The holiday season is just around the corner, and retailers and marketers are gearing up for the busiest shopping period of the year. It’s crucial to understand how consumer behavior is evolving and what emerging trends to expect. Experian’s 2023 Holiday spending trends and insights report analyzes recent trends, consumer spending habits, and anticipates what’s to come in 2023 to help you deliver a top-notch shopping experience this holiday season.

In this blog post, we’ll cover three key insights from our report.

1. Consumers are shopping earlier

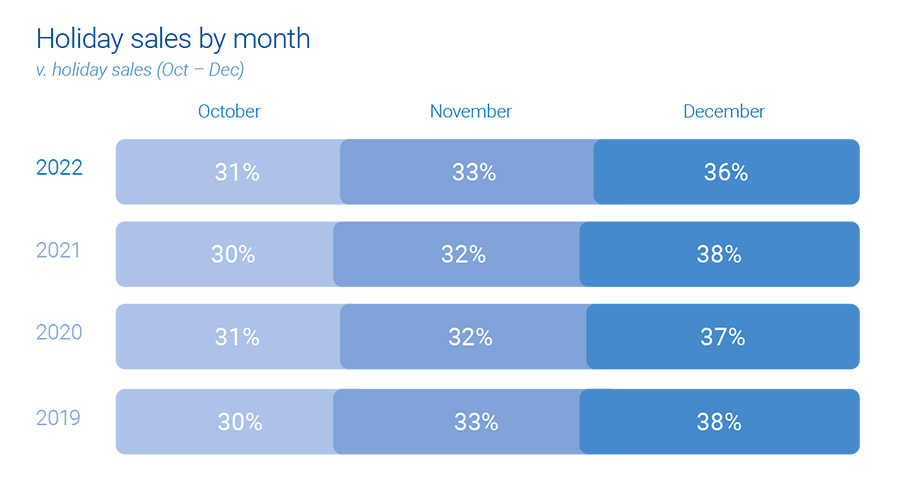

It’s no secret that December has always been the go-to month for consumers when it comes to holiday spending. However, holiday shopping now starts earlier, particularly with online sales.

This can be attributed to a surge in promotions and deals, enticing shoppers to open their wallets ahead of time, giving a significant boost to holiday sales. Notably, Cyber Week sales have proven to be an influential factor, accounting for 8% of total consumer holiday spending.

Experian tip

Reach the right shoppers with your promotions with sell-side targeting. This powerful approach gives you control over where your ads are placed while ensuring maximum visibility through direct connections with publishers. Whether on mobile, web, or CTV, this seamless ad experience will engage your audience effectively.

2. Online sales are on the rise

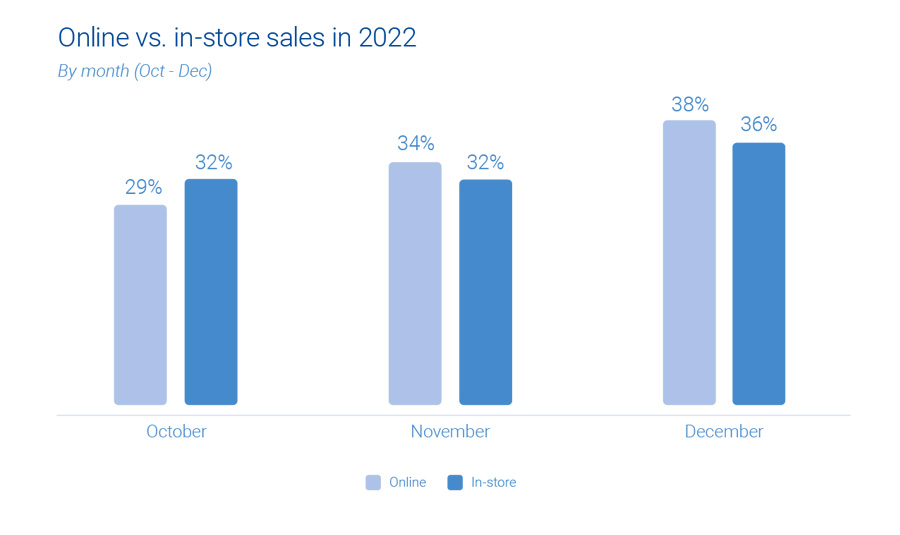

The popularity of online holiday sales is continuously growing, surpassing in-store shopping. There has been a consistent 1% year-over-year increase in online sales, while in-store sales have seen a 1% decrease.

“It’s easier for consumers to comparison shop for large ticket items online that they might find at a mass retailer or office supply store. Consumers prefer to have larger, bulkier items shipped directly to their home for minimal cost. By shopping online, consumers can save time since they don’t need to wait in checkout lines.”

Anna Liparoto, Sr. Account Executive, Retail & CPG

Although online sales currently make up only one-third of all holiday shopping, there is immense potential for further expansion. Mass retailers and office, electronics, and games industries particularly excel in online holiday sales. While in-store purchases remain the primary choice for holiday shoppers, consumer online and offline activities intersect before the final purchase.

Experian tip

Take advantage of the surge in online shopping by diversifying your marketing channels. An agnostic identity graph can bring together device and media data, capturing valuable user insights. By gaining a holistic view of your target audience, you’ll be able to optimize your ad spend and allocate resources effectively, ultimately boosting your return on investment.

“Omnichannel targeting during the upcoming holiday season will continue to prove to be the best way to reach scale and maximize ROI across all marketing channels.”

Joe LigÉ, Head of Enterprise Demand Partnerships

3. 2023 holiday spending will be on par with 2022

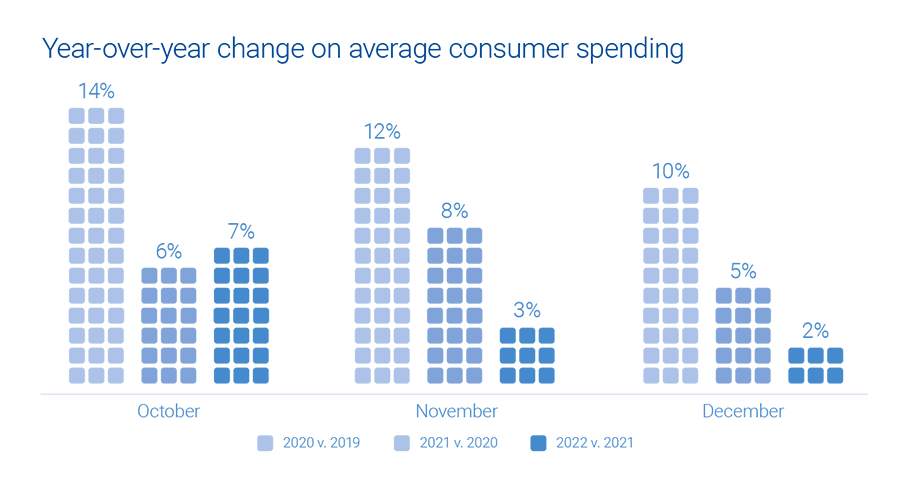

During the holiday season in 2022, consumer spending showed an anticipated increase, although the growth rate was slightly lower compared to previous years. October saw a surge in average consumer spending, indicating a swift response to early discounts and promotions offered by retailers.

As the holiday season progressed, holiday spending gradually slowed down and reached a level similar to that of the previous year. Overall, there was a modest 2% growth. Looking into the future, if economic conditions remain stable in the second half of 2023, we can expect holiday spending to align with the figures from last year.

Experian tip

To truly maximize impact, consider data enrichment. By diving deeper into your target audience’s preferences and behaviors, you can better tailor your strategies and seamlessly integrate the enriched data across various channels. This allows you to unlock the true potential of your ad inventory, creating more meaningful connections with your audience.

Download our 2024 report

Get ready for the holiday shopping season with Experian’s 2024 Holiday spending trends and insights report. Inside you’ll find:

- Analysis of past trends and what they mean for 2024

- Exclusive predictions for the upcoming holiday season

- The top audiences to activate this holiday season

To access to all of our predictions for this year’s holiday shopping season, download our 2024 Holiday spending trends and insights report today.

Latest posts

According to Epsilon Targeting’s latest Consumer Channel Preference Study of 5,000 consumers in North America, 60% of consumers report an "emotional boost" from receiving direct mail, agreeing that they enjoying checking their mailbox. This report showed that across all categories, direct mail continues to be a trusted source of information. It's always good to reach out to consumers via email, but the disadvantage to this is that the consumer has the ability to receive emails from you on their own terms, which may be infrequent or not at all. The use of direct mail has shown to be a pleasing emotional hook. Even with the ever growing digital world, consumers are still responding to your direct mail pieces. Don't let your businesses address contact data fall to the wayside – this is still just as important as ever to have. To ensure as timely delivery, make sure you're using address validation tools to make sure you're saving money and getting the most out of your direct mail campaigns.

Thanks to simulcast streaming of games online and via mobile apps, die-hards are better equipped to keep track of multiple games at once. Those who stream games online live in every corner of the country, but some locales are more likely to log on for their March Madness fix than others.

The social media space continues to evolve. Pinterest, a site launched in March 2010 that describes itself as an online pinboard to organize and share things you love, recently emerged as one of the top 10 websites within the Hitwise Social Networking & Forums category. The invitation only site received nearly 11 million total visits during the week ending December 17, 2011, almost 40 times the number of total visits versus just six months ago (week ending June 18, 2011). Pinterest content has something for everyone, but the site is dominated by images featuring home décor, crafts, fashion, and food. Not surprisingly, visitors to the site in the 12 rolling weeks ending December 17th skewed female (58%) and between the ages of 25 and 44 (59%). Pinterest and the Social Networking & Forums category both receive their highest share of visits from California and Texas. However, the Social Networking category as a whole over-indexes on share of visits from Northeastern states while Pinterest over-indexes on visits from the states in the Northwest and Southeast. This data indicates that Pinterest visitors have a different profile versus their counterparts visiting other social networking sites such as Facebook and YouTube. In fact, nine of the top ten over-indexed states for Pinterest visitors also over-index for the Hobbies and Crafts category (versus the online population) which is expected given the abundance of crafts content on the website. When comparing the Mosaic USA 2011 types that visit both Pinterest.com and Hobbies and Crafts websites during the 12 weeks ending December 17, 2011, the data shows that Boomers and Boomerangs are the group most likely to visit, particularly the Pinterest website (comprising over 10% of visits). This group of consumers is characterized as baby boomers and young adults who are heavy web users who spend time on house and garden, sports and fitness, and family-oriented websites. This information is useful to companies who wish to target their content to be “pinned” by Pinterest users. Thanks to Lauren Rice, an Analyst with the Strategic Services team at Experian Hitwise for today's analysis.