business and consumer needs and priorities and keep visiting the Insights blog in the coming weeks for a deeper dive into US-specific findings. Download the report

In today’s uncertain economic environment, the question of how to reduce portfolio volatility while still meeting consumers’ needs is on every lender’s mind. With more than 100 million consumers already restricted by traditional scoring methods used today, lenders need to look beyond traditional credit information to make more informed decisions. By leveraging alternative credit data, you can continue to support your borrowers and expand your lending universe. In our most recent podcast, Experian’s Shawn Rife, Director of Risk Scoring and Alpa Lally, Vice President of Data Business, discuss how to enhance your portfolio analysis after an economic downturn, respond to the changing lending marketplace and drive greater access to credit for financially distressed consumers. Topics discussed, include: Making strategic, data-driven decisions across the credit lifecycle Better managing and responding to portfolio risk Predicting consumer behavior in times of extreme uncertainty Listen in on the discussion to learn more. Experian · Effective Lending in the Age of COVID-19

As the COVID-19 pandemic continues to create uncertainty for the U.S. economy, different states and industries have seen many changes with each passing month. In our July edition of the State of the Economy report, written by Principal Economist Joseph Mayans, we’ll be breaking down the data that financial institutions can use to navigate a recovery. Labor markets and state-level employment impact Prior to the pandemic, unemployment in the U.S. was at a 50-year low, at an astonishing rate of 3.5%. Following the start of the pandemic, research shows that unemployment rose from 6.2 million in February to 20.5 million in May 2020, and sent the unemployment rate soaring to 14.7%. However, the data from last month’s State of the Economy Report revealed that the unemployment rate began to decline, with 46 states seeing rises in new job opportunities. Although unemployment started to increase, many states (like Nevada) saw a 25.3% unemployment rate statewide. The numbers for June are much more promising, and reveal a continuous uptick in the number of jobs added. The unemployment rate in the U.S. also fell from 13.3% to 11.1%. The impact to industries COVID-19 had major impacts on every industry in the U.S., with the leisure and hospitality industry being the hardest-hit at 7.7 millions job lost. According to CNBC, “The large number of layoffs in this industry led the U.S. economy to its worst month of job losses in modern history.” However, job growth for the leisure and hospitality industry began to gain momentum in May, with 1.2 million jobs added. This can be attributed to a slow and gradual rollback of stay-at-home orders nationwide. As of June 2020, 4.8 million jobs have been added to this industry. The trade, transportation, and utilities, as well as education and health services, manufacturing, and business services industries also saw improvements in employment. The impact to retail sales Clothing stores, furniture, and sporting goods stores were only a few of the many retailers that saw heavy declines following lockdown orders. After two consecutive months of decline, retail sales finally rebounded by 17.7% in May, with the largest gains occurring in clothing stores (+188%). In June, retail sales continued to rise substantially, resulting in saw a v-shaped bounce. However, with unemployment benefits nearing the expiration date and the number of pandemic cases continuing to increase, recovery remains tentative. Our State of the Economy report also covers manufacturing, homebuilders, consumer sentiments, and more. To see the rest of the data, download our report for July 2020. We’ll be sharing a new report every month, so keep an eye out! Download Now

Do consumers pay certain types of credit accounts before others during financial distress? For instance, do they prioritize paying mortgage bills over credit card bills or personal loans? During the Great Recession, the traditional notion of payment priority among multiple credit accounts was upended, throwing strategies employed by financial institutions into disarray. Similarly, current circumstances in the context of COVID-19 might cause sudden shifts in prioritization of payments which might have a dramatic impact on your credit portfolio. Financial institutions would be better able to forecast and control exposure to credit risk, and to optimize servicing practices such as forbearance and collections treatments if they could understand changing customer payment behaviors and priorities of their existing customers across all open trades. Unfortunately, financial institutions’ data—including their own behavioral data and refreshed credit bureau data--are limited to information about their own portfolio. Experian data provides insight which complements the financial institutions’ data expanding understanding of consumer payment behavior and priorities spanning all trades. Experian recently completed a study aimed at providing financial institutions valuable insights about their customer portfolios prior to COVID-19 and during the initial months of COVID-19. Using the Experian Ascend Technology Platform™, our data scientists evaluated a random 10% sample of U.S. consumers from its national credit file. Data from multiple vintages were pulled (June 2006, June 2008 and February 2018) and the payment trends were studied over the subsequent performance period. Experian tabulated the counts of consumers who had various combinations of open and active trade types and selected several trade type combinations with volume to differentiate performance by trade type. The selected combinations collectively span a variety of scenarios involving six trade types (Auto Loans, Bankcard, Student Loan, Unsecured Personal Loans, Retail Cards and First Mortgages). The trade combinations selected accommodate a variety of lenders offering different products. For each of the consumer groups identified, Experian calculated default rates associated with each trade type across several performance periods. For brevity, this blog will focus on customers identified as of February 2018 and their subsequent performance through February 2020. As the recession evolves and when the economy eventually recovers, we will continue to monitor the impacts of COVID-19 on consumer payment behavior and priorities and share updates to this analysis. Consumers with Bankcard, Mortgage, Auto and Retail accounts Among consumers having open and recently active Bankcard, Mortgage, Auto and Retail accounts, bankcard delinquency was highest throughout the 24-month performance window, followed by Retail. Delinquency rates for Auto and Mortgage were the lowest. During the pre-COVID-19 period, consumers paid their secured loans before their unsecured loans. As demonstrated in the table below, customer payment priority was stable across the entire 24-month period, with no significant shift in payment priorities between trade types. Consumers with Unsecured Personal Loan, Retail Card and Bankcard accounts. Among consumers having open and recently active Unsecured Personal Loan, Retail Card and Bankcard accounts, consumers are likely to pay unsecured personal loans first when in financial distress. Retail is the second priority, followed by Bankcard. KEY FINDINGS From February 2018 through April 2020, relative payment priority by trade type has been stable Auto and Mortgage trades, when present, show very high payment priority Download the full Payment Hierarchy Report here. Download Now Learn more about how Experian can create a custom payment hierarchy for the customers in your own portfolio, contact your Experian Account Executive, or visit our website.

Consumer sentiment can help automotive marketers create a more human connection with consumers.

Experian recently released its Q1 2020 Market Trends report, which provides insights about the vehicles on the road and the most popular vehicle segments.

Origination data from April and May provide some insight into the more immediate effects of the pandemic on the automotive industry.

Experian’s Chris Ryan and Bobbie Paul recently re-joined David Mattei from Aite to discuss how emerging fraud trends and changes in consumer behavior will have long-term impacts on businesses. Chris, Bobbie, and David have combined experience of more than 60 years in the world of fraud prevention. In this discussion, they bring that experience to bear as they review how businesses should revise their long-term fraud strategy in response to COVID-19 and the subsequent economic shifts, including: The requirements to authenticate a digital customer Businesses’ technology challenges Differentiating between first party and third party fraud The importance of businesses’ technology investment How to build a roadmap for the next 90 days and beyond Experian · Make Your Fraud Plan Recession-Ready: Your 90 Day and Beyond Plan

Every few months we hear in the news about a fraud ring that has been busted here in the U.S. or in another part of the world. In May, I read about a fraud ring based in Georgia and Louisiana that bought 13,000 stolen identities of children who were on the Louisiana Medicaid program and billed the government for services not rendered. This group defrauded the Medicaid program of more than $500,000. This is just one of many stories that we hear about fraud rings, and given the rapidly changing economic environment, now is the time for businesses to think about how to protect against fraud rings. There are a number of challenges that organizations may have when it comes to sharing trends and collaborations, understanding the ways to tie fraud rings together, creating treatments for identifying fraud rings and ways to store and catalogue fraud ring experiences so they can be easily recognized. The trouble with identifying fraud rings It’s important to understand the challenges that organizations have because they see the fraud rings through their own internal lens. Here are a few of the top things businesses should work on: Think like a fraudster. This will help businesses become more creative in their approach to fraud prevention. Facilitate internal collaboration. Share with in-organization partners. Sometimes this can be difficult due to organizational structure. Promote external collaboration. Intel-sharing groups are a great way for businesses to network within their industries and learn about the fraud that others are seeing. An organization that I’ve worked with in the past is the National Cyber Forensic and Training Alliance (NCFTA). Putting the pieces together How do businesses identify a fraud ring? There are three steps to get started. The first is reviewing and understanding the data. Fraudsters are lazy and want to replicate the process over and over again, and because of this there is always some piece of information that is repeated. It could be a name, an email address, device fingerprint, or similar. The second step is tying the fraud ring together. This is done by creating rules to help identify the trends. Having rules in place to identify fraud rings allows businesses to easily pull stats together for their leadership. Lastly, applying an acronym or name to the particular fraud ring and adding comments to the cases associated with a particular ring will help with post-investigation analysis. Learning from the past Before I became a consultant, I remember identifying a fraud ring that was submitting events with the same language pack and where the device fingerprint was staying consistent. Those events were being referred out for review and marked with the same note. At a post-mortem review, I was able to talk to the fraud ring we had seen, and it was easy to pull all events associated with this fraud ring because my team had marked the events with the same comments. Another fraud ring example happened a few years ago. A client called me and said that they were under a fraud attack and this fraud ring was rotating the email handle. I reviewed the data and came up with a rule to catch this activity. Fraud rings will use email handle rotation to help them keep track of accounts that are opened or what emails they used in the past. By coupling the email handle rotation with an email verification service like Emailage, this insight could be very telling. I would assume that when fraud rings use email handle rotation these emails are new and have just been created. These are just a few of the many fraud rings that I’ve encountered over the course of my career and I’m sure there will be a lot more in the years to come. The best advice I can give to anyone that reads this post is to understand the data that you are reviewing, look for anomalies within the data, ask questions and test your theories by running queries on the data that you’re reviewing. I would love to hear about the different fraud rings that you’ve encountered over your career. Stay safe. Contact us

Experian’s own Chris Ryan and Bobbie Paul recently joined David Mattei from Aite to discuss the latest research and insights into emerging fraud schemes and how businesses can combat them in light of COVID-19 and the resulting economic changes. Between them, Chris, Bobbie, and David have more than 60 years of experience in the world of fraud prevention. Listen in as they discuss how businesses can shape their fraud prevention plan in the short term, including: The impacts of the health crisis and physical distancing The rise of e-commerce and consumer digital engagement Changes in criminal activity Fraud attack vectors 2020 fraud loss projections Critical next steps for the 30-60 day time frame Experian · Make Your Fraud Plan Recession-Ready: 2020 Fraud Trends

Account management is a critical strategy during any type of economy (pro-cycle, counter-cycle, cycle neutral). In times like these, marked by economic volatility, it is an effective way to identify which parts of your portfolio and which of your consumers need the most attention. Check out this podcast where Cyndy Chang, Senior Director of Product Management, and Craig Wilson, Senior Director of Consulting, discuss the foundational elements of account management, best practices and use cases. Account management today looks very different than what it has been during over a decade of growth proactive; account review is a critical part of navigating the path forward. Questions that need to be addressed include: Do you have the right data? Are you monitoring between data loads? Are you reviewing accounts at the frequency that today’s changing demands require? Listen in on the discussion to learn more. Experian · Look Ahead Podcast

Today, Experian and Oliver Wyman launched the Ascend Portfolio Loss ForecasterTM, a solution built to help lenders make better decisions – during COVID-19 and beyond – with customized forecasts and macroeconomic data. Phrases like “the new normal,” “unprecedented times,” and “extreme economic volatility” have flooded not only media for the last few months, but also financial institutions’ strategic discussions regarding plans to move forward. What has largely been crisis response is quickly shifting to an urgent need to answer the many questions around “Will we survive this crisis?,” let alone “What’s next?” And arguably, we’ve entered a new era of loss forecasting. After the longest period of economic growth in post-war U.S. history, previously built models are not sufficient for the unprecedented and sudden changes in economic conditions due to COVID-19. Lenders need instant insights to assess impact and losses to their portfolios. The Ascend Portfolio Loss Forecaster combines advanced modeling from Oliver Wyman, pandemic-specific insights and macroeconomic scenarios from Oxford Economics, and Experian’s quality data to analyze and produce accurate loan loss forecasts. Additionally, all of the data, including the forecasts and models, are regularly updated as macroeconomic conditions change. “Experian’s agility and innovative technologies allow us to help lenders make informed decisions in real time to mitigate future risk,” said Greg Wright, chief product officer of Experian’s Consumer Information Services, in a recent press release. “We’re proud to work with our partners, Oxford Economics and Oliver Wyman, to bring lenders a product powered by machine learning, comprehensive data and macroeconomic forecast scenarios.” Built using advanced modeling and expert scenarios, the web-based application maximizes the more than 15 years of Experian’s loan-level data, including VantageScore® credit score, bankruptcy scores and customer-level attributes. Financial institutions can gauge loan portfolio performance under various scenarios. “It is important that the banks take into account the evolving credit behaviors due to the COVID-19 pandemic, in addition to the robust modeling technique for their loss forecasting and strategic decisioning,” said Anshul Verma, senior director of products at Oliver Wyman, also in the release. “With the Ascend Portfolio Loss Forecaster, lenders get robust models that work in the current conditions and take into account evolving consumer behaviors,” Verma said. To watch Experian’s webinar on portfolio loss forecasting, please click here and to learn more about the Ascend Portfolio Loss Forecaster, click the button below. Learn More

The COVID-19 pandemic and resulting rush to transition to a remote lifestyle made it clear that many businesses need a refreshed digital authentication and fraud prevention strategy that includes an investment in technology and provides consumer assurance. This is particularly important when it comes to identity, as many of the standard in-person verification methods and tools are currently unavailable. The meaning of identity is growing and shifting Technology trends are intersecting with social trends to create heightened awareness, and a whole new public conversation has emerged around customer trust and privacy. Attitudes and ideas are changing—even to the point of what we mean by “identity.” An identity is no longer just a name, date of birth, and SSN. Now, there are digital manifestations everywhere you look: screen names, email addresses, mobile phone numbers, device identifiers, and the other “exhaust” we leave behind as we travel the internet. This leads to concerns about what an identity is, who owns it, and who manages and protects it. Businesses have to be able to prove to their ability to protect their customers’ identities through investment in technology and a robust fraud strategy. Consumer attitudes are changing Several years ago, consumers were excited by all the new digital capabilities and the speed, ease, and convenience they provided. Last year, Experian found that consumers still wanted those things, with 70% willing to provide more information to businesses if there was a perceived benefit. However, they also wanted more security in the balance. In Experian’s most recent Global Identity and Fraud Report, we found that 74% of consumers say that security is the most important factor when deciding to engage with a business. Consumers are particularly more tolerant of friction during the enrollment process—as a means of building trust. But, when they return to the app or website, they want to be recognized. This means achieving a balance by using layered technologies, some of which are active and visible to the consumer, and some of which are invisibly working in the background to confirm the identity of returning consumers. Consumer attitudes vs. regulatory pressure The drivers behind the business changes are twofold: shifting consumer attitudes and regulatory changes. While regulations are becoming stricter on a national and global level, they’re not keeping pace with technology and social change. The digital world is evolving at a rapid pace, opening up more new ways for companies to collect information about consumers and use it to identify and verify, and also to target goods and services. With all of this data available, it’s important for businesses to use the tools in the market to help protect identity information. Next steps in technology The bottom line is, businesses can’t wait for regulations to dictate how best to protect information. Instead, they should be looking to technologies like physical and behavioral biometrics to help provide identity authentication and protection – layering those solutions with information from the user and from third parties to give a holistic consumer view. Businesses should adopt a platform approach for identity and fraud in order to be able to adapt quickly, whether to incorporate new kinds of technology or to prevent emerging types of fraud. By investing in technology now, even in the midst of the COVID-19 pandemic, businesses can build the flexibility needed to respond to future crises and help offset future fraud losses. In turn, those fraud-loss savings can then be used to help grow the business in the future. Learn more about Experian’s commitment to helping businesses maximize their investment in technology to safeguard against fraud. Learn more

Rays of hope are beginning to shine in the economy that suggest the U.S. may have moved beyond the most acute phase of the economic crisis. The housing sector, in particular, looks poised to regain momentum and perhaps lead the path towards stabilization in the second half of 2020. A “V-Shaped” rebound in mortgage applications Despite record levels of unemployment and widespread economic uncertainty, homebuyers have returned to the market with conviction. After shelter-in-place restrictions curtailed open-house visits and crimped buyer demand in early April, applications to purchase a home have risen for six consecutive weeks, according to the Mortgage Bankers Association. The latest data for the week of May 22nd, indicate that purchase applications were 9% higher than during the same period in 2019. If this trend continues, it will show that significant pent-up demand exists in the housing market that may be able to offset some of the lost spring buying season. April new home sales far exceed expectations After declining by 13.7% in March, new home sales rose a modest 0.6% in April. While this was only a slight gain, it was considerably above economists’ projections of a fall of 20% and may mark the turning point in the downtrend. Since the recording of new home sales data occurs when the purchase contract is signed or a deposit is accepted – and is typically for a house that hasn’t been built yet or is currently under construction – it provides a gauge of how buyers feel about their future economic prospects. Building a home also requires hiring new construction workers, buying building supplies, and supporting a host of ancillary industries, thus making it an indicator of further economic activity. Some of the increase in demand for new homes may have been driven by coronavirus quirks. The number of existing homes on the market is at record lows and many people may have been reluctant to put their home up for sale and have buyers tour as health concerns remain. Buyers, as well, may have preferred to steer clear of occupied homes or were unable to make in-person visits due to shelter-in-place restrictions. This lack of options for home buyers, coupled with record-low mortgage rates, likely drove sales of new homes higher. However, for the same reasons why new home sales rose, pending sales for existing homes fell sharply. In April, the National Association of Realtors reported that sales declined by 21.8%, which is the largest drop in ten years. Home prices continue to gain ground Even with shelter-in-place restrictions dampening buyer demand in early April, home values have continued to rise. This is because the supply of homes on the market also contracted, resulting in a simultaneous drop of demand and supply. According to Zillow Research, the total inventory of homes for sale is down roughly 20% from this time last year. With fewer competing homes on the market, sellers have been reluctant to slash prices and are betting that the lack of options and low mortgage rates will keep buyers on the hook. In April, U.S. home values rose 4.3% from the year before. The states with the strongest growth were Idaho (9.8%), Arizona (8.5%), Maine (7.6%), and Washington (7.4%). It will be interesting to see if this pattern of growth changes as newly implemented work from home policies may shift where people prefer to live and work. Why it matters The housing market has an outsized influence on the overall direction of the U.S. economy. Housing is not only is a big contributor to economic growth, but many owners have a large portion of their wealth tied up in their home. If the housing market can find its footing in the second half of 2020, then it could set the stage for an eventual economic recovery. Learn more

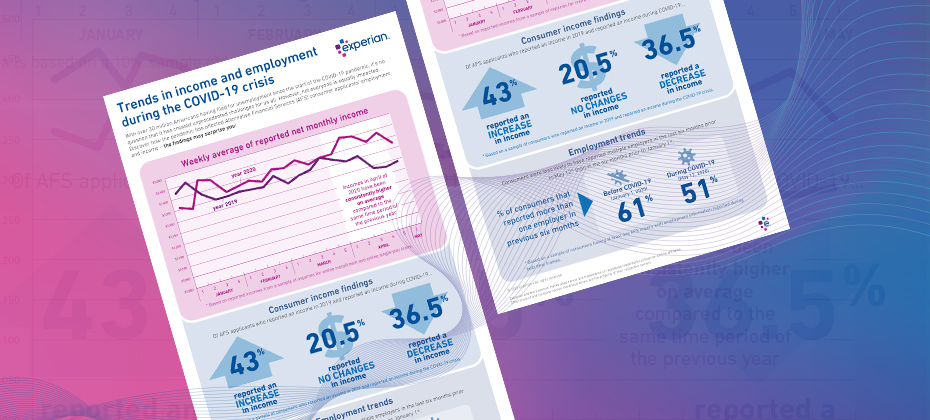

With many individuals finding themselves in increasingly vulnerable positions due to COVID-19, lenders must refine their policies based on their consumers’ current financial situations. Alternative Financial Services (AFS) data helps you gain a more comprehensive view of today's consumer. The COVID-19 pandemic has had far-reaching economic consequences, leading to drastic changes in consumers’ financial habits and behavior. When it comes to your consumers, are you seeing the full picture? See if you qualify for a complimentary hit rate analysis Download AFS Trends Report