Tag: credit trends

The economic expansion just passed the eight-year mark, and consumer credit defaults across mortgages, bankcards and auto loans are at pre–financial crisis levels. More specifically: The first-mortgage default rate dropped 4 basis points from May to 0.60%. The bankcard default rate experienced its first drop in 9 months, with a decrease of 4 basis points bringing it to 3.49%. Auto loan defaults decreased 3 basis points from the previous month to 0.82%. With inflation at 1% to 2%, debt service levels close to record lows, and disposable income increasing and supporting spending growth, consumers are in good financial shape nationally. Lenders should take this opportunity to review and adjust their acquisition strategies accordingly. Can your originations platform capitalize on this?

1 in 10 Americans are living paycheck to paycheck Financial health means more than just having a great credit score or money in a savings account. It includes being able to manage daily finances, save for the future and weather a financial shock. Here are some facts about Americans’ financial health: 46% of Americans are struggling financially. Roughly 31% of nonretired adults have no retirement savings or pension. Approximately 50% are unprepared for a financial emergency, and about 1 in 5 have no savings set aside to cover unexpected emergencies. It’s never too late for people to achieve financial health. By providing education on money management, you can drive new opportunities for increased engagement, loyalty and long-term revenue streams. Why financial health matters >

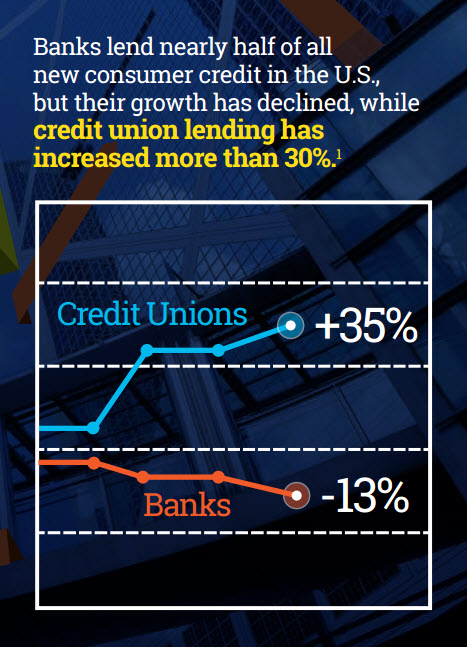

The State of Credit Unions 2017 In the financial services universe, there is no shortage of players battling for consumer attention and share of wallet. Here’s a look at how one player — credit unions — has fared over the past two years compared to banks and online lenders: Personal loans grew 2%, but online lenders and finance companies still own 51% of this market. Card originations at credit unions increased 18%, with total credit limits on newly originated cards approaching $100 billion in Q1 2017. Mortgage market share rose 7% for credit unions, while banks lost share to online lenders. Auto originations increased 25% for credit unions to 1.93 million accounts in Q1 2017. Whether your organization is a credit union, a financial institution or an online lender, a “service first” mentality is essential for success in this highly competitive market. The State of Credit Unions 2017

Summer spending A study by Experian and Edelman Berland noted that travelers relied heavily on credit for vacation purchases last year — with many planning to charge more than half of their vacation expenses this summer. Of those surveyed about their 2015 summer purchases: 86% spent money on a summer vacation in 2015. $2,275 was spent per person, with $1,308 of that being credit card purchases. 35% hadn’t saved in advance. 61% spent more than they planned. Summer brings vacations and credit card use. By identifying consumer credit trends like these, you can target new customers and identify balance transfer opportunities. Learn more>

A recent analysis revealed a 9-point negative shift in the average VantageScore® credit score for personal loan originations from Q3 to Q4 of 2016. Additional insights into the personal loan market include: 67% of those who opened a personal installment loan had a revolving trade with a balance. 5% of consumers who close a personal loan open another within a few months of the original loan closure. 68% of consumers who open a new personal loan shortly after closing another one do so with the same company. Lenders must dig deeper to keep their loan volumes up in today’s competitive marketplace. Using a propensity score and attributes, as well as tools to learn more about ability-to-pay metrics and offer alignment, can improve your organization’s marketing and retention strategies. Learn more>

Big changes for the new year 2017 is expected to bring some big changes. But what do those changes mean for the financial services space? Here are 3 trends and twists Experian expects to occur over the next 12 months: Trump and the Republican-controlled Congress will move forward with a deregulatory agenda. Recognizing and scoring more previously invisible consumers through alternative data sources will be emphasized. Personalized credit offers delivered via multiple digital channels in a sequenced, trackable manner. What are your predictions for 2017? Only time will tell, but we’re certain that regulations and advancements in digital will be huuuge. >>More 2017 trends

It’s the “Battle of the Sexes” credit edition. Who sports higher scores, less debt and more on-time payments? According to Experian’s latest analysis, women take the credit title. Thank you very much. The report analyzed multiple categories including credit scores, average debt, number of open credit cards, utilization ratios, mortgage amounts and mortgage delinquencies of men and women in the United States. Results revealed: Women’s average credit score of 675 compared to men’s score of 670 Women have 3.7 percent less average debt than men Women have 23.5 percent more open credit cards Women and men have the same revolving utilization ratio of 29.9 percent Women’s average mortgage loan amount is 7.9 percent less than men’s Women have a lower incidence of late mortgage payments by 8.1 percent “There were several gaps between men and women in this study, including the five-point credit score lead that the women hold,” said Michele Raneri, Experian’s Vice President of Analytics and New Business Development. “Even with more credit cards, women have fewer overall debts and are managing to pay those debts on time.” The report also takes a look at the vehicle preferences of men and women and how those choices play into their overall credit and financial health. Below are the top-line results: Women were more likely to purchase a more functional, utilitarian vehicle, while men tended to lean toward sports cars and trucks The top three vehicle segments men purchased in 2015 were mid-size pickup trucks, large pickup trucks and standard specialty cars. In fact, they were 1.37 times more likely to purchase a mid-sized pickup truck than the general population The top three vehicle segments for women were small crossover-utility vehicles, mid-size sports-utility vehicles and compact crossover-utility vehicles. Women were 1.40 times more likely to purchase the small crossover-utility vehicle than the general population Experian conducted a similar study, comparing men and women on various credit attributes in 2013. At that time, women also scored higher than men in the credit score category - holding steady with a 675 VantageScore® credit score compared to the men’s 674 VantageScore® credit score, but the gap has widened, with the men’s score further lowering to 670. While men’s scores have dropped since 2013, the overall financial health for both sexes is strong. Most notably, the mortgage 60-plus delinquency rate has dropped significantly. In the 2013 pull, men were tracking at 5.7 percent and women were 5.3 percent. Today, those numbers have dropped to .86 percent for men and .79 percent for women. What a difference a few years has made in regards to the recovering housing market. Time will tell if the country’s state of credit will continue to trend higher, as indicated in the 2015 annual report, or if the buzz of potential recession and an election year will reverse the positive trend. As for now, the women once again claim bragging rights as it pertains to credit. Analysis methodology The analysis is based on a statistically relevant, sampling of depersonalized data of Experian’s consumer credit database from December 2015. Gender information was obtained from Experian Marketing Services.

Experian data shows consumers are more confident managing their credit since the recession. The Q3 2015 Experian Market Intelligence Brief was released today featuring data that highlights consumer credit card debt has now reached its highest level since Q4 2009. Credit card debt levels reached $650 billion in Q3 2015, the highest it has been since Q4 2009 when it was $667 billion. Credit card delinquency rates on outstanding balances 60 or more days past due have decreased 71 percent during the same time period. Combining those indicators with the national unemployment rate dropping 50 percent during the same span illustrates a positive economic outlook on credit card trends among lenders and consumers. “Overall credit card limits have increased 102 percent since Q4 2009 with $82 billion originated in Q3 2015,” said Kelly Kent, vice president of Experian Decision Analytics. “The increase in limits from lenders and the steady climb in credit card debt combined with exceptional delinquency rates signals greater confidence among consumers as they are showing more assurance in managing their credit since the recession. We expect to see credit card debt increase in Q4 based on historical seasonal trends driven by the holiday shopping season especially with the early positive holiday sales as a sign.” The Q3 2015 Experian Market Intelligence Brief report is now available.

Using bankcard utilization to forecast holiday spend It’s officially November, and like me, you’ve probably noticed all the holiday promotions in your mailbox and inbox. With only a brief window of holiday shopping available, it’s a retailer’s race to get consumer discretionary dollars. As we near the end of 2015, the U.S. economy continues to improve steadily, and consumers are cautiously optimistic about their financial well-being. National unemployment[i] is down to 5.1 percent, and while the Consumer Confidence Index®[ii] slipped to 97.6 in October, it is still higher than it was at the end of 2014. So will the U.S. consumer spend more this holiday season? One way to measure this behavior is through bankcard utilization rates — i.e., how much of their available credit consumers use. Overall, average bankcard utilization didn’t show much movement in Q3 2015, averaging 20.6 percent, compared with 20.3 percent the year before (a 1.5 percent increase).[iii] However, when we look at utilization rates by VantageScore® credit score tier, we see not only varying year-over-year (YOY) changes among consumer risk segments, but, more importantly, significant disparity in the overall usage of available credit. Q3 2014 Q3 2015 YOY increase Super Prime (781-850) 5.5% 5.6% 1.8% Prime (661-780) 27.4% 27.8% 1.4% Near Prime (601-660 63.8% 64.5% 1.2% Subprime (501-600) 76.1% 78.4% 3.1% Deep Subprime (300-500) 94.7% 97.6% 3.1% Super-prime consumers use less than 6 percent of their available credit limits, while consumers in the deep-subprime tier use nearly every dollar allotted. So while we can’t yet determine how “black” this holiday season will be, we can predict that the lower a consumer’s credit tier, the more that consumer will rely on bankcards to fund his or her holiday shopping. For more credit and market insights, join Robert Stone and I for a Webinar, Unique insights on consumer credit trends and outlook for the remainder of 2015. [i]Bureau of Labor Statistics [ii]The Conference Board [iii]Experian IntelliView℠ VantageScore® is a registered trademark of VantageScore Solutions, LLC.

According to the latest Experian-Oliver Wyman Market Intelligence Report, mortgage originations for Q2 2015 increased 56% over Q2 2014 — $547 billion versus $350 billion.

Mortgage originations kicked off Q1 2015 with a 25% year over year increase to $315 billion.

Consumer debt for every major consumer lending category has decreased over the past few years, except for student loans.

According to the latest Experian-Oliver Wyman Market Intelligence Report, home equity line of credit (HELOC) originations warmed up significantly heading into summer.

Are you sure you are making the best consumer credit decisions? Given the constantly evolving market conditions, it is a challenge to keep informed. In order to confidently grow and manage the bottom line, organizations need to avoid these four basic risks of making credit decisions with limited trend visibility. Competitive Risk - With limited visibility to industry trends, organizations cannot understand their position relative to peers. Product Risk - Organizations without access to the latest consumer behaviors cannot identify and capitalize on emerging trends. Market Risk - Decisions suffer when made without considering market trends in the context of the economy. Resource Risk - Extracting useful insights from vast market data requires abundant resources and comprehensive expertise. Get more information on the business risks of navigating credit decisions with limited trend visibility.

According to the latest Experian-Oliver Wyman Market Intelligence Report, mortgage originations for Q1 2014 decreased by 53 percent over Q1 2013 - $235 billion versus $515 billion, respectively.