In a perfect world, we’d all have a single, go-to grocery store that carried everything on our shopping list – fresh produce, gourmet coffee beans, rare spices, and maybe even that special-grade olive oil, right alongside our wholesale bulk purchases at unbeatable prices. It would be convenient and efficient, and it’d save a lot of driving around town.

The changing data marketplace: From one-stop shop to specialized selection

For a long time, data buyers enjoyed something similar in their world: a small set of large-scale data marketplaces that offered a wide array of audiences, making it easy to load up on whatever you needed in one place. Not only are there fewer places to pick everything up, but new factors like privacy and signal deprecation are placing a spotlight on quality and addressability.

Just as our dinner plans are growing more ambitious insofar as we want health, flavor, value, and convenience all in one place – so are our data strategies. Instead of a single steak-and-potatoes meal, today’s data marketplace operators might be cooking up a complex menu of campaigns.

“Experian has been a longstanding partner of DISH Media, and we’re excited to be an early adopter of their marketplace which leverages the foundation of their identity solutions to ensure maximum cross-channel reach as we look to expand the breadth and depth of data we use for addressable TV.”

Kemal Bokhari, Head of Data, Measurement & Analytics, DISH Media

As a result, data buyers are beginning to shop around. Some still rely on large-scale marketplaces for familiar staples, but now they have reasons to explore other options. Some are turning to providers known for offering top-tier, transparently sourced segments. Others are focusing on specialty providers that excel in one area.

A more selective approach to data buying

In this environment, choosing where to “shop” for data is becoming more deliberate and selective. Data buyers aren’t just thinking about broad scale; they’re looking to prioritize quality, durability, data privacy, and differentiation. They need to place higher value on data marketplaces that can maintain audience addressability over time, despite signal loss. Sometimes, that means accepting a smaller assortment in exchange for tighter vetting and more reliable targeting. Other times it means mixing and matching – stopping by one marketplace for premium segments and another for cost-friendly, wide-reaching data sets. Either way, they can benefit from having more choices.

“Experian has been a longstanding partner of DISH Media, and we’re excited to be an early adopter of their marketplace which leverages the foundation of their identity solutions to ensure maximum cross-channel reach as we look to expand the breadth and depth of data we use for addressable TV.”

Kemal Bokhari, Head of Data, Measurement & Analytics, DISH Media

Experian’s marketplace: A trusted source for high-quality data

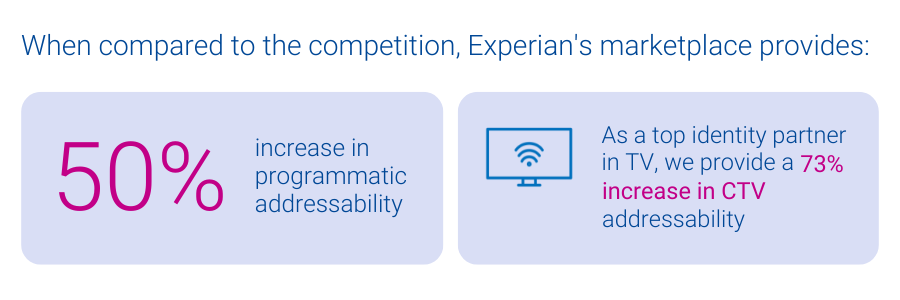

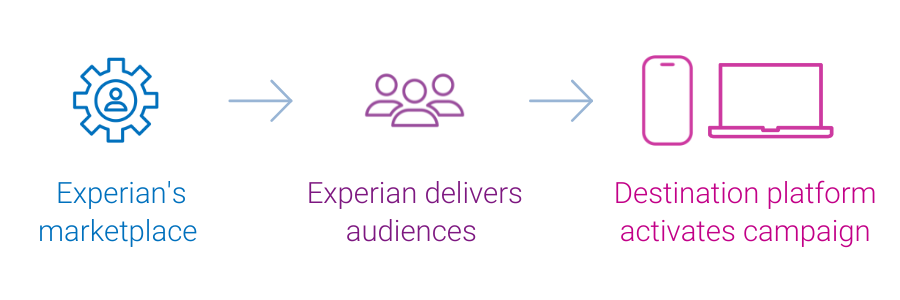

Experian’s vetted and curated blend of data partners and vertically-aligned audiences offers a trusted specialty store for data buyers. Experian’s marketplace, powered by identity graphs that include 126 million households, 250 million individuals, and 4 billion active digital IDs, enables partner audiences to be easily activated and maintain high addressability across display, mobile, and connected TV (CTV) channels. In particular, Experian’s marketplace provides:

The future of data marketplaces: Precision and flexibility matter

The evolution of data marketplaces reflects the industry’s shifting priorities. Data buyers seek specificity, reliability, and adaptability to align with their diverse campaign needs. The best data strategy, much like the best grocery run, isn’t about grabbing everything in one place – it’s about carefully selecting the right ingredients to create the perfect recipe for success. This shift underscores the importance of flexibility and precision as data buyers navigate a landscape shaped by privacy regulations, signal loss, and evolving consumer expectations.

As data marketplaces adapt to meet these demands, they are redefining what it means to deliver value. Experian’s marketplace enables buyers to strike the perfect balance between reach and quality by offering enhanced match rates, precise audience planning, and seamless distribution. In this new era, data buyers have the tools and options to craft campaigns that are impactful and aligned with the increasingly selective and privacy-conscious digital landscape. The key is recognizing that today’s data strategy is about utilizing the strengths of many to create a cohesive and effective whole.

If you’re interested in learning more about Experian’s marketplace or becoming an active buyer or seller in our marketplace, please contact us.

Latest posts

With the growth of digital marketing and the targeting capabilities associated with online outreach, many predicted that this would mark the end of direct mail advertising. But if Millennials have anything to say about it, that’s not going to happen anytime soon. Yes, believe it or not, Millennials are driving the resurgence of direct mail advertising, and many leading brands are now pivoting their omnichannel marketing plans to include direct mail. And with the USPS reporting more than 75.7 billion in marketing mail volume in 2019, this trend shows no sign of slowing down. Including direct mail in your plans may give your brand a better chance of reaching your audience. Why? 1. Millennials actually like getting mail.While most of us have decried “junk mail” as being environmentally unfriendly or just a pain to deal with, Millennials actually enjoy physical mail. Valassis recently cited research from USPS Customer & Market Insights stating that Millennials spend the most time sorting mail (about six minutes compared to the average, which is four minutes), plus they’re opening mail and reading it (at eight minutes versus the average of seven minutes). Valassis also conducted a study that showed that 68% of Millennials read print ads or inserts from retailers, and 64% prefer getting them through the mail. So, while digital outreach may be convenient, it hasn’t completely decimated the desire for that old-school, hands-on experience of opening and reading something that’s addressed to you. 2. Millennials respond to a multi-channel approach.Oftentimes, marketers think of omnichannel as being a combination of digital and TV, but when you add print into the mix, it can make an even bigger impact on Millennial audiences. Valassis found that 60% of consumers are more likely to make a purchase after seeing an ad when it’s presented across both offline and online channels, while 72% of Millennial parents say print ads encourage them to go online and make a purchase from that retailer. 3. Millennials think physical mail makes for a more personal approach.You’d think that e-mail would feel more personal, but with the influx of spam most people get, that’s just not the case. In fact, 67% of people see physical mail as being more personal than an e-mail, with seven out of 10 saying they prefer receiving actual mail over digital mail. And for marketers looking to make a one-to-one connection, this is music to their ears. With changing marketing plans, the mailbox has less competition than the inbox. Getting a catalog at their door with the perfect offer at the perfect time helps the marketer make the direct connection. 4. Direct mail lasts longer than digital mail.That may seem like an obvious statement, but there’s more to it than you think. When an e-mail arrives in someone’s inbox, it’s easy to ignore it, read the subject line and forget about it, or even just randomly delete it, if spam filters don’t take care of that on their own. But the average lifespan of a piece of direct mail is 17 days, which may account for how direct mail generates purchases five times larger than e-mail campaigns. It’s harder to ignore when it’s in your house and you have to physically handle it as opposed to just clicking a mouse to get rid of it. 5. Millennials trust direct mail.It’s true—research shows that 90% of Millennials think direct mail advertising is reliable. Plus, Millennials are 24% more likely to show mail to others, compared to 19% of non-Millennials… which means if they find a deal they like in the mail, they’re probably going to spread the word. Visit our Retail Marketing Solutions page to learn more about how we can help you find new customers and have more meaningful engagements with existing ones.

As the nation slowly works its way up to full speed, it’s undeniable that the landscape has changed dramatically for every brand—especially when it comes to marketing and advertising. Many are looking for new ways to better connect with customers to meet their needs and encourage their continued patronage and loyalty, while others are attempting to reach out to a whole new audience who may not have known about them pre-pandemic. But even as brands are eager to get back to normal—whatever the new normal is—much like consumers, they’re faced with an uncertain future that may be affected by new financial restraints. For marketers looking to make a big impact on their bottom line, now is the time to consider pivoting advertising efforts to advanced TV (Connected TV/OTT and addressable TV). While traditionally cost prohibitive for many brands, the pandemic has greatly changed the availability of TV advertising. TV advertising is now more affordable than ever, opening up opportunities to brands who may not have had the ability to include it in their previous marketing plans. Whether it was due to the cancellation of live events or the delay of basketball season, or just general skittishness that’s keeping other brands from spending money on TV advertising, their pivot is to your benefit. There’s no question that consumers’ attitudes toward brands will have changed during the pandemic, which means they might need to be reminded of your brand and what it has to offer. There may be some who are seeing your brand for the first time, or for the first time in a long time. The good news is, people are watching TV now more than ever before. According to Experian’s Consumer Sentiment Index, television consumption is up 41% from mid-May to mid-June. Cable TV viewership has seen a 22% increase over the same period of time, showing that consumers are still connected to traditional TV viewership. Another reason why now is a great time to make advanced TV part of your marketing plan. While many states are still rolling out their re-opening plans, many consumers are still working from home, and the job landscape is still firming up. That means your customers will still be passing the time at home as the landscape continues to shift and change, and their attention will likely be directed toward their TVs. Plus, with consumer spending starting to rebound, you can benefit from this directed attention in a new medium. And consumers aren’t just watching TV on their televisions. Smartphone use is up 41% over last month, as is desktop/laptop use at 38%, and tablet use at 21%. And, when they’re not watching their favorite show on their phones, computers or tablets, they’re visiting advertiser websites and using apps more heavily. This means that brands can supplement their TV advertising with an omnichannel approach to ensure their consumer can connect with them through any device they’re using. All of this may sound intimidating to brands who haven’t previously advertised on TV or executed an omnichannel campaign, but rest assured that the power of data can help make the experience fairly seamless. A data-driven marketing strategy can help brands better understand their audience, including demographics, lifestyle, behavior and attitudes—as well as their preferred engagement channels. This helps ensure that your message resonates and is seen on the devices and channels your audience frequents most. With Experian’s 50+ years of experience with consumer data, you can rely on us to help you execute a data-driven advanced TV campaign that targets the right audience with your message. And we collaborate with all TV operators and have connections with many industry media partners, so you can choose exactly where you want your outreach to go. Find out more about how Experian’s Advanced TV capabilities can help you have more meaningful interactions with people: https://www.experian.com/marketing-services/television-advertising.

Retailers have always known that building a loyal customer base is the key to success. But whether they’d successfully done so or were still working towards their customer loyalty goals in Q1 of 2020, the global pandemic changed everything. With shoppers shifting purchasing habits almost solely online, retailers with an established online presence were able to navigate stay-at-home orders and other business restrictions. As of June 9, 2020, according to Experian’s Consumer Sentiment Index, half of Americans (47%) are buying more online than they did in the past. So those who previously relied on their brick and mortar business may have had difficulty staying afloat. Undeniably, the landscape has shifted dramatically, and it’s about to do so again as stay-at-home orders are lifted and retailers are being given the green light to re-open, albeit with guidelines and restrictions they’ve never faced before. With so many different messages that need to be shared, and the need to stand out among thousands of other retailers working to grab the attention of the same audience, mobile location data is an important tool in a retail marketer’s arsenal. For example, so much of the in-store experience moved online at the start of the pandemic. As a result, a lot of consumers have gotten comfortable with that format and may be apprehensive about the in-store experience, especially with all the changes required for re-opening. Using mobile location data, retailers can identify audiences that are more likely to return to in-store visits, and tailor messaging to address their questions and concerns to encourage their patronage. They can effectively communicate information surrounding the rules for in-store shopping, including face masks, social distancing, how they plan to protect their clientele, and more. If, after sharing their re-opening information, retailers find customers aren’t coming to them but are instead visiting competitors, mobile location data can help them determine consumer patterns based on competitor shopping to gain a greater understanding of why they’re shopping elsewhere. Using this information, retailers can adjust their outreach to better speak to their target customer and their needs, and encourage their visit with more relevant messaging. And of course, there will still be some customers who feel more comfortable continuing with online shopping. Mobile location data can also assist brands in identifying those audiences so that they can adjust their communications strategies and messages accordingly. Meanwhile, many retailers have shifted from a buy online pick up in store (BOPIS) model to buy online pick up at curbside (BOPAC), both for convenience and safety. As restrictions lift, some will soon be shifting back to BOPIS. Mobile location data can help you determine if this is a more preferred method of shopping by analyzing consumer behavior. If customers aren’t ready for an in-store visit but still have needs that could be met by a particular retailer, that brand can create messaging that supports their desire to do their shopping online and pick up their purchase—whether they come inside or opt for curbside pickup. The more retailers know about their customer’s habits, behaviors and interests, the more they can address their needs and concerns with personalized messaging that can make an impact. Additionally, because so much of life moved online during the pandemic, consumer data may be even more fragmented than before, with their attention spread across multiple devices and channels. Using mobile location data—in combination with demographic and psychographic data—retailers can learn more about consumer behavior, including stores visited, shopping preference insights, hobbies, and more. While the retail industry is facing incredible challenges in the wake of unprecedented change, the right data can help them bridge the gap between where they were, and where they want to be—especially when it comes to nurturing consumer connections. And as retail marketers work on new messaging that shares their unique plans for re-opening and emerging post-pandemic, how that communication is delivered, and who it’s delivered to, could make all the difference in a successful re-opening plan. Contact us today to find out how more about Experian’s retail marketing solutions. And be sure to check out our other retail blog posts as well.