As we approach 2024, marketers must grasp the evolving landscape of digital activation. Understanding emerging audience trends and activation strategies is key to developing impactful marketing initiatives and positioning your brand for success.

In Experian’s 2024 Digital audience trends and predictions report you’ll find:

- Data-driven insights that will empower you to confidently develop marketing strategies that resonate with your audience and drive meaningful results.

- Insights from Experian experts and our industry-leading data.

- Our outlook for 2024 marketing trends.

In this blog post, we’ll provide a sneak peek of the 2024 marketing trends you can expect in our full report.

Digital activation

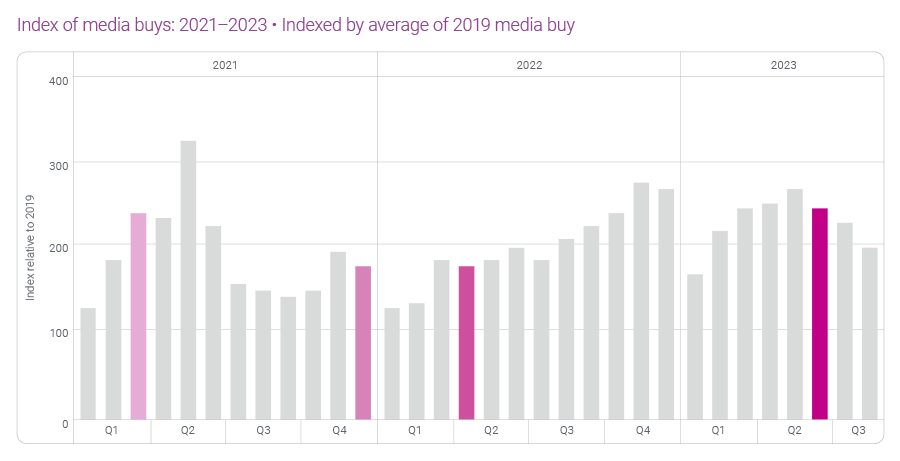

Digital activation grew by 63% between 2022 and 2023. We expect digital activation to increase in 2024 but at a slower rate than in 2023 due to economic uncertainty caused by high-interest rates, recent state privacy regulations, and work stoppages in the entertainment and automotive industries.

Top digital audiences

Which digital audiences are advertisers purchasing from Experian?

We are seeing growth in four major data categories: Automotive, Demographics, Lifestyle and Interests, and Retail Shoppers: Purchase Based audiences. Here are a few audiences within these categories that you can activate on-the-shelf of your preferred platform:

- Automotive: Autos, Cars, and Trucks > In Market-Make and Models

- Demographics: Demographics > Homeowners/Renters > Renter

- Lifestyle and Interests: Lifestyle and Interests (Affinity) > Activities and Entertainment > Wine Lovers

- Retail Shoppers: Purchase Based: Retail Shoppers: Purchase Based > Food and Drink > Restaurants: Fast Food/QSR Chicken Frequent Spenders

Top digital audiences by industry

What are the top digital audiences being activated by industry? Download our 2024 Digital audience trends and predictions report to discover the top digital audiences in the following industries:

- Automotive

- Health

- Financial Services

- Retail & CPG

Download our new 2025 Digital trends and predictions report

Marketers, agencies, and platforms are facing new challenges as privacy regulations evolve, AI technology advances, and consumer behaviors shift. Our latest report highlights actionable strategies for navigating these changes and improving how you connect with audiences, measure impact, and deliver results.

What you’ll learn

- Navigating signal loss: Explore the rise of alternative IDs and contextual targeting as privacy regulations and signal loss reshape data-driven advertising.

- Connected TV (CTV): Understand the growth of connected TV (CTV), the importance of frequency capping, and strategies for effective audience activation.

- Omnichannel campaigns: Learn how marketers are moving from channel-specific strategies to audience-led omnichannel campaigns that tell a more cohesive story.

- Retail media networks: Learn how retail media networks (RMNs) are capitalizing on enriched first-party data to learn more about their customers and reach them across on-site and off-site inventory.

- Curation: Examine how curation is transforming programmatic campaigns by combining audience, contextual, and supply chain signals to deliver premium inventory packages that maximize addressability, efficiency, and performance.

Latest posts

John Fetto answers frequently asked questions about the TV watching habits of consumers based on from our Cross-Device Video Analysis.

Now is the perfect time to begin planning back-to-school marketing campaigns. Follow these five simple tips and be on your way to back-to-school success.

Highlights from the 2014 Hispanic Market Overview presented by López Negrete Communications focused on Hispanic consumers’ adoption and use of smartphones.