At Experian, we understand the critical role that audience targeting plays in the success of marketing campaigns. That’s why we’re excited to share this curated list, aimed at helping agencies and media buyers plan their campaigns and effectively reach their audiences with precision and confidence.

Here’s a look at the Experian audiences that were the most popular in Q2 2023. Which ones will you add to your Q2 campaign planning?

Our top 10 audiences for Q2

Fitness enthusiast

Lifestyle and Interests (Affinity) > Health & Fitness > Fitness Enthusiast

In-store high spender on baby products

Retail Shoppers: Purchase Based > Shopping Behavior > Baby Products: In Store High Spenders

Has a bachelor’s degree

Demographics > Education > Bachelor Degree

In-market for an SUV and CUV

Autos, Cars and Trucks > In Market-Body Styles > SUV and CUV

In-market for a mid-size truck

Autos, Cars and Trucks > In Market-Body Styles > Mid-Size Truck

Homeowner

Demographics > Homeowners/Renters > Homeowner

In-market for a small, mid-size SUV

Autos, Cars and Trucks > In Market-Body Styles > Small Mid-Size SUV

In-market for a full-size truck

Autos, Cars and Trucks > In Market-Body Styles > Full-Size Trucks

In-market for a full-size SUV

Autos, Cars and Trucks > In Market-Body Styles > Full-Size SUVs

Household income level

Demographics > Household Income (HHI) > $75,000+

Our top 5 audiences by vertical

Which audience segments were the most popular by advertiser vertical?

Advanced TV

Household income level

Demographics > Household Income (HHI) > $75,000-$99,999

Interested in dogs

Lifestyle and Interests (Affinity) > Pets > Dogs (FLA / Fair Lending Friendly)1

Homeowner

Demographics > Homeowner/Renter > Homeowner

Household income level

Demographics > Household Income (HHI) > $100,000-$124,999

Interested in arts and entertainment

Lifestyle and Interests (Affinity) > Art and Entertainment > Visual Art and Design (FLA / Fair Lending Friendly)

Agency

Dog owner

Lifestyle And Interests (Affinity) > Pets > Dog Owners

Cat owner

Lifestyle And Interests (Affinity) > Pets > Cat Owners

Active investor

Lifestyle And Interests (Affinity) > Investors > Active Investor

Mutual fund investor

Lifestyle And Interests (Affinity) > Investors > Mutual Fund Investor

In-market for a full-size SUV

Autos, Cars and Trucks > In Market-Body Styles > Full-Size SUVs

Auto

In-market for a new car

Autos, Cars and Trucks > In Market-New/Used > New Car

In-market for a used car

Autos, Cars and Trucks > In Market-New/Used > Buyer Used

In-market for a Honda

Autos, Cars And Trucks > In Market-Make And Models > Honda

In-market for an auto loan

Financial FLA Friendly > In Market Auto Loan

In-market for an auto lease

Financial FLA Friendly > In Market Auto Lease

Did you know?

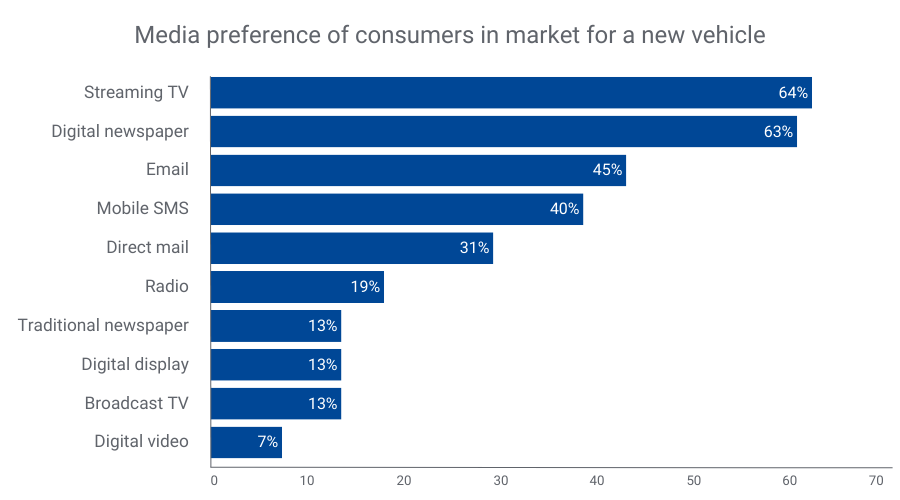

Consumers looking to buy a new vehicle prefer streaming TV, digital newspapers, and email for communication2. By merging our TrueTouchTM engagement channel audiences with our Auto in-market audiences, you can effectively target these consumers through their preferred channels. TrueTouch facilitates personalized advertising campaigns by predicting consumer preferences, ensuring messaging styles align with the right channels and calls to action.

By understanding what types of media people prefer, you can match the best way to talk to them with what to offer, using the right channels for personalized ads. No consumer is the same – and you need to engage with them on their terms to successfully market to them.

Financial

Active in the military

Lifestyle And Interests (Affinity) > Occupation > Military – Active

In-market for a credit union loan

Financial FLA Friendly > In Market Credit Union Loan

40-49 years old

Demographics > Ages > 40-49

30-39 years old

Demographics > Ages > 30-39

Small business owner

Consumer Behaviors > Occupation: Small Business Owners

Health

25-29 years old

Demographics > Ages > 25-29

30-34 years old

Demographics > Ages > 30-34

Weight conscious

Lifestyle and Interests (Affinity) > Health & Fitness > Weight Conscious

Moms interested in fitness

Lifestyle and Interests (Affinity) > Moms, Parents, Families > Fitness Mothers

High spenders at vitamin/supplement stores

Retail Shoppers: Purchase Based > Health and Fitness > Vitamins/Supplements: Vitamins/Supplements

Retail & CPG

Dog owners

Lifestyle And Interests (Affinity) > Pets > Dog Owners

Cat owners

Lifestyle And Interests (Affinity) > Pets > Cat Owners

Fitness enthusiast

Lifestyle and Interests (Affinity) > Health & Fitness > Fitness Enthusiast

Interested in healthy living

Lifestyle and Interests (Affinity) > Health & Fitness > Healthy Living

High spenders at vitamin/supplement stores

Retail Shoppers: Purchase Based > Health and Fitness > Vitamins/Supplements: Vitamins/Supplements

Activate the right audiences with Experian

When you choose Experian’s syndicated audiences, you gain access to over 2,400 audiences that span across 15 verticals and categories. These audiences are directly available for activation on over 30 platforms and can be sent to over 200 media platforms. Experian is ranked #1 for data accuracy (as validated by Truthset) and Experian Marketing Data is the foundation for successful targeting, enrichment, and activation.

For a full list of Experian’s syndicated audiences and activation destinations, download our syndicated audiences guide. Need a custom audience? We can help you build and activate an Experian audience on the platform of your choice.

Check out other seasonal audiences you can activate today.

Footnotes

- Fair Lending Act Friendly audiences: “Fair Lending Friendly” indicates data fields that Experian has made available without use of certain demographic attributes that may increase the likelihood of discriminatory practices prohibited by the Fair Housing Act (“FHA”) and Equal Credit Opportunity Act (“ECOA”). These excluded attributes include, but may not be limited to, race, color, religion, national origin, sex, marital status, age, disability, handicap, family status, ancestry, sexual orientation, unfavorable military discharge, and gender. Experian’s provision of Fair Lending Friendly indicators does not constitute legal advice or otherwise assure your compliance with the FHA, ECOA, or any other applicable laws. Clients should seek legal advice with respect to your use of data in connection with lending decisions or application and compliance with applicable laws.

- Experian looked at our Auto and TrueTouch audience data to understand media preference trends over the past year.

Latest posts

For British Petroleum (BP), 2010 has been marked by the unfortunate developments resulting after the Deepwater Horizon oil rig explosion in the Gulf of Mexico on April 20. Since then, BP’s crisis mismanagement and failed attempts to stop the oil spill have transformed this unfortunate event into an ecological disaster with political and financial consequences for the company. The oil leak has caused BP to lose a noticeable number of its American customers, namely their most loyal consumers. Experian Simmons DataStream shows that between April 26 and June 28, 2010 the percentage of American adults who report going to BP fell from 26.4% to 16.4%, a relative loss of 38% of their client base in just nine weeks. More astounding is the fact that BP’s most loyal consumers (those who said that BP is the gas or service station that they go to most often) declined a relative 56% during the same time. In fact, on June 28, 2010, only 9.5% of adults went to BP most often compared with 21.5% who were loyal to BP the week of the spill. With the flow of oil temporarily ceased and nearing a permanent solution, BP may finally be able to cap the flow of bad publicity and to reverse some of their loss in market share. Experian Simmons will continue to monitor this and other important consumer trends and share those findings here.

According to data released by Standard and Poor’s and Experian for S&P/Experian Consumer Credit Default Indices, “default rates nationally fell in May across the board.” Defaulting balances declined among all types of credit lines, including bank card loans, first and second mortgage default rates and auto loans. Further research from Experian Simmons DataStream underscores this trend. Between November 17, 2008 and May 10, 2010, there has been a 15% increase in the share of major credit card holders who report usually paying their credit card balance in full each month. This increase is reflected among both VISA and MasterCard credit card holders, during the same time period. Specifically, the percent of VISA and MasterCard credit card holders who usually pay their credit card balance in full increased by 25% and 17%, respectively. During the later part of 2008 and much of the first half of 2009, MasterCard holders were the more likely to pay their card balance in full each month. Today, however, VISA card holders are the more likely to pay the full amount due. As of May 10, 2010, 42% of VISA card holders usually paid their VISA balance in full compared with 40% of MasterCard holders. American consumers’ attempt to become solvent shows that personal financial responsibility standards are increasing in response to the recent financial crisis. According to data released by Standard and Poor’s and Experian for S&P/Experian Consumer Credit Default Indices, “default rates nationally fell in May across the board.” Defaulting balances declined among all types of credit lines, including bank card loans, first and second mortgage default rates and auto loans. Further research from Experian Simmons DataStream underscores this trend. Between November 17, 2008 and May 10, 2010, there has been a 15% increase in the share of major credit card holders who report usually paying their credit card balance in full each month. This increase is reflected among both VISA and MasterCard credit card holders, during the same time period. Specifically, the percent of VISA and MasterCard credit card holders who usually pay their credit card balance in full increased by 25% and 17%, respectively. During the later part of 2008 and much of the first half of 2009, MasterCard holders were the more likely to pay their card balance in full each month. Today, however, VISA card holders are the more likely to pay the full amount due. As of May 10, 2010, 42% of VISA card holders usually paid their VISA balance in full compared with 40% of MasterCard holders. American consumers’ attempt to become solvent shows that personal financial responsibility standards are increasing in response to the recent financial crisis.

Forward thinking marketers leverage the power of social networking sites like Facebook, MySpace, Twitter and more to connect to consumers in a more personal and meaningful way. That's why Experian Simmons is focusing on social networking in this issue of Consumer Insights, featuring the freshest insights available from the latest Simmons New Media Study. The 2010 Social Networking Report provides the hard data behind this consumer revolution, including the fact that fully 66% of online Americans use social networking sites today, up from just 20% in 2007. Social networking is an increasingly addictive activity, with nearly half of those who access such sites (43%) reporting that they visit them multiple times per day. While users of social networking sites may have initially signed up to better keep in touch with friends, a growing number say they now use sites like Facebook to connect with family members. An astounding 70% of social networkers keep in touch with family via their various online networks, up from 61% a year ago. Fully two-thirds of all online adults today have visited a social networking site in the last 30 days, up from 53% in 2008 and 20% in 2007. Social networks have most thoroughly penetrated the young adult market, as nearly 9-in-10 online 18-to 34-year-olds visit such sites today. But even older Americans are tapping into social networks, with 41% of online adults age 50 and older making monthly visits to sites like Facebook, MySpace and Twitter. The rise of social networking tracks closely with that of Facebook. As of April 26, 2010, 46% of the U.S. online adult population reported having visited Facebook in the past 30 days. While keeping in touch with others is an important part of social networking, the popularity of games like Farmville and Mafia Wars illustrate that fun is a big part of the appeal of social networking. Whether it’s keeping in touch with others, playing games, debating politics or any of the other reasons people use social networking sites, it cannot be denied that there’s a sense of addictiveness to it all. Visiting social networking sites multiple times a day is up 28% over last year, while less frequent visits are down across the board. As social networking sites extend their reach across generations, Americans are increasingly using such sites to connect with more than just their friends. Today, 17% of social networkers communicate with their parents via those sites and 22% connect with their kids, up from 9% and 15%, respectively, a year ago. An astounding two-thirds of social networking site visitors (68%) say they have shown their support of a product, service, company or musical group by becoming a “fan” or a “friend” on a social networking site. One year earlier, only 57% of social networkers had publicly declared their “like” for a product, service, company or musical group. Knowing that social networkers are comfortable connecting with products and brands they support, it's important to understand which brands have the best opportunity to connect with this group. Top retail brands among Facebook users, for instance, include H&M, Hot Topc and Forever 21. Specifically, Facebook users are full twice as likely as the average American adult to shop at H&M. Twitter visitors are 3.7 times more likely to shop at Nordstrom. Heavy users of social networking sites are primarily concentrated in the Northwest and markets that are heavily influenced by major colleges or universities.