Following the success of our recent launch of Third-Party Onboarding, we are excited to introduce the Experian marketplace, a new addition to our portfolio of data-driven activation solutions.

Experian’s marketplace bridges TV operators, programmers, supply partners, and demand platforms with top-tier third-party audiences across retail, CPG, health, B2B, and location intelligence. Easily activate premium audiences from leaders like Attain, Alliant, Circana, and Dun & Bradstreet – driving precise, efficient consumer reach.

“Experian has been a longstanding partner of DISH Media, and we’re excited to be an early adopter of their marketplace which leverages the foundation of their identity solutions to ensure maximum cross-channel reach as we look to expand the breadth and depth of data we use for addressable TV.”

Kemal Bokhari, Head of Data, Measurement & Analytics, DISH Media

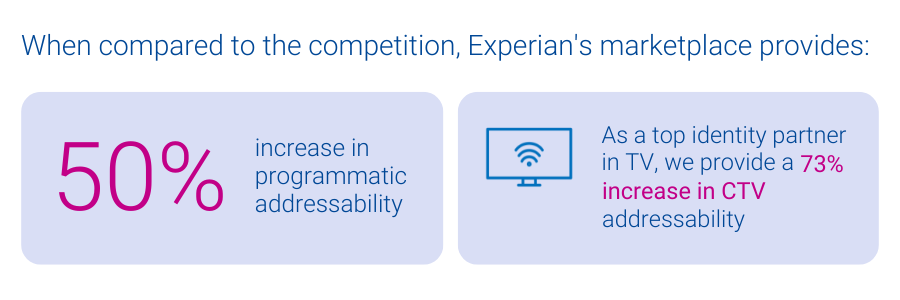

As privacy regulations evolve and traditional identity signals shift, many activation platforms face declining addressability. This impacts their ability to effectively reach consumers, which is critical to staying competitive. Experian’s marketplace, powered by our identity graphs which include 126 million households, 250 million individuals, and 4 billion active digital IDs, enables audiences to be easily activated and maintain high addressability across display, mobile, and connected TV (CTV) channels.

Benefits of Experian’s marketplace

- Enhanced addressability and match rates: All audiences delivered from our marketplace benefit from our best-in-class offline and digital identity graphs, which ensure addressability across all channels like display, mobile, and CTV. Unlike other data marketplaces, Experian ensures all identifiers associated with an audience have been active and are targetable, improving the accuracy of audience planning.

- Simplified audience planning and distribution for TV Operators: TV operators can build custom audiences matched directly to their subscriber footprint and distribute them across all advanced TV channels (data-driven linear, addressable, digital, and CTV) for maximum impact.

- Diversification within the data marketplace ecosystem: With the recent departure of Oracle’s advertising business, the optionality for buyers and sellers to connect with third-party data has become increasingly limited. With Experian marketplace, we’re excited to offer a new solution to the market that ensures data-driven targeting can continue to take place at scale.

- Lower activation costs: Experian’s marketplace offers transparent, pass-through pricing with no additional access fees, enabling partners to maximize their earnings while reducing costs.

- Audience diversity and scale: Platforms can access a broad range of audiences across top verticals from our partner audiences, which can be combined with 2,400+ Experian Audiences. This offers the flexibility, reach, and scale necessary to effectively execute advertising campaigns.

- Remove compliance concerns: Experian’s rigorous data partner review ensures available audiences comply to all federal, state and local consumer privacy regulations.

“Circana and Experian have enjoyed a deep partnership for over a decade. We are exceedingly excited to extend our partnership and be an early adopter and launch partner of the Experian data marketplace. This additional capability will enable the ecosystem to more easily access Circana’s purchase-based CPG and General Merchandise (for example Consumer Electronics, Toys, Beauty, Apparel etc.) audience segments to drive performance outcomes across all media channels.”

Patty Altman, President, Global Solutions, Circana

“Capturing the attention of target audiences across channels is critical for marketers navigating an increasingly connected digital world. We are excited to be an exclusive provider of B2B solutions within Experian’s marketplace, helping brands and media agencies to accelerate their reach, addressability and targeting capabilities across TV, mobile and connected TV channels.”

Georgina Bankier, VP of Platform Partnerships at Dun & Bradstreet

Better connections start here: Experian’s marketplace

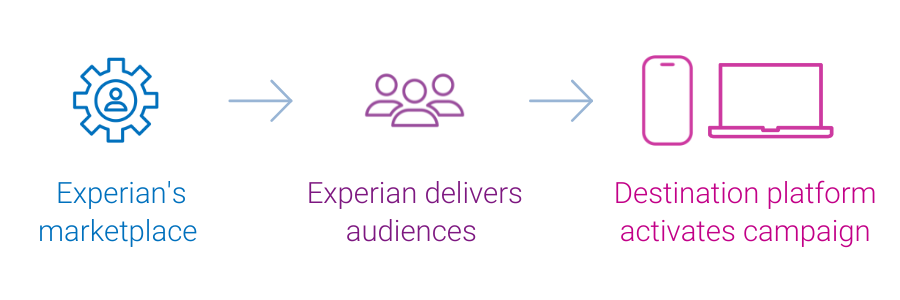

Experian’s marketplace, easily accessible from our Audience Engine platform, brings unparalleled addressability, enabling our clients to reach more relevant consumers and increase revenue.

If you’re interested in learning more about Experian’s marketplace or becoming an active buyer or seller in our marketplace, please contact us.

Latest posts

An Experian Marketing Services study shows niche social networks significantly increased market share of all visits to social sites.

Experian Simmons presents a new list of the top 20 television programs for reaching political party loyals as well as three key swing voter segments.

Marketers have always struggled to target the right consumer with the right offer. And with more than 313 million people live in the United States according to the U.S. Census, the challenge is more difficult than ever. With the proliferation of the Internet and mobile technology, today’s consumer operates differently and expects more from their favorite brands. To adapt to that new American consumer, marketers are using highly targeted strategies to drive interest. These can be messages that are relevant to a few hundred consumers or detailed one-on-one communications that target individuals at the point of sale or online. But some marketers struggle to execute these tactics effectively. Most segmentation is currently done prior to a campaign, meaning that marketers determine which message a consumer will receive before ever interacting with that individual. Unfortunately, with the rapid nature of purchasing decisions and buying transactions, businesses often miss opportunities because it takes too long to get the right message to the right consumer. To keep up, marketers need to collect intelligence at the point of contact so they can understand each individual consumer’s habits and preferences during that connection. This intelligence can then feed modeling algorithms that enable automatic offers based on an individual’s preferences. To develop a strategy around real-time marketing intelligence, marketers should take the following steps: Clean existing data – at the root of any intelligence strategy is data. Information determines a company’s ability to reach target individuals – and understand who they are and what they’re interested in. Unfortunately, if the data that feeds intelligence efforts is inaccurate, marketers are simply unable to communicate with or understand consumers. Ensuring the validity of contact information, internal records and third-party data elements helps organizations target consumers and ensures that sophisticated analysis is as precise as possible. Identify strategies – organizations should analyze their target markets and determine which communication channels could benefit from a more personalized customer experience. Marketers should decide how they want to change each communication to help drive the desired action from each consumer. Consider personalizing website displays based on geographic regions, customizing an introductory message or revamping loyalty campaigns based on purchase history and consumer interests. Real-time intelligence – marketers should build models to help predict the best offers for each target audience. These models can be designed to take into account demographic and behavioral information, as well as purchase history and internal data. Marketers can feed these models with intelligence gained at the point of contact to prompt consumers in real time with specific, relevant offers. As marketers continue to enhance and refine targeting efforts, it’s important to gain customer insight. Those who leverage these advanced technologies and strategies will create stronger customer engagement. Segmenting customers and taking measurable action in real time are advanced techniques that appeal to many marketers today. Achieving this level of interaction allows organizations to optimize marketing efforts and provide the right offer at the right time to the right consumer.