At Experian, we understand the critical role that audience targeting plays in the success of marketing campaigns. That’s why we’re excited to share this curated list, aimed at helping agencies and media buyers plan their campaigns and effectively reach their audiences with precision and confidence.

Here’s a look at the Experian audiences that were the most popular in Q2 2023. Which ones will you add to your Q2 campaign planning?

Our top 10 audiences for Q2

Fitness enthusiast

Lifestyle and Interests (Affinity) > Health & Fitness > Fitness Enthusiast

In-store high spender on baby products

Retail Shoppers: Purchase Based > Shopping Behavior > Baby Products: In Store High Spenders

Has a bachelor’s degree

Demographics > Education > Bachelor Degree

In-market for an SUV and CUV

Autos, Cars and Trucks > In Market-Body Styles > SUV and CUV

In-market for a mid-size truck

Autos, Cars and Trucks > In Market-Body Styles > Mid-Size Truck

Homeowner

Demographics > Homeowners/Renters > Homeowner

In-market for a small, mid-size SUV

Autos, Cars and Trucks > In Market-Body Styles > Small Mid-Size SUV

In-market for a full-size truck

Autos, Cars and Trucks > In Market-Body Styles > Full-Size Trucks

In-market for a full-size SUV

Autos, Cars and Trucks > In Market-Body Styles > Full-Size SUVs

Household income level

Demographics > Household Income (HHI) > $75,000+

Our top 5 audiences by vertical

Which audience segments were the most popular by advertiser vertical?

Advanced TV

Household income level

Demographics > Household Income (HHI) > $75,000-$99,999

Interested in dogs

Lifestyle and Interests (Affinity) > Pets > Dogs (FLA / Fair Lending Friendly)1

Homeowner

Demographics > Homeowner/Renter > Homeowner

Household income level

Demographics > Household Income (HHI) > $100,000-$124,999

Interested in arts and entertainment

Lifestyle and Interests (Affinity) > Art and Entertainment > Visual Art and Design (FLA / Fair Lending Friendly)

Agency

Dog owner

Lifestyle And Interests (Affinity) > Pets > Dog Owners

Cat owner

Lifestyle And Interests (Affinity) > Pets > Cat Owners

Active investor

Lifestyle And Interests (Affinity) > Investors > Active Investor

Mutual fund investor

Lifestyle And Interests (Affinity) > Investors > Mutual Fund Investor

In-market for a full-size SUV

Autos, Cars and Trucks > In Market-Body Styles > Full-Size SUVs

Auto

In-market for a new car

Autos, Cars and Trucks > In Market-New/Used > New Car

In-market for a used car

Autos, Cars and Trucks > In Market-New/Used > Buyer Used

In-market for a Honda

Autos, Cars And Trucks > In Market-Make And Models > Honda

In-market for an auto loan

Financial FLA Friendly > In Market Auto Loan

In-market for an auto lease

Financial FLA Friendly > In Market Auto Lease

Did you know?

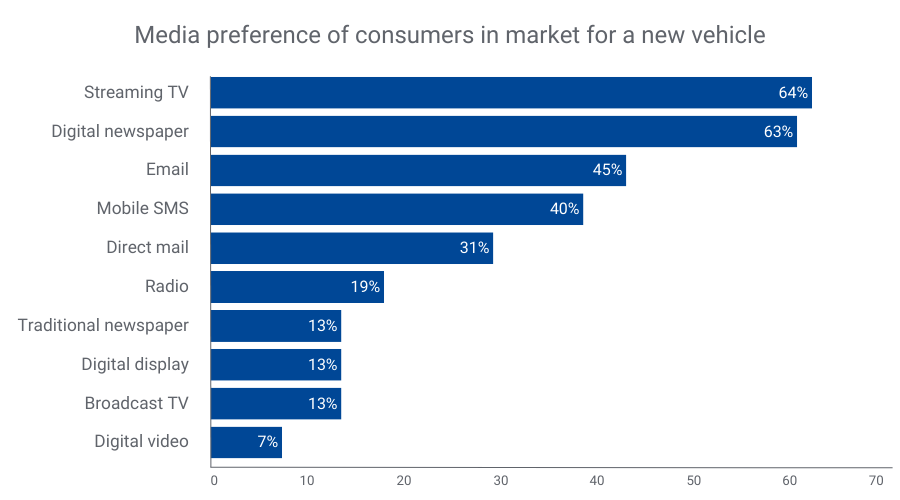

Consumers looking to buy a new vehicle prefer streaming TV, digital newspapers, and email for communication2. By merging our TrueTouchTM engagement channel audiences with our Auto in-market audiences, you can effectively target these consumers through their preferred channels. TrueTouch facilitates personalized advertising campaigns by predicting consumer preferences, ensuring messaging styles align with the right channels and calls to action.

By understanding what types of media people prefer, you can match the best way to talk to them with what to offer, using the right channels for personalized ads. No consumer is the same – and you need to engage with them on their terms to successfully market to them.

Financial

Active in the military

Lifestyle And Interests (Affinity) > Occupation > Military – Active

In-market for a credit union loan

Financial FLA Friendly > In Market Credit Union Loan

40-49 years old

Demographics > Ages > 40-49

30-39 years old

Demographics > Ages > 30-39

Small business owner

Consumer Behaviors > Occupation: Small Business Owners

Health

25-29 years old

Demographics > Ages > 25-29

30-34 years old

Demographics > Ages > 30-34

Weight conscious

Lifestyle and Interests (Affinity) > Health & Fitness > Weight Conscious

Moms interested in fitness

Lifestyle and Interests (Affinity) > Moms, Parents, Families > Fitness Mothers

High spenders at vitamin/supplement stores

Retail Shoppers: Purchase Based > Health and Fitness > Vitamins/Supplements: Vitamins/Supplements

Retail & CPG

Dog owners

Lifestyle And Interests (Affinity) > Pets > Dog Owners

Cat owners

Lifestyle And Interests (Affinity) > Pets > Cat Owners

Fitness enthusiast

Lifestyle and Interests (Affinity) > Health & Fitness > Fitness Enthusiast

Interested in healthy living

Lifestyle and Interests (Affinity) > Health & Fitness > Healthy Living

High spenders at vitamin/supplement stores

Retail Shoppers: Purchase Based > Health and Fitness > Vitamins/Supplements: Vitamins/Supplements

Activate the right audiences with Experian

When you choose Experian’s syndicated audiences, you gain access to over 2,400 audiences that span across 15 verticals and categories. These audiences are directly available for activation on over 30 platforms and can be sent to over 200 media platforms. Experian is ranked #1 for data accuracy (as validated by Truthset) and Experian Marketing Data is the foundation for successful targeting, enrichment, and activation.

For a full list of Experian’s syndicated audiences and activation destinations, download our syndicated audiences guide. Need a custom audience? We can help you build and activate an Experian audience on the platform of your choice.

Check out other seasonal audiences you can activate today.

Footnotes

- Fair Lending Act Friendly audiences: “Fair Lending Friendly” indicates data fields that Experian has made available without use of certain demographic attributes that may increase the likelihood of discriminatory practices prohibited by the Fair Housing Act (“FHA”) and Equal Credit Opportunity Act (“ECOA”). These excluded attributes include, but may not be limited to, race, color, religion, national origin, sex, marital status, age, disability, handicap, family status, ancestry, sexual orientation, unfavorable military discharge, and gender. Experian’s provision of Fair Lending Friendly indicators does not constitute legal advice or otherwise assure your compliance with the FHA, ECOA, or any other applicable laws. Clients should seek legal advice with respect to your use of data in connection with lending decisions or application and compliance with applicable laws.

- Experian looked at our Auto and TrueTouch audience data to understand media preference trends over the past year.

Latest posts

Facebook has become a cultural phenomenon over the years and an object of affection for marketers to connect with its users. Experian Simmons has put together 10 consumer behavioral stats based on their National Consumer Study and New Media Study about the social networking site leading up to its Friday IPO launch: 39% of Facebook users say “this website gives me something to talk about.” Top 3 reasons Facebook users visit social networking sites: 86% to keep in touch with friends 72% for fun 66% to reconnect with/find people they’ve lost touch with 78% of Facebook users have shown support for a group or business on a social networking site. 34% of Facebook users have played games on a social networking site. Among those: 73% play social games (like Farmville, SIMS social, etc) 68% play casual games (like Bejeweled, etc) 73% play games on a social networking site once or more a day 28% of Facebook users with cell phones and 42% of Facebook users with a tablet computer have downloaded a social networking app for the device Adult residents of the following Designated Market Areas (DMAs) with 1,000,000 or more adult residents are the most likely to have visited Facebook in the last 7 days: ) Seattle-Tacoma, WA Austin, TX Salt Lake City, UT Portland, OR Washington, DC 15% of Facebook visitors follow a musical group on a social networking site, 14% follow a TV show, 11% follow a newspaper or news outlet and 4% follow a magazine. The average Facebook user is 39.3 years old. The average Facebook user claims an annual household income of $69,900 with annual household spending on discretionary goods and services of $15,500. Hispanic users of Facebook are 55% more likely than non-Hispanic users to say they like to follow their favorite brands or companies on social networking sites. Don’t miss 15 stats about Facebook, previously posted on the Experian Marketing services blog. . For more information like the data provided above please download the Experian Marketing Services 2012 Digital Marketer report.

Today, it costs more than $40 to send a five pound package from the U.S. to Canada or Mexico. The cost to Europe or South America is even more expensive. For U.S. companies operating on a global scale, such as retail specialists or ecommerce organizations, address accuracy is crucial. Organizations can’t afford undeliverable mail and packages due to a wrong address – the total cost would be unmanageable. Mistakes happen frequently, whether it is an error by the company or the customer. If a mistake is made, companies can’t ask the customer to cover delivery fees, leaving the organization with the bill. Retailers must also consider potential delays due to long distances and custom checks. Altogether, address errors result in a poor customer experience and a decrease in efficiency. Implementing international address verification will save money, time and improve the customer experience. By combining primary address data from national postal authorities with partner-supplied data, businesses can verify international addresses from countries all around the world.

On April 22nd, Americans and many of their terrestrial counterparts in countries around the world will celebrate Earth Day, a tradition that was started in the United States by Wisconsin Senator Gaylord Nelson in 1970. Much has changed on the planet since the first Earth Day, and even in recent years attitudes continue to evolve when it comes to our outlook towards the environment. In 2007, Experian Simmons created the GreenAware consumer segmentation, which classified respondents to the Simmons National Consumer Study between 2005 until 2007 into one of four mutually exclusive segments based on their consumer behaviors and attitudes toward the environment. Since then, Experian Simmons has continuously classified all adult respondents into the GreenAware segments providing our clients with valuable insights into the evolution of the environmental movement. The four GreenAware segments are: Behavioral Greens: This group of people thinks and acts green. They have negative attitudes towards products that pollute and incorporate green practices into their lives on a regular basis. Think Greens: This group of consumers think green, but don’t always act green. Potential Greens: This group neither behaves, nor thinks along particularly environmentally conscious lines and remains on the fence about key green issues. True Browns: They are not environmentally conscious, and may in fact have negative attitudes about environmental issues. Since 2005, we have observed a nearly constant increase in the percent of U.S. adults who are classified as Behavioral Greens, the “greenest” segment of the four. Today, 33% of adults are Behavioral Greens, up from 27% who were classified as such in 2005. Meantime, Think Greens have maintained an almost perfectly constant 21% share of the population. The size of the True Browns segment has also remained constant at between 14% and 15% of the total adult population. The Potential Green segment, however, has steadily declined in market share from 39% in 2005 to 31% today. La Vida Verde Hispanic Americans have traditionally been ahead of the curve when it comes to green thoughts and deeds and they’re only getting greener with time. Today, 39% of Hispanic adults are Behavioral Greens, up from 33% in 2007. Just 32% of non-Hispanic adults are Behavioral Greens today, up from 29% who fell into the greenest segment in 2007. Interestingly, among the True Browns segment there are virtually no Hispanics to be found, and, in fact, while the True Brown population is actually growing among non-Hispanics, Hispanics are increasingly moving to greener segments. Specifically, just 1.3% of Hispanics are True Browns today, down from 8% who registered as such in 2007. By comparison, 17% of non-Hispanics are True Browns today, up from 14% in 2007. Green Today, Greener Tomorrow? The illustration below shows the alignment of America’s largest metropolitan areas with the four GreenAware segments today and in 2007. We see that residents of the San Francisco-, New York- and Miami-areas are the most likely to be in alignment with the Behavioral Green mindset today. Denizens of Washington, D.C., Los Angeles, Chicago, Philadelphia and Boston tend to fit more closely with the Think Green set that has green attitudes and intentions, but not always the actions to back it up. But things are changing. In fact, since 2007, we’ve seen that as local minds change, some cities become aligned with a different, often greener, segment. Let’s look at Chicago, for instance. In 2007, Chicagoans’ environmental outlook was more reflective of a mix of Potential Greens and True Browns. Since then, local attitudes have changed so much that Chicago-area residents are now more aligned with Think Greens and Behavioral Greens. Likewise, Cleveland, which was clearly a True Brown town in 2007, now falls in step with the Potential Green segment. In five years’ time, who knows? Cleveland could be America’s next green leader. Not brown now towns Looking at markets large and small with the biggest drop in concentration of True Browns, we see that attitudes in inland markets located in Gulf States have become disproportionately less brown since the Deepwater Horizon oil spill in 2010. In fact, seven of the ten Designated Market Areas (DMA) that saw the biggest decline in the percentage of their population classified as True Browns between 2007 and 2011 are inland markets in states bordering the Gulf of Mexico. While the oil didn’t directly reach these markets, the attitude change did spread: For example, 3.2% of adults residing in the Columbus-Tupelo-West Point, Mississippi DMA today are classified as True Browns, down from 19.3% who were categorized as such in 2007. In Macon, Georgia, while not a Gulf State, a more impressive shift took place. In 2007, the Macon, Georgia DMA had the fourth highest percentage of its population classified as True Browns (20.1%) out of 209 DMAs. Today, only 5.8% of area residents are True Browns, which makes it the market with the 10th lowest concentrations of True Browns in the nation. Macon still has one of the lowest shares of residents who are Behavioral Greens in the nation, but what a difference a few years makes. While the towns directly in the path of the oil spill are not among those with the biggest relative decline in True Browns, area residents’ attitudes did take on a greener hue since the spill. Today, 8.4% of residents in Panama City are True Browns down from 17.3% in 2007. Likewise, only 9.8% of adults in both the Mobile-Pensacola and Biloxi Gulfport DMAs are True Browns down from 17.3% and 19.0%, respectively, who fell into the least green segment prior to the spill. Learn more about Experian Simmons consumer segmentation offerings