As we approach 2024, marketers must grasp the evolving landscape of digital activation. Understanding emerging audience trends and activation strategies is key to developing impactful marketing initiatives and positioning your brand for success.

In Experian’s 2024 Digital audience trends and predictions report you’ll find:

- Data-driven insights that will empower you to confidently develop marketing strategies that resonate with your audience and drive meaningful results.

- Insights from Experian experts and our industry-leading data.

- Our outlook for 2024 marketing trends.

In this blog post, we’ll provide a sneak peek of the 2024 marketing trends you can expect in our full report.

Digital activation

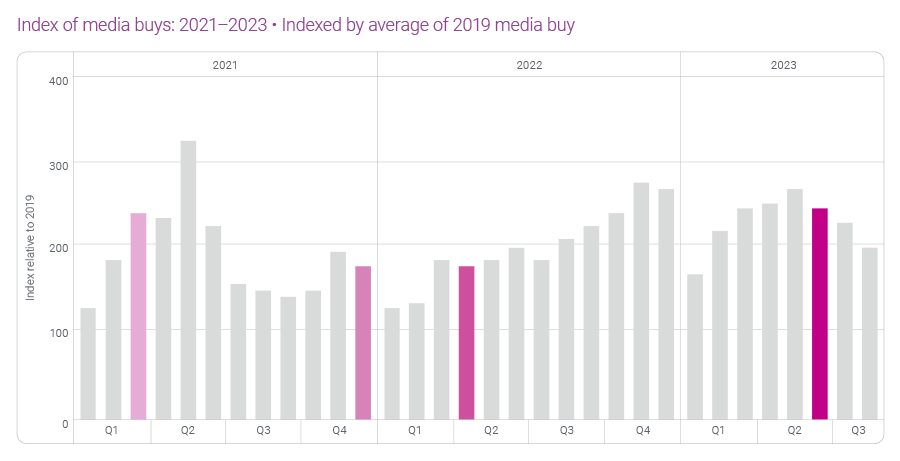

Digital activation grew by 63% between 2022 and 2023. We expect digital activation to increase in 2024 but at a slower rate than in 2023 due to economic uncertainty caused by high-interest rates, recent state privacy regulations, and work stoppages in the entertainment and automotive industries.

Top digital audiences

Which digital audiences are advertisers purchasing from Experian?

We are seeing growth in four major data categories: Automotive, Demographics, Lifestyle and Interests, and Retail Shoppers: Purchase Based audiences. Here are a few audiences within these categories that you can activate on-the-shelf of your preferred platform:

- Automotive: Autos, Cars, and Trucks > In Market-Make and Models

- Demographics: Demographics > Homeowners/Renters > Renter

- Lifestyle and Interests: Lifestyle and Interests (Affinity) > Activities and Entertainment > Wine Lovers

- Retail Shoppers: Purchase Based: Retail Shoppers: Purchase Based > Food and Drink > Restaurants: Fast Food/QSR Chicken Frequent Spenders

Top digital audiences by industry

What are the top digital audiences being activated by industry? Download our 2024 Digital audience trends and predictions report to discover the top digital audiences in the following industries:

- Automotive

- Health

- Financial Services

- Retail & CPG

Download our new 2025 Digital trends and predictions report

Marketers, agencies, and platforms are facing new challenges as privacy regulations evolve, AI technology advances, and consumer behaviors shift. Our latest report highlights actionable strategies for navigating these changes and improving how you connect with audiences, measure impact, and deliver results.

What you’ll learn

- Navigating signal loss: Explore the rise of alternative IDs and contextual targeting as privacy regulations and signal loss reshape data-driven advertising.

- Connected TV (CTV): Understand the growth of connected TV (CTV), the importance of frequency capping, and strategies for effective audience activation.

- Omnichannel campaigns: Learn how marketers are moving from channel-specific strategies to audience-led omnichannel campaigns that tell a more cohesive story.

- Retail media networks: Learn how retail media networks (RMNs) are capitalizing on enriched first-party data to learn more about their customers and reach them across on-site and off-site inventory.

- Curation: Examine how curation is transforming programmatic campaigns by combining audience, contextual, and supply chain signals to deliver premium inventory packages that maximize addressability, efficiency, and performance.

Latest posts

New health information exchanges are prompting data quality efforts, as state and local healthcare agencies look to electronically share patient data.

If the time spent on the Internet for personal computers was distilled into an hour then 27 percent of it would be spent on social networking and forums across the United States, United Kingdom and Australia. In the U.S., 16 minutes out of every hour online is spent on social networking and forums, nine minutes on entertainment sites and five minutes shopping. Global comparison In the UK, 13 minutes out of every hour online is spent on social networking and forums, nine minutes on entertainment sites and six minutes shopping. Australian Internet users spend 14 minutes on social sites, nine on entertainment and four minutes shopping online. Across all three markets, time spent shopping online grew year-over-year, but the UK market emerged as having the most prolific online shoppers, spending proportionally more time on retail Websites than online users in the U.S. or Australia. British Internet users spent 10 percent of all time online shopping in 2012, compared to nine percent in the U.S. and six percent in Australia. This was in part due to a bumper winter holiday season in the UK where 370 million hours were spent shopping online, 24 percent higher than the monthly average. Consumption of news content also increased across all three markets with Australian users emerging as the most voracious consumers of news online. Six percent of all time spent online in Australia in 2012 was on a news Website, compared to five percent in the UK and four percent in the U.S. Meanwhile, the time spent on social media proportionate to other online activities declined across all three regions. The U.S., which has been the most dominant market for social media consumption in the last three years dropped from 30 percent of all time spent online to 27 percent. In Australia time spent on social dropped from 27 percent to 24 percent while in the UK it dipped from 25 percent to 22 percent year-over-year. This highlights the rise in access via 3G and 4G networks as consumers spend increasingly more time online while on the move. "Understanding consumer behavior across channels is more important than ever as more visits are being made on the move, particularly among social networking and email,” says Bill Tancer, general manager of global research for Experian Marketing Services. "With smartphones and tablets becoming more powerful, our data clearly indicates the difference between mobile and traditional desktop usage further enabling the ‘always on’ consumer mentality. Marketers need to understand these differences, as well as regionally, to ensure campaigns can be tailored for better and more effective engagement.” Mobile browsing When looking at the U.S. browsing data for mobile devices, email accounted for the largest time spent on average, for the same categories for Q1 2013. Email made up 23 percent of time spent on mobile devices for Q1-13, while social networking accounted for 15 percent. Entertainment had the third highest time spent with 13 percent, followed by shopping with 11 percent and travel with 9 percent. The mobile data does not include app usage, but does include mobile browsing within an app. Read more of the latest consumer trends in The 2013 Digital Marketer Report Learn more about consumer online behavior by visiting our Online Trends page Learn more about the author, Matt Tatham

The generation of 18- to 34-year-olds known as millennials is an increasingly influential group that impacts many aspects of the American lifestyle, including fashion, technology, entertainment and beyond.