As Earth Day approaches, it’s the perfect opportunity for marketers to explore innovative ways to engage with eco-conscious customers. With a strong and growing interest in sustainable business practices worldwide, green audiences are becoming increasingly influential. In addition to being good for the planet, engaging these customers is great for any brand or organization striving to become more eco-friendly and socially responsible. By taking advantage of this timely event and using appropriate tools, you can create personalized campaigns that will both promote your brand and increase customer loyalty.

Eco-conscious audiences

In this blog post, we’ll cover three eco-conscious audiences to target this Earth Day:

- Solar energy

- GreenAwareTM

- Electric vehicles

Solar energy

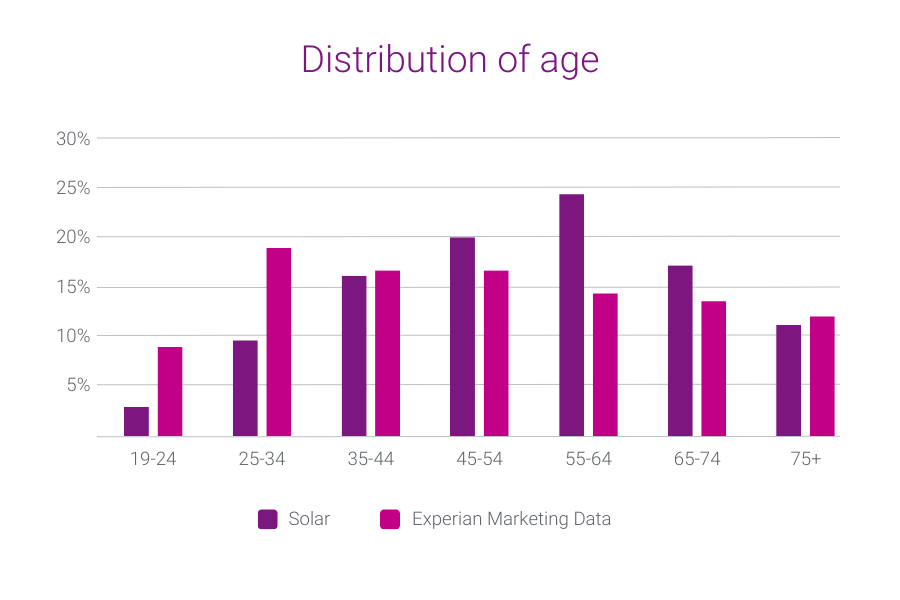

Our first eco-conscious audience is Solar energy. Consumers in this audience show an inclination toward harnessing the power of the sun as a clean, renewable energy source. Our audience data can provide valuable insights into the Solar energy consumer base, including their age, education level, occupation, household income, and communication preferences. Let’s explore these metrics to better understand how to reach this group effectively.

Age and living situation

Consumers in our Solar energy audience are more likely to live in a home with two or more adults and are between the ages of 45-74.

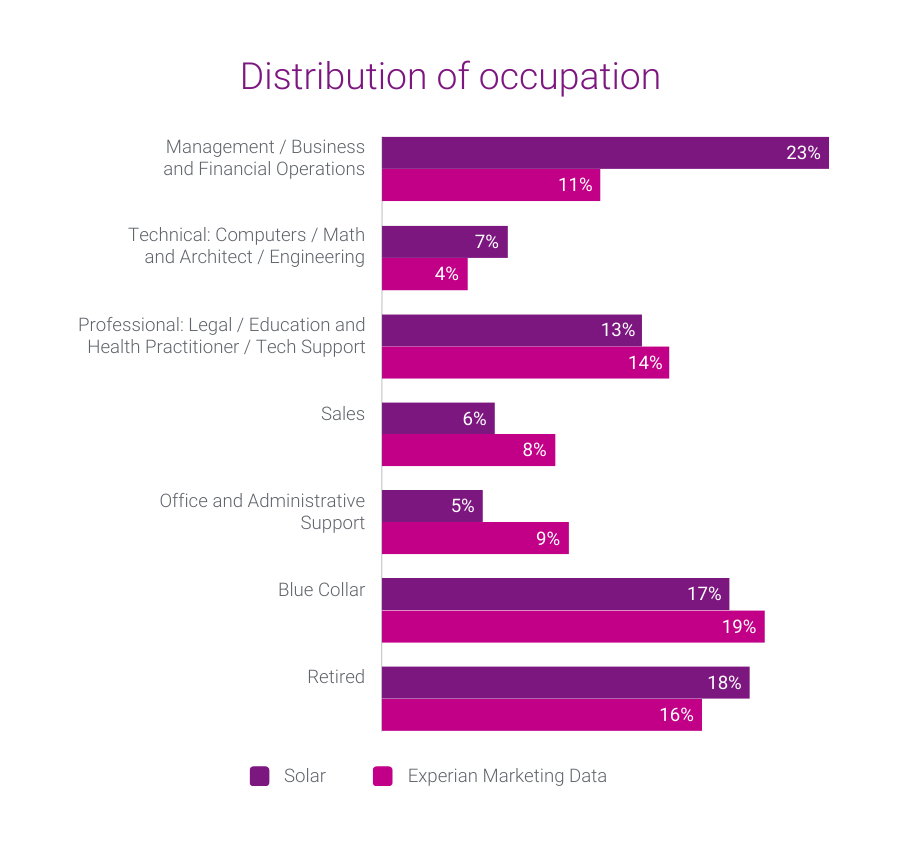

Education level and occupation

Consumers in our Solar energy audience are more likely to have graduated from college or graduate school and work in management-level occupations.

Household income

Consumers in our Solar energy audience have household incomes of more than $75,000 and their homes are valued at over $550,000.

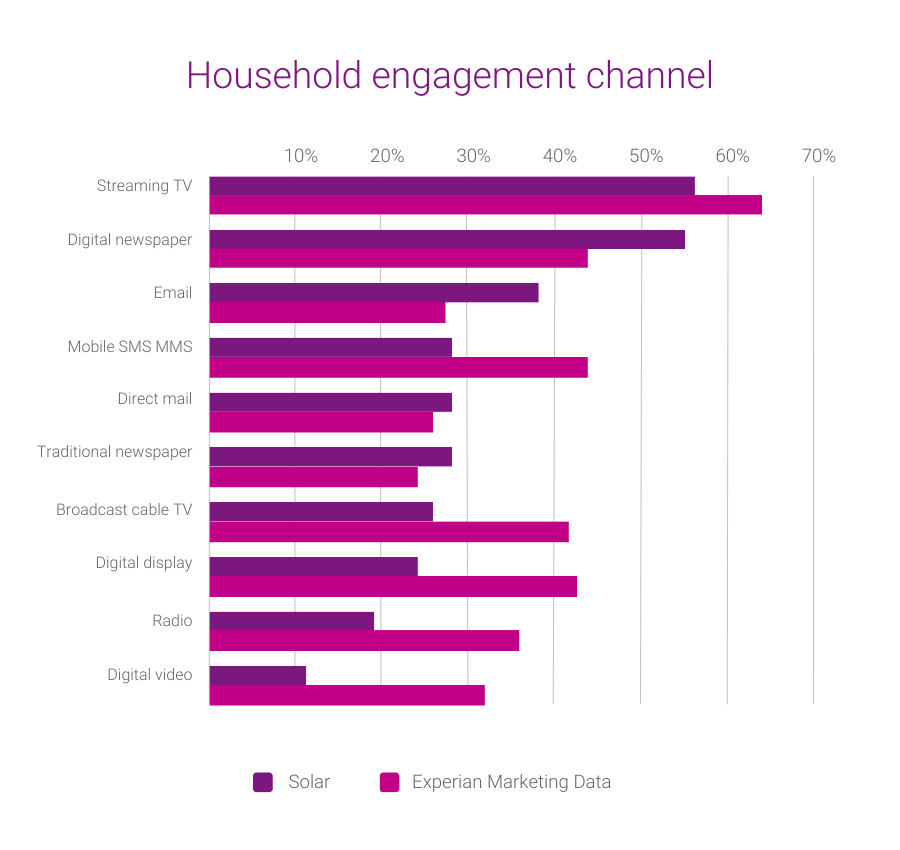

Preferred engagement channels

Consumers in our Solar energy audience are most receptive to ads served through digital channels like digital newspapers and email.

Solar energy audience pairings

Consumers in our Solar energy audience also belong to three of our Mosaic® USA groups:

- Power Elite

- Flourishing Families

- Booming with Confidence

Our consumer segmentation portal of 126 million households and 650 lifestyle and interest attributes empowers marketers like you to precisely target your ideal audience and communicate with them on a personal level. Mosaic’s data segments the U.S. into 19 overarching groups and 71 underlying types, giving you the insights needed to anticipate the behavior, attitudes, and preferences of your most profitable customers and communicate with them on their preferred channels, with messaging that resonates.

GreenAware

Our second eco-conscious audience is GreenAware.

GreenAware segments the 126 million U.S. households within Consumer View into four distinct groups. Each group differs in their attitudes and behaviors toward purchasing products that are environmentally safe and working with companies that are eco-conscious. We created these groups using an enhanced application of traditional statistical clustering techniques based on environmentally relevant measurements in Simmons’ National Consumer Study.

Based on the distinctive mindset of consumers toward the environment, you can learn how environmental concerns fit into their lives through four major consumer segments:

- Eco-Friendly Enthusiasts

- Sustainable Spectators

- Passive Greenies

- Eco Critics

Let’s dive deeper into each group to understand their unique perspective on the environment and how this impacts their attitudes and behaviors.

Eco-Friendly Enthusiasts

This eco-conscious segment prioritizes a green lifestyle and takes pride in avoiding products that harm the planet. With traditional and liberal values, they embrace optimism and prioritize family. With their children out of the house, they take the time for some well-deserved rejuvenation and are committed to a healthy lifestyle. Some members of this group are transitioning into retirement and welcoming a new chapter in their life.

- Mature adults and retirees

- College graduate or more

- Above average income

- May be married or single

- Typically own their homes

Sustainable Spectators

This segment aspires to be more sustainable, but they struggle with translating their green ideas into action. They have a soft spot for a cozy home. While their love for interior design and taking care of their own space is evident, they’re always looking for new experiences and opportunities to learn. Staying healthy and active is a top priority for this group, so it’s no surprise that they’re always looking for ways to stay fit and feel their best.

- Established and mid-life adults

- College graduate or more

- High income

- Typically married

- Likely to own their homes

Passive Greenies

This is the largest and one of the most youthful groups. Known for their love of exploration and self-discovery, they may not have fully embraced eco-conscious behaviors yet, but they are eager to stay current with the latest technology and trends. With their incredible ability to multitask, they’re always on-the-go, and constantly seek the next best thing.

- Mainly young adults and diverse

- Education ranges from high school through some college

- Below average income

- More likely to be single or divorced

- Typically rent

Eco Critics

This group is not likely to be eco-conscious and may have negative attitudes about the environment. They are confident, driven, and focused on their personal growth. They crave instant gratification, seeking out quick and easy solutions to their everyday decisions. They place a high value on entertainment, their social life, and carefully curate their image.

- Young and established adults

- Education ranges from high school through post-graduate studies

- High income

- Married or single

- Typically own their homes

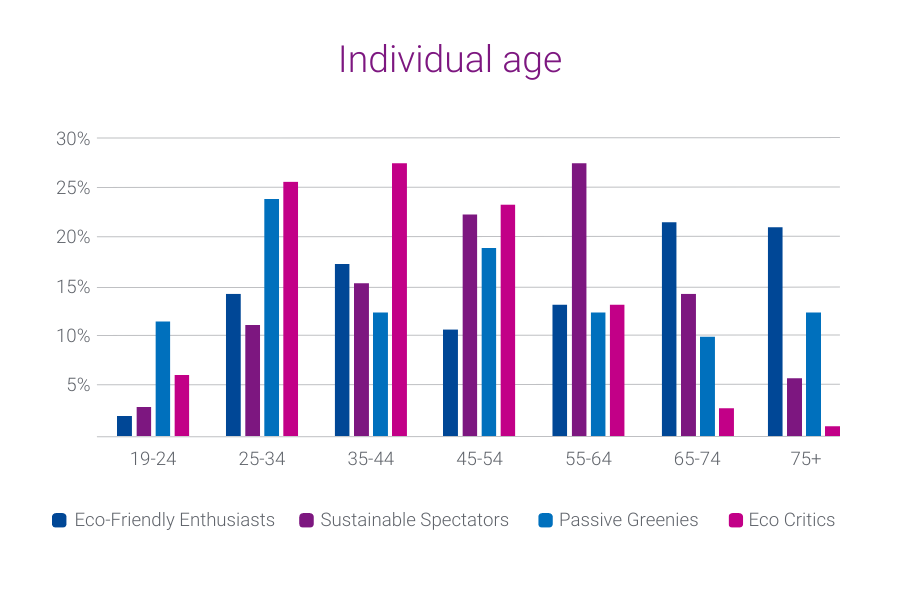

Let’s take a look at how the GreenAware segments stack up against each other in terms of age, household income, education level, and media preference. How do they compare? Let’s find out.

Age

Consumers in the Eco-Friendly Enthusiasts segment are the oldest of the four GreenAware segments – about half of the consumers are 65 or older. Eco Critics are the youngest segment, with over half of consumers in this group between ages 25-44.

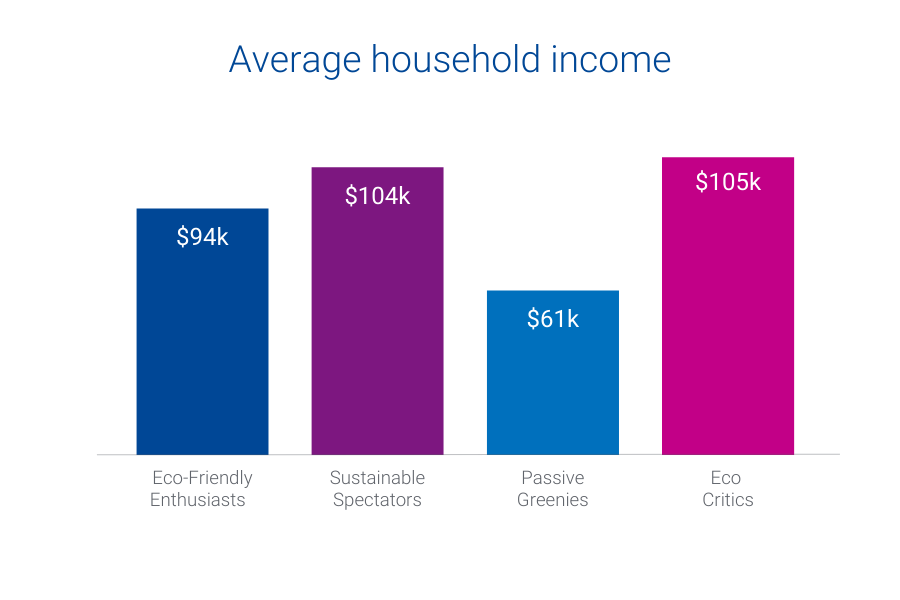

Household income

Sustainable Spectators and Eco Critics are the wealthiest GreenAware segments. The average household income of consumers in these segments is above $100,000. Passive Greenies have the lowest household income, with a majority below $50,000.

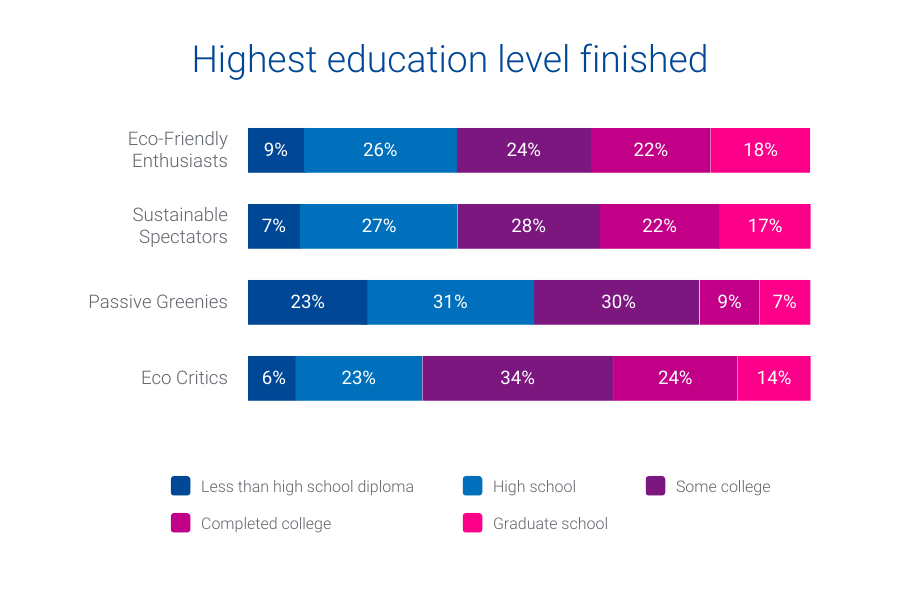

Education level and occupation

Passive Greenies are more likely to work Blue Collar jobs and have the lowest level of education. As the wealthiest segments, Sustainable Spectators and Eco Critics have the highest levels of college degrees and work in management, business, and financial operations. Eco-Friendly Enthusiasts are the most likely to be retired and out of the workforce.

Preferred engagement channels

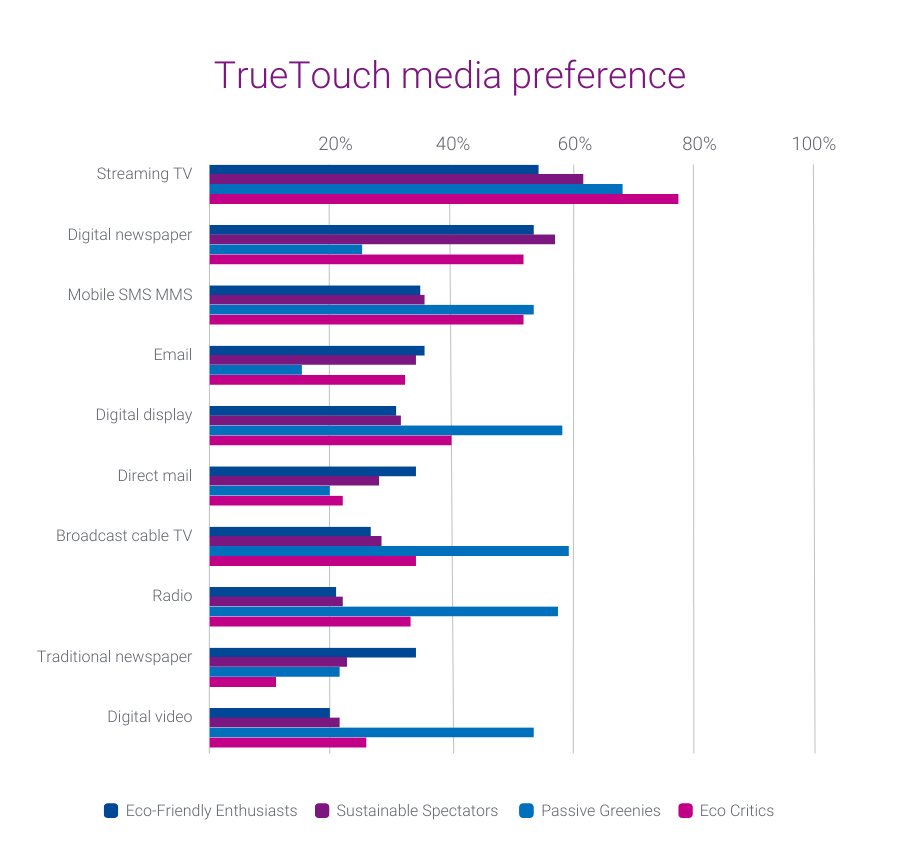

Streaming TV is the preferred engagement channel for all GreenAware segments.

Eco-Friendly Enthusiasts prefer digital channels like digital newspapers, mobile SMS, and email. They also engage with traditional channels like direct mail and newspaper.

Passive Greenies have a high preference for digital display, mobile SMS, digital video, broadcast cable TV, and radio.

Eco Critics have a high preference for digital channels like digital newspapers, mobile SMS, and digital display.

Sustainable Spectators strongly prefer digital newspapers. They don’t show as strong of a preference for mobile SMS and digital display as Eco Critics and Passive Greenies.

GreenAware audience pairings

Six of our Mosaic groups have at least one GreenAware segment with 10% or more of the population. For more precise targeting, below are suggested Mosaic audiences you can pair with each GreenAware segment:

| Eco-Friendly Enthusiasts | Sustainable Spectators | Passive Greenies | Eco Critics |

| Booming with Confidence | Power Elite | Singles and Starters | Power Elite |

| Autumn Years | Booming with Confidence | Golden Year Guardians | Suburban Style |

| Golden Year Guardians | Singles and Starters |

Electric vehicles

Our third eco-conscious audience is electric vehicles.

Electric vehicles (EVs) are having a major moment in the automotive industry. This is no surprise given that new EV models are being released and an increasing number of charging stations are popping up around the country. As EVs become more prominent, it’s essential to stay up to date on relevant trends to make informed decisions about what lies ahead.

The demand for electric vehicles (EVs) is on the rise

Consumers are embracing the EV revolution, showing their desire for a cleaner, greener future. Automotive marketers are increasingly looking to reach in-market EV shoppers and current alternative fuel vehicle owners due to the growing availability of electric vehicles, improved infrastructure, and rising popularity. In 2022, EVs charged up the market and accounted for a remarkable 6% of new retail registrations.

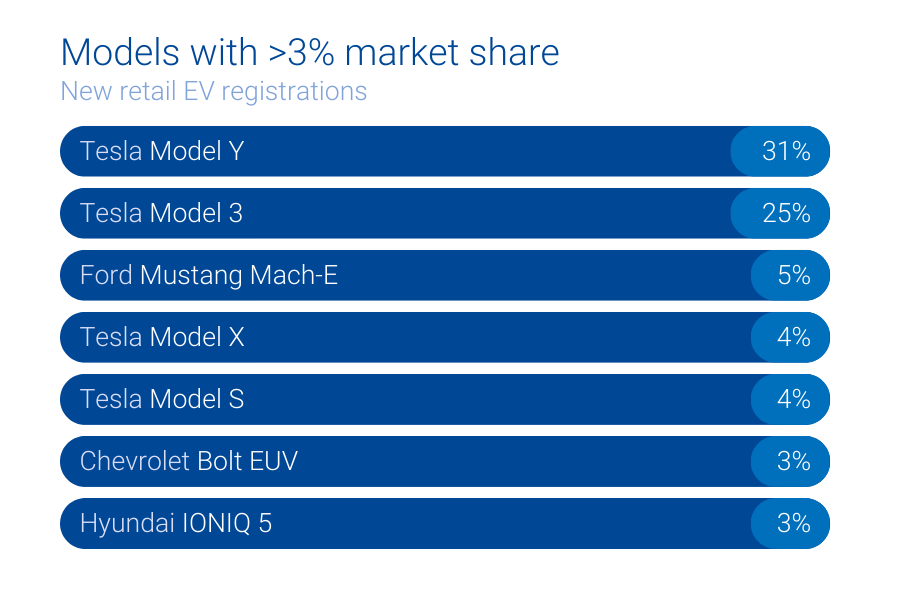

While Tesla continues to dominate the EV market, Ford, Chevrolet, and Hyundai are starting to compete, each holding more than 3% of the market share of new retail EV registrations.

Geography

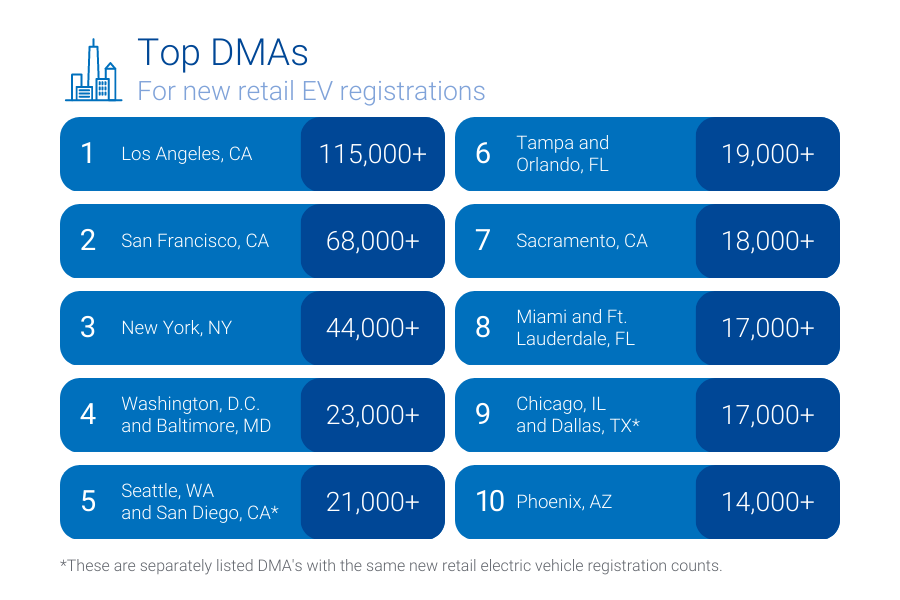

Where are we seeing the most new retail EV registrations? The top designated market areas (DMAs) for new retail EV registrations are mostly located in heavily populated, coastal cities like Los Angeles, CA and New York, NY.

The fastest growing DMAs, however, are in smaller cities like Tucson, AZ and Oklahoma City, OK.

Generational demographics

Gen X and Millennials make up the largest percentage of new retail EV buyers at 37.5% and 34.4%. Gen Z and the Silent generation represent the smallest shares at 5% and 2.1%. Boomers hover between Gen X and Millennials’ share and account for 20.6% of new EV retail purchases.

EV audience pairings

Our top five Mosaic groups for new EV buyers include:

- American Royalty

- Cosmopolitan Achievers

- Philanthropic Sophisticates

- Couples with Clout

- Fast Track Couples

How to target consumers in-market for electric vehicles

We offer 70+ audiences that are focused on likely buyers and owners of EV and plug-in hybrid (PHEV) vehicles. We also offer a subset of 28 audiences focused on individual EV/PHEV vehicle models.

Below is how you can find a few of these audiences on-the-shelf of most trusted advertising platforms:

- Autos, Cars, and Trucks > In Market-Fuel Type > Electric

- Autos, Cars, and Trucks > In Market-Fuel Type > Used Electric

- Autos, Cars, and Trucks > In-Market Make and Models > Tesla

- Autos, Cars, and Trucks > In-Market Make and Models > Chevrolet Bolt EV

We can help you reach eco-conscious consumers

Earth Day is a great opportunity to get creative with your marketing efforts with our three eco-conscious audiences: Solar energy, GreenAware, and electric vehicles. To find out how you can add eco-conscious audiences to your marketing plan, contact us.

Latest posts

Adapt with Tapad, a part of Experian Leading browsers have made public announcements and technical deployments to reduce the digital advertising accessibility of third-party cookies for data collection, storage, and sharing due to growing privacy concerns. As a result, there has been growing momentum to find an alternative via cookieless IDs, with the intent to create a replacement that helps ensure continuity across the ecosystem. At Tapad we’ve chosen to approach the market with a solution that provides agnostic interoperability for these cookieless identifiers, so that marketers can continue to work with the identity providers of their choice while maintaining the most holistic view of consumers across digital touchpoints. Introducing switchboard Switchboard is a module within The Tapad Graph that leverages our core capabilities across machine learning and identity management to provide a connection between traditional digital identifiers and the new wave of cookieless IDs that will be utilized in the future. Customers of Tapad can take advantage of its broad ecosystem of identifiers to drive targeting and frequency capping strategies and enable detailed measurement and attribution post-deprecation of the third-party cookie. Our goal is to accelerate the adoption, scale, and utility of cookieless IDs with the release of the Switchboard module within The Tapad Graph, while maintaining an agnostic approach to the market. Switchboard for identity solutions In the evolving landscape agencies and marketers will need to invest, test, and analyze the best combination of cookieless ID partners to meet their objectives. The Switchboard module will increase the utility and value of the cookieless ID space in conjunction with other addressable IDs, by providing a layer of connectivity that will be natively missing with the deprecation of third-party cookies. Identity solutions at launch: Switchboard for graph customers For existing Tapad customers who leverage the Switchboard module in The Tapad Graph, it will provide a seamless way to facilitate interoperability while resolving identity back to a Household or Individual. By providing this translation layer, Tapad will take on the responsibility of encryption and decryption protocols where applicable, which will deliver added functionality to our customers. Tapad + Experian partners at launch: Use cases Resolve existing first-party data with new cookieless solutions through The Tapad Graph to minimize data loss Frequency cap at the Individual and Household level via Cookieless and traditional ID Reach consumers at scale across all touchpoints and IDs Build a more inclusive and holistic view of the consumer journey Run accurate and scalable measurement before and after the formal deprecation of third-party cookies in Chrome Map online data into offline activities Hear why industry leaders are adapting with Tapad + Experian As advertisers continue to contemplate the future of identity, Amobee is proud to partner with Tapad, a part of Experian, on this next-generation solution to provide a comprehensive view of consumers. With the imminent loss of cookies, advertisers must think creatively in order to respectfully engage consumers in a privacy-compliant way and Switchboard can play an important role in addressing their respective identity needs. — Bryan Everett | Senior Vice President of Global Business Development | Amobee Connecting offline and online shopper activity in a privacy-compliant way is fundamental to marketing effectiveness and determining return on ad-spend. That’s why we’re excited to be a launch partner for Tapad + Experian's Switchboard offering; it provides a unified solution for supporting the variety of proprietary and anonymous user ID standards required by advertising demand-side platforms today. — Brian Dunphy | SVP Digital Business and Strategic Partnerships | Catalina As the industry evolves, Tapad + Experian's Switchboard presents a privacy-safe solution that allows for the continued activation of data and an alternative to advertising within walled garden environments. We look forward to collaborating with Tapad and the industry as we collectively transition to support cookieless identity. — Don Lee |SVP of Global Platform Partnerships | Eyeota We are excited to participate in this proactive solution to the sunset of third-party cookies. Switchboard’s agnostic interoperability, with BritePool and other ID providers, will create high-value for marketers as they transition to the era of cookieless web advertising. — David J. Moore | CEO | BritePool Interoperability is paramount for brand marketers, agencies, publishers and platforms if we want to support an open and free Internet and break free of the stranglehold of walled gardens. Lotame Panorama ID’s participation in Switchboard reflects our steadfast commitment to collaborating across and within the industry and providing value to all of its players. — Pierre Diennet | Global Partnerships | Lotame At this pivotal moment in the industry, we are excited to be partnering with Tapad, a part of Experian on their cookieless initiative and making Retargetly IDx available into the Switchboard solution, providing global brands, platforms and publishers with a compliant, cookieless ID solution for the Latin American market; enabling them to target, reach and measure users at scale through the region. — Daniel Czaplinski | CEO and Co-Founder | Retargetly With Audigent’s Halo ID, we’re architecting a cookieless future where clients and partners have confidence in the actionability and interoperability of exclusive 1st party audiences, originated from some of the world’s leading publishers and creators. We see collaboration as being critical to a collective understanding of identity and Tapad, a part of Experian as a trusted partner with solutions such as Switchboard to support continuity for marketers’ addressability. — Drew Stein | CEO and Founder | Audigent Facilitating access and usage of 1st party identifiers is crucial to help marketers prepare for the cookieless future. Thanks to Switchboard, ID5’s cookie-less IDs will be available to a wider audience of brands and agencies and enable them to run effective, data-driven campaigns beyond the third-party cookie. — Mathieu Roche | CEO and Co-Founder | ID5 Addressing the current identity challenge requires transparency and collaboration. We are pleased to align ShareThis data with Tapad + Experian’s growing ecosystem. ShareThis data helps marketers evolve beyond the cookie to complete the picture. Tapad + Experian’s Switchboard offering will support ShareThis’s deep connections to clients and technology platforms, preserving and growing the accessibility of our data. — Michael Gorman | SVP Product and Business Development | ShareThis Get started with The Tapad Graph For personalized consultation on the value and benefits of The Tapad Graph for your business, email Sales@tapad.com today!

With the emergence of email addresses as a currency for brands to communicate with their consumers offline; attaching email data to in-store purchases lays the groundwork for future advertising strategies. However, this advantage in having an additional digital touchpoint also creates a new challenge for marketers. How do they connect what they know about their customers via offline data and PII, or personally identifiable information, with what they want to know about their online behaviors and interactions? Taken a step further, how can they create actionable strategies that connect these two streams of consumer insights in order to drive them to make more future purchases; and even become loyalists? At a time when the shift from traditional to online shopping feels more like a landslide; connecting online and offline data has never been more valuable or more urgent. The solution for these marketers lies in the framework of identity resolution; and a key capability called hashed email onboarding. Hashed email onboarding is a privacy-safe way to connect consumer email addresses to their related digital devices and other digital identifiers. The methodology prevents the consumers actual email address from being readable; while still providing marketers a connection between those emails and other touchpoints for an individual. Instead of understanding the customer journey in two distinct parts; how they interact with a brand or company offline and separately how they interact with a brand online; hashed email onboarding allows for the two parts to be woven together in a holistic view of that consumer. The power of connecting these data sets can be seen when combining offline and online attribution and measurement to improve frequency capping and look-alike modeling. It’s important to note that not all identity resolution vendors that onboard hashed emails function in the same way or provide the same level of data. Some connect only to desktop or only to mobile devices; while others don’t actually make direct linkages at all- they simply provide the hashed emails as a targetable digital audience for upload. While hashed email onboarding and the connection between offline and online data is a powerful strategy; it needs to be as structured as possible across the most data available to reveal truly efficient targeting and measurement strategies. Tapad, a part of Experian has built a hashed email product feature that works with the existing flexibility of The Tapad Graph to deliver the most holistic consumer view in the structure that works best for your business objectives. Get started with The Tapad Graph For personalized consultation on the value and benefits of The Tapad Graph for your business, email Sales@tapad.com today!

One of the biggest challenges marketers face when planning digital advertising campaigns is getting an adequate number of impressions that yields measurable results at the lowest possible cost. As agencies, operators and advertisers are increasingly challenged about media budget, it is more important than ever to plan campaigns that generate enough information at the lowest possible cost. Through our design, deployment and measurement of advertising on a variety of platforms, Experian has developed best practices when planning digital advertising campaigns. We share some of these here, to help marketers with future campaign planning to maximize marketing effectiveness at a minimal cost. Using Path to Purchase to Determine the Right Number of Touch Points The Path to Purchase Funnel provides a framework to determine the number of touchpoints required to turn a prospect into a buyer. There are various phases the consumer goes through at each contact, and these phases dictate the number of touch points (or ‘touches’) required to induce a purchase. In the table below, we’ve described what these phases are, and the number of touch points required for those phases. The required number of touches will vary greatly among marketers, who must consider the expected time for a prospect to make decisions, competition in the marketplace, the novelty of the offer, and the level of engagement of the audience. For example, 15-second or 30-second audio and video ads played during scheduled breaks in programming may require more repetition than an ad played at a moment of high engagement, such as when the user interacts with the app, or during a “pre-roll” advertisement view prior to streamed content. Determining the Target Number of Impressions Needed to Persuade The next step involves determining how many exposures will be required to get the impressions or touch points needed to satisfy the consumer’s path to purchase. Let’s say a marketer has decided that four impressions are enough to make the case for the consumer to purchase, and that the marketer plans to reach 1 million prospects during the campaign. Perhaps the most intuitive solution is to provide four impressions for each reached prospect, such that 4 million impressions would be served during the campaign. However, during a normal digital campaign, some prospects will have zero impressions while others will have many. Because of this, we recommend planning to reach a target fraction (typically 80%) of the audience to receive the required number of impressions for purchase. The following table shows the predicted percent of audience exposed by average number of impressions served. Factoring Advertising Half-Life into Impressions Required Advertisement decay, or the fading consumer memory that reduces ad effectiveness, should also be factored into determining the right number of impressions for a successful campaign. For example, if a campaign length is planned to be 6 weeks, but the half-life of the advertisement is only three weeks, then more impressions would be needed to attain the number of touches required for the path to purchase. When planning campaigns for our partners, we adjust the target mean exposure frequency by the square root of the proportion of campaign length over advertisement half-life. For example, assuming a 3-week half-life and a 6-week campaign, we should multiply our target 5.5MM impressions by to get 7.78MM impressions. In the table below, we’ve demonstrated several scenarios of varying advertisement half-life. Other Considerations During Post-Campaign Analysis Once the campaign is completed, Experian recommends analyzing the distribution of impression frequency to determine how closely the actual impression frequencies matched to what was predicted. If frequencies do not align with the predicted, check to see if these assumptions are met: Make sure that advertising impressions are independent of each other. If rules are in place such that a prior impression affects the likelihood of a subsequent impression, this can affect the impression frequency. Check that the entire targeted population is on the ad platform long enough to be available for targeting. Some campaigns may have been instructed to be deployed in phases, which could limit the number of impressions to be delivered. Confirm that exposures can only occur one at a time, so that the impressions are deployed at distinct time intervals, giving the consumer the opportunity to view the advertisement Planning a successful campaign is critical for a test-measure-learn environment for an agency, operator, platform or advertiser. While initial up-front costs can be expensive, the long-term value to the business is significantly greater if tests are designed and administered appropriately. As a result, spending a little extra time thinking about your consumer’s path to purchase, exposure frequency, and the half-life of your advertisement can pay significant dividends in developing your digital advertising strategy.