Tag: VantageScore

As industry experts are still unsure when the economy will fully recover, re-entry into marketing preapproved credit offers seems like a far-off proposal. However, several of the top credit card issuers are already mailing prescreen offers, with many other lenders following suit. When the time comes for organizations to resume, or even expand this type of targeting, odds are that the marketing budget will be tighter than in the past. To make the most of the limited available marketing spend, lenders will need to be more prescriptive with their selection process to increase response rates on fewer delivered offers. Choosing the best candidates to receive these offers, from a credit risk perspective, will be critical. With delinquencies being suppressed due to CARES Act reporting guidelines, identifying consumers with the ability to repay will require additional assessment of recent credit behavior metrics, such as actual payment amounts and balance migration. Along with the presence of explicit indicators of accommodated trades (trades affected by natural disaster, trades with a balance but no scheduled payment amount) on a prospect’s credit file, their recent trends in payments and balance shifts can be integral in determining whether a prospect has been adversely impacted by today’s economic environment. Once risk criteria have been developed using a mix of bureau scores (like the VantageScore® credit score), traditional credit attributes and trended attributes measuring recent activity, additional targeting will be critical for selecting a population that’s most likely to open the relevant trade type. For credit cards and personal installment loans, response performance can be greatly improved by aligning product offers with prospects based on their propensity to revolve, pay in full each month or consolidate balances. Additionally, the process to select final prospects should integrate a propensity to open/respond assessment for the specific offering. While many lenders have custom models developed on previous internal response performance, off-the-shelf propensity to open models are also available to provide an assessment of a prospect’s likelihood to open a particular type of trade in the coming months. These models can act as a fast-start for lenders that intend to develop internal custom models, but don’t have the response performance within a particular product/geography/risk profile. They are also commonly used as a long-term solution for lenders without an internal model development team or budget for an outsourced model. Prescreen selection best practices Identify geography and traditional credit risk assessment of the prospect universe. Overlay attributes measuring accommodated trades and recent payment/balance trends to identify prospects with indications of ability to pay. Segment the prospect universe by recent credit usage to determine products that would resonate. Make final selections using propensity to open model scores to increase response rates by only making offers to consumers who are likely looking for new credit offers. While the best practices listed above don’t represent a risk-free approach in these uncertain times, they do provide a framework for identifying prospects with mitigated repayment risk and insights into the appropriate credit offer to make and when to make it. Learn about in the market models Learn about trended attributes VantageScore® is a registered trademark of VantageScore Solutions, LLC.

Achieving collection results within the subprime population was challenging enough before the current COVID-19 pandemic and will likely become more difficult now that the protections of the Coronavirus Aid, Relief, and Economic Security (CARES) Act have expired. To improve results within the subprime space, lenders need to have a well-established pre-delinquent contact optimization approach. While debt collection often elicits mixed feelings in consumers, it’s important to remember that lenders share the same goal of settling owed debts as quickly as possible, or better yet, avoiding collections altogether. The subprime lending population requires a distinct and nuanced approach. Often, this group includes consumers that are either new to credit as well as consumers that have fallen delinquent in the past suggesting more credit education, communication and support would be beneficial. Communication with subprime consumers should take place before their account is in arrears and be viewed as a “friendly reminder” rather than collection communication. This approach has several benefits, including: The communication is perceived as non-threatening, as it’s a simple notice of an upcoming payment. Subprime consumers often appreciate the reminder, as they have likely had difficulty qualifying for financing in the past and want to improve their credit score. It allows for confirmation of a consumer’s contact information (mainly their mobile number), so lenders can collect faster while reducing expenses and mitigating risk. When executed correctly, it would facilitate the resolution of any issues associated with the delivery of product or billing by offering a communication touchpoint. Additionally, touchpoints offer an opportunity to educate consumers on the importance of maintaining their credit. Customer segmentation is critical, as the way lenders approach the subprime population may not be perceived as positively with other borrowers. To enhance targeting efforts, lenders should leverage both internal and external attributes. Internal payment patterns can provide a more comprehensive view of how a customer manages their account. External bureau scores, like the VantageScore® credit score, and attribute sets that provide valuable insights into credit usage patterns, can significantly improve targeting. Additionally, the execution of the strategy in a test vs. control design, with progression to successive champion vs. challenger designs is critical to success and improved performance. Execution of the strategy should also be tested using various communication channels, including digital. From an efficiency standpoint, text and phone calls leveraging pre-recorded messages work well. If a consumer wishes to participate in settling their debt, they should be presented with self-service options. Another alternative is to leverage live operators, who can help with an uptick in collection activity. Testing different tranches of accounts based on segmentation criteria with the type of channel leveraged can significantly improve results, lower costs and increase customer retention. Learn About Trended Attributes Learn About Premier Attributes

Article written by Alex Lintner, Experian's Group President of Consumer Information Services and Sandy Anderson, Experian's Senior Vice President of Client and Sales Operations Many consumers are facing financial stress due to unemployment and other hardships related to the COVID-19 pandemic. Not surprisingly, data scientists at Experian are looking into how consumers’ credit scores may be impacted during the COVID-19 national emergency period as financial institutions and credit bureaus follow guidance from financial regulators and law established in Section 4021 of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). In a nutshell, Experian finds that if consumers contact their lenders and are granted an accommodation, such as a payment holiday or forbearance, and lenders report the accommodation accordingly, consumer scores will not be materially affected negatively. It’s not just Experian’s findings, but also those of the major credit scoring companies, FICO® and VantageScore®. FICO has reported that if a lender provides an accommodation and payments are reported on time consistent with the CARES Act, consumers will not be negatively impacted by late payments related to COVID-19. VantageScore® has also addressed this issue and stated that its models are designed to mitigate the impact of missed payments from COVID-19. At the same time, if as predicted, lenders tighten underwriting standards following 11 consecutive years of economic growth, access to credit for some consumers may be curtailed notwithstanding their score because their ability to repay the loan may be diminished. Regulatory guidance and law provide a robust response Recently, the Federal Reserve, along with the federal and state banking regulators, issued a statement encouraging mortgage servicers to work with struggling homeowners affected by the COVID-19 national emergency by allowing borrowers to defer mortgage payments up to 180-days or longer. The Federal Deposit Insurance Corporation stated that financial institutions should “take prudent steps to assist customers and communities affected by COVID-19.” The Office of the Comptroller of the Currency, which regulates nationally chartered banks, encouraged banks to offer consumers payment accommodations to avoid delinquencies and negative credit bureau reporting. This regulatory guidance was backed by Congress in passing the CARES Act, which requires any payment accommodations to be reported to a credit bureau as “current.” The Consumer Financial Protection Bureau, which has oversight of all financial service providers, reinforced the regulatory obligation in the CARES Act. In a statement, the Bureau said “the continuation of reporting such accurate payment information produces substantial benefits for consumers, users of consumer reports and the economy as a whole.” Moreover, the consumer reporting industry has a history of successful coordination during emergency circumstances, like COVID-19, and we’ve provided the support necessary for lenders to report accurately and consistent with regulatory guidance. For example, when a consumer faces hardship, a lender can add a code that indicates a customer or borrower has been “affected by natural or declared disaster.” If a lender uses this or a similar code, a notification about the disaster or other event will appear in the credit report with the trade line for the customer’s account and will remain on the trade line until the lender removes it. As a result, the presence of the code will not negatively impact the consumer credit score. However, other factors may impact a consumer’s score, such as an increase in a consumer’s utilization of their credit lines, which is a likely scenario during a period of financial stress. Suppression or Deletion of late payments will hurt, not help, credit scores In response to the nationwide impact of COVID-19, some lawmakers have suggested that lenders should not report missed payments or that credit bureaus should delete them. The presumption is that these actions would hold consumers harmless during the crisis caused by this pandemic. However, these good intentions end up having a detrimental impact on the whole credit ecosystem as consumer credit information is no longer accurately reflecting consumers’ specific situation. This makes it difficult for lenders to assess risk and for consumers to obtain appropriately priced credit. Ultimately, the best way to help is a consumer-specific solution, meaning one in which a lender reaches an accommodation with each affected individual, and accurately reflects that person’s unique situation when reporting to credit bureaus. When a consumer misses a payment, the information doesn’t end up on a credit report immediately. Most payments are monthly, so a consumer’s payment history with a financial institution is updated on a similar timeline. If, for example, a lender was required to suppress reporting for three months during the COVID-19 national emergency, the result would be no data flowing onto a credit report for three months. A credit report would therefore show monthly payments and then three months of no updates. The same would be true if a credit reporting agency were required to suppress or delete payment information. The lack of data, due to suppression or deletion, means that lenders would be blinded when making credit decisions, for example to increase a credit limit to an existing customer or to grant a new line of credit to a prospective customer. When faced with a blind spot, and unable to assess the real risk of a consumer’s credit history, the prudential tendency would be to raise the cost of credit, or to decrease the availability of credit, to cover the risk that cannot be measured. This could effectively end granting of credit to new customers, further stifling economic recovery and consumer financial health at a time when it’s needed most. Beyond the direct impact on consumers, suppression or deletion of credit information could directly affect the safety and soundness of the nation’s consumer and small business lending system. With missing data, lenders and their regulators would be flying blind as to the accurate information about a consumer’s risk and could result in unknowingly holding loan portfolios with heightened risk for loss. Too many unexpected losses threaten the balance of the financial system and could further seize credit markets. Experian is committed to helping consumers manage their credit and working with lenders on how best to report consumer-specific solutions. To learn more about what consumers can do to manage credit during the COVID-19 national emergency, we’ve provided resources on our website. For individuals looking to explore options their lenders may offer, we’ve included links to many of the companies and update them continuously. With good public policy and consumer-specific solutions, consumers can continue to build credit and help our economy grow.

Article written by Melanie Smith, Senior Copywriter, Experian Clarity Services, Inc. It’s been almost a decade since the Great Recession in the United States ended, but consumers continue to feel its effects. During the recession, millions of Americans lost their jobs, retirement savings decreased, real estate reduced in value and credit scores plummeted. Consumers that found themselves impacted by the financial crisis often turned to alternative financial services (AFS). Since the end of the recession, customer loyalty and retention has been a focus for lenders, given that there are more options than ever before for AFS borrowers. To determine what this looks like in the current climate, we examined today’s non-prime consumers, what their traditional scores look like and if they are migrating to traditional lending. What are alternative financial services (AFS)? Alternative financial services (AFS) is a term often used to describe the array of financial services offered by providers that operate outside of traditional financial institutions. In contrast to traditional banks and credit unions, alternative service providers often make it easier for consumers to apply and qualify for lines of credit but may charge higher interest rates and fees. More than 50% of new online AFS borrowers were first seen in 2018 To determine customer loyalty and fluidity, we looked extensively at the borrowing behavior of AFS consumers in the online marketplace. We found half of all online borrowers were new to the space as of 2018, which could be happening for a few different reasons. Over the last five years, there has been a growing preference to the online space over storefront. For example, in our trends report from 2018, we found that 17% of new online customers migrated from the storefront single pay channel in 2017, with more than one-third of these borrowers from 2013 and 2014 moving to online overall. There was also an increase in AFS utilization by all generations in 2018. Additionally, customers who used AFS in previous years are now moving towards traditional credit sources. 2017 AFS borrowers are migrating to traditional credit As we examined the borrowing behavior of AFS consumers in relation to customer loyalty, we found less than half of consumers who used AFS in 2017 borrowed from an AFS lender again in 2018. Looking into this further, about 35% applied for a loan but did not move forward with securing the loan and nearly 24% had no AFS activity in 2018. We furthered our research to determine why these consumers dropped off. After analyzing the national credit database to see if any of these consumers were borrowing in the traditional credit space, we found that 34% of 2017 borrowers who had no AFS activity in 2018 used traditional credit services, meaning 7% of 2017 borrowers migrated to traditional lending in 2018. Traditional credit scores of non-prime borrowers are growing After discovering that 7% of 2017 online borrowers used traditional credit services in 2018 instead of AFS, we wanted to find out if there had also been an improvement in their credit scores. Historically, if someone is considered non-prime, they don’t have the same access to traditional credit services as their prime counterparts. A traditional credit score for non-prime consumers is less than 600. Using the VantageScore® credit score, we examined the credit scores of consumers who used and did not use AFS in 2018. We found about 23% of consumers who switched to traditional lending had a near-prime credit score, while only 8% of those who continued in the AFS space were classified as near-prime. Close to 10% of consumers who switched to traditional lending in 2018 were classified in the prime category. Considering it takes much longer to improve a traditional credit rating, it’s likely that some of these borrowers may have been directly impacted by the recession and improved their scores enough to utilize traditional credit sources again. Key takeaways AFS remains a viable option for consumers who do not use traditional credit or have a credit score that doesn’t allow them to utilize traditional credit services. New AFS borrowers continue to appear even though some borrowers from previous years have improved their credit scores enough to migrate to traditional credit services. Customers who are considered non-prime still use AFS, as well as some near-prime and prime customers, which indicates customer loyalty and retention in this space. For more information about customer loyalty and other recently identified trends, download our recent reports. State of Alternative Data 2019 Lending Report

Millennials have been accused of “killing” a lot of things. From napkins and fabric softener to cable and golf, the generation which makes up the largest population of the United States (aka Gen Y) is cutting a lot of cords. Despite homeowning being listed as one of the notorious generational group’s casualties, it’s one area that millennials want to keep alive, according to recent statistics. In fact, a new Experian study revealed 86% of millennials believe that buying a house is a good financial investment. However, only 15% have a mortgage today. One explanation for this gap may be that they appear too risky. Younger millennials (age 22-28) have an average near prime score of 652 and older millennials (age 29-35) have a prime score of 665. Both subsets fall below the average VantageScore® credit score* of U.S. consumers – 677. Yes, with the majority of millennials having near prime or worse credit scores, we can agree that they will need need to improve their financial hygiene to improve their overall credit rankings. But their dreams of homeownership have not yet been dashed. Seemingly high aspirations (of homeownership), disrupted by a reality of limited assets, low scores, and thin credit files, create a disconnect that suggests a lack of resources to get into their first homes – rather than a lack of interest. Or, maybe not. Maybe, after surviving a few first-time credit benders that followed soon after opening the floodgates to credit, millennials feel like the combination of low scores and the inability to get any credit is only salt in their wounds from their lending growing pains. Or maybe it’s all the student loans. Or maybe it’s the fact that so many of them are underemployed. But maybe there’s still more to the story. This emerging generation is known for having high expectations for change and better frictionless experiences in all areas of their life. It turns out, their borrowing behavior is no different. Recent research by Experian reveals consumers who use alternative financial services (AFS) are 11 years younger on average than those that do not. What’s the attraction? Financial technology companies have contributed to the explosive growth of AFS lenders and millennials are attracted to those online interactions. The problem is many of these trades are alternative finance products and are not reported to traditional credit bureaus. This means they do nothing to build credit experience in the eyes of traditional lenders and millennials with good credit history find it difficult to get access to credit well into their 20s. Alternative credit data provides a deeper dive into consumers, revealing their transactions and ability to pay as evidenced by alternative finance data, rental, utility and telecom payments. Alt data may make some millennials more favorable to lenders by revealing that their three-digit credit score (or lack there of) may not be indicative of their financial stability. By incorporating alternative financial services data (think convenient, tech-forward lenders that check all the boxes for bank removed millennials, not just payday loan recipients), credit-challenged millennials have a chance at earning recognition for their experience with alternative financial services that may help them get their first mortgage. Society may have preconceived notions about millennials, but lenders may want to consider giving them a second look when it comes to determining creditworthiness. In a national Experian survey, 53% of consumers said they believe some of these alternative sources would have a positive effect on their credit score. We all grow up sometime and as our needs change, there may come a day when millennials need more traditional financial services. Lenders who take a traditional view of risk may miss out on opportunities that alternative credit data brings to light. As lending continues to evolve, combining both traditional credit scores and alternative credit data appears to offer a potentially sweet (or rather, home sweet home) solution for you and your customers. *Calculated on the VantageScore® credit score model. Your VantageScore® credit score from Experian indicates your credit risk level and is not used by all lenders, so don't be surprised if your lender uses a score that's different from your VantageScore® credit score.

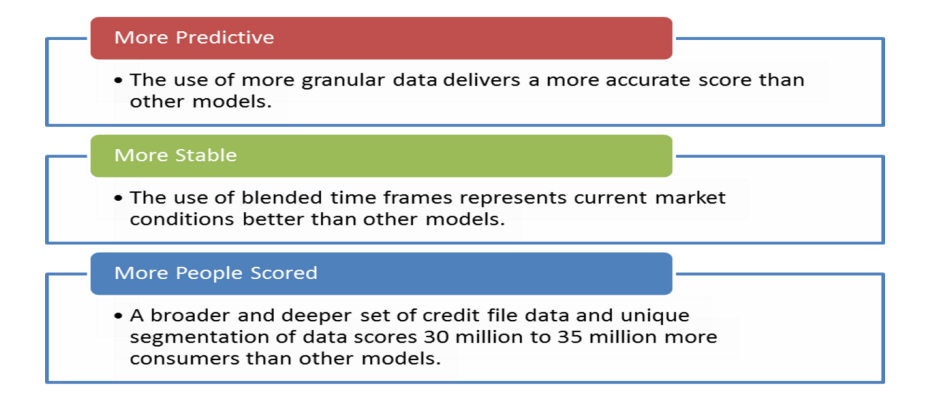

The 1990s brought us a wealth of innovative technology, including the Blackberry, Windows 98, and Nintendo. As much as we loved those inventions, we moved on to enjoy better technology when it became available, and now have smartphones, Windows 10 and Xbox. Similarly, technological and modeling advances have been made in the credit scoring arena, with new software that brings significant benefits to lenders who use them. Later this year, FICO will retire its Score V1, making it mandatory for those lenders still using the old software to find another solution. Now is the time for lenders to take a look at their software and myriad reasons to move to a modern credit score solution. Portfolio Growth As many as 70 million Americans either have no credit score or a thin credit file. One-third of Millennials have never bothered to apply for a credit card, and the percentage of Americans under 35 with credit card debt is at its lowest level in more than 25 years, according to the Federal Reserve. A recent study found that Millennials use cash and debit cards much more than older Americans. Over time, Millennials without credit histories could struggle to get credit. Are there other data sets that provide a window into whether a thin file consumer is creditworthy or not? Modern credit scoring models are now being used in the marketplace without negatively impacting credit quality. For example, the VantageScore® credit score allows for the scoring of 30 million to 35 million more people consumers who are typically unscoreable by other traditional generic credit models. The VantageScore® credit score does this by using a broader, deeper set of credit file data and more advanced modeling techniques. This allows the VantageScore® credit score model to more accurately predict unique consumer behaviors—is the consumer paying his utility bill on time?—and better evaluate thin file consumers. Mitigate Risk In today’s ever-changing regulatory landscape, lenders can stay ahead of the curve by relying on innovative credit score models like the VantageScore® credit score. These models incorporate the best of both worlds by leaning on innovative scoring analytics that are more inclusive, while providing marketplace lenders with assurances the decisioning is both statistically sound and compliant with fair lending laws. Newer solutions also offer enhanced documentation to ease the burden associated with model risk management and regulatory compliance responsibilities. Updated scores Consumer credit scores can vary depending on the type of scoring model a lender uses. If it's an old, outdated version, a consumer might be scored lower. If it's a newer, more advanced model, the consumer has a better shot at being scored more fairly. Moving to a more advanced scoring model can help broaden the base of potential borrowers. By sticking to old models—and older scores—a sizable number of consumers are left at a disadvantage in the form of a higher interest rate, lower loan amount or even a declined application. Introducing advanced scoring models can provide a more accurate picture of a consumer. As an example, for many of the newest consumer risk models, like FICO Score 9, a consumer’s unpaid medical collection agency accounts will be assessed differently from unpaid non-medical collection agency accounts. This isn't true for most pre-2012 consumer risk score versions. Each version contains different nuances for increasing your score, and it’s important to understand what they are. Upgrading your credit score to the latest VantageScore® credit score or FICO solution is easier than you think, with a switch to a modern solution taking no longer than eight weeks and your current business processes still in place. Are you ready to reap the rewards of modern credit scoring?

A recent analysis revealed a 9-point negative shift in the average VantageScore® credit score for personal loan originations from Q3 to Q4 of 2016. Additional insights into the personal loan market include: 67% of those who opened a personal installment loan had a revolving trade with a balance. 5% of consumers who close a personal loan open another within a few months of the original loan closure. 68% of consumers who open a new personal loan shortly after closing another one do so with the same company. Lenders must dig deeper to keep their loan volumes up in today’s competitive marketplace. Using a propensity score and attributes, as well as tools to learn more about ability-to-pay metrics and offer alignment, can improve your organization’s marketing and retention strategies. Learn more>

Personal loans have been booming for the past couple of years with double-digit growth year-over-year. But the party can’t last forever, right? In a recent Experian webinar, experts noted they have seen originations leveling off. In fact, numbers indicate it’s gone from leveled off to a slight year-over-year decline. They projected the first quarter of calendar year 2017 may also be down, but then we’ll see a peak again in the second quarter, which is typical with the seasonality often associated with personal loans. The landscape is changing. A recent data pull revealed a 9-point shift in the average VantageScore® credit score for originations from Q3 to Q4 of 2016. Lenders are digging deeper in order to keep their loan volumes up, and it is definitely a more competitive marketplace. The days where lenders were once able to grow their personal loan business with little effort are gone. Kelley Motley, Experian’s director of analytics, noted some of the personal loan origination volume shifts may be due to the rebound in the housing market and increased housing values, enabling super-prime and prime consumers to now also consider home equity loans and lines of credit, in lieu of personal loans. Still, the personal loan market is healthy. Lenders just need to be smart about their marketing efforts and utilize data to improve their response rates, expand their risk criteria to identify consumers trending upward in the credit ranks, and then retain them as their cash-flow and financial situations evolve. In the presentation, experts revealed a few interesting stats: 67% of those that open a personal installment loan had a revolving trade with a balance >$0 5% of consumer that close a personal loan reopen another within a few months of the original loan closure 68% of consumers that re-open a new personal loan within a short timeframe of closing another personal loan do so with the same company Together, these stats illustrate that individuals are largely leveraging personal loans to consolidate debt or perhaps fund an expense like a vacation or an unexpected event. Once the consumer comes into cash, they’ll pay off the loan, but consider revisiting a personal loan again if their financial situation warrants it. The calendar year Q2 peak has been consistent since the Great Recession. For many consumers, after racking up holiday debt and end-of-year expenses, the bills start coming in during the first quarter. With the high APRs often attached to revolving cards, there is a sense of urgency to consolidate and lock in a more reasonable rate. Others utilize the personal loan to fund weddings, vacations and home improvement projects. Kyle Matthies, a senior product manager for Experian, reminded participants that most people don’t need your product, so it’s essential to leverage data find those that do. Utilizing propensity score and attributes, as well as tools to dig into ability-to-pay metrics and offer alignment can really fine-tune both an organization’s marketing and retention strategies. To learn more about the current state of personal loans, access our free webinar How lenders can capitalize on the growth in personal loans.

Looking to score more consumers, but worried about increased risk? A recent VantageScore® LLC study found that consumers rendered “unscoreable” by commonly used credit scoring models are nearly identical in their financial and credit behavior to scoreable consumers. To get a more detailed financial portrait of the “expanded” population, credit files were supplemented with demographic and economic data. The study found: Consumers who scored above 620 using the VantageScore® credit score exhibited profiles of sufficient quality to justify mortgage loans on par with those of conventionally scoreable consumers. 3 to 2.5 million – a majority of the 3.4 million consumers categorized as potentially eligible for mortgages – demonstrated sufficient income to support a mortgage in their geographic areas. The findings demonstrate that the VantageScore® credit score is a scalable solution to expanding mortgage credit without relaxing credit standards should the FHFA and GSEs accept VantageScore® credit scores. Want to know more?

Lenders are looking for ways to accurately score more consumers and grow their applicant pool without increasing risk. And it looks like more and more are turning to the VantageScore® credit score to help achieve their goals. So, who’s using the VantageScore® credit score? 9 of the top 10 financial institutions. 18 of the top 25 credit card issuers. 21 of the top 25 credit unions. VantageScore leverages the collective experience of the industry’s leading experts on credit data, modeling and analytics to provide a more consistent and highly predictive credit score. >>Want to know more?

As credit behavior and economic conditions continue to evolve, using a model that is validated regularly can give lenders greater confidence in the model’s performance. VantageScore® Solutions, LLC validates all its models annually to promote transparency and support financial institutions with model governance. The results of the most recent validation demonstrate the consistent ability of VantageScore® to accurately score more than 30 million to 35 million consumers considered unscoreable by other models — including 9.5 million Hispanic and African-American consumers. The findings reinforce the importance of using advanced credit scoring models to make more accurate decisions while providing consumers with access to fair and equitable credit. >> VantageScore® Annual Validation Results 2016 VantageScore® is a registered trademark of VantageScore Solutions, LLC

A recent survey commissioned by VantageScore® Solutions, LLC found that among consumers who are unable to obtain credit, 27% attribute the situation to lack of a credit score. Most consumers support newer methods of calculating credit scores 49% feel that consistent rental, utility and telecommunications payments should count in determining credit scores 50% agree that competition in the credit scoring marketplace is beneficial Lenders can help solve the credit gap by using advanced risk models that can accurately score more consumers. The result is a win-win: More consumers get access to mainstream credit, and lenders gain more customers. >> Infographic: America’s Giant Credit Gap VantageScore® is a registered trademark of VantageScore Solutions, LLC.

Experian® recently released the 2015 State of Credit report, which analyzes key credit metrics across the nation.

According to a recent survey commissioned by VantageScore® Solutions, millennials cite being unscoreable as the main obstacle to credit access. Among the findings: One-third of millennials cannot obtain the credit they need Of those unable to obtain credit, 34% attribute it to lack of a credit score 49% of millennials agree that competition in the credit-scoring marketplace is beneficial Lenders can help this segment and open the gateway of credit by using advanced risk models that can accurately score consumers considered unscoreable by conventional risk models. >> Infographic: The Giant Credit Gap VantageScore® is a registered trademark of VantageScore Solutions, LLC.

VantageScore® models are the only credit scoring models to employ the same characteristic information and model design across the three credit bureaus.