In this article…

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Phasellus at nisl nunc. Sed et nunc a erat vestibulum faucibus. Sed fermentum placerat mi aliquet vulputate. In hac habitasse platea dictumst. Maecenas ante dolor, venenatis vitae neque pulvinar, gravida gravida quam. Phasellus tempor rhoncus ante, ac viverra justo scelerisque at. Sed sollicitudin elit vitae est lobortis luctus. Mauris vel ex at metus cursus vestibulum lobortis cursus quam. Donec egestas cursus ex quis molestie. Mauris vel porttitor sapien. Curabitur tempor velit nulla, in tempor enim lacinia vitae. Sed cursus nunc nec auctor aliquam. Morbi fermentum, nisl nec pulvinar dapibus, lectus justo commodo lectus, eu interdum dolor metus et risus. Vivamus bibendum dolor tellus, ut efficitur nibh porttitor nec.

Pellentesque habitant morbi tristique senectus et netus et malesuada fames ac turpis egestas. Maecenas facilisis pellentesque urna, et porta risus ornare id. Morbi augue sem, finibus quis turpis vitae, lobortis malesuada erat. Nullam vehicula rutrum urna et rutrum. Mauris convallis ac quam eget ornare. Nunc pellentesque risus dapibus nibh auctor tempor. Nulla neque tortor, feugiat in aliquet eget, tempus eget justo. Praesent vehicula aliquet tellus, ac bibendum tortor ullamcorper sit amet. Pellentesque tempus lacus eget aliquet euismod. Nam quis sapien metus. Nam eu interdum orci. Sed consequat, lectus quis interdum placerat, purus leo venenatis mi, ut ullamcorper dui lorem sit amet nunc. Donec semper suscipit quam eu blandit. Sed quis maximus metus. Nullam efficitur efficitur viverra. Curabitur egestas eu arcu in cursus.

H1

H2

H3

H4

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Vestibulum dapibus ullamcorper ex, sed congue massa. Duis at fringilla nisi. Aenean eu nibh vitae quam auctor ultrices. Donec consequat mattis viverra. Morbi sed egestas ante. Vivamus ornare nulla sapien. Integer mollis semper egestas. Cras vehicula erat eu ligula commodo vestibulum. Fusce at pulvinar urna, ut iaculis eros. Pellentesque volutpat leo non dui aliquet, sagittis auctor tellus accumsan. Curabitur nibh mauris, placerat sed pulvinar in, ullamcorper non nunc. Praesent id imperdiet lorem.

H5

Curabitur id purus est. Fusce porttitor tortor ut ante volutpat egestas. Quisque imperdiet lobortis justo, ac vulputate eros imperdiet ut. Phasellus erat urna, pulvinar id turpis sit amet, aliquet dictum metus. Fusce et dapibus ipsum, at lacinia purus. Vestibulum euismod lectus quis ex porta, eget elementum elit fermentum. Sed semper convallis urna, at ultrices nibh euismod eu. Cras ultrices sem quis arcu fermentum viverra. Nullam hendrerit venenatis orci, id dictum leo elementum et. Sed mattis facilisis lectus ac laoreet. Nam a turpis mattis, egestas augue eu, faucibus ex. Integer pulvinar ut risus id auctor. Sed in mauris convallis, interdum mi non, sodales lorem. Praesent dignissim libero ligula, eu mattis nibh convallis a. Nunc pulvinar venenatis leo, ac rhoncus eros euismod sed. Quisque vulputate faucibus elit, vitae varius arcu congue et.

Ut convallis cursus dictum. In hac habitasse platea dictumst. Ut eleifend eget erat vitae tempor. Nam tempus pulvinar dui, ac auctor augue pharetra nec. Sed magna augue, interdum a gravida ac, lacinia quis erat. Pellentesque fermentum in enim at tempor. Proin suscipit, odio ut lobortis semper, est dolor maximus elit, ac fringilla lorem ex eu mauris.

- Phasellus vitae elit et dui fermentum ornare. Vestibulum non odio nec nulla accumsan feugiat nec eu nibh. Cras tincidunt sem sed lacinia mollis. Vivamus augue justo, placerat vel euismod vitae, feugiat at sapien. Maecenas sed blandit dolor. Maecenas vel mauris arcu. Morbi id ligula congue, feugiat nisl nec, vulputate purus. Nunc nec aliquet tortor. Maecenas interdum lectus a hendrerit tristique. Ut sit amet feugiat velit.

- Test

- Yes

According to a recent Experian analysis of Q2 2013 bankcard trends, bankcard origination volumes increased 21% year-over-year equating to a $12 billion increase in new bankcard limits. The increase was largely driven by the prime and near-prime segments which made up the majority of the $12 billion increase. Download our recent Webinar: It's a new reality…and time for a new risk score.

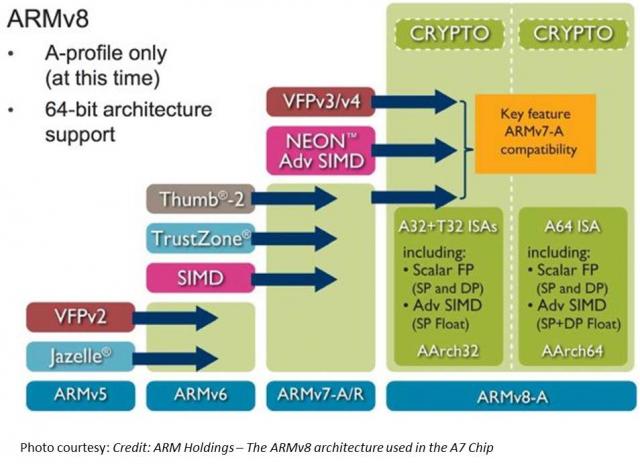

TL;DR Read within as to how Touch ID is made possible via ARM’s TrustZone/TEE, and why this matters in the context of the coming Apple’s identity framework. Also I explain why primary/co-processor combos are here to stay. I believe that eventually, Touch ID has a payments angle – but focusing on e-commerce before retail. Carriers will weep over a lost opportunity while through Touch ID, we have front row seats to Apple’s enterprise strategy, its payment strategy and beyond all – the future direction of its computing platform. I had shared my take on a possible Apple Biometric solution during the Jan of this year based on its Authentec acquisition. I came pretty close, except for the suggestion that NFC is likely to be included. (Sigh.) Its a bit early to play fast and loose with Apple predictions, but its Authentec acquisition should rear its head sometime in the near future (2013 – considering Apple’s manufacturing lead times), that a biometric solution packaged neatly with an NFC chip and secure element could address three factors that has held back customer adoption of biometrics: Ubiquity of readers, Issues around secure local storage and retrieval of biometric data, Standardization in accessing and communicating said data. An on-chip secure solution to store biometric data – in the phone’s secure element can address qualms around a central database of biometric data open to all sorts of malicious attacks. Standard methods to store and retrieve credentials stored in the SE will apply here as well. Why didn’t Apple open up Touch ID to third party dev? Apple expects a short bumpy climb ahead for Touch ID before it stabilizes, as early users begin to use it. By keeping its use limited to authenticating to the device, and to iTunes – it can tightly control the potential issues as they arise. If Touch ID launched with third party apps and were buggy, it’s likely that customers will be confused where to report issues and who to blame. That’s not to say that it won’t open up Touch ID outside of Apple. I believe it will provide fettered access based on the type of app and the type of action that follows user authentication. Banking, Payment, Productivity, Social sharing and Shopping apps should come first. Your fart apps? Probably never. Apple could also allow users to set their preferences (for app categories, based on user’s current location etc.) such that biometrics is how one authenticates for transactions with risk vs not requiring it. If you are at home and buying an app for a buck – don’t ask to authenticate. But if you were initiating a money transfer – then you would. Even better – pair biometrics with your pin for better security. Chip and Pin? So passé. Digital Signatures, iPads and the DRM 2.0: It won’t be long before an iPad shows up in the wild sporting Touch ID. And with Blackberry’s much awaited and celebrated demise in the enterprise, Apple will be waiting on the sidelines – now with capabilities that allow digital signatures to become ubiquitous and simple – on email, contracts or anything worth putting a signature on. Apple has already made its iWork productivity apps(Pages, Numbers, Keynote), iMovie and iPhoto free for new iOS devices activated w/ iOS7. Apple, with a core fan base that includes photographers, designers and other creative types, can now further enable iPads and iPhones to become content creation devices, with the ability to attribute any digital content back to its creator by a set of biometric keys. Imagine a new way to digitally create and sign content, to freely share, without worrying about attribution. Further Apple’s existing DRM frameworks are strengthened with the ability to tag digital content that you download with your own set of biometric keys. Forget disallowing sharing content – Apple now has a way to create a secondary marketplace for its customers to resell or loan digital content, and drive incremental revenue for itself and content owners. Conclaves blowing smoke: In a day and age where we forego the device for storing credentials – whether it be due to convenience or ease of implementation – Apple opted for an on-device answer for where to store user’s biometric keys. There is a reason why it opted to do so – other than the obvious brouhaha that would have resulted if it chose to store these keys on the cloud. Keys inside the device. Signed content on the cloud. Best of both worlds. Biometric keys need to be held locally, so that authentication requires no roundtrip and therefore imposes no latency. Apple would have chosen local storage (ARM’s SecurCore) as a matter of customer experience, and what would happen if the customer was out-of-pocket with no internet access. There is also the obvious question that a centralized biometric keystore will be on the crosshairs of every malicious entity. By decentralizing it, Apple made it infinitely more difficult to scale an attack or potential vulnerability. More than the A7, the trojan in Apple’s announcement was the M7 chip – referred to as the motion co-processor. I believe the M7 chip does more than just measuring motion data. M7 – A security co-processor? I am positing that Apple is using ARM’s TrustZone foundation and it may be using the A7 or the new M7 co-processor for storing these keys and handling the secure backend processing required. Horace Dediu of Asymco had called to question why Apple had opted for M7 and suggested that it may have a yet un-stated use. I believe M7 is not just a motion co-processor, it is also a security co-processor. I am guessing M7 is based on the Cortex-M series processors and offloads much of this secure backend logic from the primary A7 processor and it may be that the keys themselves are likely to be stored here on M7. The Cortex-M4 chip has capabilities that sound very similar to what Apple announced around M7 – such as very low power chip, that is built to integrate sensor output and wake up only when something interesting happens. We should know soon. This type of combo – splitting functions to be offloaded to different cores, allows each cores to focus on the function that it’s supposed to performed. I suspect Android will not be far behind in its adoption, where each core focuses on one or more specific layers of the Android software stack. Back at Google I/O 2013, it had announced 3 new APIs (the Fused location provider) that enables location tracking without the traditional heavy battery consumption. Looks to me that Android decoupled it so that we will see processor cores that focus on these functions specifically – soon. I am fairly confident that Apple has opted for ARM’s Trustzone/TEE. Implementation details of the Trustzone are proprietary and therefore not public. Apple could have made revisions to the A7 chip spec and could have co-opted its own. But using the Trustzone/TEE and SecurCore allows Apple to adopt existing standards around accessing and communicating biometric data. Apple is fully aware of the need to mature iOS as a trusted enterprise computing platform – to address the lack of low-end x86 devices that has a hardware security platform tech. And this is a significant step towards that future. What does Touch ID mean to Payments? Apple plans for Touch ID kicks off with iTunes purchase authorizations. Beyond that, as iTunes continue to grow in to a media store behemoth – Touch ID has the potential to drive fraud risk down for Apple – and to further allow it to drive down risk as it batches up payment transactions to reduce interchange exposure. It’s quite likely that à la Walmart, Apple has negotiated rate reductions – but now they can assume more risk on the front-end because they are able to vouch for the authenticity of these transactions. As they say – customer can longer claim the fifth on those late-night weekend drunken purchase binges. Along with payment aggregation, or via iTunes gift cards – Apple has now another mechanism to reduce its interchange and risk exposure. Now – imagine if Apple were to extend this capability beyond iTunes purchases – and allow app developers to process in-app purchases of physical goods or real-world experiences through iTunes in return for better blended rates? (instead of Paypal’s 4% + $0.30). Heck, Apple can opt for short-term lending if they are able to effectively answer the question of identity – as they can with Touch ID. It’s Paypal’s ‘Bill Me Later’ on steroids. Effectively, a company like Apple who has seriously toyed with the idea of a Software-SIM and a “real-time wireless provider marketplace” where carriers bid against each other to provide you voice, messaging and data access for the day – and your phone picks the most optimal carrier, how far is that notion from picking the cheapest rate across networks for funneling your payment transactions? Based on the level of authentication provided or other known attributes – such as merchant type, location, fraud risk, customer payment history – iTunes can select across a variety of payment options to pick the one that is optimal for the app developer and for itself. And finally, who had the most to lose with Apple’s Touch ID? Carriers. I wrote about this before as well, here’s what I wrote then (edited for brevity): Does it mean that Carriers have no meaningful role to play in commerce? Au contraire. They do. But its around fraud and authentication. Its around Identity. … But they seem to be stuck imitating Google in figuring out a play at the front end of the purchase funnel, to become a consumer brand(Isis). The last thing they want to do is leave it to Apple to figure out the “Identity management” question, which the latter seems best equipped to answer by way of scale, the control it exerts in the ecosystem, its vertical integration strategy that allows it to fold in biometrics meaningfully in to its lineup, and to start with its own services to offer customer value. So there had to have been much ‘weeping and moaning and gnashing of the teeth’ on the Carrier fronts with this launch. Carriers have been so focused on carving out a place in payments, that they lost track of what’s important – that once you have solved authentication, payments is nothing but accounting. I didn’t say that. Ross Anderson of Kansas City Fed did. What about NFC? I don’t have a bloody clue. Maybe iPhone6? iPhone This is a re-post from Cherian's original blog post "Smoke is rising from Apple's Conclave"

According to data from Experian’s IntelliViewSM, Iowa residents carry the lowest average credit card balance per consumer in the U.S. with an average balance of $2,904, as of the second quarter of 2013. On the other end of the spectrum, the state with the highest average credit card balance is Alaska, where residents carry an average credit card balance of $4,706. New Jersey citizens are close behind with an average balance of $4,523.