Originally appeared on MediaPost

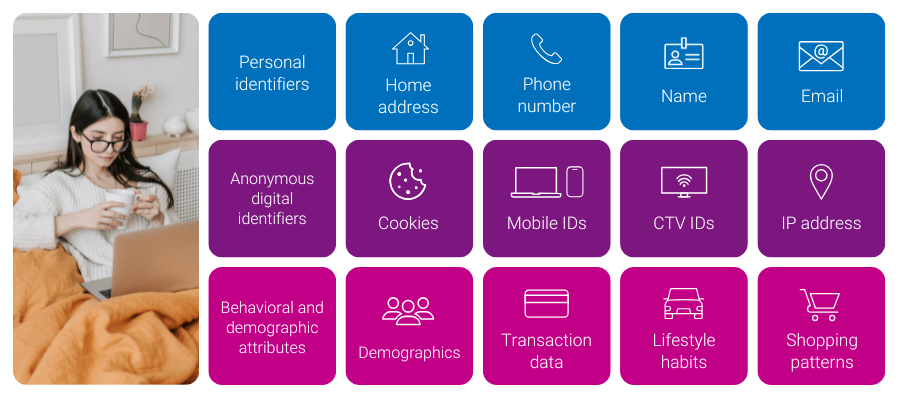

As the digital ecosystem becomes more complex, managing multiple identifiers for consumers has emerged as a significant challenge. From cookies and IP addresses to mobile IDs and universal IDs, marketers and platforms face increasing difficulty in maintaining a unified view of their consumers. Without a coherent identity strategy, campaigns can suffer from poor targeting, limited personalization, and flawed attribution.

Experian understands these challenges and offers solutions to help our partners navigate the complexities of a multi-ID landscape. By utilizing both digital and offline data, we provide the tools to unify fragmented identifiers and maintain a persistent view of consumers. As a result, marketers and platforms get rich insights, accurate cross-device targeting, improved addressability, and measurable advertising.

The shifting identity landscape

For years, the industry has relied on cookies to identify consumers across devices and platforms. However, with ongoing signal loss, including the uncertainty around cookies, and the evolution of privacy regulations, the digital identity landscape has grown more complicated. As consumers hop from one device to another, they are now represented by multiple signals, each tied to a different aspect of their digital behavior.

While this shift brings complexity, it also opens the door for innovation. Marketers and ad platforms now have the opportunity to rethink their identity strategies and adopt more flexible approaches that are not reliant on a single identifier.

This is where Experian comes in.

Connecting the dots: A holistic view of the customer journey

Our identity solutions are designed to help manage today’s multi-ID ecosystem by connecting digital and offline identifiers to a single customer profile. This creates a unified view of the consumer, and when combined with our understanding of customer behavior (e.g. demo, interests, shopping patterns) marketers and platforms get both insights about their customers and the addressability to reach them across channels.

Four examples of what you can do with a strong identity foundation

- If an advertiser wants to make its first-party data more addressable, it can utilize our Digital Graph with universal IDs, hashed emails (HEMs), and connected TV (CTV) IDs to extend its reach.

- A publisher who wants to gain further insights into their audiences and create private marketplaces (PMPs) can achieve this goal with the use of our Digital Graph with hashed emails, universal IDs, mobile ad IDs (MAIDs), CTV IDs, and IPs. The publisher can use this in concert with Marketing Attributes to understand age, gender, household income, buying behavior, and more. The publisher can connect marketing attributes to the Digital Graph via our Living Unit ID (LUID) to understand more about consumers that fall into their segments.

- A demand-side platform (DSP) who wants to extend first-party and third-party audience reach across all digital devices on their platform will use the Digital Graph with all digital IDs to allow users of their platform to select cross-device extension against first-party and third-party audiences.

- A retail media network (RMN) can use our Offline and Digital Graphs to connect in-store and online purchases to a household profile—even when purchases are made by different people. The RMN can then reach that household across digital media platforms and accurately attribute the in-store purchase back to digital ad exposure.

Identity as a strategic asset: Today and in the future

In our paradoxical world where consumers are represented by multiple identifiers, yet marketers and platforms face signal loss, identity is more than a technical issue—it’s a strategic asset. The ability to unify identity data into a single profile provides marketers with the customer intelligence needed to drive growth and stay competitive. Here’s how we do it:

- Deep, persistent customer understanding: With roots in offline, deterministic data like names, addresses, and emails, we provide an accurate and persistent view of identity to our customers. This allows you to maintain a consistent and comprehensive understanding of your customers and their marketing attributes over time.

- Highly accurate and refreshed digital identities: Our signal-agnostic graph is not reliant on any one signal as it includes HEMs, cookies, MAIDs, IPs, Universal IDs, and CTV IDs. Our Digital Graph is updated weekly, ensuring the data is always fresh and addressable. This persistent linkage of individuals and households to their identifiers and devices means your campaigns are always targeting the right people.

- Connected offline and digital graphs for holistic insights: We connect offline and digital identities by following privacy-first best practices, such as preventing re-identification, to allow insights from the offline world to be used in the online world. This integrated approach, enriched with marketing data, gives you better insights, more addressable advertising, and the ability to engage customers across multiple devices while accurately measuring campaign impact.

Transform challenges into opportunities

The rise of the multi-ID landscape presents both challenges and opportunities for the advertising industry. We stand as the trusted partner to navigate this complexity, utilizing insights from the offline world to inform decisions in the online world, enabling personalized marketing and accurate attribution, and helping you achieve your current and future goals.

Latest posts

Thanks to simulcast streaming of games online and via mobile apps, die-hards are better equipped to keep track of multiple games at once. Those who stream games online live in every corner of the country, but some locales are more likely to log on for their March Madness fix than others.

The social media space continues to evolve. Pinterest, a site launched in March 2010 that describes itself as an online pinboard to organize and share things you love, recently emerged as one of the top 10 websites within the Hitwise Social Networking & Forums category. The invitation only site received nearly 11 million total visits during the week ending December 17, 2011, almost 40 times the number of total visits versus just six months ago (week ending June 18, 2011). Pinterest content has something for everyone, but the site is dominated by images featuring home décor, crafts, fashion, and food. Not surprisingly, visitors to the site in the 12 rolling weeks ending December 17th skewed female (58%) and between the ages of 25 and 44 (59%). Pinterest and the Social Networking & Forums category both receive their highest share of visits from California and Texas. However, the Social Networking category as a whole over-indexes on share of visits from Northeastern states while Pinterest over-indexes on visits from the states in the Northwest and Southeast. This data indicates that Pinterest visitors have a different profile versus their counterparts visiting other social networking sites such as Facebook and YouTube. In fact, nine of the top ten over-indexed states for Pinterest visitors also over-index for the Hobbies and Crafts category (versus the online population) which is expected given the abundance of crafts content on the website. When comparing the Mosaic USA 2011 types that visit both Pinterest.com and Hobbies and Crafts websites during the 12 weeks ending December 17, 2011, the data shows that Boomers and Boomerangs are the group most likely to visit, particularly the Pinterest website (comprising over 10% of visits). This group of consumers is characterized as baby boomers and young adults who are heavy web users who spend time on house and garden, sports and fitness, and family-oriented websites. This information is useful to companies who wish to target their content to be “pinned” by Pinterest users. Thanks to Lauren Rice, an Analyst with the Strategic Services team at Experian Hitwise for today's analysis.

We are asking marketers – specifically retailers – to take a look back at the Holiday selling season because there are a few steps to take in order to finish out strong and THEN start the new year off right.