Historical data that illustrates lower credit card use and increases in payments is key to finding consumers whose credit trajectory is improving. But positive changes in consumer behavior—especially if it happens slowly over time—don’t necessarily impact a consumer’s credit score. And many lenders are missing out on capturing new business by failing to take a closer look.

It’s easy to categorize consumers by their credit score alone, but you owe it to your bottom line to investigate further:

- Are the consumer’s overall payments increasing?

- Is his credit card utilization decreasing?

- Are the overall card balances remaining consistent or declining?

- Could the consumer be within your credit score guidelines within a month or two?

- And most importantly, could a competitor acquire the consumer a month or two after you declined him?

Identifying new customers who previously used credit responsibly is relatively easy since they typically have rich credit profiles that may include a mortgage and numerous types of credit accounts.

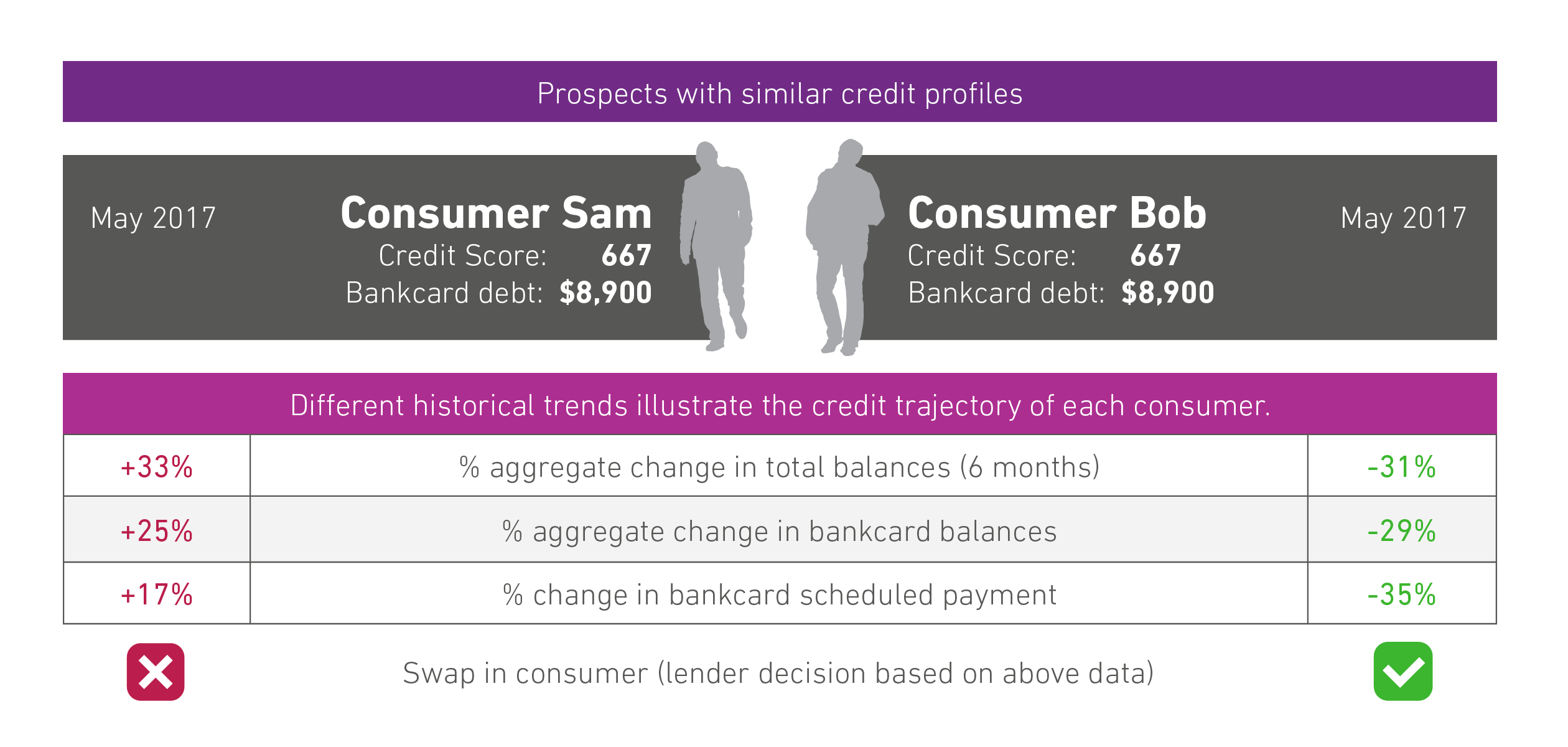

But how do you evaluate consumers who may look identical?

Trended data and attributes provide insight into whether a consumer is headed in the right direction:

With more than 613 trended attributes available for real-time decisioning and for batch campaigns, Experian trends key factors that provide the insight needed for lenders to lend deeper without sacrificing credit quality.

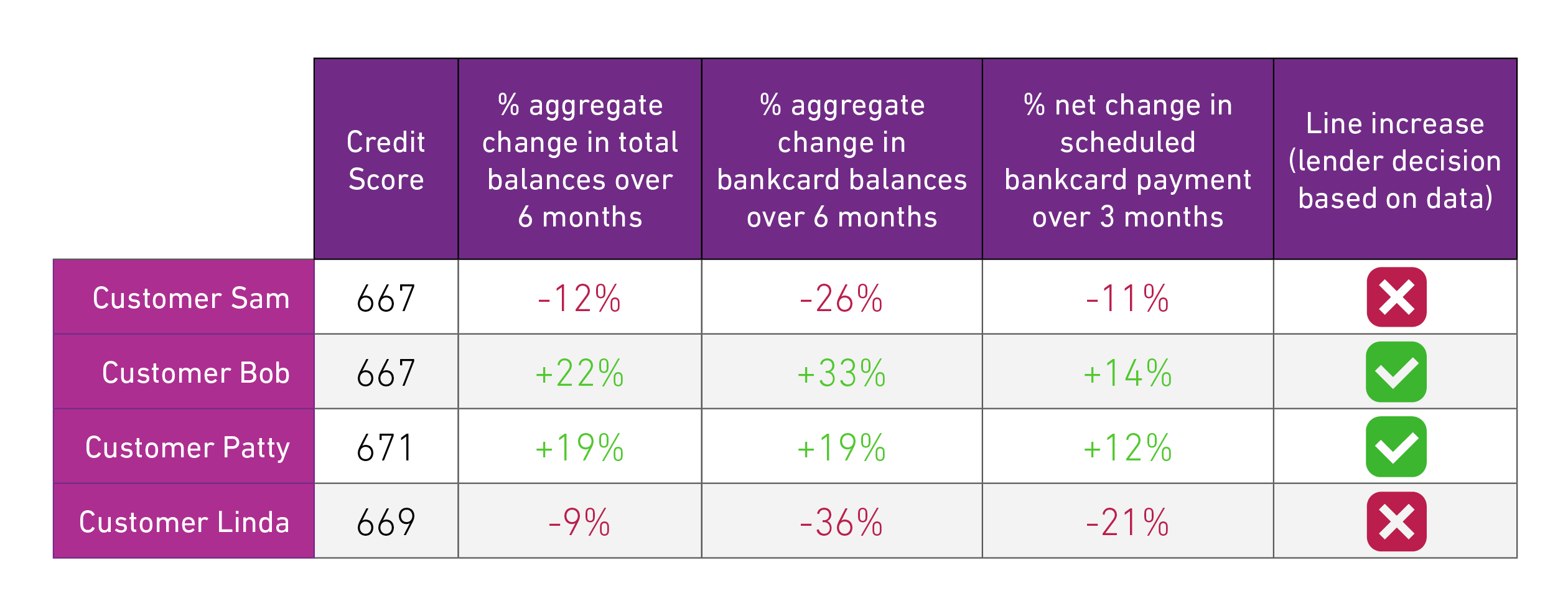

Looking at trended data and attributes is critical for portfolio growth, and credit line increases based on good credit behavior is a must for lenders for two reasons. First, you’ve already spent the money acquiring the consumer and you should not waste the opportunity to maximize returns. Second, competition is fierce; another lender could reward the consumer for great credit behavior they’ve displayed with your company. Be there first, be consistent, or be left behind.

Use Experian’s Payment Stress Attributes and Short-term Utilization Attributes in custom scores or swap-set strategies in order to find quality customers who may be worthy of line increases or other attribute credit terms.

Look to trended data to swap in consumers who may fall within a few points under your credit score guidelines, and reward your existing customers before another lender does. Near-prime consumers of today are the prime consumers of tomorrow.