There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humour, or randomised words which don’t look even slightly believable.

Paragraph block

Heading block

Pull Quote cloud news blog

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humour, or randomised words which don’t look even slightly believable.

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humour, or randomised words which don’t look even slightly believable.

- There are many variations of passages of Lorem Ipsum available,

- but the majority have suffered alteration in some form, by injected humour, or randomised words which don’t look even slightly believable.

Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.

This guest post from Erin Lowry. Erin is the founder of Broke Millennial, where her sarcastic sense of humor entertains and educates her peers about finances. Erin lives and works in New York City, so she’s developed quite the knack for finding deals and free events.

At the tender age of 18 I opened a letter from my bank to find my first credit card. I peeled the card off the letter and took a moment to stare in awe at this powerful little piece of plastic that suddenly offered me access to money.

This was 2007, pre-Credit CARD Act of 2009, when all a college student had to do to get a credit card was head down to the local back — or in some ghastly cases walk through vendor tables set up during orientation days. Students scribbled down their information in exchange for a free t-shirt or water bottle and gleefully received plastic cards that seemingly offered “free money.”

This guest post from Erin Lowry. Erin is the founder of Broke Millennial, where her sarcastic sense of humor entertains and educates her peers about finances. Erin lives and works in New York City, so she’s developed quite the knack for finding deals and free events.

At the tender age of 18 I opened a letter from my bank to find my first credit card. I peeled the card off the letter and took a moment to stare in awe at this powerful little piece of plastic that suddenly offered me access to money.

This was 2007, pre-Credit CARD Act of 2009, when all a college student had to do to get a credit card was head down to the local back — or in some ghastly cases walk through vendor tables set up during orientation days. Students scribbled down their information in exchange for a free t-shirt or water bottle and gleefully received plastic cards that seemingly offered “free money.”

![State of Credit 2013 [Infographic]](https://stg1.experian.com/blogs/news/wp-content/uploads/default-post-image.png)

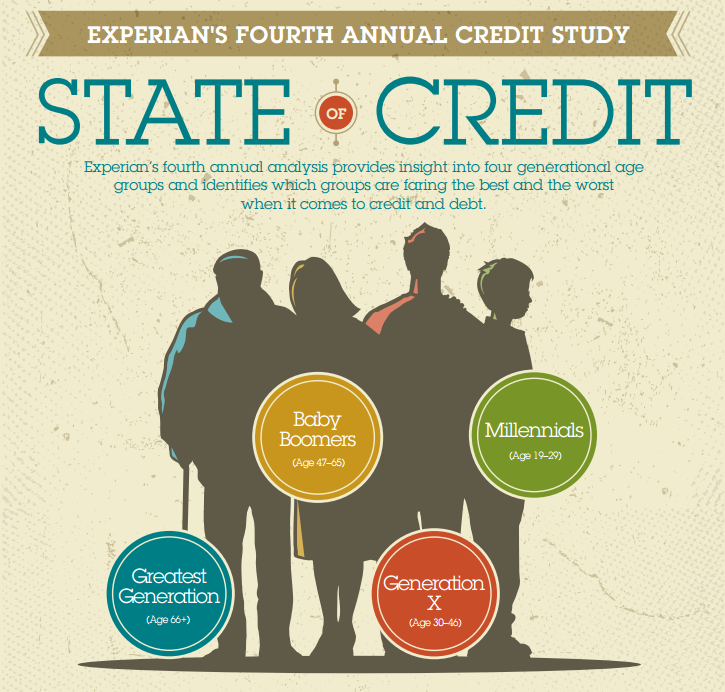

The Fourth Annual State of Credit report is Experian’s comprehensive look at nationwide data to determine how four different generations are managing their debts by analyzing their credit scores, the number of credit cards they have, how much they are spending on those cards and the occurrence of late payments.

Additionally, credit scores were examined in Metropolitan Statistical Areas (MSAs) to provide the 10 highest and 10 lowest credit scores in each generation across the nation. The study creates an opportunity for consumers to better understand how credit works so they can make informed financial decisions and live credit smart even in the face of national economic challenges.

Check out the full infographic.

This guest post is from Donna Freedman (@DLFreedman). Donna is a former newspaper journalist and staff writer for MSN Money and Get Rich Slowly. Currently she writes for Money Talks News and for her own website, donnafreedman.com.

What do Baby Boomers and millennials have in common? Stereotyping, retirement issues and, sometimes, a residence. About that last: According to a Pew Research Center study called “The Boomerang Generation,” 29% of adults aged 20 to 34 live with their folks. Which leads us to a two-pronged stereotype: Boomers were overly indulgent parents who never let their kids suffer even a moment of The Sadz, which is why millennials are such an entitled, failure-to-launch cadre.In this article…

First Heading

Lorem Ipsumis simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged.

It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum

- test1

- test1

Second Heading

It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout. The point of using Lorem Ipsum is that it has a more-or-less normal distribution of letters, as opposed to using ‘Content here, content here’, making it look like readable English.

Many desktop publishing packages and web page editors now use Lorem Ipsum as their default model text, and a search for ‘lorem ipsum’ will uncover many web sites still in their infancy. Various versions have evolved over the years, sometimes by accident,

How Experian can help with card fraud prevention and detection

Contrary to popular belief, Lorem Ipsum is not simply random text. It has roots in a piece of classical Latin literature from 45 BC, making it over 2000 years old. Richard McClintock, a Latin professor at Hampden-Sydney College in Virginia, looked up one of the more obscure Latin words, consectetur, from a Lorem Ipsum passage, and going through the cites of the word in classical literature, discovered the undoubtable source.

Lorem Ipsum comes from sections 1.10.32 and 1.10.33 of “de Finibus Bonorum et Malorum” (The Extremes of Good and Evil) by Cicero, written in 45 BC. This book is a treatise on the theory of ethics,

very popular during the Renaissance. The first line of Lorem Ipsum, “Lorem ipsum dolor sit amet..”, comes from a line in section 1.10.32.

Fourth Heading

Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.