This holiday shopping season, marketers will look to take advantage of the surge in spending across channels like connected TV (CTV), programmatic, and mobile. Despite challenges such as privacy regulations and Google’s new cookie deprecation plan, this moment presents a unique opportunity for marketers to reshape their traditional approaches to consumer engagement and capitalize on these changes.

As we approach the holiday season, understanding how consumers spend, where they shop, and how their shopping habits are changing are key components to consider when crafting your holiday advertising campaigns. Our 2024 Holiday spending trends and insights report utilizes our expertise in data and insights to highlight emerging consumer behaviors and spending patterns. In our report, we share what these trends mean for marketers and how Experian can help, so you can refine your messaging and target the right audience through the best channels.

In this blog post, we cover three insights from our report. Watch our video for a recap below.

1. Consumers are shopping evenly throughout the holiday season

35% of holiday shopping was done in December, peaking at 9% of total holiday sales the week before Christmas. Cyber Week, the five-day period between Thanksgiving and Cyber Monday, and the week before Christmas brought the highest weekly sales for the past two holiday seasons.

What this means for marketers

Prepare for an extended promotional period. Schedule your marketing campaigns and sales initiatives to maximize impact during the extended season, focusing on the peaks of Cyber Week and the week before Christmas.

How Experian can help you target these shoppers

Experian’s data, ranked #1 in accuracy by Truthset, offers advertisers the ability to reach people based on demographic, geographic, and behavioral attributes (e.g. websites visited and purchase history). Our audiences are available on-the-shelf of most major platforms, making it easy for you to activate and target holiday shoppers.

We recently released 19 new holiday-focused audience segments. Here are a few you can activate:

- Black Friday Shoppers

- Cyber Monday Shoppers

- Big Box/Club Store Shoppers

- Luxury Gift Shoppers

- Discount Holiday Shoppers

- Holiday Airline Travel

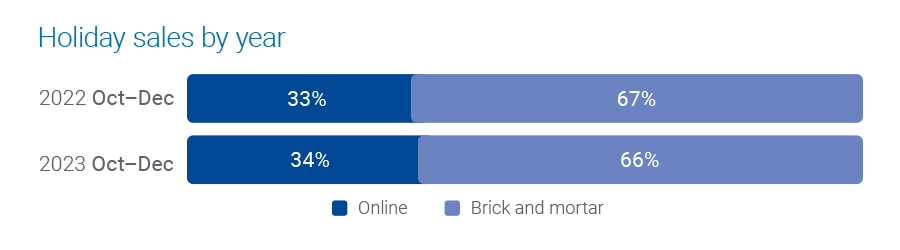

2. Online shopping is leveling out

Online holiday spending continues to remain around a third of all holiday shopping spending.

We are starting to see online shopping slow and level out – people are going back in-store. The high amount of online shopping we saw during the pandemic is starting to return to pre-pandemic behaviors.

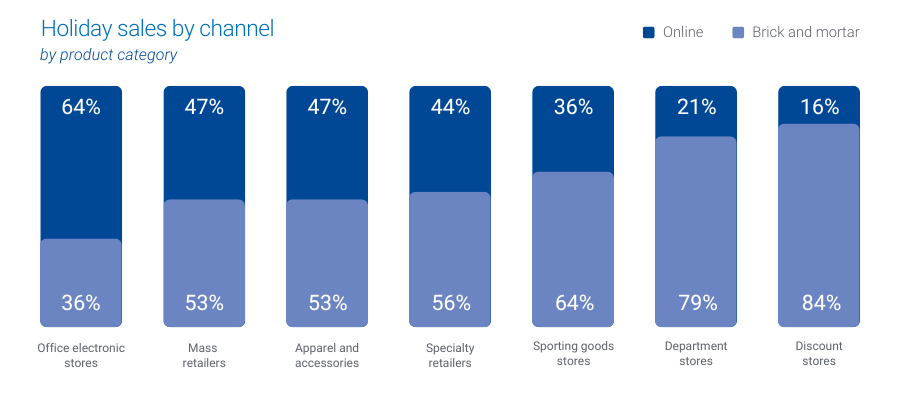

Consumers are spending more in-store at department and discount stores but are shopping online for office/electronics/games, mass retailers, and apparel.

- 84% of holiday shopping was done in-store for discount stores.

- 79% of holiday shopping was done in-store for department stores.

- 64% of holiday shopping was done online for office, electronics, and games stores.

What this means for marketers

Digital and physical experiences work together. Retailers should have a multi-channel plan to reach consumers, tailoring their approach to their target audience and product and creating engaging in-store experiences to drive visitors.

How Experian can help you target and measure across channels

We connect online and offline data to enable precise targeting and measurement of marketing efforts across multiple channels. Read our case study with Cuebiq to learn how they used our Activity Feed solution to deliver in-store lift analyses to their clients.

3. CTV is the top channel to reach consumers

Over two-thirds of the U.S. population now use CTV, and the average time spent among adults is expected to surpass two hours per day in 2024. CTV offers a creative ad experience similar to its linear counterpart but provides more sophisticated targeting and analytics capabilities.

What this means for marketers

As CTV viewing continues to dominate, the importance of cross-device targeting and measurement increases.

How Experian can help you reach shoppers across devices

Later this year, we’ll add support for IPv6 in our Digital Graph as well as phone-based UID2s. This is in addition to our current coverage of IPv4 and email-based UID2s. As a result, all IP signals and UID2s will be resolved back to Experian’s household and individual profiles and their associated devices, which means marketers and platforms can better understand the full customer journey and reach people across their devices.

Download our 2024 Holiday spending trends and insights report

This holiday season is about more than just transactions – it’s about cultivating meaningful connections with your audience. Download our 2024 Holiday spending trends and insights report to access all of our predictions for this year’s holiday season.

When you work with Experian for your holiday shopping campaigns, you’re getting:

- Accurate consumer insights: Better understand your customers’ behavioral and demographic attributes with our #1 ranked data covering the full U.S. population.

- Signal-agnostic identity solutions: Our deep understanding of people in the offline and digital worlds provides you a persistent linkage of personally identifiable information (PII) data and digital IDs, ensuring you accurate cross-device targeting, addressability and measurement.

- Secure connectivity: Bring data and identity to life in a way that meets your needs by securely sharing data between partners, utilizing the integrations we have across the ecosystem, and using our marketing data in flexible ways.

Make the most of this holiday shopping season with Experian. Contact us today to get started.

Latest posts

Americans spend $1.47 trillion annually on discretionary goods and services. Find out how Experian Simmons evaluates discretionary spending against any of the 60,000 consumer variables.

In many ways it’s wrong to refer to Brazil, Russia, India and China as “developing” markets — by some measures they can be considered just as developed as the “developed” markets.

According to Experian Simmons, users of printed coupons — those obtained from newspapers, magazines, mail, etc.—outnumber users of digital coupons by a margin of almost 3-to-1. Fully 68% of all U.S. adults said their household uses print coupons, a number that has remained relatively unchanged during the past five years.