There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humour, or randomised words which don’t look even slightly believable.

Paragraph block

Heading block

Pull Quote cloud news blog

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humour, or randomised words which don’t look even slightly believable.

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humour, or randomised words which don’t look even slightly believable.

- There are many variations of passages of Lorem Ipsum available,

- but the majority have suffered alteration in some form, by injected humour, or randomised words which don’t look even slightly believable.

Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.

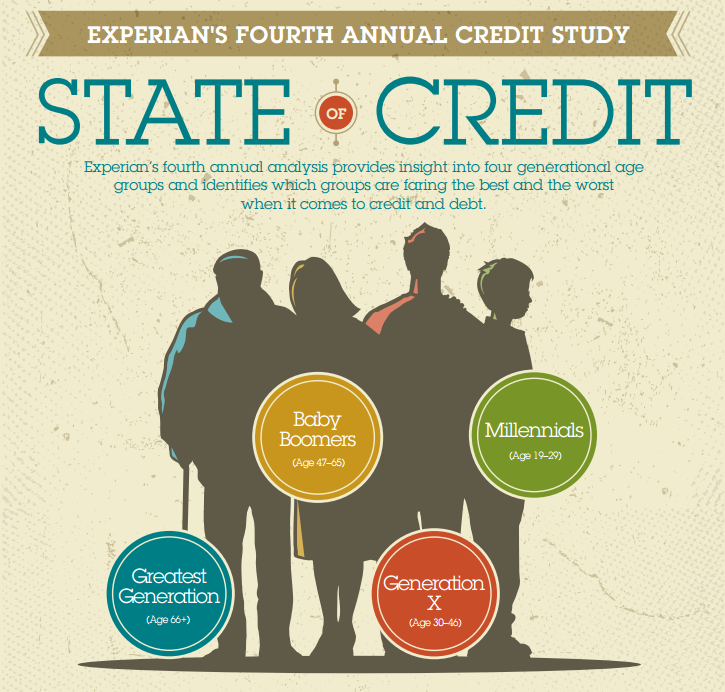

The Fourth Annual State of Credit report is Experian’s comprehensive look at nationwide data to determine how four different generations are managing their debts by analyzing their credit scores, the number of credit cards they have, how much they are spending on those cards and the occurrence of late payments. Additionally, credit scores were examined in Metropolitan Statistical Areas (MSAs) to provide the 10 highest and 10 lowest credit scores in each generation across the nation. The study creates an opportunity for consumers to better understand how credit works so they can make informed financial decisions and live credit smart even in the face of national economic challenges.

Check out the full infographic.

The National Foundation for Credit Counseling® (NFCC) and Experian® jointly announced today that Experian committed 80,000 free, 12-month memberships to its freecreditscore.comTM product, in support of the NFCC’s Sharpen Your Financial Focus™ program. The NFCC program, launched in September of this year, includes a broad cross-section of supporters – Experian and others – who are committed to increasing the financial well-being of Americans.

Owning your own business is what many perceive to be as the American dream. And if you’ve been fortunate enough to make that dream a reality, then you’ve certainly heard how indispensable your business is to the country’s economy. But as invaluable as your small business is, many small business owners face daily challenges when it comes to sustainability, profitability and growth. For the last year, Experian and the Small Business Administration (SBA) have lent a helping hand to small businesses that are facing those types of challenges. As a part of their efforts, all Historically Underutilized Business Zone (HUBZone) firms and small businesses that are considered to be socially and economically disadvantaged under the SBA’s 8(a) business development program have full access to BusinessIQ Express.

In this article…

First Heading

Lorem Ipsumis simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged.

It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum

- test1

- test1

Second Heading

It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout. The point of using Lorem Ipsum is that it has a more-or-less normal distribution of letters, as opposed to using ‘Content here, content here’, making it look like readable English.

Many desktop publishing packages and web page editors now use Lorem Ipsum as their default model text, and a search for ‘lorem ipsum’ will uncover many web sites still in their infancy. Various versions have evolved over the years, sometimes by accident,

How Experian can help with card fraud prevention and detection

Contrary to popular belief, Lorem Ipsum is not simply random text. It has roots in a piece of classical Latin literature from 45 BC, making it over 2000 years old. Richard McClintock, a Latin professor at Hampden-Sydney College in Virginia, looked up one of the more obscure Latin words, consectetur, from a Lorem Ipsum passage, and going through the cites of the word in classical literature, discovered the undoubtable source.

Lorem Ipsum comes from sections 1.10.32 and 1.10.33 of “de Finibus Bonorum et Malorum” (The Extremes of Good and Evil) by Cicero, written in 45 BC. This book is a treatise on the theory of ethics,

very popular during the Renaissance. The first line of Lorem Ipsum, “Lorem ipsum dolor sit amet..”, comes from a line in section 1.10.32.

Fourth Heading

Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.