Following the success of our recent launch of Third-Party Onboarding, we are excited to introduce the Experian marketplace, a new addition to our portfolio of data-driven activation solutions.

Experian’s marketplace bridges TV operators, programmers, supply partners, and demand platforms with top-tier third-party audiences across retail, CPG, health, B2B, and location intelligence. Easily activate premium audiences from leaders like Attain, Alliant, Circana, and Dun & Bradstreet – driving precise, efficient consumer reach.

“Experian has been a longstanding partner of DISH Media, and we’re excited to be an early adopter of their marketplace which leverages the foundation of their identity solutions to ensure maximum cross-channel reach as we look to expand the breadth and depth of data we use for addressable TV.”

Kemal Bokhari, Head of Data, Measurement & Analytics, DISH Media

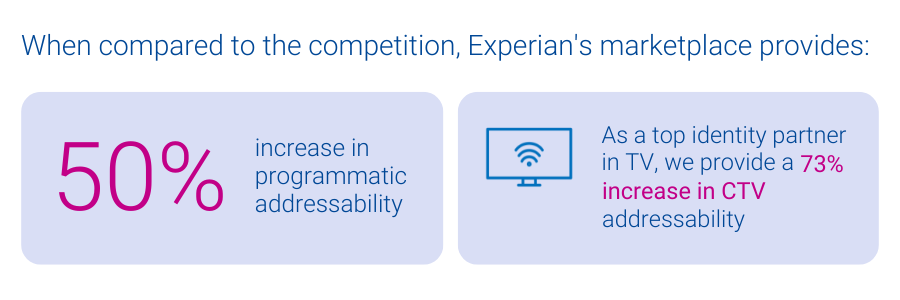

As privacy regulations evolve and traditional identity signals shift, many activation platforms face declining addressability. This impacts their ability to effectively reach consumers, which is critical to staying competitive. Experian’s marketplace, powered by our identity graphs which include 126 million households, 250 million individuals, and 4 billion active digital IDs, enables audiences to be easily activated and maintain high addressability across display, mobile, and connected TV (CTV) channels.

Benefits of Experian’s marketplace

- Enhanced addressability and match rates: All audiences delivered from our marketplace benefit from our best-in-class offline and digital identity graphs, which ensure addressability across all channels like display, mobile, and CTV. Unlike other data marketplaces, Experian ensures all identifiers associated with an audience have been active and are targetable, improving the accuracy of audience planning.

- Simplified audience planning and distribution for TV Operators: TV operators can build custom audiences matched directly to their subscriber footprint and distribute them across all advanced TV channels (data-driven linear, addressable, digital, and CTV) for maximum impact.

- Diversification within the data marketplace ecosystem: With the recent departure of Oracle’s advertising business, the optionality for buyers and sellers to connect with third-party data has become increasingly limited. With Experian marketplace, we’re excited to offer a new solution to the market that ensures data-driven targeting can continue to take place at scale.

- Lower activation costs: Experian’s marketplace offers transparent, pass-through pricing with no additional access fees, enabling partners to maximize their earnings while reducing costs.

- Audience diversity and scale: Platforms can access a broad range of audiences across top verticals from our partner audiences, which can be combined with 2,400+ Experian Audiences. This offers the flexibility, reach, and scale necessary to effectively execute advertising campaigns.

- Remove compliance concerns: Experian’s rigorous data partner review ensures available audiences comply to all federal, state and local consumer privacy regulations.

“Circana and Experian have enjoyed a deep partnership for over a decade. We are exceedingly excited to extend our partnership and be an early adopter and launch partner of the Experian data marketplace. This additional capability will enable the ecosystem to more easily access Circana’s purchase-based CPG and General Merchandise (for example Consumer Electronics, Toys, Beauty, Apparel etc.) audience segments to drive performance outcomes across all media channels.”

Patty Altman, President, Global Solutions, Circana

“Capturing the attention of target audiences across channels is critical for marketers navigating an increasingly connected digital world. We are excited to be an exclusive provider of B2B solutions within Experian’s marketplace, helping brands and media agencies to accelerate their reach, addressability and targeting capabilities across TV, mobile and connected TV channels.”

Georgina Bankier, VP of Platform Partnerships at Dun & Bradstreet

Better connections start here: Experian’s marketplace

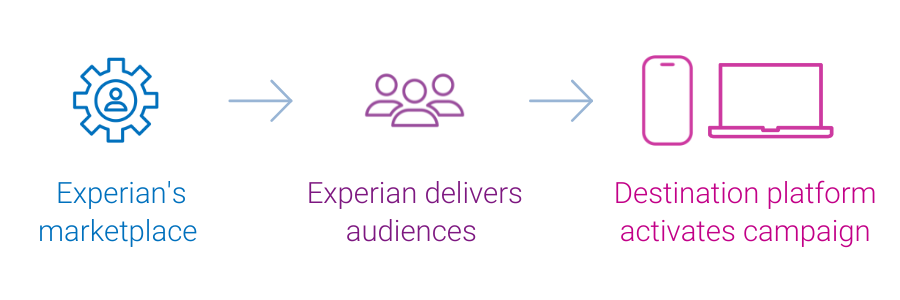

Experian’s marketplace, easily accessible from our Audience Engine platform, brings unparalleled addressability, enabling our clients to reach more relevant consumers and increase revenue.

If you’re interested in learning more about Experian’s marketplace or becoming an active buyer or seller in our marketplace, please contact us.

Latest posts

Industry Canada releases its final regulations under Canada’s Anti-Spam Law, simultaneously announcing that CASL will come into force on July 1, 2014. Final regulations and guidance confirm all but one of the expected business-friendly exemptions, provide much needed clarity on outstanding topics and delay implementation of more controversial aspects of the law.

![Price matters, but behind other factors in Deal Seeker analysis [VIDEO]](https://stg1.experian.com/blogs/marketing-forward/wp-content/uploads/default-post-image.png)

Watch our video chat with John Fetto as he shares insights from the Deal Seekers Report.

As consumers use smartphones and tablets to take pictures, make phone calls, read books and listen to music, these devices replace the functions of the traditional holiday gifts of years past.