Originally appeared on MediaPost

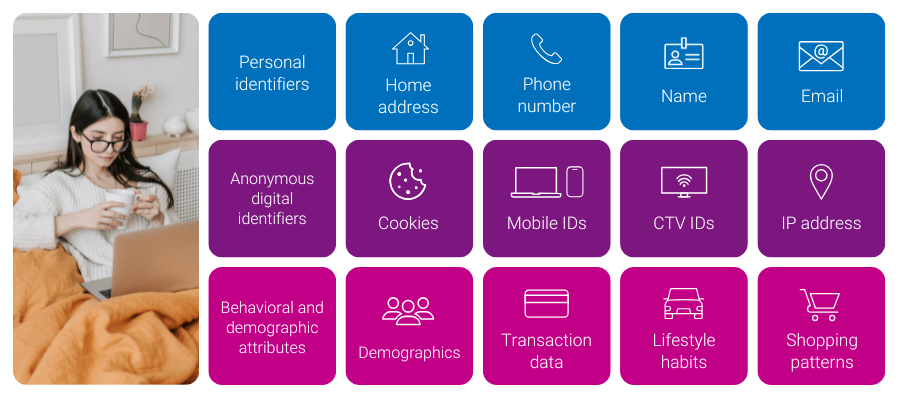

As the digital ecosystem becomes more complex, managing multiple identifiers for consumers has emerged as a significant challenge. From cookies and IP addresses to mobile IDs and universal IDs, marketers and platforms face increasing difficulty in maintaining a unified view of their consumers. Without a coherent identity strategy, campaigns can suffer from poor targeting, limited personalization, and flawed attribution.

Experian understands these challenges and offers solutions to help our partners navigate the complexities of a multi-ID landscape. By utilizing both digital and offline data, we provide the tools to unify fragmented identifiers and maintain a persistent view of consumers. As a result, marketers and platforms get rich insights, accurate cross-device targeting, improved addressability, and measurable advertising.

The shifting identity landscape

For years, the industry has relied on cookies to identify consumers across devices and platforms. However, with ongoing signal loss, including the uncertainty around cookies, and the evolution of privacy regulations, the digital identity landscape has grown more complicated. As consumers hop from one device to another, they are now represented by multiple signals, each tied to a different aspect of their digital behavior.

While this shift brings complexity, it also opens the door for innovation. Marketers and ad platforms now have the opportunity to rethink their identity strategies and adopt more flexible approaches that are not reliant on a single identifier.

This is where Experian comes in.

Connecting the dots: A holistic view of the customer journey

Our identity solutions are designed to help manage today’s multi-ID ecosystem by connecting digital and offline identifiers to a single customer profile. This creates a unified view of the consumer, and when combined with our understanding of customer behavior (e.g. demo, interests, shopping patterns) marketers and platforms get both insights about their customers and the addressability to reach them across channels.

Four examples of what you can do with a strong identity foundation

- If an advertiser wants to make its first-party data more addressable, it can utilize our Digital Graph with universal IDs, hashed emails (HEMs), and connected TV (CTV) IDs to extend its reach.

- A publisher who wants to gain further insights into their audiences and create private marketplaces (PMPs) can achieve this goal with the use of our Digital Graph with hashed emails, universal IDs, mobile ad IDs (MAIDs), CTV IDs, and IPs. The publisher can use this in concert with Marketing Attributes to understand age, gender, household income, buying behavior, and more. The publisher can connect marketing attributes to the Digital Graph via our Living Unit ID (LUID) to understand more about consumers that fall into their segments.

- A demand-side platform (DSP) who wants to extend first-party and third-party audience reach across all digital devices on their platform will use the Digital Graph with all digital IDs to allow users of their platform to select cross-device extension against first-party and third-party audiences.

- A retail media network (RMN) can use our Offline and Digital Graphs to connect in-store and online purchases to a household profile—even when purchases are made by different people. The RMN can then reach that household across digital media platforms and accurately attribute the in-store purchase back to digital ad exposure.

Identity as a strategic asset: Today and in the future

In our paradoxical world where consumers are represented by multiple identifiers, yet marketers and platforms face signal loss, identity is more than a technical issue—it’s a strategic asset. The ability to unify identity data into a single profile provides marketers with the customer intelligence needed to drive growth and stay competitive. Here’s how we do it:

- Deep, persistent customer understanding: With roots in offline, deterministic data like names, addresses, and emails, we provide an accurate and persistent view of identity to our customers. This allows you to maintain a consistent and comprehensive understanding of your customers and their marketing attributes over time.

- Highly accurate and refreshed digital identities: Our signal-agnostic graph is not reliant on any one signal as it includes HEMs, cookies, MAIDs, IPs, Universal IDs, and CTV IDs. Our Digital Graph is updated weekly, ensuring the data is always fresh and addressable. This persistent linkage of individuals and households to their identifiers and devices means your campaigns are always targeting the right people.

- Connected offline and digital graphs for holistic insights: We connect offline and digital identities by following privacy-first best practices, such as preventing re-identification, to allow insights from the offline world to be used in the online world. This integrated approach, enriched with marketing data, gives you better insights, more addressable advertising, and the ability to engage customers across multiple devices while accurately measuring campaign impact.

Transform challenges into opportunities

The rise of the multi-ID landscape presents both challenges and opportunities for the advertising industry. We stand as the trusted partner to navigate this complexity, utilizing insights from the offline world to inform decisions in the online world, enabling personalized marketing and accurate attribution, and helping you achieve your current and future goals.

Latest posts

2020 has been a year of change and challenges for businesses and consumers alike. With the global pandemic, we have seen stay at home orders put in place, a shift to work from home for many, major events canceled, schools shifted to online format, graduations and other end-of-year activities canceled, and more. As we move through the phases of reopening, everyone is figuring out how to navigate the ‘new normal’ in the wake of new safety requirements, businesses are working to determine what their day-to-day operations will look like as they reopen. The changing times have implications on how consumers act, what and how they purchase, and how they manage their daily lives. With these changing times, consumers are quickly adapting their lifestyles which impacts the choices they make on how they shop, bank and provide for their families. Businesses across the United States are trying to understand how consumers are feeling during this time and how that might correlate with their visitation patterns. Using Experian’s Mobile Location data, coupled with Consumer Sentiment data, we looked at foot traffic and sentiment trends in the retail space throughout the pandemic. As you can see from the chart, there has been a steady increase in household visits to retail locations since March that correlates with the rise in sentiment. Note the differences in visitation patterns across the regions. You can see some foot traffic spikes, which correlate to reopening phases in several states during the week of May 4th and Memorial Day weekend. However, you see a lower average of foot traffic in the Northeast U.S. where reopening phases are rolling out at a slower pace. It is going to be essential for businesses to craft marketing strategies on a regional level as guidelines for reopening are the state-level. This means that a business’s consumers look different based on where they are located and might require more targeted and sensitive messaging. For example, using Experian’s Mosaic segmentation, we further delved into what consumers look like today by analyzing those Mosaics who have the most positive change in regard to the pandemic, versus those that had the most negative. You can see in the charts that there is a significant difference between the Mosaics trending positively versus those trending negatively. Consumer segments have drastically different sentiment, and foot traffic patterns and understanding how your consumers are feeling and where they are shopping will help improve your ROI. Having a comprehensive and targeted marketing plan will be essential for companies as they navigate the intricacies of reopening. Experian’s Reopening Package allows brands to take a phased approach to better understand and reach both new and existing customers through targeting, analytics and key insights. Companies can analyze their consumers’ sentiments and visitation patterns during the pandemic, segmented by Experian Mosaic® lifestyle segmentation group. Businesses can then take those insights and apply them to other models, or create their own models, to build out and run effective marketing campaigns that target current and prospective customers. A successful long-term marketing strategy needs to be data-driven, leveraging data and analytics to help craft targeted messaging. We can see that consumers want to shop again – foot traffic patterns appear to have increased since June, and sentiment is up – now it is necessary to understand where your customers fit into the spectrum. Missed our recent webinar, How COVID-19 Has Shaped Consumer Behavior for Retailers? Access the on demand version here.

Overview Chartable leverages The Tapad Graph to improve cross-device attribution rates and remove non-addressable IPs for clients. Challenge Chartable needs to differentiate between consumer and potential business IP addresses to provide accurate household modeling and reduce excess data for their customers. Podcasting generally only has access to IP addresses as a form of digital ID which limits its ability to connect activity to individuals and extend it across all devices. The Tapad + Experian solution Using Tapad, now a part of Experian, Chartable is able to cut through the noise of IP data and discard any addresses deemed a shared IP or business. Then, Tapad + Experian connects individual users to their other digital IDs and users in their household; creating a richer attribution model for Chartable customers. Increase in podcast attribution rates Get started with The Tapad Graph For personalized consultation on the value and benefits of The Tapad Graph for your business, email Sales@tapad.com today!

With the growth of digital marketing and the targeting capabilities associated with online outreach, many predicted that this would mark the end of direct mail advertising. But if Millennials have anything to say about it, that’s not going to happen anytime soon. Yes, believe it or not, Millennials are driving the resurgence of direct mail advertising, and many leading brands are now pivoting their omnichannel marketing plans to include direct mail. And with the USPS reporting more than 75.7 billion in marketing mail volume in 2019, this trend shows no sign of slowing down. Including direct mail in your plans may give your brand a better chance of reaching your audience. Why? 1. Millennials actually like getting mail.While most of us have decried “junk mail” as being environmentally unfriendly or just a pain to deal with, Millennials actually enjoy physical mail. Valassis recently cited research from USPS Customer & Market Insights stating that Millennials spend the most time sorting mail (about six minutes compared to the average, which is four minutes), plus they’re opening mail and reading it (at eight minutes versus the average of seven minutes). Valassis also conducted a study that showed that 68% of Millennials read print ads or inserts from retailers, and 64% prefer getting them through the mail. So, while digital outreach may be convenient, it hasn’t completely decimated the desire for that old-school, hands-on experience of opening and reading something that’s addressed to you. 2. Millennials respond to a multi-channel approach.Oftentimes, marketers think of omnichannel as being a combination of digital and TV, but when you add print into the mix, it can make an even bigger impact on Millennial audiences. Valassis found that 60% of consumers are more likely to make a purchase after seeing an ad when it’s presented across both offline and online channels, while 72% of Millennial parents say print ads encourage them to go online and make a purchase from that retailer. 3. Millennials think physical mail makes for a more personal approach.You’d think that e-mail would feel more personal, but with the influx of spam most people get, that’s just not the case. In fact, 67% of people see physical mail as being more personal than an e-mail, with seven out of 10 saying they prefer receiving actual mail over digital mail. And for marketers looking to make a one-to-one connection, this is music to their ears. With changing marketing plans, the mailbox has less competition than the inbox. Getting a catalog at their door with the perfect offer at the perfect time helps the marketer make the direct connection. 4. Direct mail lasts longer than digital mail.That may seem like an obvious statement, but there’s more to it than you think. When an e-mail arrives in someone’s inbox, it’s easy to ignore it, read the subject line and forget about it, or even just randomly delete it, if spam filters don’t take care of that on their own. But the average lifespan of a piece of direct mail is 17 days, which may account for how direct mail generates purchases five times larger than e-mail campaigns. It’s harder to ignore when it’s in your house and you have to physically handle it as opposed to just clicking a mouse to get rid of it. 5. Millennials trust direct mail.It’s true—research shows that 90% of Millennials think direct mail advertising is reliable. Plus, Millennials are 24% more likely to show mail to others, compared to 19% of non-Millennials… which means if they find a deal they like in the mail, they’re probably going to spread the word. Visit our Retail Marketing Solutions page to learn more about how we can help you find new customers and have more meaningful engagements with existing ones.