Following the success of our recent launch of Third-Party Onboarding, we are excited to introduce the Experian marketplace, a new addition to our portfolio of data-driven activation solutions.

Experian’s marketplace bridges TV operators, programmers, supply partners, and demand platforms with top-tier third-party audiences across retail, CPG, health, B2B, and location intelligence. Easily activate premium audiences from leaders like Attain, Alliant, Circana, and Dun & Bradstreet – driving precise, efficient consumer reach.

“Experian has been a longstanding partner of DISH Media, and we’re excited to be an early adopter of their marketplace which leverages the foundation of their identity solutions to ensure maximum cross-channel reach as we look to expand the breadth and depth of data we use for addressable TV.”

Kemal Bokhari, Head of Data, Measurement & Analytics, DISH Media

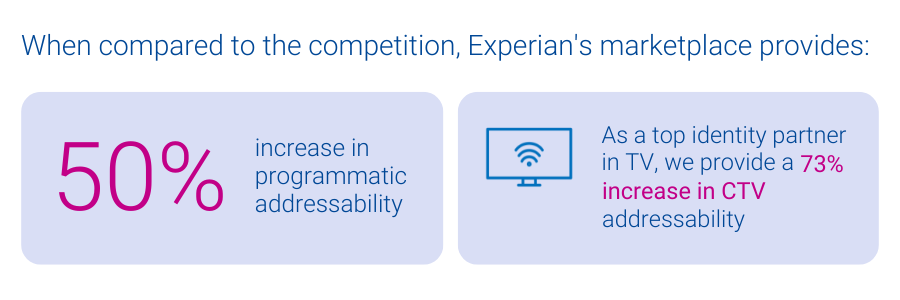

As privacy regulations evolve and traditional identity signals shift, many activation platforms face declining addressability. This impacts their ability to effectively reach consumers, which is critical to staying competitive. Experian’s marketplace, powered by our identity graphs which include 126 million households, 250 million individuals, and 4 billion active digital IDs, enables audiences to be easily activated and maintain high addressability across display, mobile, and connected TV (CTV) channels.

Benefits of Experian’s marketplace

- Enhanced addressability and match rates: All audiences delivered from our marketplace benefit from our best-in-class offline and digital identity graphs, which ensure addressability across all channels like display, mobile, and CTV. Unlike other data marketplaces, Experian ensures all identifiers associated with an audience have been active and are targetable, improving the accuracy of audience planning.

- Simplified audience planning and distribution for TV Operators: TV operators can build custom audiences matched directly to their subscriber footprint and distribute them across all advanced TV channels (data-driven linear, addressable, digital, and CTV) for maximum impact.

- Diversification within the data marketplace ecosystem: With the recent departure of Oracle’s advertising business, the optionality for buyers and sellers to connect with third-party data has become increasingly limited. With Experian marketplace, we’re excited to offer a new solution to the market that ensures data-driven targeting can continue to take place at scale.

- Lower activation costs: Experian’s marketplace offers transparent, pass-through pricing with no additional access fees, enabling partners to maximize their earnings while reducing costs.

- Audience diversity and scale: Platforms can access a broad range of audiences across top verticals from our partner audiences, which can be combined with 2,400+ Experian Audiences. This offers the flexibility, reach, and scale necessary to effectively execute advertising campaigns.

- Remove compliance concerns: Experian’s rigorous data partner review ensures available audiences comply to all federal, state and local consumer privacy regulations.

“Circana and Experian have enjoyed a deep partnership for over a decade. We are exceedingly excited to extend our partnership and be an early adopter and launch partner of the Experian data marketplace. This additional capability will enable the ecosystem to more easily access Circana’s purchase-based CPG and General Merchandise (for example Consumer Electronics, Toys, Beauty, Apparel etc.) audience segments to drive performance outcomes across all media channels.”

Patty Altman, President, Global Solutions, Circana

“Capturing the attention of target audiences across channels is critical for marketers navigating an increasingly connected digital world. We are excited to be an exclusive provider of B2B solutions within Experian’s marketplace, helping brands and media agencies to accelerate their reach, addressability and targeting capabilities across TV, mobile and connected TV channels.”

Georgina Bankier, VP of Platform Partnerships at Dun & Bradstreet

Better connections start here: Experian’s marketplace

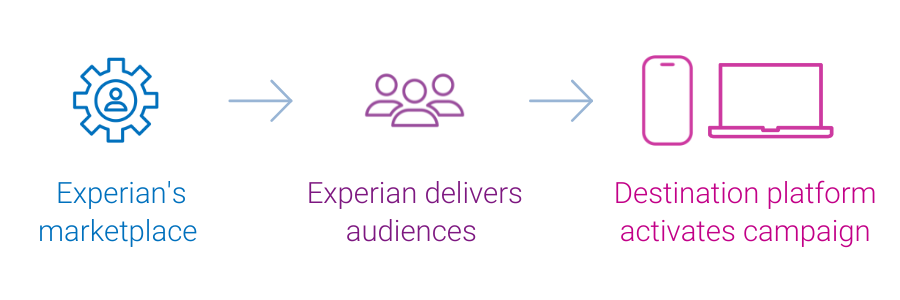

Experian’s marketplace, easily accessible from our Audience Engine platform, brings unparalleled addressability, enabling our clients to reach more relevant consumers and increase revenue.

If you’re interested in learning more about Experian’s marketplace or becoming an active buyer or seller in our marketplace, please contact us.

Latest posts

Even though most kids haven’t even completed their current school year, now is the time for retailers to start preparing their 2012-2013 back-to-school marketing strategies.

Facebook has become a cultural phenomenon over the years and an object of affection for marketers to connect with its users. Experian Simmons has put together 10 consumer behavioral stats based on their National Consumer Study and New Media Study about the social networking site leading up to its Friday IPO launch: 39% of Facebook users say “this website gives me something to talk about.” Top 3 reasons Facebook users visit social networking sites: 86% to keep in touch with friends 72% for fun 66% to reconnect with/find people they’ve lost touch with 78% of Facebook users have shown support for a group or business on a social networking site. 34% of Facebook users have played games on a social networking site. Among those: 73% play social games (like Farmville, SIMS social, etc) 68% play casual games (like Bejeweled, etc) 73% play games on a social networking site once or more a day 28% of Facebook users with cell phones and 42% of Facebook users with a tablet computer have downloaded a social networking app for the device Adult residents of the following Designated Market Areas (DMAs) with 1,000,000 or more adult residents are the most likely to have visited Facebook in the last 7 days: ) Seattle-Tacoma, WA Austin, TX Salt Lake City, UT Portland, OR Washington, DC 15% of Facebook visitors follow a musical group on a social networking site, 14% follow a TV show, 11% follow a newspaper or news outlet and 4% follow a magazine. The average Facebook user is 39.3 years old. The average Facebook user claims an annual household income of $69,900 with annual household spending on discretionary goods and services of $15,500. Hispanic users of Facebook are 55% more likely than non-Hispanic users to say they like to follow their favorite brands or companies on social networking sites. Don’t miss 15 stats about Facebook, previously posted on the Experian Marketing services blog. . For more information like the data provided above please download the Experian Marketing Services 2012 Digital Marketer report.

Today, it costs more than $40 to send a five pound package from the U.S. to Canada or Mexico. The cost to Europe or South America is even more expensive. For U.S. companies operating on a global scale, such as retail specialists or ecommerce organizations, address accuracy is crucial. Organizations can’t afford undeliverable mail and packages due to a wrong address – the total cost would be unmanageable. Mistakes happen frequently, whether it is an error by the company or the customer. If a mistake is made, companies can’t ask the customer to cover delivery fees, leaving the organization with the bill. Retailers must also consider potential delays due to long distances and custom checks. Altogether, address errors result in a poor customer experience and a decrease in efficiency. Implementing international address verification will save money, time and improve the customer experience. By combining primary address data from national postal authorities with partner-supplied data, businesses can verify international addresses from countries all around the world.