Cont. Understanding Gift Card Fraud

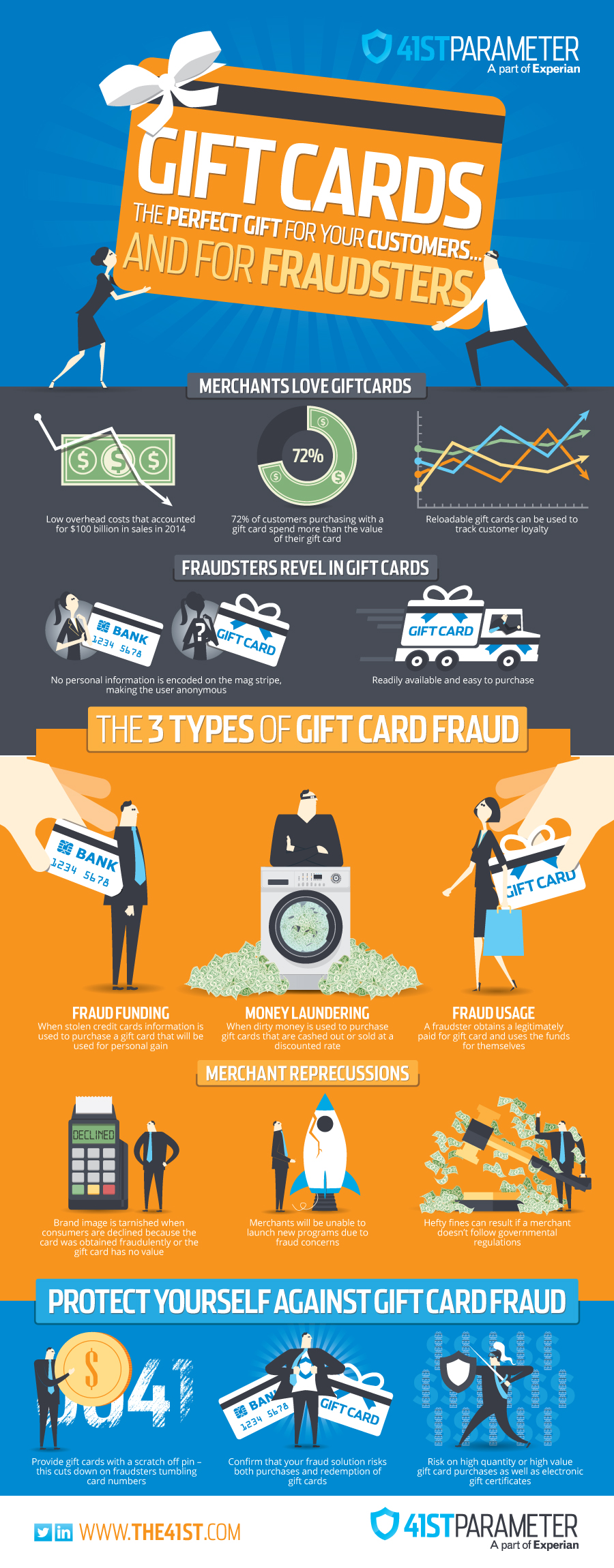

In part one, we spoke about what an amazing deal gift cards (GCs) are, and why they are incredibly popular among consumers. Today we are going to dive deeper and see why fraudsters love gift cards and how they are taking advantage of them.

We previously mentioned that it’s unlikely a fraudster is the actual person that redeems a gift card for merchandise. Although it is true that some fraudsters may occasionally enjoy a latte or new pair of shoes on us, it is much more lucrative for them to turn these forms of currency into cold hard cash. Doing this also shifts the risk onto an unsuspecting victim and off of the fraudster.

For the record, it’s also incredibly easy to do.

All of the innovation that was used to help streamline the customer experience has also helped to streamline the fraudster experience. The websites that are used to trade unredeemed cards for other cards or cash are the same websites used by fraudsters. Although there are some protections for the customer on the trading sites, the website host is usually left holding the bag when they have paid out for a GC that has been revoked because it was purchased with stolen credit card information.

Others sites, like Craigslist and social media yard sale groups, do not offer any sort of consumer protection, so there is no recourse for the purchaser. What seems like a great deal— buying a GC at a discounted rate— could turn out to be a devalued Gift card with no balance, because the merchant caught on to the original scheme.

There are ten states in the US that have passed laws surrounding the cashing out of gift cards. * These laws enable consumers to go to a physical store location and receive, in cash, the remaining balance of a gift card. Most states impose a limit of $5, but California has decided to be a little more generous and extend that limit to $10. As a consumer, it’s a great benefit to be able to receive the small remaining balance in cash, a balance that you will likely forget about and might never use, and the laws were passed with this in mind.

Unfortunately, fraudsters have zeroed in on this benefit and are fully taking advantage of it. We have seen a host of merchants experiencing a problem with fraudulently obtained GCs being cashed out in California locations, specifically because they have a higher threshold. While five dollars here and ten dollars there does not seem like it is very much, it adds up when you realize that this could be someone’s full time job. Cashing out three ten dollar cards would take on average 15 minutes. Over the course of a 40-hour workweek it can turn into a six-figure salary.

At this point, you might be asking yourself how fraudsters obtain these GCs in the first place. That part is also fairly easy. User credentials and account information is widely available for purchase in underground forums, due in part to the recent increase in large-scale data breaches. Once these credentials have been obtained, they can do one of several things:

- Put card data onto a dummy card and use it in a physical store

- Use credit card data to purchase on any website

- Use existing credentials to log in to a site and purchase with stored payment information

- Use existing credentials to log in to an app and trigger auto-reloading of accounts, then transfer to a GC

With all of these daunting threats, what can a merchant do to protect their business?

First, you want to make sure your online business is screening for both the purchase and redemption of gift cards, both electronic and physical. When you screen for the purchase of GCs, you want to look for things like the quantity of cards purchased, the velocity of orders going to a specific shipping address or email, and velocity of devices being used to place multiple orders.

You also want to monitor the redemption of loyalty rewards, and any traffic that goes into these accounts. Loyalty fraud is a newer type of fraud that has exploded because these channels are not normally monitored for fraud— there is no actual financial loss, so priority has been placed elsewhere in the business. However, loyalty points can be redeemed for gift cards, or sold on the black market, and the downstream affect is that it can inconvenience your customer and harm your brand’s image.

Additionally, if you offer physical GCs, you want to have a scratch off PIN on the back of the card. If a GC is offered with no PIN, fraudsters can walk into a store, take a picture of the different card numbers, and then redeem online once the cards have been activated. Fraudsters will also tumble card numbers once they have figured out the numerical sequence of the cards. Using a PIN prevents both of these problems.

The use of GCs is going to continue to increase in the coming years— this is no surprise. Mobile will continue to be incorporated with these offerings, and answering security challenges will be paramount to their success. Although we are in the age of the data breach, there is no reason that the experience of purchasing or redeeming a gift card should be hampered by overly cautious fraud checks. It’s possible to strike the right balance— grow your business securely by implementing a fraud solution that is fraud minded AND customer centric.

*The use of GC/eGC is used interchangeably