Originally appeared on MediaPost

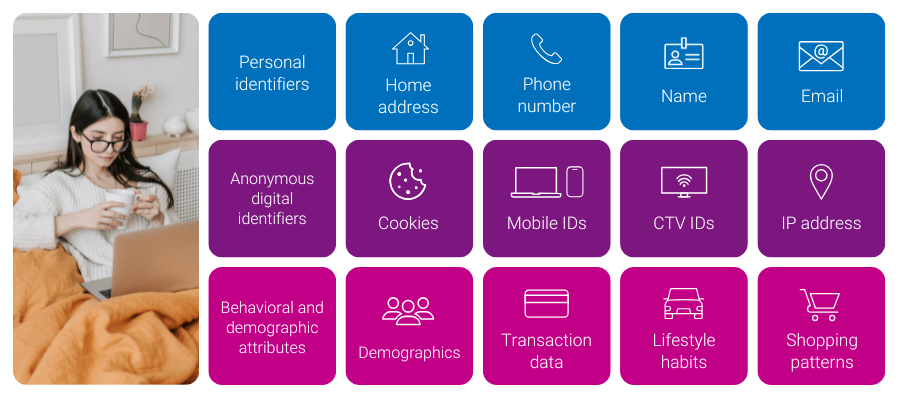

As the digital ecosystem becomes more complex, managing multiple identifiers for consumers has emerged as a significant challenge. From cookies and IP addresses to mobile IDs and universal IDs, marketers and platforms face increasing difficulty in maintaining a unified view of their consumers. Without a coherent identity strategy, campaigns can suffer from poor targeting, limited personalization, and flawed attribution.

Experian understands these challenges and offers solutions to help our partners navigate the complexities of a multi-ID landscape. By utilizing both digital and offline data, we provide the tools to unify fragmented identifiers and maintain a persistent view of consumers. As a result, marketers and platforms get rich insights, accurate cross-device targeting, improved addressability, and measurable advertising.

The shifting identity landscape

For years, the industry has relied on cookies to identify consumers across devices and platforms. However, with ongoing signal loss, including the uncertainty around cookies, and the evolution of privacy regulations, the digital identity landscape has grown more complicated. As consumers hop from one device to another, they are now represented by multiple signals, each tied to a different aspect of their digital behavior.

While this shift brings complexity, it also opens the door for innovation. Marketers and ad platforms now have the opportunity to rethink their identity strategies and adopt more flexible approaches that are not reliant on a single identifier.

This is where Experian comes in.

Connecting the dots: A holistic view of the customer journey

Our identity solutions are designed to help manage today’s multi-ID ecosystem by connecting digital and offline identifiers to a single customer profile. This creates a unified view of the consumer, and when combined with our understanding of customer behavior (e.g. demo, interests, shopping patterns) marketers and platforms get both insights about their customers and the addressability to reach them across channels.

Four examples of what you can do with a strong identity foundation

- If an advertiser wants to make its first-party data more addressable, it can utilize our Digital Graph with universal IDs, hashed emails (HEMs), and connected TV (CTV) IDs to extend its reach.

- A publisher who wants to gain further insights into their audiences and create private marketplaces (PMPs) can achieve this goal with the use of our Digital Graph with hashed emails, universal IDs, mobile ad IDs (MAIDs), CTV IDs, and IPs. The publisher can use this in concert with Marketing Attributes to understand age, gender, household income, buying behavior, and more. The publisher can connect marketing attributes to the Digital Graph via our Living Unit ID (LUID) to understand more about consumers that fall into their segments.

- A demand-side platform (DSP) who wants to extend first-party and third-party audience reach across all digital devices on their platform will use the Digital Graph with all digital IDs to allow users of their platform to select cross-device extension against first-party and third-party audiences.

- A retail media network (RMN) can use our Offline and Digital Graphs to connect in-store and online purchases to a household profile—even when purchases are made by different people. The RMN can then reach that household across digital media platforms and accurately attribute the in-store purchase back to digital ad exposure.

Identity as a strategic asset: Today and in the future

In our paradoxical world where consumers are represented by multiple identifiers, yet marketers and platforms face signal loss, identity is more than a technical issue—it’s a strategic asset. The ability to unify identity data into a single profile provides marketers with the customer intelligence needed to drive growth and stay competitive. Here’s how we do it:

- Deep, persistent customer understanding: With roots in offline, deterministic data like names, addresses, and emails, we provide an accurate and persistent view of identity to our customers. This allows you to maintain a consistent and comprehensive understanding of your customers and their marketing attributes over time.

- Highly accurate and refreshed digital identities: Our signal-agnostic graph is not reliant on any one signal as it includes HEMs, cookies, MAIDs, IPs, Universal IDs, and CTV IDs. Our Digital Graph is updated weekly, ensuring the data is always fresh and addressable. This persistent linkage of individuals and households to their identifiers and devices means your campaigns are always targeting the right people.

- Connected offline and digital graphs for holistic insights: We connect offline and digital identities by following privacy-first best practices, such as preventing re-identification, to allow insights from the offline world to be used in the online world. This integrated approach, enriched with marketing data, gives you better insights, more addressable advertising, and the ability to engage customers across multiple devices while accurately measuring campaign impact.

Transform challenges into opportunities

The rise of the multi-ID landscape presents both challenges and opportunities for the advertising industry. We stand as the trusted partner to navigate this complexity, utilizing insights from the offline world to inform decisions in the online world, enabling personalized marketing and accurate attribution, and helping you achieve your current and future goals.

Latest posts

Discount stores appear to be weathering the recession better than some of their full-price counterparts, as they carry first-quality designer merchandise at competitive prices.