As the vibrant colors of spring emerge, so do opportunities for marketers to engage with their audience in fresh and meaningful ways. Crafting effective spring advertising campaigns requires a deep understanding of your target audience. In this blog post, we’ll explore five key audience categories, each presenting unique opportunities for impactful spring advertising campaigns.

Spring cleaning and home improvement

Embrace the energy of renewal associated with spring cleaning. Target audiences interested in home improvement and organization with Experian syndicated audiences like “Gardening Mothers” or “Home Improvement & DIY Frequent Spenders.” Share tips, hacks, and products that align with the desire for a fresh start, turning mundane chores into exciting opportunities for your brand to shine.

Here are 6 audience segments that you can activate to target consumers focused on spring cleaning and home improvements:

- Purchase Transactions > Household Goods > Frequent Spenders

- Purchase Predictors > Shoppers All Channels > Home Maintenance and Improvement

- Purchase Transactions > DIY and Advice Seekers > High Spenders

- Purchase Transactions > Home Improvement/DIY > High Spenders

- Retail Shoppers: Purchase Based > Home Improvement & DIY > Hardware & Home Improvement

- Retail Shoppers: Purchase Based > Shopping Behavior > Big Box and Club Stores: Walmart Frequent Spenders

Gardening

Spring is the time when consumers are investing in gardening equipment for lawn care. Here are a few audience segments you can activate to target consumers focused on gardening:

- Retail Shoppers: Purchase Based > Home Improvement & DIY > Garden & Landscaping Stores: Frequent Spenders

- Lifestyle and Interests (Affinity) > Hobbies > Gardening

- Lifestyle and Interests (Affinity) > Moms, Parents, Families > Gardening Mothers

- Purchase Predictors > Shoppers All Channels > Lawn and Garden

Movers and new homeowners

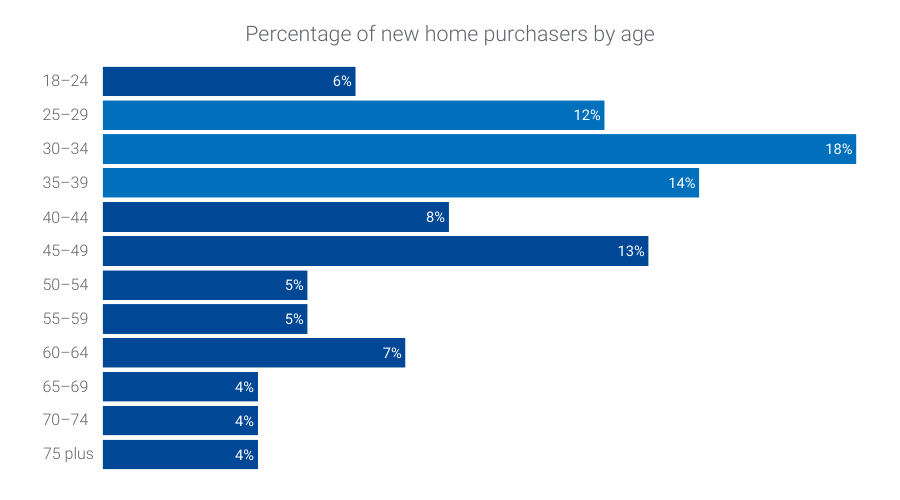

Did you know?

44% of new homeowners are between the ages of 25-39*.

Improve engagement for your spring targeting by pairing our new homeowner audiences with our Demographics > Ages > 25-29, 30-34, and 35-39 syndicated audiences. Here are a few you can activate now:

- Life Events > New Homeowners > Last 6 Months

- Life Events > New Movers > Last 12 Months

Mother’s Day: Unveil the perfect gift

Appealing to the emotion of gratitude and love, Mother’s Day is a significant occasion for marketers. Activate Experian syndicated audiences such as “Mother’s Day Shoppers” and “Florists & Flower Gifts High Spenders” to tailor your spring advertising campaign toward those likely to purchase heartfelt gifts. Share ideas and promotions that resonate with the nurturing and caring spirit of this celebration.

Here are 6 audience segments that you can activate to target consumers getting ready to celebrate Mother’s Day:

- Retail Shoppers: Purchase Based > Seasonal > Mothers Day Shoppers Spenders

- Lifestyle and Interests (Affinity) > Moms, Parents, Families > Mothers with 2+ children

- Mobile Location Models > Visits > Mothers Day Shoppers

- Lifestyle and Interests (Affinity) > Moms, Parents, Families > Moms Age 25-54

- Mobile Location Models > Visits > Jewelry Retail Stores

- Retail Shoppers: Purchase Based > Shopping Behavior > Florists & Flower Gifts: High Spenders

Father’s Day: Celebrate Dads in style

Highlighting the significance of paternal bonds, Father’s Day is an excellent opportunity to showcase thoughtful gifts and experiences. Engage the “Father’s Day Shoppers” or “Growing and Expanding families” with content and products aligned with their interests. Craft a campaign that acknowledges the varied roles fathers play and the unique gifts they would appreciate.

Here are 6 audience segments that you can activate to target consumers getting ready to celebrate Father’s Day:

- Retail Shoppers: Purchase Based > Seasonal > Fathers Day Shoppers Spenders

- Mobile Location Models > Visits > Fathers Day Shoppers

- Mosaic – Personas – Lifestyle and Interests > Group M: Families in Motion > M45 – Growing and Expanding (Young, working-class families and single parent households that live in small city residences)

- Geo-Indexed > Demographics > Presence of Children: Ages: 7-9

- Lifestyle and Interests (Affinity) > Activities and Entertainment > Home Improvement Spenders

- Life Events > New Parents > Child Age 0-36 Months

Plan for the 2024 TV Upfronts

When gearing up for the 2024 upfronts, you can expand your TV planning by incorporating diverse audience categories into your spring advertising campaigns. It’s not just about targeting a demographic; it’s about captivating your unique audience. Whether it’s cord cutters, ad avoiders, avid streamers, or households that watch TV together, understanding and engaging with these distinct segments is paramount. To maximize impact, use comprehensive TV data that goes beyond broad demographics.

Here are 6 audience segments that you can activate as part of your TV planning strategy:

- Retail Shoppers: Purchase Based > Entertainment > Streaming/Video/Audio/CTV/Cable TV: Cable/Broadcast TV: Cord Cutters: Recent

- Retail Shoppers: Purchase Based > Entertainment > Streaming/Video/Audio/CTV/Cable TV: Streaming Video: High Spenders

- Television (TV) > Ad Avoiders/Ad Acceptors > Ad Avoiders

- Television (TV) > TV Enthusiasts > Paid TV High Spenders

- Television (TV) > Ad Avoiders/Ad Acceptors > Ad Acceptors

- Television (TV) > Household/Family Viewing > Pay TV/vMVPD Subscribers Households

To find consumers who are most likely to engage with your TV ads, you can layer in our TrueTouchTM engagement channel audiences:

- TrueTouch: Communication Preferences > Engagement Channel Preference > Digital Video

- TrueTouch: Communication Preferences > Engagement Channel Preference > Streaming TV

Summer preparation: Anticipate the fun ahead

As spring transitions to summer, help your audience gear up for the upcoming season. Target “Summer break travelers” or “Memorial Day Shoppers” with offerings that align with their summer plans. Whether it’s fashion, travel essentials, or outdoor gear, position your brand as an essential companion for their summer adventures.

Here are 6 audience segments that you can activate to target consumers getting ready for summer:

- Mobile Location Models > Visits > Summer Break Travelers

- Retail Shoppers: Purchase Based > Seasonal > Summer Sales Event Shoppers: Independence Day Shoppers

- Retail Shoppers: Purchase Based > Travel > Vacation/Leisure Travelers: Summer Trips

- Mosaic – Personas – Lifestyle and Interests > Group B: Flourishing Families > B09 – Family Fun-tastic (Upscale, middle-aged families with older children that live in suburban areas and lead busy lives focused on their children)

- Mobile Location Models > Visits > Memorial Day Shoppers

- Retail Shoppers: Purchase Based > Seasonal > Summer Sales Event Shoppers: High Spenders: Memorial Day Shoppers

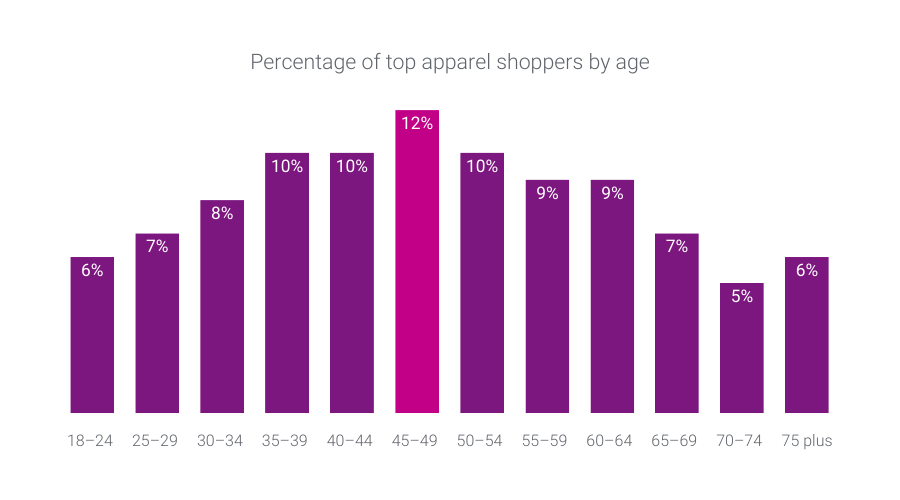

Did you know?

Consumers between the age of 45-49 make up the largest percentage of top apparel shoppers*.

Improve engagement for summer apparel shopping targeting by refining your audience with our Demographics > Ages > 45-49 syndicated audience.

Spring into effective advertising with Experian’s syndicated audiences

For spring advertising campaigns, understanding your audience is the key to success. By activating Experian’s syndicated audiences, you can refine your approach and resonate by activating specific segments. Embrace our syndicated audiences so you deliver campaigns that not only capture attention but also build lasting connections with your audience. As you embark on this spring marketing journey, remember – the possibilities are as endless as the blossoming flowers.

You can activate our syndicated audiences on-the-shelf of most major platforms. For a full list of Experian’s syndicated audiences and activation destinations, download our syndicated audiences guide below.

Check out other seasonal audiences you can activate today.

Footnote

*Experian looked at our demographic and purchase-based data to understand retail trends over the past year. Our demographic and purchase-based data covers credit and debit card usage across 500 top merchants.

Latest posts

Forward thinking marketers leverage the power of social networking sites like Facebook, MySpace, Twitter and more to connect to consumers in a more personal and meaningful way. That's why Experian Simmons is focusing on social networking in this issue of Consumer Insights, featuring the freshest insights available from the latest Simmons New Media Study. The 2010 Social Networking Report provides the hard data behind this consumer revolution, including the fact that fully 66% of online Americans use social networking sites today, up from just 20% in 2007. Social networking is an increasingly addictive activity, with nearly half of those who access such sites (43%) reporting that they visit them multiple times per day. While users of social networking sites may have initially signed up to better keep in touch with friends, a growing number say they now use sites like Facebook to connect with family members. An astounding 70% of social networkers keep in touch with family via their various online networks, up from 61% a year ago. Fully two-thirds of all online adults today have visited a social networking site in the last 30 days, up from 53% in 2008 and 20% in 2007. Social networks have most thoroughly penetrated the young adult market, as nearly 9-in-10 online 18-to 34-year-olds visit such sites today. But even older Americans are tapping into social networks, with 41% of online adults age 50 and older making monthly visits to sites like Facebook, MySpace and Twitter. The rise of social networking tracks closely with that of Facebook. As of April 26, 2010, 46% of the U.S. online adult population reported having visited Facebook in the past 30 days. While keeping in touch with others is an important part of social networking, the popularity of games like Farmville and Mafia Wars illustrate that fun is a big part of the appeal of social networking. Whether it’s keeping in touch with others, playing games, debating politics or any of the other reasons people use social networking sites, it cannot be denied that there’s a sense of addictiveness to it all. Visiting social networking sites multiple times a day is up 28% over last year, while less frequent visits are down across the board. As social networking sites extend their reach across generations, Americans are increasingly using such sites to connect with more than just their friends. Today, 17% of social networkers communicate with their parents via those sites and 22% connect with their kids, up from 9% and 15%, respectively, a year ago. An astounding two-thirds of social networking site visitors (68%) say they have shown their support of a product, service, company or musical group by becoming a “fan” or a “friend” on a social networking site. One year earlier, only 57% of social networkers had publicly declared their “like” for a product, service, company or musical group. Knowing that social networkers are comfortable connecting with products and brands they support, it's important to understand which brands have the best opportunity to connect with this group. Top retail brands among Facebook users, for instance, include H&M, Hot Topc and Forever 21. Specifically, Facebook users are full twice as likely as the average American adult to shop at H&M. Twitter visitors are 3.7 times more likely to shop at Nordstrom. Heavy users of social networking sites are primarily concentrated in the Northwest and markets that are heavily influenced by major colleges or universities.

The vast majority of Facebook visitors—like most Internet users—say they like websites that take special care to protect their privacy. Yet as the popularity of Facebook grew during 2009 among both younger and older adults, there was a general waning in visitors’ advocacy of online privacy. In fact, the share of Facebook visitors sensitive to privacy protection experienced a 9% relative decline between January and November of 2009. That decline may have continued, were it not for a series of privacy policy updates issued by the social networking giant. In November 2009, Facebook changed its default settings to publicly reveal a larger than before amount of its users’ information. Then in December 2009, the privacy settings were entirely removed from certain categories of users' information. And lastly, in April 2010, users’ General Information became publicly exposed whenever they connected to certain applications or websites, a move that seriously angered many Facebook adherents. Following these changes, the share of Facebook users who are sensitive to privacy protection rose. Specifically, between November 2009 and April 2010, the percent of users who like sites that protect their privacy increased a relative 7%. Facebook’s decision to return, and even simplify, control over privacy settings to account holders may appease users, but whether a subsequent drop in support of online privacy will ensue down the line is far from certain.

Same-sex marriage is a hot button topic no matter on which side of the issue you stand. But there can be no denying that same-sex couples are finding an expanding number of options in the U.S. and abroad should they decide to legally wed. The 2010 LGBT Consumer Report explores the household arrangements and behaviors of America's LGBT consumers—in particular, those associated with marriage—compared to America's heterosexual population. You will learn that despite being less than half as likely to be married, lesbian, gay and bisexual adults are 22% more likely than their "straight" counterparts to have recently wed or to be planning nuptials for the next year. Looking for that perfect gift for the newly wed couple? You will also get some shopping tips for identifying favored retailers of lesbian, gay and bisexual shoppers. We'll start by sizing the LGBT market. An estimated 3.7% of the non-Hispanic adult population (7.1 million adults) self-identifies as LGBT, which can be broken down as follows: The average heterosexual adult lives in a household with 1.9 other individuals, including adults and kids. By comparison, the average lesbian shares her home with only 1.6 other people. Gay men live in the smallest households, sharing their home with only one other person, on average. Over a third of gay or bisexual men (38%) share their home with at least one other adult male, compared with only 24% of heterosexual men who live under the same roof as another adult male. Thirty-five percent of gay or bisexual men say they live with one (and only one) other adult male, a living arrangement that has a higher chance of consisting of a same-sex, co-habiting couple. Over half of lesbians or bisexual women (53%) share their home with at least one other adult female, compared with only 23% of heterosexual women who live under the same roof as another adult female. Forty-three percent of lesbian or bisexual women say they live with one (and only one) other adult female, a living arrangement that has a higher chance of consisting of a same-sex, co-habiting couple. Lesbian, Gay and Bisexual adults (LGB) as a group are less than half as likely as heterosexuals to be married. Only 26% of LGB adults are wed, compared with 57% of “straight” adults. Of all LGB adults, bisexuals are the most likely group to be married, with over 4 in 10 reporting they are presently wed. Lesbians are more than four and a half times more likely than gay men to be married, with 23% of lesbians having tied the knot versus only 5% of gay men. Lesbian, gay and bisexual adults as a group are 22% more likely than heterosexual adults to have either tied the knot in the last 12 months or have plans to wed in the coming year. 5.7% of lesbian, gay or bisexual adults are newly weds or “soonly” weds vs. 4.6% of heterosexual adults. Lesbian, gay and bisexual adults are twice as likely to shop at Neiman Marcus, making the department store the number one retailer with a wedding registry program among LGB shoppers. With many retailers ending their registry programs in favor of gift cards, we looked at how stores without registry programs stack up among lesbian, gay and bisexual shoppers. LGB adults are almost twice as likely to shop at J. Crew, making the store the number one retailer without a wedding registry program among LGB shoppers.