It’s been one week since the highly anticipated Cannes Lions 2024—the event of the year for advertising and creativity. We are excited to present our top five takeaways from the event, revealing the industry’s priorities for the year ahead.

Navigating the post-cookie era

One of the pivotal discussions at Cannes Lions 2024 centered around signal loss and identity resolution. The industry is grappling with the impact of third-party cookie deprecation, driving a move toward alternative identifiers such as Unified I.D. 2.0 (UID2) and ID5, and contextual targeting. This shift aims to uphold accurate audience targeting while addressing privacy concerns through authenticated forms of identity. Brands and agencies are actively exploring these new strategies to replace traditional cookie-based methods with stable, privacy-compliant solutions.

First-party data providers are also seeking data onboarding solutions to navigate this transition. They need streamlined integration processes, comprehensive ID-matching capabilities, and transparent pricing structures.

Fortified by our roots in offline data and significant investments in our Graph, and our newest offering, Third-Party Onboarding, you can count on Experian’s solutions to maintain strong signal coverage in a cookieless world so you can have uninterrupted, effective marketing.

Unifying targeting across TV platforms

Another focal point at Cannes Lions 2024 was the challenge of navigating TV fragmentation. Advertisers strive for unified targeting across diverse TV platforms, including connected TV (CTV) and traditional linear TV. They emphasize integrating data sources and ad servers to reach audiences across these platforms. CTV continues to stand out in conversations as a crucial and expanding area for advertising, offering new opportunities for targeted campaigns and broader audience engagement.

We’re fueling the expansion of CTV advertising through our signal-agnostic Graph, which seamlessly integrates CTV IDs, universal identifiers such as UID2, IP addresses, and mobile ad IDs (MAIDs) for targeted campaigns. Our newest offering, Third-Party Onboarding, also provides connectivity to more than 10 TV destinations.

Transforming marketing with AI

We would be remiss not to mention the hottest topic at Cannes Lions 2024, the transformative power of AI within data and identity. Discussions highlighted AI’s pivotal role in revolutionizing marketing strategies by enhancing campaign planning, dynamic optimization, measurement, and analytics. AI is not just a tool; it enables marketers to work smarter and faster. With real-time data enrichment, AI will empower marketers to manage large-scale campaigns with unprecedented efficiency and precision.

Marketers envision a future where AI seamlessly integrates into every aspect of their strategy, from understanding and predicting consumer behavior to automating personalized engagement. They see AI as the key to unlocking new levels of precision and efficiency, allowing them to adjust real-time campaigns based on consumer interactions and preferences. This vision includes using AI for deeper audience insights, ensuring that every marketing touchpoint is relevant and impactful.

Striving for strategies for proven ROI

Discussions on measurement at Cannes Lions 2024 focused on how measurement metrics are evolving to keep pace with industry changes. Cross-device, multi-touch attribution, and outcome-based metrics like consumer lifetime value and conversion rates are becoming more important. Accurate measurement is critical for demonstrating campaign impact and optimizing future marketing efforts.

These developments reflect a shift toward more sophisticated measurement practices to optimize marketing strategies and prove tangible ROI.

Through our Consumer Sync solutions, you can improve your attribution quality to understand the true path to conversion by linking all digital touchpoints to a single person.

Creating integrated consumer experiences with retail media networks

Retail media networks (RMNs) are becoming more integrated and connected. Their goal is to provide consumers with a unified online and physical store experience and create a comprehensive marketplace where retailers can work together and use shared data to better reach and engage with their audiences.

“Throughout the conversations, it’s been clear that there’s a lot of demand and interest in building and growing retail media networks. What strikes me is that Experian products, both across identity and data, can be a big support to help grow and fill in these gaps.”

budi tanzi, vp, product

Discussions at Cannes Lions 2024 emphasized how collaborations with technology providers and industry groups can help set measurement standards and ensure transparency. These partnerships can enable RMNs to expand their reach and compete with larger advertising platforms, driving industry growth and innovation.

Experian offers comprehensive solutions for RMNs. Our Profile Insights and Enrichment tools offer valuable customer behavior insights, driving smarter inventory management. We enhance ad targeting beyond item-level purchases with accurate data and syndicated audiences, aligning with broader media strategies. Third-Party Onboarding enables expansion beyond owned and operated inventory, supported by our Graph for enhanced connectivity.

“Data providers are excited to eliminate digital hops in their data flow using Experian Third-Party Onboarding. Third-Party Onboarding is uniquely set up to reduce friction for third-party data and the ecosystem in general.”

adam kobus, director of data partnerships

Experian events at Cannes Lions 2024

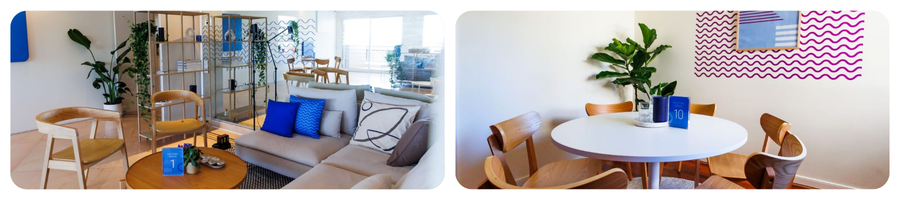

This year, we hosted a kick-off happy hour, content studio, and members of our team joined various panels across the Croisette. Here’s a recap of our week at Cannes.

Experian’s kick-off event with Audigent and LG Ad Solutions

To kick off the week, we co-hosted a happy hour with Audigent and LG Ad Solutions. At our sold-out event, attendees enjoyed a live performance from St. Lucia.

Content studio

We interviewed 27 thought leaders across the industry in our content studio. Our interviews covered topics like:

• Signal loss

• Connected and linear TV

• Data collaboration

• Future of addressability and personalization

• Retail media networks

• And more

We’ll be sharing more from our content studio over the coming months. Follow us on LinkedIn or sign up for our email newsletter for the latest updates.

Panel participation

The Experian team participated in four panels throughout the week across the Croisette:

- Scott Kozub, VP, Product Management, joined the Brand Innovators panel, “Future of media,” where he discussed how media companies can adapt their content and distribution strategies to cater to changing consumption habits as media becomes more fragmented across devices and platforms.

- Kimberly Gilberti, Chief Product Officer, joined OpenX’s panel, “Unlocking addressability: Navigating the post-cookie era,” to discuss the prevailing strategies for achieving addressability in a cookieless world.

- Budi Tanzi, VP, Product, participated in Audigent’s panel, “Curation in regulated industries,” where they talked about why curation is effective in regulated markets like finance and health.

- Rachael Donnelly, Chief Marketing Officer, joined The Female Quotient in the Equality Lounge for their panel “Emotional agility: Leading beyond the double standard,” where they explored the power of diverse storytelling and its impact on audience engagement, brand building, and the bottom line.

Let’s keep the momentum going

As we wrap up another exciting week at Cannes Lions, the discussions have shown us the potential for innovation in signal loss, TV fragmentation, AI, measurement, and retail media networks. These topics pave the way for a more connected future in advertising. Which trends are you most excited about? Let’s continue the conversation! Reach out to us, and let’s dive deeper into these topics together.

We understand that customers may be experiencing uncertainty with their marketing strategies with Oracle’s exit from advertising. Experian is one of Oracle’s primary data providers powering their audiences. We can help marketers easily make the switch from Oracle audiences to Experian audiences without changes in advertising effectiveness or efficiency.

We have mapped Oracle audiences to Experian audiences to make it easy for you to switch your campaign targeting to Experian. Reach out to your account representative or our audiences team for information about audience mapping and finding the most relevant Experian audience for your campaigns.

Latest posts

New health information exchanges are prompting data quality efforts, as state and local healthcare agencies look to electronically share patient data.

If the time spent on the Internet for personal computers was distilled into an hour then 27 percent of it would be spent on social networking and forums across the United States, United Kingdom and Australia. In the U.S., 16 minutes out of every hour online is spent on social networking and forums, nine minutes on entertainment sites and five minutes shopping. Global comparison In the UK, 13 minutes out of every hour online is spent on social networking and forums, nine minutes on entertainment sites and six minutes shopping. Australian Internet users spend 14 minutes on social sites, nine on entertainment and four minutes shopping online. Across all three markets, time spent shopping online grew year-over-year, but the UK market emerged as having the most prolific online shoppers, spending proportionally more time on retail Websites than online users in the U.S. or Australia. British Internet users spent 10 percent of all time online shopping in 2012, compared to nine percent in the U.S. and six percent in Australia. This was in part due to a bumper winter holiday season in the UK where 370 million hours were spent shopping online, 24 percent higher than the monthly average. Consumption of news content also increased across all three markets with Australian users emerging as the most voracious consumers of news online. Six percent of all time spent online in Australia in 2012 was on a news Website, compared to five percent in the UK and four percent in the U.S. Meanwhile, the time spent on social media proportionate to other online activities declined across all three regions. The U.S., which has been the most dominant market for social media consumption in the last three years dropped from 30 percent of all time spent online to 27 percent. In Australia time spent on social dropped from 27 percent to 24 percent while in the UK it dipped from 25 percent to 22 percent year-over-year. This highlights the rise in access via 3G and 4G networks as consumers spend increasingly more time online while on the move. "Understanding consumer behavior across channels is more important than ever as more visits are being made on the move, particularly among social networking and email,” says Bill Tancer, general manager of global research for Experian Marketing Services. "With smartphones and tablets becoming more powerful, our data clearly indicates the difference between mobile and traditional desktop usage further enabling the ‘always on’ consumer mentality. Marketers need to understand these differences, as well as regionally, to ensure campaigns can be tailored for better and more effective engagement.” Mobile browsing When looking at the U.S. browsing data for mobile devices, email accounted for the largest time spent on average, for the same categories for Q1 2013. Email made up 23 percent of time spent on mobile devices for Q1-13, while social networking accounted for 15 percent. Entertainment had the third highest time spent with 13 percent, followed by shopping with 11 percent and travel with 9 percent. The mobile data does not include app usage, but does include mobile browsing within an app. Read more of the latest consumer trends in The 2013 Digital Marketer Report Learn more about consumer online behavior by visiting our Online Trends page Learn more about the author, Matt Tatham

The generation of 18- to 34-year-olds known as millennials is an increasingly influential group that impacts many aspects of the American lifestyle, including fashion, technology, entertainment and beyond.