In a perfect world, we’d all have a single, go-to grocery store that carried everything on our shopping list – fresh produce, gourmet coffee beans, rare spices, and maybe even that special-grade olive oil, right alongside our wholesale bulk purchases at unbeatable prices. It would be convenient and efficient, and it’d save a lot of driving around town.

The changing data marketplace: From one-stop shop to specialized selection

For a long time, data buyers enjoyed something similar in their world: a small set of large-scale data marketplaces that offered a wide array of audiences, making it easy to load up on whatever you needed in one place. Not only are there fewer places to pick everything up, but new factors like privacy and signal deprecation are placing a spotlight on quality and addressability.

Just as our dinner plans are growing more ambitious insofar as we want health, flavor, value, and convenience all in one place – so are our data strategies. Instead of a single steak-and-potatoes meal, today’s data marketplace operators might be cooking up a complex menu of campaigns.

“Experian has been a longstanding partner of DISH Media, and we’re excited to be an early adopter of their marketplace which leverages the foundation of their identity solutions to ensure maximum cross-channel reach as we look to expand the breadth and depth of data we use for addressable TV.”

Kemal Bokhari, Head of Data, Measurement & Analytics, DISH Media

As a result, data buyers are beginning to shop around. Some still rely on large-scale marketplaces for familiar staples, but now they have reasons to explore other options. Some are turning to providers known for offering top-tier, transparently sourced segments. Others are focusing on specialty providers that excel in one area.

A more selective approach to data buying

In this environment, choosing where to “shop” for data is becoming more deliberate and selective. Data buyers aren’t just thinking about broad scale; they’re looking to prioritize quality, durability, data privacy, and differentiation. They need to place higher value on data marketplaces that can maintain audience addressability over time, despite signal loss. Sometimes, that means accepting a smaller assortment in exchange for tighter vetting and more reliable targeting. Other times it means mixing and matching – stopping by one marketplace for premium segments and another for cost-friendly, wide-reaching data sets. Either way, they can benefit from having more choices.

“Experian has been a longstanding partner of DISH Media, and we’re excited to be an early adopter of their marketplace which leverages the foundation of their identity solutions to ensure maximum cross-channel reach as we look to expand the breadth and depth of data we use for addressable TV.”

Kemal Bokhari, Head of Data, Measurement & Analytics, DISH Media

Experian’s marketplace: A trusted source for high-quality data

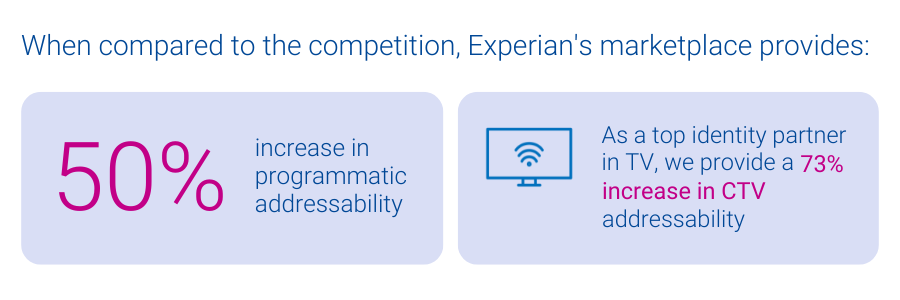

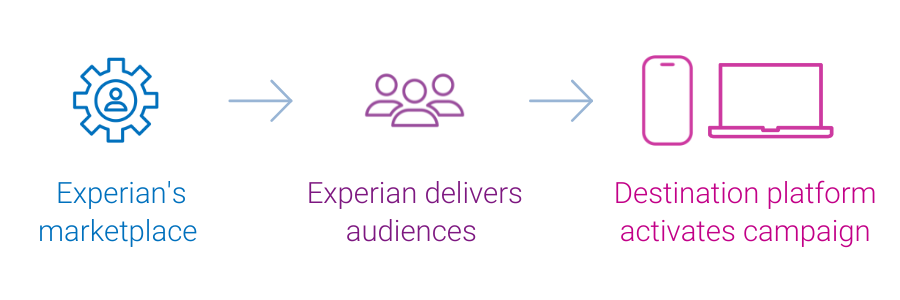

Experian’s vetted and curated blend of data partners and vertically-aligned audiences offers a trusted specialty store for data buyers. Experian’s marketplace, powered by identity graphs that include 126 million households, 250 million individuals, and 4 billion active digital IDs, enables partner audiences to be easily activated and maintain high addressability across display, mobile, and connected TV (CTV) channels. In particular, Experian’s marketplace provides:

The future of data marketplaces: Precision and flexibility matter

The evolution of data marketplaces reflects the industry’s shifting priorities. Data buyers seek specificity, reliability, and adaptability to align with their diverse campaign needs. The best data strategy, much like the best grocery run, isn’t about grabbing everything in one place – it’s about carefully selecting the right ingredients to create the perfect recipe for success. This shift underscores the importance of flexibility and precision as data buyers navigate a landscape shaped by privacy regulations, signal loss, and evolving consumer expectations.

As data marketplaces adapt to meet these demands, they are redefining what it means to deliver value. Experian’s marketplace enables buyers to strike the perfect balance between reach and quality by offering enhanced match rates, precise audience planning, and seamless distribution. In this new era, data buyers have the tools and options to craft campaigns that are impactful and aligned with the increasingly selective and privacy-conscious digital landscape. The key is recognizing that today’s data strategy is about utilizing the strengths of many to create a cohesive and effective whole.

If you’re interested in learning more about Experian’s marketplace or becoming an active buyer or seller in our marketplace, please contact us.

Latest posts

In today’s multi-channel shopping world online behavior can’t be overlooked. Marketers need to enhance their offline marketing efforts with online data to take advantage of incorporating online behavior into targeting efforts.

Income levels are important to consider when targeting consumers, as is determining the amount of money they have left over for non-essentials after the bills are paid.

My Experian Marketing Services’ colleagues and resident data experts Bill Tancer and Marcus Tewskbury answered the above question for marketers during our recent 2012 Holiday Planning Webinar. The webinar recapped key 2011 holiday marketing results, plus featured trends, benchmarks and recommendations for a successful and profitable 2012 holiday shopping season.