This holiday shopping season, marketers will look to take advantage of the surge in spending across channels like connected TV (CTV), programmatic, and mobile. Despite challenges such as privacy regulations and Google’s new cookie deprecation plan, this moment presents a unique opportunity for marketers to reshape their traditional approaches to consumer engagement and capitalize on these changes.

As we approach the holiday season, understanding how consumers spend, where they shop, and how their shopping habits are changing are key components to consider when crafting your holiday advertising campaigns. Our 2024 Holiday spending trends and insights report utilizes our expertise in data and insights to highlight emerging consumer behaviors and spending patterns. In our report, we share what these trends mean for marketers and how Experian can help, so you can refine your messaging and target the right audience through the best channels.

In this blog post, we cover three insights from our report. Watch our video for a recap below.

1. Consumers are shopping evenly throughout the holiday season

35% of holiday shopping was done in December, peaking at 9% of total holiday sales the week before Christmas. Cyber Week, the five-day period between Thanksgiving and Cyber Monday, and the week before Christmas brought the highest weekly sales for the past two holiday seasons.

What this means for marketers

Prepare for an extended promotional period. Schedule your marketing campaigns and sales initiatives to maximize impact during the extended season, focusing on the peaks of Cyber Week and the week before Christmas.

How Experian can help you target these shoppers

Experian’s data, ranked #1 in accuracy by Truthset, offers advertisers the ability to reach people based on demographic, geographic, and behavioral attributes (e.g. websites visited and purchase history). Our audiences are available on-the-shelf of most major platforms, making it easy for you to activate and target holiday shoppers.

We recently released 19 new holiday-focused audience segments. Here are a few you can activate:

- Black Friday Shoppers

- Cyber Monday Shoppers

- Big Box/Club Store Shoppers

- Luxury Gift Shoppers

- Discount Holiday Shoppers

- Holiday Airline Travel

2. Online shopping is leveling out

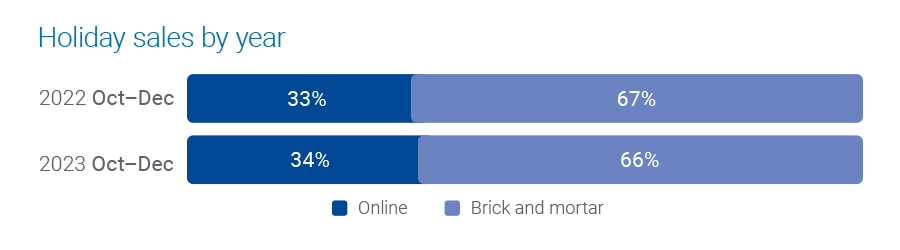

Online holiday spending continues to remain around a third of all holiday shopping spending.

We are starting to see online shopping slow and level out – people are going back in-store. The high amount of online shopping we saw during the pandemic is starting to return to pre-pandemic behaviors.

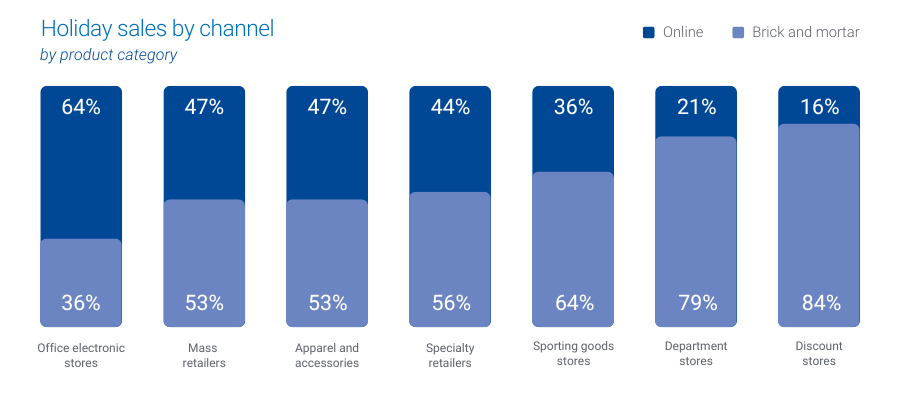

Consumers are spending more in-store at department and discount stores but are shopping online for office/electronics/games, mass retailers, and apparel.

- 84% of holiday shopping was done in-store for discount stores.

- 79% of holiday shopping was done in-store for department stores.

- 64% of holiday shopping was done online for office, electronics, and games stores.

What this means for marketers

Digital and physical experiences work together. Retailers should have a multi-channel plan to reach consumers, tailoring their approach to their target audience and product and creating engaging in-store experiences to drive visitors.

How Experian can help you target and measure across channels

We connect online and offline data to enable precise targeting and measurement of marketing efforts across multiple channels. Read our case study with Cuebiq to learn how they used our Activity Feed solution to deliver in-store lift analyses to their clients.

3. CTV is the top channel to reach consumers

Over two-thirds of the U.S. population now use CTV, and the average time spent among adults is expected to surpass two hours per day in 2024. CTV offers a creative ad experience similar to its linear counterpart but provides more sophisticated targeting and analytics capabilities.

What this means for marketers

As CTV viewing continues to dominate, the importance of cross-device targeting and measurement increases.

How Experian can help you reach shoppers across devices

Later this year, we’ll add support for IPv6 in our Digital Graph as well as phone-based UID2s. This is in addition to our current coverage of IPv4 and email-based UID2s. As a result, all IP signals and UID2s will be resolved back to Experian’s household and individual profiles and their associated devices, which means marketers and platforms can better understand the full customer journey and reach people across their devices.

Download our 2024 Holiday spending trends and insights report

This holiday season is about more than just transactions – it’s about cultivating meaningful connections with your audience. Download our 2024 Holiday spending trends and insights report to access all of our predictions for this year’s holiday season.

When you work with Experian for your holiday shopping campaigns, you’re getting:

- Accurate consumer insights: Better understand your customers’ behavioral and demographic attributes with our #1 ranked data covering the full U.S. population.

- Signal-agnostic identity solutions: Our deep understanding of people in the offline and digital worlds provides you a persistent linkage of personally identifiable information (PII) data and digital IDs, ensuring you accurate cross-device targeting, addressability and measurement.

- Secure connectivity: Bring data and identity to life in a way that meets your needs by securely sharing data between partners, utilizing the integrations we have across the ecosystem, and using our marketing data in flexible ways.

Make the most of this holiday shopping season with Experian. Contact us today to get started.

Latest posts

For British Petroleum (BP), 2010 has been marked by the unfortunate developments resulting after the Deepwater Horizon oil rig explosion in the Gulf of Mexico on April 20. Since then, BP’s crisis mismanagement and failed attempts to stop the oil spill have transformed this unfortunate event into an ecological disaster with political and financial consequences for the company. The oil leak has caused BP to lose a noticeable number of its American customers, namely their most loyal consumers. Experian Simmons DataStream shows that between April 26 and June 28, 2010 the percentage of American adults who report going to BP fell from 26.4% to 16.4%, a relative loss of 38% of their client base in just nine weeks. More astounding is the fact that BP’s most loyal consumers (those who said that BP is the gas or service station that they go to most often) declined a relative 56% during the same time. In fact, on June 28, 2010, only 9.5% of adults went to BP most often compared with 21.5% who were loyal to BP the week of the spill. With the flow of oil temporarily ceased and nearing a permanent solution, BP may finally be able to cap the flow of bad publicity and to reverse some of their loss in market share. Experian Simmons will continue to monitor this and other important consumer trends and share those findings here.

According to data released by Standard and Poor’s and Experian for S&P/Experian Consumer Credit Default Indices, “default rates nationally fell in May across the board.” Defaulting balances declined among all types of credit lines, including bank card loans, first and second mortgage default rates and auto loans. Further research from Experian Simmons DataStream underscores this trend. Between November 17, 2008 and May 10, 2010, there has been a 15% increase in the share of major credit card holders who report usually paying their credit card balance in full each month. This increase is reflected among both VISA and MasterCard credit card holders, during the same time period. Specifically, the percent of VISA and MasterCard credit card holders who usually pay their credit card balance in full increased by 25% and 17%, respectively. During the later part of 2008 and much of the first half of 2009, MasterCard holders were the more likely to pay their card balance in full each month. Today, however, VISA card holders are the more likely to pay the full amount due. As of May 10, 2010, 42% of VISA card holders usually paid their VISA balance in full compared with 40% of MasterCard holders. American consumers’ attempt to become solvent shows that personal financial responsibility standards are increasing in response to the recent financial crisis. According to data released by Standard and Poor’s and Experian for S&P/Experian Consumer Credit Default Indices, “default rates nationally fell in May across the board.” Defaulting balances declined among all types of credit lines, including bank card loans, first and second mortgage default rates and auto loans. Further research from Experian Simmons DataStream underscores this trend. Between November 17, 2008 and May 10, 2010, there has been a 15% increase in the share of major credit card holders who report usually paying their credit card balance in full each month. This increase is reflected among both VISA and MasterCard credit card holders, during the same time period. Specifically, the percent of VISA and MasterCard credit card holders who usually pay their credit card balance in full increased by 25% and 17%, respectively. During the later part of 2008 and much of the first half of 2009, MasterCard holders were the more likely to pay their card balance in full each month. Today, however, VISA card holders are the more likely to pay the full amount due. As of May 10, 2010, 42% of VISA card holders usually paid their VISA balance in full compared with 40% of MasterCard holders. American consumers’ attempt to become solvent shows that personal financial responsibility standards are increasing in response to the recent financial crisis.

Forward thinking marketers leverage the power of social networking sites like Facebook, MySpace, Twitter and more to connect to consumers in a more personal and meaningful way. That's why Experian Simmons is focusing on social networking in this issue of Consumer Insights, featuring the freshest insights available from the latest Simmons New Media Study. The 2010 Social Networking Report provides the hard data behind this consumer revolution, including the fact that fully 66% of online Americans use social networking sites today, up from just 20% in 2007. Social networking is an increasingly addictive activity, with nearly half of those who access such sites (43%) reporting that they visit them multiple times per day. While users of social networking sites may have initially signed up to better keep in touch with friends, a growing number say they now use sites like Facebook to connect with family members. An astounding 70% of social networkers keep in touch with family via their various online networks, up from 61% a year ago. Fully two-thirds of all online adults today have visited a social networking site in the last 30 days, up from 53% in 2008 and 20% in 2007. Social networks have most thoroughly penetrated the young adult market, as nearly 9-in-10 online 18-to 34-year-olds visit such sites today. But even older Americans are tapping into social networks, with 41% of online adults age 50 and older making monthly visits to sites like Facebook, MySpace and Twitter. The rise of social networking tracks closely with that of Facebook. As of April 26, 2010, 46% of the U.S. online adult population reported having visited Facebook in the past 30 days. While keeping in touch with others is an important part of social networking, the popularity of games like Farmville and Mafia Wars illustrate that fun is a big part of the appeal of social networking. Whether it’s keeping in touch with others, playing games, debating politics or any of the other reasons people use social networking sites, it cannot be denied that there’s a sense of addictiveness to it all. Visiting social networking sites multiple times a day is up 28% over last year, while less frequent visits are down across the board. As social networking sites extend their reach across generations, Americans are increasingly using such sites to connect with more than just their friends. Today, 17% of social networkers communicate with their parents via those sites and 22% connect with their kids, up from 9% and 15%, respectively, a year ago. An astounding two-thirds of social networking site visitors (68%) say they have shown their support of a product, service, company or musical group by becoming a “fan” or a “friend” on a social networking site. One year earlier, only 57% of social networkers had publicly declared their “like” for a product, service, company or musical group. Knowing that social networkers are comfortable connecting with products and brands they support, it's important to understand which brands have the best opportunity to connect with this group. Top retail brands among Facebook users, for instance, include H&M, Hot Topc and Forever 21. Specifically, Facebook users are full twice as likely as the average American adult to shop at H&M. Twitter visitors are 3.7 times more likely to shop at Nordstrom. Heavy users of social networking sites are primarily concentrated in the Northwest and markets that are heavily influenced by major colleges or universities.